Invest In Iras And Roth Iras

If you remember the rule of thumb earlier, experts advise saving 10% to 20% of your gross salary each year for retirement. You could put this all in your 401, but you should consider some other options once you cover your 401 match.

If you earn less than $122,000, you qualify for a Roth IRA in 2019. Youll qualify for a Roth IRA in 2020 if you earn less than $124,000. This is a retirement savings vehicle that you can open at virtually any bank or financial institution. You fund these with after-tax dollars. So your contributions wont reduce your taxable income. However, eligible withdrawals you make after turning 59.5 are tax free. Its good to have a mix of taxable and non-taxable income in your retirement.

Roth IRAs are particularly useful for young people who are just starting their careers. Chances are that if you just graduated from college, youre in a lower tax bracket than you will be in when you retire. Paying the income tax now instead of later can save you money, especially when you need it the most

In 2019, you can contribute up to $6,000 to a Roth IRA. The $1,000 catch-up contribution for those who are at least 50 years old applies here too. You can also contribute up to $6,000 in 2020.

You can also invest in a traditional IRA, which takes pre-tax dollars and lessens your taxable income just like a 401. Some people also have an IRA because when they left a previous employer, they moved their 401 funds into an IRA via an IRA rollover.

Why Should I Use One

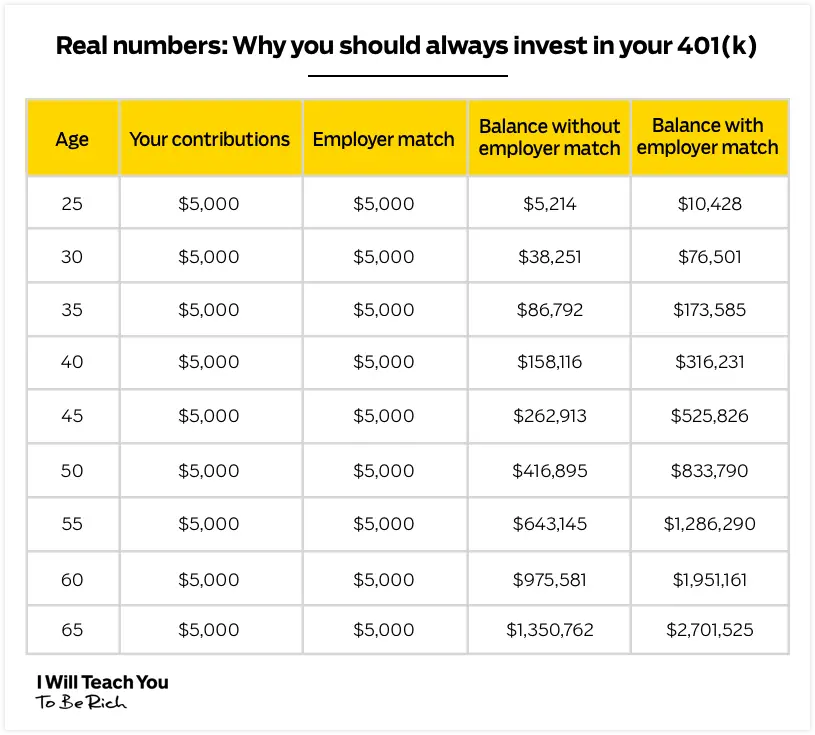

Matching dollars, for one thing. Over 90% of employers that offer a 401 plan also kick in a matching contribution, which means as you contribute, your employer will, too. Commonly, that match will be worth 50% to 100% of your contributions, up to a limit that typically falls between 3% and 6% of your annual income. If your employer offers up this free money, a good rule of thumb is to do everything you can to contribute enough to take advantage of it.

The other huge benefit of the 401 is that it allows you to put a lot of money away for retirement in a tax-advantaged way. The annual contribution limit is $19,500 for tax year 2021, with an extra $6,500 allowed as a catch-up contribution every year for participants age 50 or older.

Total 401 Employer And Employee Annual Contribution Limits

| 2020 | ||

|---|---|---|

|

Total with Catch-Up Contributions for those 50 or Older |

$63,500 |

$64,500 |

Vanguard data from 2018 show that among 401 plans the firm administered, 95% of employers provided matching or non-matching contributions to their employees. Approximately 85% of employers provided a 401 match to their employees. Approximately 10% of employers provided non-matching 401 contributions, with no requirement that employees also contribute.

While the annual limits for individual contributions are cumulative across 401 plans, employer contribution limits are per plan. If you were to participate in multiple 401 plans in one calendar year , each of your employers could max out their contributions.

You May Like: What To Do With Your 401k

Are You Eligible To Invest In Other Tax

Claiming a tax deduction to save for retirement is always smart. But, you don’t necessarily have to invest in a 401 to get a tax break. You could invest in an IRA or a health savings account .

If you have the money to max out all your tax-advantaged retirement accounts, including your 401, HSA, and IRA, you should do that. But, if you have more money to save for retirement than the amount needed to earn the employer match and you can’t max out all your accounts, you’ll need to determine if some of your money should go into a tax-advantaged account that isn’t a 401. The catch is, there’s no guarantee everyone can invest in these accounts.

The Ascent’s picks for the best online stock brokers

Find the best stock broker for you among these top picks. Whether you’re looking for a special sign-up offer, outstanding customer support, $0 commissions, intuitive mobile apps, or more, you’ll find a stock broker to fit your trading needs.

HSAs are meant to help save for healthcare, as you make contributions with pre-tax funds and aren’t taxed on withdrawals used to pay medical expenses. But, they can be used as retirement accounts because you can take money out for any purpose after age 65 and pay ordinary income taxes just like with a 401. However, you can only contribute to an HSA if you have an eligible high-deductible health plan and the annual contribution limit is $3,500 for a solo HSA or $7,000 for a family HSA.

Running The Numbers: How Much Money Should You Put In Your 401

When you first have a job with access to retirement savings with a 401, it can be difficult to determine how much of your check to set aside for your golden years. Even if you have been dutifully contributing to your account for a decade or more, you might be unsure about whether your savings will be enough to sustain your retirement. Use these benchmarks to see if your 401 investments are on track for a financially sound future.

Read Also: Should I Open A 401k

The Two Fundamental Rules Of Retirement Savings

Here are two rules that will apply to almost everyone:

Choosing Health Insurance Bills Or Your 401

If you cant afford to pay your monthly bills, you cant afford to make 401 contributions. If there are unexpected expenses or loss of income, you may even need to withdraw retirement money early. If possible, focus on putting in the minimum to get your employers match, then use additional money to pay off any high-interest debt, like credit cards.

One option, if youre struggling to afford your 401 contributions, is to choose a cheaper health insurance plan. People who overpay for health insurance are 23% more likely to forgo their employers retirement match, a TIAA Institute study found.

A health savings account can help you reduce health costs and save for retirement at the same time. You can only fund one if you have a high-deductible health plan, which often leads to higher out-of-pocket costs. You fund an HSA with pretax money. When you spend it on Internal Revenue Service -approved qualified medical expenses, your distributions for those are also tax-free and penalty-free.

An HSA is a good supplement to your 401 contributions, because if you have unused money in the account when you turn 65, you can withdraw it without penalty for any purpose, though youll owe income taxes for distributions made for non-qualified medical expenses.

You May Like: Can You Convert A Roth 401k To A Roth Ira

If Youre In Debt Focus On High

If your employer matches 401 contributions, put in enough to get that match, even if youre in debt.

Next, if youre in credit card debt, stop. Put your extra money towards paying that off before making additional retirement contributions. Focus first on getting out of credit card debt and then come back.

Got student loans? Follow the above schedule anyway. Unless your private loans have double-digit interest rates, I dont recommend repaying student loans early.

Good News About Retirement Contribution Limits And Income Ranges

If you’re already maxing out your retirement accounts, some news you should know: The Internal Revenue Service made a cost of living adjustment that allows you to put away more money in retirement plans.

Anyone enrolled in their employers retirement plan and still working can generally make a maximum contribution of $19,500 per year, which remains unchanged from 2020.2

If you have an IRA, your annual max contribution is still $6,000.

Get the scoop: Read more about the 2021 contribution limits and income ranges.

You May Like: How To Convert 401k To A Roth Ira

It Never Hurts To Save More

Twenty percent is a great goal, but some retirement experts actually suggest saving more like 25% or even 30. Why?

You know that saying, Past returns are no guarantee of future performance? Thats why. Its true that the annual average return of the S& P 500 between 1928 and 2014 was 10%. But that doesnt mean well get that average return over the next 86 years.

Jack Bogle, the father of index funds and founder of Vanguard, says that investors should plan on lower returns in the coming decade and other commenters suggest lower yields even beyond that.

We have no way of knowing what future returns will bethey could be 8%, they could be 4%. But the only way to hedge against an uncertain future is to save more money. The more you have, the less you need jaw-dropping returns to meet your goals.

Do They Take 401k Out Of Bonus

In some cases, your company may not allow you to make 401 contributions using your bonus. Thus, if you typically contribute 10 percent from every paycheck to your 401, that same amount could be withheld from your bonus, unless you say otherwise. So in the case of a $15,000 bonus, $1,500 would go into your 401.

Read Also: How Do I Use My 401k To Start A Business

Build Wealth Through Real Estate

In addition to investing in stocks and bonds through your 401k, I recommend diversifying into real estate as well. Real estate is a core asset class that has proven to build long-term wealth for Americans. Its important to own a tangible asset that provides utility and a steady stream of income.

Given interest rates have come way down, the value of rental income has gone way up. The reason why is because it now takes a lot more capital to generate the same amount of risk-adjusted income. Inflation is picking up steam, which further boosts the value of real estate.

With real estate, you can earn a steady stream of passive to semi-passive income well before age 59.5, which is when you can withdraw from a 401k penalty-free.

Plan To Replace About 80% Of Income

When you stop working, aim to replace about 80% of pre-retirement earnings from all income sources combined, such as 401s and IRAs, Social Security, and pensions.

You can anticipate spending less, because youll no longer be paying payroll taxes or making 401 contributions. You may also spend less on things like gas and clothing, because youre no longer working. The actual amount youll need in order to replace your working income depends on how frugal or luxurious you want your retirement to be.

Read Also: What Employees Can Be Excluded From A 401k Plan

Does Your 401 Have High Fees

Many 401 plans charge fees for managing assets. According to one 2018 report from BrightScope, the average total plan cost among all plans in 2015 was .88% of assets. However, some plans charged as much as 1.38% of assets.

Fees undeniably eat into your returns and make saving way harder. If you’re charged a .5% fee, you’d need to invest around $575 more per year to end up with the same retirement nest egg compared with paying no fee at all. You’d lose out on around $71,000 due to fees. And it only gets worse. If you’re charged a 2% fee, you need to contribute more than $2,600 extra per year to end up with the same amount of money and would miss out on almost $240,000 due to the fees you’re paying.

Buying your first stocks: Do it the smart way

Once youve chosen one of our top-rated brokers, you need to make sure youre buying the right stocks. We think theres no better place to start than with Stock Advisor, the flagship stock-picking service of our company, The Motley Fool. Youll get two new stock picks every month, plus 10 starter stocks and best buys now. Over the past 17 years, Stock Advisors average stock pick has seen a 640% return more than 4.5x that of the S& P 500! . Learn more and get started today with a special new member discount.

Start Saving Your 401k Immediately

Another thing that can make a big difference in how much you end up with is when you begin. With the generous benefits of the tax code, putting money into a 401k should be a priority. Just starting five years earlier can make a big difference. Plus, the longer compound interest has to work on your behalf, the better off youll be in the long run. You can even set aside a little bit less each month the longer you plan to save. Start now to save and then look for ways to increase your 401k saving until you hit the max. Its vital to your future financial health that you do what you can to improve your situation. The more you do now, the better your retirement is likely to be.

Recommended Reading: Can I Buy 401k Myself

Take Note Older Savers

If you start saving later in life, especially when you’re in your 50s, you may need to increase your contribution amount to make up for lost time.

Luckily, late savers are generally in their peak earning years. And, from age 50, they have a greater opportunity to save. As noted above, the 2021 limit on catch-up contributions is $6,500 for individuals who are age 50 or older on any day of that calendar year.

If you turn 50 on or before Dec. 31, 2021, for example, you can contribute an additional $6,500 above the $19,500 401 contribution limit for the year for a total of $6,000.

“As far as an ‘ideal’ contribution is concerned, that depends on many variables,” says Dave Rowan, a financial advisor with Rowan Financial in Bethlehem, Pa. Perhaps the biggest is your age. If you begin saving in your 20s, then 10% is generally sufficient to fund a decent retirement. However, if you’re in your 50s and just getting started, you’ll likely need to save more than that.”

The amount your employer matches does not count toward your annual maximum contribution.

The Quality Of Your 401and The Funds In Itmatters A Lot

Although its always better to save more, you cant overlook how youre investing your hard-earned dollars.

All 401 plans are not created equal. And though 401s have a lot of upsideshigh tax-advantaged contribution limits and employer matches they have negatives, too. The biggest complaint about 401 plans is a lack of investment choices.

The companies that administer 401s choose the funds you can invest in. Depending on your employer and your 401 administrator, you may not have many funds to choose from and/or the available funds will have higher fees than you could get if you were investing on your own.

This is the biggest reason we recommend opening an IRA, whether its to:

- Invest funds after taking advantage of your employers match or

- Rollover an old 401 as soon as you leave a job.

In an IRA, you can find more investment options with lower costs.

Related: Best Investment Accounts For Young Investors

Not long ago, you had two options: Give up 1% of your annual assets for a professional wealth manager to handle your investmentsor figure it out on your own.

Fortunately, there are new, powerful tools out there that can give you free insights into whether youre investing in the right areas within your 401 and IRAs. Personal Capital is a free app that creates easy-to-understand visuals of the investments you own in your 401, IRA, and other investment accounts. It then provides recommendations for how to rebalance your portfolio for maximum results and reduce expenses.

Also Check: How Do You Get Money From 401k

So How A Lot Do You Have To Spend Money On Your 401k

Okay. So, whereas investing is very private and monetary objectives needs to be personalised, youre right here so we are able to train you to be wealthy. Now we have some recommendation to get you began.

How a lot it is best to really be investing every month relies on a system we name the Ladder of Private Finance. Take a look at this video, or learn in regards to the Ladder under:

1. Your employers 401k match. Every month you ought to be contributing as a lot as it is advisable to in an effort to get essentially the most out of your organizations 401k match. Which means if your organization presents a 5% match, you ought to be contributing AT LEAST 5% of your month-to-month earnings to your 401k every month.

Weve already mentioned the significance of this dont throw away free cash and the returns from that free cash.

2. Whether or not youre in debt. When youve dedicated your self to contributing a minimum of the employer match on your 401k, it is advisable to be sure to dont have any debt. Keep in mind, if in case you have worker matching, youre successfully incomes a 100% return on each penny you spend money on your 401k thats considerably greater than the curiosity youd save by paying down your debt.

Should you dont, nice! Should you do, thats okay. You may try my system on eliminating debt fast to help you.