Best For Businesses With 1000 Employees Or Less: T Rowe Price

T. Rowe Price is a respected name in retirement planning. It has been in business for more than 80 years. These 401 plans are a great choice if you’re an employer with less than 1,000 people on your books.

T. Rowe Price offers over 100 no-load mutual funds and common trusts. It also has more than 5,400 non-proprietary funds. It designs its low-cost mutual funds to give you steady returns over 75% of these funds have expense costs lower than the industry average.

In addition to its 401 plans, T. Rowe Price offers 403 plans for nonprofit and tax-exempt organizations such as hospitals, churches, and schools. The 403 provides an effective way to save.

T.Rowe Price’s mutual fund options include stock funds, bond funds, and target-date funds. There are also asset allocation funds and money market funds to choose from. These mutual funds have low fees, and their expense ratios are below the industry average.

Staying Competitive For Top Talent

The pursuit of hiring great employees often comes down to what you can offer by way of compensation and benefits. Particularly when vying for quality talent with industry competitors, a 401 plan and even better, offering a company match can help your business stand out if candidates are weighing job offers.

What Is The Best Retirement Plan For A Small Business Owner

Establish a SIMPLE IRA: The savings incentive match plan for employees, or SIMPLE IRA, is one retirement plan available to small businesses. In 2020, employees can defer up to $13,500 of their salary, pretax, and those who are 50 or older can defer up to $16,500 by taking advantage of a $3,000 catch-up contribution.

Read Also: How To Find 401k From An Old Employer

This Biotech Business Goes For Double Digits

Biotechnology leader Amgen offers employee an automatic 5% contribution into their retirement plans. In addition, the company will match employees’ contributions dollar for dollar on up to 5% of their pay. As a leader in its industry, Amgen has several active products generating billions in revenue, enabling it to continue to invest in researching the next breakthroughs while simultaneously rewarding its people well for their service.

Timing Payments For The Most Money

Some employers will pay their match no matter how many paychecks it takes for you to reach your allowed amount for the year. But many companies will make a contribution only during the pay periods when 401 money is taken from your paycheck. You can avoid leaving employer money on the table by putting in smaller amounts each pay period. That way, your employer will put money into your account in every period.

Let’s say you’re paid twice a month, and your employer will only add money into your 401 when you do. If you reach your $19,500 limit at the end of November, you’ve missed out on two chances for your employer to make its match. In this case, you’d be earning much more than $50,000 a year, but this issue could apply no matter how much you earn if you put too much money into your 401 too soon.

Your plan manager can help you manage your 401 account to make the most of your employer match. You can also use an online calculator to figure out how much you should put in from each paycheck.

Also Check: What Is Max 401k Contribution For 2021

The 5 Most Popular Small Business 401 Plan Features

- The 5 Most Popular Small Business 401 Plan Features

Tens of thousands of dollars are on the line.

This might sound a bit sensational, but when it comes to choosing the right type of 401 plan, this is true a lot more often than many small business owners realize.

Over the years, our firm has helped thousands of business owners design a 401 plan for their company. During these consultations, I cant tell you how many times weve seen a business save thousands in annual contribution expenses by choosing one type of 401 plan over another, while still meeting their plan goals.

And its not just money thats at stake.

Choosing the wrong type of 401 plan can result in failed nondiscrimination testing, countless hours of administrative hassle, and can ultimately make it more difficult for the plan to achieve its goals.

So it goes without saying that choosing the right plan is important. The problem? 401 plans are complex, and it can be really difficult to know which type of 401 plan is best for you.

Our goal today is to make it easy.

Using data gathered in our study of 3,975 small businesses, well break down the 5 most popular types of 401 plans. Well explain how they work and why theyre so popular, helping you come to the quickest decision as to which type is best for you.

Before we dive in though, theres a common misconception well need to clear up…

Sign Up For Automatic 401 Contributions

Enroll in automatic payroll deductions, so contributions are deposited in your 401 each pay period without any further action by you.

One of the advantages of these plans is the power of payroll deduction, said Young. You pay yourself first, automatically, every paycheck, making retirement savings easy.

Use Vanguards plan savings calculator to find out how a given level of contributions will impact your paycheck, and how much you could be earning for your retirement with an employers match.

Also Check: What Percentage Should I Be Putting In My 401k

Taxes And Employer 401 Matching Contributions

You dont have to pay any income taxes on employer 401 matching contributions until you start making withdrawals.

Gross income includes wages, salaries, bonuses, tips, sick pay and vacation pay. Your own 401 contributions are pre-tax, but still count as part of your gross pay. However, your employers matching contributions do not count as income, said Joshua Zimmelman, president of Westwood Tax & Consulting.

Your employers matching contribution grows tax-deferred in a traditional 401, boosting your compounding returns over the years. You dont have to pay any taxes on the employer match until you start making withdrawals, said Zimmelman. Traditional 401 withdrawals are taxed as ordinary income at whatever tax bracket youre in when you make those withdrawals..

This Energy Titan Offers A Titanic Match

Oil and natural gas giant ConocoPhillips provides a match of 6% for all employees who contribute at least 1% to their 401 plans, plus an additional discretionary match of between 0% and 6% depending on factors like the company’s performance. The company targets 3% for the discretionary match, putting the targeted match at 9% of an employee’s salary. Given the cyclical nature of the energy business, the flexibility in the discretionary match helps the company be generous when times are good and cut back when times are tough without affecting employees’ take-home pay.

A 787 Dreamliner Airplane. Image source: Boeing.

Read Also: Is A 401k A Defined Benefit Plan

How Much Do Companies Typically Match On 401 In 2021

Dylan Telerski / 9 Apr 2021 / Business

Whether youre a small business owner or employee, seeing how much other companies match on their 401s can give you a valuable measure of how generous your own plan is, and help you to adjust your own contributions.

Given the economic uncertainties resulting from the COVID-19 pandemic, many employees may be wondering if company matches will be reduced in 2021, and if so, how this will affect their savings goals for the year.

The good news is that though an estimated 11.5% of small companies suspended or reduced their employer match during the COVID-19 crisis of 2020, most of these employers said they plan to reinstate the matching contributions in 2021. Overall, about 51% of employers who offer a 401 also provide matching contributions.

If your employer is increasing their match in 2021, it could be a great opportunity to take advantage of this free money and set more ambitious savings goals. If your employer decreased their match in 2020 and will not be restoring their contributions to previous levels in 2021, you may want to consider increasing your own contributions to make up for the shortfall.

No matter what strategy you choose, investing in a 401 plan is one of the best ways to ensure a comfortable retirement. Small business retirement plans that offer employer-matched funds provide a generous incentive to encourage employees to save as much as they can.

This Aerospace Giant Pays Up To 6%

Airline manufacturer Boeing offers employees up to 6% above and beyond their salary in the form of a 401 match. Boeing’s match is 75% of up to 8% of an employee’s salary contributed to the 401 plan. While that 401 match is a generous one, it’s actually part of a replacement for an even more generous pension plan. In addition to the match, Boeing employees transitioning from the pension plan get a percentage of their salaries automatically contributed to their retirement plan, with the long-run target between 3% and 5% based on employee age.

Also Check: Where Can I Get A 401k Plan

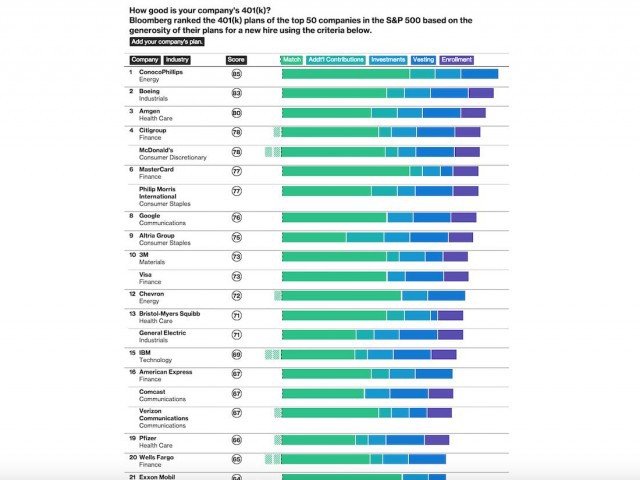

Report: These Companies Offer The Best Retirement Plans

Money expert Clark Howard says its one of the best ways people can invest the amount that your employer matches is essentially free money. But if you havent done it before, its easy to become intimidated.

Investing can seem so complicated that you might shut down and do nothing about it or feel you need to hire someone to guide you, Clark says. However, it doesnt need to be complex. You probably already have the opportunity to get started right where you work.

Indeed, many employers offer 401 plans but which companies offer the best ones? Believe it or not, some companies will even contribute to your retirement whether or not you set aside any of your own money.

To that end, U.S. News recently released a report that shows the five best company-sponsored retirement plans. Lets take a look at how generous they are:

Can I Have A 401k And An Ira

Yes, you can have both accounts and many people do. The traditional individual retirement account and 401 provide the benefit of tax-deferred savings for retirement. Depending on your tax situation, you may also be able to receive a tax deduction for the amount you contribute to a 401 and IRA each tax year.

Don’t Miss: Can I Borrow From My 401k To Start A Business

Why Do Employers Match 401 Contributions

Why would employers match 401 contributions? Perhaps the foremost reason is that employers view the matching contribution as a means of attracting and retaining top talent so that they dont have to continually hire and retrain a revolving door of workers.

Its also in their best interest to encourage as many eligible employees to participate in the plan and save as much as they can so the highly-compensated employees and business owners can contribute the maximum amounts to their own plans without failing annual IRS tests for fairness and nondiscrimination.

Favorable tax benefits make it even easier for companies to offer this benefit to their workers. Employers can deduct 100% of their matching contributions on their federal income tax returns, as well as 25% of what all eligible employees contribute.

Companies That Have Changed Or Temporarily Suspended Their 401 Matching Contributions

Below is a list of employers that have announced plans to reduce or suspend matching contributions to their employees’ 401 and other defined contribution plan accounts since June 2008. For details on each company’s decision, click the employer’s name to see the company’s press release or news story announcing the change.

Learn why the employer match is such an important feature of 401 plans. We also have similar lists of companies that have made changes to their defined benefit plans and companies that are offering lump-sum pension buyouts.

Please note that this is not a comprehensive list. The companies listed below are only the companies that we are aware of, based on corporate press releases, news reports and other sources. When we have learned, via a news report or correspondence, that a company plans to reinstate its 401 match, we have indicated it below.

Tags

Also Check: How To Invest My 401k Money

What Is The Easiest Possible Way A Small Business Can Offer A Retirement Benefit To Their Employees

The SIMPLE IRA gives small businesses an easy way to offer their employees a retirement savings plan. You complete an IRS form, and setup can be free, depending on the institution you select. Any advisor fees are charged to the employee, and larger contribution amounts are allowed on this type of IRA.

Philip Morris International Inc

You may have qualms about working for the king of tobacco, but Philip Morris does its best to reward and retain top talent. In addition to matching the first 5% of employee contributions, the company adds an additional 7% of eligible employee compensation for a total of up to 12%.

There are no bond funds to select, but a broad range of stock and international index funds are available. Eligible employees are automatically enrolled and are 100% vested immediately.

Recommended Reading: Who Has The Best 401k Match

Companies With The Best Retirement Plans

Today’s workersunless they’ve been in the workforce a very long time with the same employer or work in certain public sector or union organizationswill never know what a retirement pension, or defined benefits plan, looks like in real life. That’s because these retirement plans are going the way of the dinosaur, replaced by the defined contribution plan, typically a 401 account.

What’s the difference? A pension plan pays a guaranteed amount each month, based on salary and years of service. A 401 plan, on the other hand, depends on employee and sometimes employer contributions and reflects the performance of the investments within them.

While the vast majority of businesses now offer 401 plans for retirement, there’s a great deal of difference between the most and least generous among them. For example, some employers offer a generous employer match and even additional contributions based on salary. Others offer a better mix of investment options with lower fees. It’s a good idea to look at the fine print to see what you’re really getting when you enroll.

If you are wondering which companies do the best job setting up their employees for financial security in retirement, take a look at our list for the best retirement plans.

Best For Payroll Services: Paychex

If you own a small firm and are looking into 401 plans but also need a payroll service, Paychex has what you need. It has an all-in-one service for small employers with a fine reputation. Paychex’s lower-cost options are a nice break from some of the more expensive 401 providers.

Paychex also has HR services and benefits administration that you can use for your business. Business loans and other services also make up part of its services.

It is mainly an HR/payroll services company. However, it has teamed up with other 401 providers for you and takes care of your plan administration. If you choose to use its tax services, you’ll find it charges some extra fees for dealing with tax forms and tax services.

For one fee, Paychex makes for a less costly option for small companies that need more than one service.

Paychex has more than 100 offices around the country. Its customer support lines are open 24/7, making it easy to contact someone when you need help. Small employers are billed based on the number of workers and the number of pay periods each year.

Also Check: What Age Can You Take Out 401k

Matching Contributions For A Roth 401

If you choose to save money in a Roth 401, matching contributions must be allocated to a separate traditional 401 account. This is because IRS rules require you to pay regular income tax on employer contributions when they are withdrawnand Roth 401 withdrawals arent taxed in all but a few cases.

Remember, with a traditional 401 account, your contributions are made pre-tax, and you pay regular income tax on withdrawals. And with a Roth 401 account, your contributions are made using after-tax dollars, and qualified withdrawals are generally tax free.

Vesting And Employer 401 Contributions

Some 401 plans include a vesting schedule for employer contributions. With vesting, you must wait for a period of time before taking ownership of the 401 contributions made by your employer.

Note that most 401 plans let you start contributing to your account as soon as you join the company. Contributions that you make to your 401 account are always considered fully vestedthey are always 100% owned by you. Extended vesting periods only cover employer contributions.

According to Vanguard, 40% of 401 participants were in plans with immediate vesting of employer matching contributions. Smaller plans, meaning plans with fewer participants, used longer vesting schedules, with employees only becoming fully vested after five or six years.

If you have a 401 and your employer matches your contributions, be sure to ask about the vesting schedule. If your plan has a vesting schedule, you dont own your employers contributions to your 401 until you are fully vested. If you take a new job before that point, you could lose some or even all of your employers 401 contributions.

You May Like: How Much Should I Have In My 401k At 60

Companies That Will Help You Retire A Millionaire

According to the International Longevity Centre UK , you should save at least 11 percent of your income in order to retire comfortably. However, research shows that most Americans fall short of this goal, with just $5,000 tucked away for retirement.

Eric Roberge, a CFP and founder of Beyond Your Hammock, tells CNBC Make It that the biggest mistake most people make when saving for retirement is not taking advantage of their employer’s 401 match.

“If you have a 401 at work and you choose to open a Roth IRA, and your employer’s willing to give you 100 percent of the first 5 percent that you put in your 401, you’re missing out on free money,” he says.

To help you find a company that’ll set you on the road to a comfortable retirement, no matter your current salary, job search platform Glassdoor compiled a list of companies with strong 401 programs and substantial company matches.