Timing Of First Payout: Immediate Vs Deferred Annuities

When would you like the distribution phase to begin? Do you want payments to start immediately or be deferred to the future?

- Immediate: With an immediate annuity, you pay the principal and begin receiving payouts right away. This is a popular option for those about to retire.

- Deferred: With a deferred annuity, you make contributions ahead of time and receive the first payment on the date specified in your contract. Because your money has more time to accrue interest tax-free, your payout amounts can be higher than those of an immediate annuity.

Purchase An Annuity With Assets You Already Have

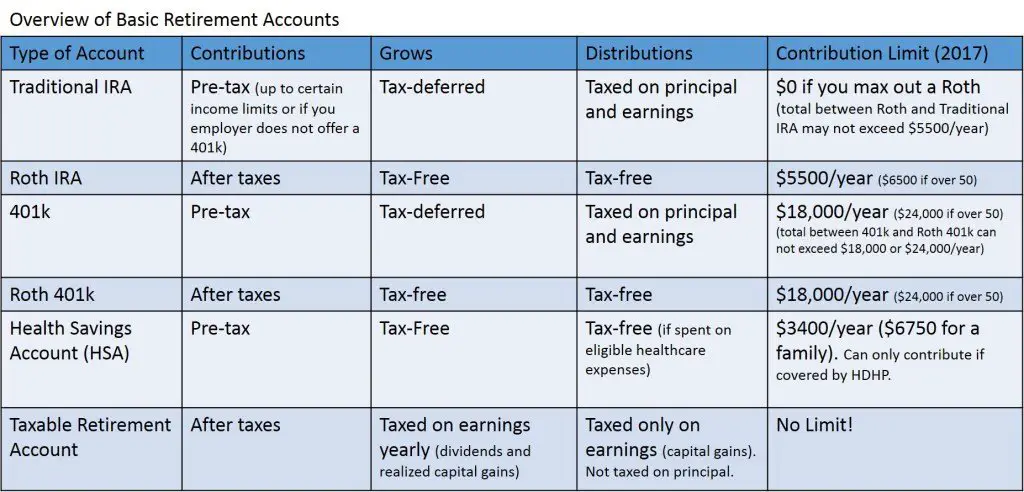

You can purchase an annuity with money from your savings or investment account. If you use qualified money from your 401 or IRA to purchase an annuity, your money will continue growing tax deferred. Most variable annuities allow you to make additional premiums, offering you a tax-deferred investment opportunity with no IRS contribution limits.

Annuity Early Withdrawal Penalties

Annuities are meant to be long-term investments. When you sign up, the contract will likely include a surrender period, usually between six to eight years. While you can request to collect payments, according to the annuity schedule, you are not supposed to make a lump sum withdrawal or cancel the policy during the surrender period.

If you try to take money out before the end of the surrender period, you would owe a surrender charge. This could range from 7% up to even 20% of your entire deposit. As time goes by, the annuity company could reduce the surrender charge. For example, some reduce the surrender fee by one percentage point a year until the surrender period ends.

The surrender charge makes annuities a very illiquid investment. Before signing up, make sure you wont need your money back in the near future.

Also Check: How Do I Know If I Have A 401k

The Overall Price You Pay For An Annuity Can Vary Between Providers

Annuity providers may offer you different income payments for the same type of annuity.

This is because providers calculate the amount of monthly income they can provide based on many factors such as:

- the type of your annuity

- the term of your annuity

- your age and gender

- their operating costs

- the return they expect to receive on their investments

Before buying an annuity, ask for the list of fees and commissions. Make sure you understand the contract restrictions, including penalties and administrative fees.

Once you know what kind of annuity you are interested in buying, compare similar products from several providers.

Should You Transfer Your 401k To An Annuity

With over 10,000 baby boomers reaching retirement age every single day, many of these retiring workers are asking questions like Can I move my 401k without penalty? and Should I transfer my 401k to an annuity. Both are questions that involve a 401k rollover strategy.

The first question is an easy one. You can move your 401k without penalty by transferring it to an IRA. This is also a non-taxable event. The second question is a little trickier. You can transfer your 401k to an annuity. The real question is…should you? Lets take a look at why you should or shouldnt transfer that 401k asset to an annuity.

Whats Your Contractual Goal?

Transferring your 401k to a personal IRA is a non-taxable event. The money transfers from one institution to another under 401k transfer rules, and that transfer is tax free to your rollover IRA. Thats the nuts and bolts on how to administratively get it done.

The bigger question is what are you trying to achieve. I always ask 2 questions to determine if you need to consider an annuity.

Growth to Income

Annuities offer one benefit that no other financial product offers. That monopoly is lifetime income. Theres no ROI until you die because you can never outlive the payments. That’s the benefit proposition unique to annuities.

Shouldering Risk To Transferring Risk

New 401K Game

All About Income

Dont Go There!

Recommended Reading: How To Avoid Penalty On 401k Withdrawal

How Does An Annuity Work

An annuity can provide you with a predictable stream of income in retirement. The primary benefits of an annuity include:

Predictable payments: Annuity income payments may be guaranteed for a set period of time or until the end of your life, or the life of your spouse or another beneficiary.

Tax-deferred growth: Money paid into an annuity grows on a tax deferred basis. When you later receive annuity payments, the earnings portion of your payments is taxed as ordinary income, while principal is generally free of tax.

Death benefits: Depending on the type of annuity you choose, a named beneficiary can receive payments after you pass away.

A variety of financial companies sell annuities, including insurance companies, banks and investment brokers. After you sign up for an annuity, you begin by making payments to the company, either as a single lump sum deposit or as regular payments over time. The period when you are contributing into your annuity is called the accumulation phase.

In exchange for payments during the accumulation period, the company promises to make regular income payments to you in the future. The period when you start collecting payments from an annuity is called the distribution phase.

You can choose when you want the payments to begin and how long they should last. You could pick a set number of years, like a 10-year payment period, or guaranteed payments for your entire life. Different terms and costs are involved with varying payout periods.

Tax Implications On Annuities

You’ll have to report the money you get from an annuity as income when you file your taxes. You may have to pay tax on this money. The amount of tax you may pay will vary depending on the product. Taxes will be different if you buy your annuity using registered savings versus non-registered savings.

Don’t Miss: Can I Contribute To Traditional Ira And 401k

Rolling Your Annuity Into A 401

Can you roll your annuity over into your 401? It depends.

First, your annuity would need to already be an IRA annuity. And second, your 401 plan would have to allow you to roll money from other tax-deferred retirement plans into it.

You should check with the person in charge of your employers plan. You should also check with your annuity provider and review the contract to make sure youre able to take the funds from the annuity.

Funding Your Retirement: 5 Things To Know About Variable Annuities

You have access to many retirement income products that can help you save for your retirement. So why consider a variable annuity? Because they can offer different advantages than other investments, theyre designed for long-term investing, and could help add balance to your retirement strategy.

Here are five things to know about variable annuities.

Recommended Reading: How Do You Get Money From 401k

What Is A Variable Annuity

With a variable annuity, your income payments depend on market performance. You choose a selection of investments, typically mutual funds that hold stocks, bonds and money market instruments. The amount of money paid out to you is determined by the performance of these investments, after expenses.

You take on more risk with a variable annuity, but you also get more upside from the investments. If your investments do well, your annuity balance will grow more quickly and your future payments will be larger. On the other hand, if your investments do poorly, your balance will grow less quickly and could even lose value, reducing your future payments.

Risk Tolerance: Fixed Vs Variable Annuities

Different annuities carry different amounts of risk. Do you feel more comfortable with a fixed interest rate on your principal investment or are you willing to accept more risk for a variable possibly higher or lower rate of return?

- A fixed annuity offers a specified rate of return, like a Certificate of Deposit . You havent invested your principal in the markets, so your returns will not fluctuate with the markets.

- A variable annuity offers the potential for greater income than a fixed annuity because its invested in the markets. However, with the potential for greater returns comes greater risk.

You May Like: How Do I Add Money To My 401k

Annuity Riders & Annuity Fees

When you sign up for an annuity, you have the option to purchase annuity riders. These are extra benefits that you add to the contract, for an extra fee. Some common riders include:

Lifetime income rider: As you start collecting payments from a variable annuity, its possible that your investments might not grow quickly enough and you run out of money. With this rider, the annuity company promises to keep making your monthly payment, even if your account balance runs out.

COLA rider: As noted above, adding this rider will grow your annuity payments over time so they keep up with inflation and an increasing cost of living. You can pick how much you want the payments to grow each year.

Impaired risk: If you get seriously ill while collecting on your annuity, it could shorten your life expectancy so you receive fewer payments and less money. With this rider, your annuity will increase the payment size when you get seriously ill so you get more money sooner to make up for your shorter life expectancy.

Death benefit/return of premium rider: Depending on when you pass away, its possible to receive less in payments than you paid into an annuity. With a death benefit rider, your heirs will receive money from the annuity company. For example, the return of premium riders makes sure they get at least as much as you paid for the contract. If you paid $300,000 and only received $200,000, your heirs would get a check for the other $100,000.

Advantages Of Buying An Annuity In Your 401

Sharing his expertise with the Wall Street Journal in April 2019, David Blanchett, head of research for Morningstar Investments, wrote about the advantages of buying an annuity within a 401.

One advantage of buying an annuity within your 401if you’re femaleis that your gender wont affect the price. Annuity prices reflect life expectancy, and outside of a 401, women can expect to pay more because they live longer on average. On the other hand, bought within a 401, this smoothed-out pricing means men might pay more.

Annuity payments might also be higher within a 401, Blanchett writes, because insurers can save money on marketing when they have a large pool of potential customers supplied by an employer. But you shouldnt assume payments are better without seeing what outside annuities have to offer, he cautions.

Plan sponsors have certain obligations to plan participants under the Employee Retirement Income Security Act . So it would be natural to assume that if your plan sponsor offers an annuity within your 401, its been vetted as a solid choice that will deliver on its promises and not rip you off with unreasonable fees. However, its unwise to blindly trust that your employer has made an ideal choice.

Why is that? As weve seen, employees have brought lawsuits against 401 plan sponsors for excessive fees. In addition, the funds in many retirement plans are known for high administrative fees, particularly if a third-party 401 recordkeeper is used.

Also Check: Can I Move My 401k To A Different Company

Its Guaranteed Income But Understand What It Will Cost You

A Tea Reader: Living Life One Cup at a Time

Thomas J Catalano is a CFP and Registered Investment Adviser with the state of South Carolina, where he launched his own financial advisory firm in 2018. Thomas’ experience gives him expertise in a variety of areas including investments, retirement, insurance, and financial planning.

Although the appeal of having guaranteed income after retirement is undeniable, there are actually a number of risks to consider before rolling your 401 into an annuity. In addition to the sometimes hefty fees incurred by annuitants, you risk losing part of your investment if you die prematurely, as you may not be able to pass the remainder of the annuity on to your beneficiaries.

Many insurance companies tout the tax benefits of annuities. However, a traditional 401 is already tax-sheltered, and a delayed rollover could cost you in taxes.

Annuity Types By Funding

Single-Premium Deferred Annuities

A single-premium deferred annuity is straightforward. You buy the annuity contract with one lump sum payment. For instance, you could use a tax return, inheritance, or the money in a savings account and convert that into a series of future payments.

Just note that if you purchase the annuity using transferred funds from a tax-advantaged traditional retirement plan, except to pay income taxes. The reason? This money hasnt been previously taxed.

Flexible-Premium Deferred Annuities

There are also flexible-premium deferred annuities. Instead of one big payment, the premium payments can be spread out over time through a series of smaller payments. The more you put towards the contract, the greater your future income will be. However, theres also the flexibility to pad your account over time.

Read Also: How To Know If You Have A 401k

Irs Tax Penalties For Early Withdrawals

Insurance companies arent the only ones with criteria for annuities.

The Internal Revenue Service has its own set of rules that guide the use and tax treatment of these products, and they have nothing to do with the criteria set forth by the insurance company.

You may be free to withdraw money at your discretion as far as the insurer is concerned, but if you are under the age of 59 ½, the IRS will charge you a 10 percent penalty.

According to IRS Publication 575, Most distributions from qualified retirement plans and nonqualified annuity contracts made to you before you reach age 59 ½ are subject to an additional tax of 10 percent.

The 10 percent additional tax applies only to the taxable portion of the withdrawal, which you can determine using either the General Rule, if your annuity is nonqualified, or the Simplified Method, if your annuity is qualified.

This section of the tax code includes exceptions specific to certain types of annuity contracts, annuity start dates and withdrawals for certain major disasters including, among others, Hurricane Harvey, Hurricane Irma, Hurricane Maria and the California wildfires in 2017 so talk to a tax professional if you have questions about the tax consequences of early withdrawals from your annuity.

Annuities: What Percentage Should Be In Your Retirement Portfolio

November 26, 2020 By Annuity Guys®

The answer is 50 percent want to know why many insurance sales agents might say that?

Its nice when empirical research validates something that we have observed and practiced for years with our financial planning clients.

Wade Pfau, a professor at American College who specializes in retirement income determined that based upon current market conditions a hypothetical couple ages 65 would have their best success for generating a four percent annual income by using a combination of

**Guarantees, including optional benefits, are backed by the claims-paying ability of the issuer, and may contain limitations, including surrender charges, which may affect policy values. During this segment, Dick and Eric are referring to Fixed Annuities unless otherwise specified.

We typically do not espouse an exact percentage, but rather design our income plans to cover the foundational expenses with sources like social security, pensions and annuities. If you take care of the foundation the flexibility with your additional assets can be significantly enhanced.

Check out more on the Death of the 4% financial planning withdrawal Rule.

Can your nest egg last your whole lifetime? Its getting tougher to tell.

Conventional wisdom says you can take 4% from your savings the first year of retirement, and then that amount plus more to account for inflation each year, without running out of money for at least three decades.

Use annuities instead of bonds

Read Also: How Do I Withdraw Money From My 401k

What Is A Tax

A tax-sheltered annuity is a retirement savings plan that allows employees of tax-exempt organizations and self-employed people to invest pretax dollars to build retirement income. Tax-sheltered annuities are designed to provide consistent payouts over time and act as a reliable source of income in retirement.

Is A Deferred Annuity Right For You

Lets be real, a deferred annuity isnt for everyone.

For example, if youre already in retirement and need money within the next year or two for medical expenses, an immediate annuity makes more sense. But, what if youre several years away from retirement and in good health? A deferred annuity could be a way to supplement your post-career income,

If thats not helpful, you can answer the following two questions

- What do you want your money to CONTRACTUALLY do?

- When do you want those CONTRACTUAL guarantees to start?

If you choose to go forward with a deferred annuity, always make sure that you clearly understand whats spelled out in the contract. If you dont, always ask or work with a trusted financial advisor.

Also Check: Does Maximum 401k Include Employer Match

Annuity Vs 401k Comparative Table

| Basis | ||

|---|---|---|

| Fixed and Variable Annuity are the two main types of Annuity. | There are no types of 401k accounts. | |

| Ownership | An annuity can be jointly owned and can be purchased by anyone who is an adult. | 401k cannot be jointly owned. It cannot be purchased and is provided only by the employer. |

| Fees | Fees for an annuity are higher. | Extra fees or any kind of commission does not have to be paid when money needs to be pulled out of 401k. |

| Loans | Annuities do not offer loans. When money is taken out from the account, it will only be withdrawals. | Some 401k plan offers loans on the amount that is in the account. An amount of $50,000 can be borrowed from the account. |