You Want To Increase Your Tax Diversification

Contributions to traditional IRAs are tax-advantaged, meaning you wont pay taxes on your invested funds until you begin taking withdrawals at retirement. Roth IRAs, on the other hand, are taxed up front but offer tax-free withdrawals after age 59 ½. If youre unsure how your tax and income situation might pan out in the future, having both types of accounts a traditional IRA and a Roth IRA is a smart move in terms of diversifying your future tax exposure.

Your 401 Lets You Move Your After

If your plan doesnt allow in-service withdrawals to a Roth IRA or in-plan rollovers to a Roth 401, then your opportunity to do the mega backdoor Roth is delayed until you leave your job. If thats the case, you might want to reconsider this strategy.

The point is to get as much money into the Roth as soon as possible to get as much tax-free growth as soon as possible.

Ideally, executing the mega backdoor Roth means throwing all of your after-tax savings into your after-tax bucket contribution limit). Then, youre almost immediately getting your money out of that bucket and into either a Roth IRA or Roth 401 before it starts accruing investment earnings. Thats because if left in the after-tax bucket, youre going to eventually owe tax on those earnings. But once that money is in a Roth, your money grows tax-free.

The point is to get as much money into the Roth as soon as possible to get as much tax-free growth as soon as possible. If your after-tax contributions accumulate investment earnings, the IRS has said its OK to split up that money, by rolling your after-tax contributions into a Roth IRA and the investment earnings into a traditional IRA. That means your contributions will still grow tax-free, and your investment earnings will grow tax-deferred youll pay income taxes when you take them out in retirement.

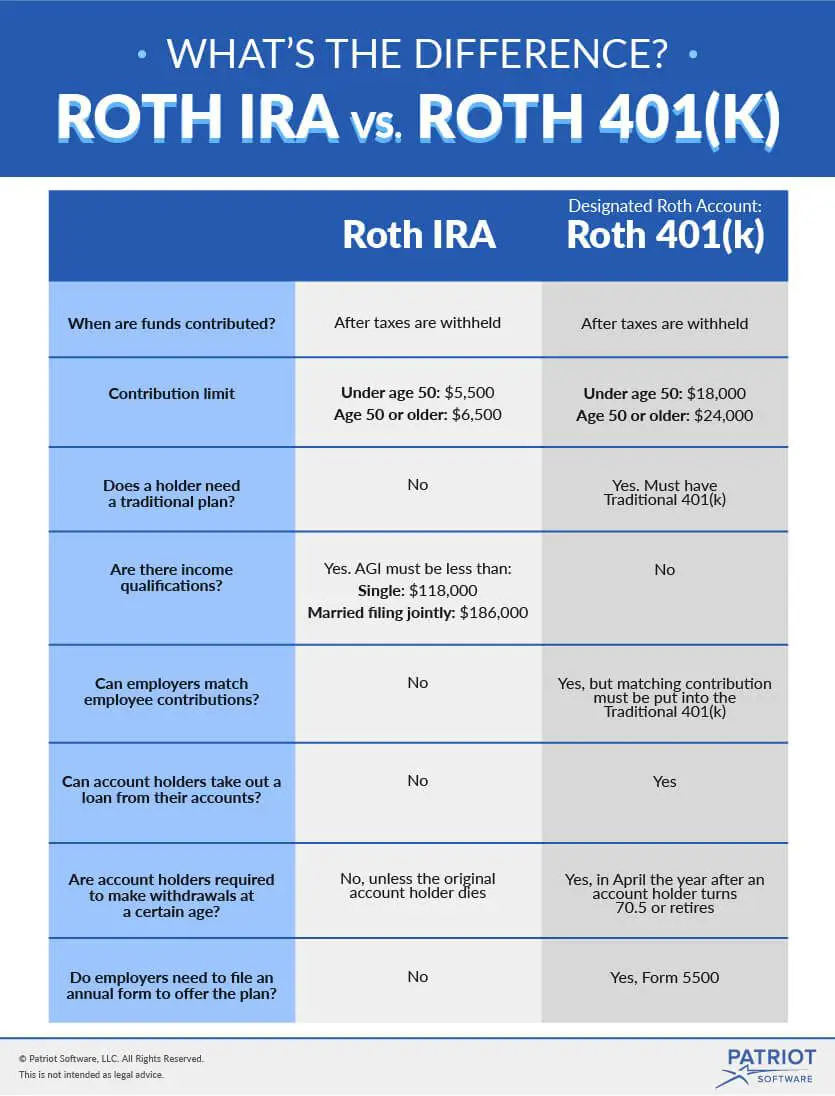

Interested In A Roth 401k Here’s How They Work

As the name suggests, a Roth 401k combines features of the traditional 401 with those of the Roth IRA. It’s offered by employers like a regular 401k plan, but as with a Roth IRA, contributions are made with after-tax dollars. While you don’t get an upfront tax-deduction, the account grows tax-free, and withdrawals taken during retirement aren’t subject to federal income tax, provided you’re at least 59 1/2 and you’ve held the account for more than five years.

Also Check: Should I Roll My 401k Into An Annuity

What You Need To Know About Gold Iras

A standard IRA allows you to invest in funds and other products with a wide range of eligibility requirements. With these types of IRAs, you will pay both a brokerage and a management fee, depending on which company you use. There are also some IRA companies that offer the option to invest in gold iras and there may be a discount or no service charge. When you buy a gold IRA, the company will typically provide a full disclosure of their brokerage and management fees and charges.

Investing in gold IRAs provides you with tax benefits over other forms of investing in a retirement plan. The most popular form of IRA investing is the Roth IRA, which allows you to invest in any form of income, without having to pay taxes on them. In order to contribute to a Roth IRA, you need to have an employer-sponsored retirement plan. The tax benefits that you receive from the investment will depend on the type of income that you have and the tax rate that you are paying.

Rolling Over From A Traditional 401

If you currently have a traditional 401 and want to convert it to a Roth 401, you also may have the option to do that. But it’s important to understand the tax implications of this type of rollover.

You contribute to a traditional 401 with pre-tax funds and are taxed on withdrawals as ordinary income after age 59 1/2 . When you contribute to a Roth 401, however, you contribute with after-tax dollars but can take tax-free withdrawals.

Because of the different tax rules, rolling over money from a traditional to a Roth 401 has tax consequences, with converted funds classified as taxable income. This can increase the amount of income taxes you owe the IRS in the year the conversion takes place.

However, while you may get a large IRS tax bill, this can make sense in some situations. You may wish to convert a traditional 401 to a Roth 401 under the following circumstances:

- You’re in a lower tax bracket now than you expect to be in retirement: If this is the case, you’ll owe less tax on the converted funds at your current low tax rate than you’d otherwise pay when taking taxable distributions from a traditional 401 as a retiree.

- You want to minimize taxes on Social Security: Distributions from a Roth 401 aren’t considered “countable” income when you’re determining if a portion of your Social Security benefits will be taxed.

Converting a traditional 401 to a Roth 401 is simple — you’ll just need to complete some paperwork to request the transfer of funds.

Don’t Miss: Can I Rollover My 401k To A Roth Ira

How To Maximize Roth Savings Through A 401k Plan

A “Roth” retirement account is the greatest savings vehicle ever invented, because all investment profits in a Roth account are totally income-tax-free. The only problem is, how do you get money into a Roth account without undue tax cost? This article looks at a case study that will illustrate little-known ways that some workers can maximize their Roth contributions to a 401k at a low tax cost.

Can My Employer Match My Designated Roth Contributions Must My Employer Allocate The Matching Contributions To A Designated Roth Account

Yes, your employer can make matching contributions on your designated Roth contributions. However, your employer can only allocate your designated Roth contributions to your designated Roth account. Your employer must allocate any contributions to match designated Roth contributions into a pre-tax account, just like matching contributions on traditional, pre-tax elective contributions.

Read Also: How To Use Your 401k

Who Is Responsible For Keeping Track Of The Designated Roth Contributions And 5

The plan administrator is responsible for keeping track of the amount of designated Roth contributions made for each employee and the date of the first designated Roth contribution for calculating an employees 5-taxable-year period. In addition, the plan administrator of a plan directly rolling over a distribution would be required to provide the administrator of the plan accepting the eligible rollover distribution) with a statement indicating either the first year of the 5-taxable-year period for the employee and the portion of the distribution attributable to basis or that the distribution is a qualified distribution.

Can I Roll Over Distributions From A Designated Roth Account To Another Employer’s Designated Roth Account Or Into A Roth Ira

Yes. However, because a distribution from a designated Roth account consists of both pre-tax money and basis , it must be rolled over into a designated Roth account in another plan through a direct rollover. If the distribution is made directly to you and then rolled over within 60 days, the basis portion cannot be rolled over to another designated Roth account, but can be rolled over into a Roth IRA.

If only a portion of the distribution is rolled over, the rolled over portion is treated as consisting first of the amount of the distribution that is includible in gross income. Alternatively, you may roll over the taxable portion of the distribution to another plans designated Roth account within 60 days of receipt. However, your period of participation under the distributing plan is not carried over to the recipient plan for purposes of measuring the 5-taxable-year period under the recipient plan.

The IRS may waive the 60-day rollover requirement in certain situations if you missed the deadline because of circumstances beyond your control. See FAQs: Waivers of the 60-Day Rollover Requirement.

You May Like: How Do I Transfer 401k To New Employer

Advantages Of Roth Conversion

Tax-free growth and withdrawals. Once the conversion tax is paid, there will be no further tax due on money inside a Roth account while it compounds, and no tax when you make withdrawals

Minimize Your RMDs. Roth IRAs are totally free of any required minimum distributions. Remember, even Roth 401s have RMDs. And even if you only convert some of your traditional account balances, the smaller balances left in traditional accounts mean smaller annual RMDs when you turn 72.

Hedge against rising tax rates. Individual tax rates are near historic lows, and the federal deficit is near historic highs. Theres no crystal ball that lets you see where tax rates might be in five, 10 or 20 years, but paying some tax today might be worth consideringespecially if you dont expect your income to decline in retirement. For people who have built up solid balances in their investment and retirement accounts, by the time they take all their RMDs from traditional accounts and add in Social Security and other pensions they might be getting, plus take away the deductions they might have had access to when they were running businesses, being in a higher bracket in retirement isnt all that unlikely, says Foss.

Disadvantages Of Roth Conversion

You expect your tax rate in retirement to be lower. If youre in a high federal tax bracket today and expect your retirement income to be low enough that your tax rate will be lower, too, Roth conversions dont make any sense. That said, you still face the wildcard issue of what Congress might do with tax rates in coming years.

Paying taxes upfront. Do you have the free cash flow to handle the extra tax hit from a Roth conversion? If you have high-rate credit card debt, or your emergency fund is a bit thin, you might want to tackle those issues before giving yourself a bigger tax bill.

Social Security issues. If youre already collecting Social Security, whether the payout is taxableand the extent to which it will be taxedis based in part on your income.

The year you do a Roth conversion, your taxable income will rise, which could cause a portion of your Social Security benefit to be taxed or push you into a situation where more of your benefit is taxed.

Less bankruptcy protection. Creditors cant touch money inside a 401 account, but there is a limit on protection of IRA assets. The combined IRA amount protected from creditors in 2021 is $1,362,800. This cap is reset every three years to adjust for inflationthe next adjustment will be in April 2022.

Don’t Miss: How Do I Transfer My 401k To A Roth Ira

Roth Iras And Income Requirements

There is another key distinction between the two accounts. Anyone can contribute to a traditional IRA, but the IRS imposes an income cap on eligibility for a Roth IRA. Fundamentally, the IRS does not want high-earners benefiting from these tax-advantaged accounts.

The income caps are adjusted annually to keep up with inflation. In 2021, the phase-out range for a full annual contribution for single filers is from $125,000 to $140,000 for a Roth IRA. For married couples filing jointly, the phase-out begins at $198,000 in annual gross income, with an overall limit of $208,000.

And that is why, if you have a high income, you have another reason to roll over your 401 to a Roth IRA. Roth income limitations do not apply to this type of conversion. Anyone with any income is allowed to fund a Roth IRA via a rolloverâin fact, it is one of the only ways.

401 funds are not the only company retirement plan assets eligible for rollover. The 403 and 457 plans for public-sector and nonprofit employees may also be converted into Roth IRAs.

Investors may choose to divide their investment dollars across traditional and Roth IRA accounts, as long as their income is below the Roth limits. However, the maximum allowable amount remains the same. That is, it may not exceed a total of $6,000 split among the accounts.

Should I Convert My Current 401 Into A Roth 401

If you already have a traditional 401 at your current job and the company just introduced a Roth 401 option, converting that 401 into a Roth might sound like a good idea. But is a conversion your best option? It depends on your situation.

The main drawback of converting a traditional 401 into a Roth 401 is the tax bill that comes with making the switch. Youre going to have to pay taxes on that money because it hasnt been taxed yet.

Lets say you have $100,000 in your traditional, pretax 401 and you want to convert the account into a Roth, after-tax 401. If youre in the 22% tax bracket, that means youd be paying $22,000 in taxes. Thats a lot of cash!

If you convert your 401 into a Roth 401, you need to have the cash on hand to cover the tax billno exceptions. Do not use money from the investment itself to pay the taxes. If you do, youll lose a lot more than $22,000. Youll also miss out on years of compound interest, which is typically about 10%. So after 30 years, a $100,000 account could grow to be $436,000 more than an account with a $78,000 starting point because of compound interest.

There are also alternatives to a 401 conversion to consider. For example, you can leave your traditional 401 alone and start putting money from your paycheck into a new Roth 401 instead. That way, you dont have to worry about taking a hit paying taxes now and still take advantage of the Roths tax-free growth later.

You May Like: Can You Roll A Traditional 401k Into A Roth Ira

Are The Income Eligibility Limits Still In Place To Make An Annual Contribution To A Roth Ira

Yes. The income limits for annual contributions are still in effect, so its possible to take advantage of a Roth conversion but not be eligible to make an annual contribution. Since there are no income eligibility limits for conversions, however, one common strategy is to make a non-deductible contribution to a Traditional IRA then convert it to a Roth IRA. This may not be an appropriate strategy if you have other Traditional, SEP, or SIMPLE IRA balances, as the pro-rata rule would apply. Please consult a tax advisor to see if this strategy would work for you.

Is A Distribution From My Designated Roth Account For Reasons Beyond My Control A Qualified Distribution Even Though It Doesn’t Meet The Criteria For A Qualified Distribution

No, if you have not held the account for more than 5 years or if the distribution is not made after death, disability, or age 59 ½, then the distribution is not a qualified distribution. However, you could roll the distribution over into a designated Roth account in another plan or into your Roth IRA. A transfer to another designated Roth account must be made through a direct rollover.

You May Like: How To Withdraw My 401k From Fidelity

Distributions From Your Rolled

Although it is typically not advisable to tap retirement funds before you leave the workforce, in tight times, the undesirable option may become the only option. If you must withdraw money from your Roth at the time of the rollover, or soon after that, be aware that the timing rules for such withdrawals differ from those of traditional IRAs and 401s. Some of these requirements may also apply to Roths that are rolled over when you are at or close to retirement age.

Specifically, to make distributions from these accounts without incurring any taxes or penalties, the distribution must be qualified, which requires that it meets what is known as the five-year rule. Also applied to inherited retirement accounts, this rule requires that funds had remained intact in the account for a five-year period to avoid or at least minimize taxes and penalties.

Transfer To Your New Employers 401 Plan

If your new employer allows it, you can move the funds from your old plan into your new one. It can be easier to manage your investments when they are all in one place, which makes this a good option for some. Keep in mind, you still may be limiting yourself regarding investment choices and expenses could be higher too.

There is no one-size-fits-all approach to retirement planning or investing, which is important to keep in mind as Roth conversion strategies gain popularity. Roth conversions may play a large part in maximizing future wealth for some investors. Consider your next steps carefully and find a strategy that is consistent with your retirement planning goals and wealth management objectives.

Don’t Miss: How Much In 401k To Retire

A Conversion May Affect Government Programs

If you participated in government healthcare programs or others that depend on your income, its vital to note that a conversion could affect your eligibility in those programs or their cost.

The Roth conversion is viewed as taxable income in the year it occurs, says Keihn. This means that it could affect your eligibility for Obamacare or financial aid or your childrens financial aid. If you are on Obamacare or completing a FAFSA application, it is important to factor that into the decision of how much to convert, if any.

People who are two years from receiving or are receiving Medicare benefits need to know that their Medicare premium most likely will go up two years after they convert to a Roth IRA, says Gilbert. Medicare has a two-year look-back to determine premiums and in the year you convert, your income will be higher than other years. But this is a one-year spike that will then decrease the following year.