Saving For Retirement In Your 40s

A lot can happen in your 40s. You may be itching for a career change, or might find yourself settling into a more senior role with a higher salary. Either way, your 40s are a time to keep your debt to a minimum and your savings at a maximum. If a career shift or new business venture is in your plans, cash savings outside of your retirement accounts can fund your dreamskeep your retirement money hard at work.

Emergency fund: Do a check-in and make sure that you still have at least six months of living expenses saved, especially if youve bought a house or started a family.

Additional savings: Keep using a taxable brokerage account to invest additional savings.

Educational savings: Keep contributing to your educational savings plans for your kids.

Retirement savings: Review your contribution percentage annually, especially if your compensation has significantly increased. By the time you turn 50, aim to have six times your current annual salary in retirement savings.

Catch-up tips: If youre feeling behind in your savings, review your expenses and see where you can cut back. Each month, save any extra money in your IRA or emergency fund to further protect your retirement savings. You could also consider a side hustle to bring in some extra cash to boost your savings.

The Impact Of Time On Retirement Savings

Time is your most powerful ally for retirement savings. Small amounts invested early in your career can grow substantially larger than even big amounts invested later in life.

Lets face it, most Americans cant afford to set aside a full 15% of their income for retirement. But dont let that discourage you. Investing any amount for retirement positions you to benefit from compounding as soon as possible.

Consider two hypothetical investors. Investor A starts investing $100 a month at 25. By age 65, they would have a retirement balance greater than $640,000, assuming annual returns of 10%, which is the average return of the S& P 500 over the long term.

Meanwhile, Investor B waited until 35 to start saving, but invested $200 a month. Investor B would have almost $200,000 less in their retirement balance by age 65, despite contributing almost $25,000 more.

The difference between Investor A and Investor B illustrates the power of time and compounding when understanding investment returns. A difference of just 10 years can dramatically impact potential returns earned by your investments.

More importantly, it also shows that you can still achieve very significant returns even if you cant start investing quite as early in your life. In the second scenario, Investor B only contributed $72,000 of their own money, starting at age 35. From that, they earned almost $380,000 in investment returns.

I Wish Id Had The Courage To Live A Life True To Myself Not The Life Others Expected Of Me

This was the most common regret of all. When people realise that their life is almost over and look back clearly on it, it is easy to see how many dreams have gone unfulfilled. Most people had not honoured even a half of their dreams and had to die knowing that it was due to choices they had made, or not made. Health brings a freedom very few realise, until they no longer have it.

Also Check: What Should I Invest In 401k

What Is A Defined Contribution Plan

A defined contribution plan is any retirement plan to which an employee or employer regularly contributes some amount. Often, the employee chooses to send a fixed percentage of monthly income to the account, and these contributions are automatically withdrawn, directly from her paycheck – no effort required. The money that doesn’t go to the employee’s take-home pay gradually accumulates, the balance earns interest from investments, and by the time retirement rolls around, its grown into a substantial nest egg for the retiree. Thats the idea.

In a defined contribution plan , there are no guarantees about the income youll receive in retirement. That doesnt mean such plans cant be just as effective, however, and employers often sweeten the deal by making contributions of their own, straight into your account.

Where Do You Stand So Far

As shown below, only 26% of people in their 60s have over $500,000 set aside for retirement. You can see the average retirement savings ranges at different ages, but everybodys situation is unique.

Average Retirement Savings at Age 65

| Avg. | |

|---|---|

| 517,085 | 289,736 |

Reminder: The median is the middle of all answers from biggest to smallest. Data source: Hou .

Lets assume you want to retire on $500k of assets in your IRA, 401, and taxable accounts. You want to spend roughly $52,000 per year. Your Social Security benefits amount to $24,000 per year, and you have an additional pension of $6,000 per year.

Subtotal: You have $30,000 of income per year, and you need an additional $22,000.

You May Like: How Do I Withdraw Money From My 401k

Which Is The Best Tool To Save For College

This college math and expense calculator is the perfect tool for planning your college education. Combine a college spending calculator with a college savings calculator 529. Get a personalized forecast of your future education expenses by specifying your child’s age, the type of college you’re saving for, and your income.

Plan To Replace About 80% Of Income

When you stop working, aim to replace about 80% of pre-retirement earnings from all income sources combined, such as 401s and IRAs, Social Security, and pensions.

You can anticipate spending less, because youll no longer be paying payroll taxes or making 401 contributions. You may also spend less on things like gas and clothing, because youre no longer working. The actual amount youll need in order to replace your working income depends on how frugal or luxurious you want your retirement to be.

Don’t Miss: How To Set Up A 401k Account

K Recommendation Amount By Age 60

The assumptions for the below chart are as follows:

- Low End column accounts for lower maximum 401k contribution amounts available to savers current above age 45

- Mid End column accounts for medium maximum contribution amounts available for savers below 45

- High End column accounts for savers who are under the age of 25. After the first year, one maximizes their contribution every year to their 401k plan without failure.

- Average starting working age is 22. But you can follow the number of years working as a different guideline if you graduate later or earlier.

- $18,000 is used as the conservative base case maximum contribution amount for ones entire working life. Hopefully the government will increase the max contribution amount over time.

- Not assuming any after-tax income contributions, although building an after-tax investment portfolio is one of the keys to early retirement. You need such a portfolio to produce useable passive income.

- The internal rate of return assumptions are between 0% 10%. 0% to account for no growth over several years due to the occasional bear market.

- Company match assumption is between 0% 3%. The average company match, if there is one, is 3% of contributions.

- The three columns should encapsulate 80%+ of all 401 contributors who aggressively contribute tot heir 401k each year. There will be those with less, and those which much, MUCH greater balances thanks to higher returns.

Im 35 What Should I Have Saved

There is a lot of research showing that people tend to rely on approximations or rules of thumb when it comes to financial decisions.

With this in mind, many financial firms publish savings benchmarks that show the ideal levels of savings at different ages relative to an individuals income. A savings benchmark isnt a replacement for comprehensive planning, but it is a quick way to gauge whether youre on track. Its much better than the alternative some people useblindly guessing! More importantly, it can act as a catalyst to take action and start saving more.

However, for the benchmark to be useful, it needs to be realistic. Setting the target too low can lead to a false sense of confidence setting it too high can discourage people from doing anything. Articles on retirement savings goals have generated spirited discussion about the reasonableness of the targets.

Don’t Miss: How To Rollover Fidelity 401k To Vanguard

Your 401 Savings And When You Want To Retire

When you retire is another premier factor in determining how much money youll need in your 401. Though the average retirement age has shifted throughout the years, most people still retire some time in their 60s or 70s. Remember, though, that modern medicine means people are living longer. If you plan on being healthy until youre in your 90s, retiring at 65 means you need enough money in your retirement account to survive another 25 years within whatever lifestyle you choose.

You might not know exactly when you want to retire, but you should try to have a general idea. If you work a relatively low-stress job, you might want to work a few more years to make some more cash. This would also mean youll have fewer years where youre surviving solely off of retirement income. Just adjust your savings to match the general age at which you think youll retire.

SmartAssets retirement calculator can help you plan our your retirement savings needs for specific ages and locations. Information youll need to run a calculation includes where you want to retire, your current annual income, your Social Security election age, your monthly savings and a few other factors.

Benefits Of 401k Saving Plans

401k plans have various benefits that might be of great help now and in the future.

Lifetime Contributions – While there may be some age limits for contributions in some 401k retirement accounts and IRAs, most 401k are designed in such a way that you can contribute and save for your retirement as long as you’re employed.

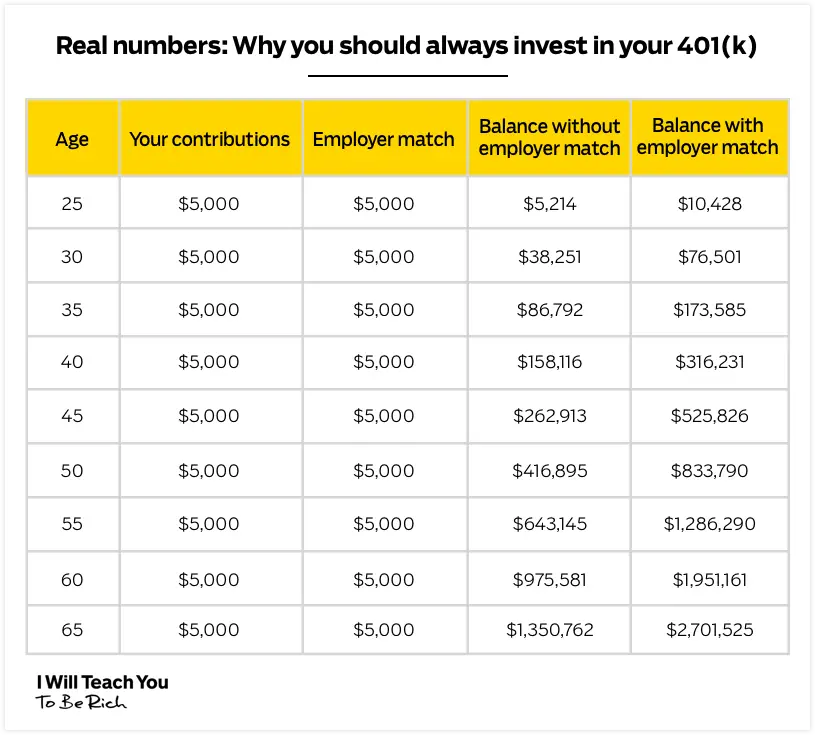

Employer Matching Contributions – Most 401k plans are structured in such a way that an employer may offer to match the amount of money that you put in your 401k plan. Most employers are known to offer a given percentage of what you put in the plan to even match your exact contribution. Needless to say, this is practically free money and is a great way to swell up your retirement savings. You should, however, keep in mind that your employer’s contributions do not count towards your yearly limit.

Tax Benefits – The savings that you direct to your 401k is pre-tax. This means that the amount of money that you contribute to your 401k plan will not be subject to an income tax and this is a great way of lowering your taxable income. In other words, you won’t have to pay tax on the amount you contribute to your 401k plan until when you withdraw them. This is even beneficial if you take into account the fact that you’ll be in a lower tax bracket during your retirement and this may lower the amount that you’re required to pay in taxes.

Recommended Reading: How To Transfer Roth 401k To Roth Ira

Investing In Your 401k Your Future Is At Stake

Focusing on a diverse portfolio is the best for your 401k, as youll get both growth and stability over the long term.

There are various factors that can influence your life and put you ahead or behind of each of these benchmarks. Keeping them as a guide can help you prepare for a comfortable retirement.

How are you tracking with your 401k? Are you ahead or behind?

How Much Should I Save To Reach My Retirement Goals

Short answer: When you are 30 you save your income once, when you are 35 you save twice, when you are 40 you save three times your income, and so on. Try to save 15% of your paycheck for retirement, or start with an interest rate that’s manageable for your budget and increase by 1% each year until you reach 15%. Use your retirement planner to compare yourself to other retirees.

Read Also: When Can I Draw From My 401k Without Penalty

S To Take Now To Improve Your Retirement Readiness

While the average 401k balance at pre-retirement age is around $600K, that balance still falls far below even the no growth column of the savings potential chart for the same age. And while $600,000 is no chump change, its also probably not enough to retire comfortably for most people.

Needless to say, many people are falling way below their savings potential. But the good news is, its not too late to turn things around.

How Much Should I Have Saved In My 401k By Age

Updated: by Financial Samurai

Are you looking for a 401k savings guide? This post will go through how much I think you should have in your 401k by age in order to have a comfortable retirement.

The 401k is one of the most woefully light retirement instruments ever invented. The maximum amount you can contribute is $19,500 for 2021. A 401k is part of your three-legged retirement stool. The other two legs include your after-tax investment accounts and your side hustles.

Although the 401k pales in comparison to a nicely funded pension, even more disappointing than the 401k is the IRA. With the IRA retirement plan, you can only contribute $6,000 in pre-tax dollars. Further, you can only contribute if you make under $76,000 a year as an individual and $125,000 as a married couple. What about the rest of us?

Meanwhile, you have to make less than $140,000 a year as a single person or $208,000 as a married couple for the privilege of contributing the maximum $6,000 in after- tax dollars to a Roth IRA. I do not recommend doing this before maxing out your 401k.

Give me a pension that pays 70% of my last years salary for the rest of my life over a 401k or IRA any time! At least with the 401k, anybody can contribute.

Read Also: How To Recover 401k From Old Job

How Much Should You Have In Your 401k At 60

Since you are so close to retirement, its probably a good idea to move away from any risky Investments. You will most likely move most your Investments to bonds instead of stocks for example. You dont want the stock market to take a downturn only a couple of years before you retire. You need to start protecting your investments.

K Savings Potential By Age

The following chart depicts 401k savings potential by age, based on several assumptions. So this is how much you could have saved. These numbers can seem high to many people, especially if you are older and started your retirement savings when the contribution limit was much lower. It can still be used as a guide for your target total retirement savings amounts, including your IRA, Roth IRA, and after-tax savings. While its designed for one person, it can also be used as a guide for a married couple if one spouse decides to no longer work.

The assumptions we used for this chart include:

| AGE | |

|---|---|

| $827,000.00 | $6,610,084.46 |

*Generally, financial planners say the expected rate of return for a 401k is between 8% and 10%.

So, how do you stack up? Are you on the high end? The low end? Do you think these numbers are realistic?

Don’t Miss: How To Avoid Taxes On 401k

Your 401 Savings And Where You Want To Retire

Where you plan on spending your retirement will have a major impact on how much money youll need to save in your 401. A number of different factors fall under this bucket, each with its own impact on your savings needs.

Cost of living is the most basic factor here. For example, retiring in Hawaii may seem like a tropical dream, but the cost of living in Hawaii is exceptionally high. If hitting the beach to surf in Oahu everyday is something you really want, youll have to make sure you have enough money in your 401 to cover the cost of living.

Big cities like New York and Los Angeles also have predictably high costs of living. However, more remote places like Montana and New Hampshire have much lower costs of living though, so youd need less in your coffers if you opt to settle in places like that.

Another location-based retirement savings factor to keep in mind is taxes. Each state has its own tax codes, and some dont have any income tax at all. Make sure you understand the tax policies of the state where you plan to retire so you have a sense of how much taxes will eat into your 401 savings over time.

For example, Texas does not charge any income taxes. That means when you withdraw funds from your 401 as a resident of Texas, you wont have any state taxes taken out. On the flip side, though, Texas has exceptionally high property taxes. So if you plan on buying a sprawling ranch in the Lone Star State, you property tax bill could be quite high.