Keep Essentials At About 50% Of Your Pay

Things like bills, rent, groceries, and debt payments should make up about 50% of a gross paycheck. Remove this money from your primary account right away, so you know your needs will be covered.

This generally works, but Poorman says if youre living in a high-cost area like Chicago or New York City, youll likely be shelling out a higher percentage for essentials. Adjust accordingly.

But Why Would I Max Out My Roth Ira Before My 401k If Its So Good

Theres a lot of nerdy debate in the personal finance sphere about this very question, but our position is based on taxes and policy.

Assuming your career goes well, youll be in a higher tax bracket when you retire, meaning that youd have to pay more taxes with a 401k. Also, tax rates will likely increase in the future.

The Ladder of Personal Finance is pretty handy when considering what to prioritize when it comes to your investments, but it is just a tool. For more about the Ladder of Personal Finance and how to make it work for you, check out THIS video where I explain it.

PRO TIP: The video is less than three minutes long. It is worth your time.

Breaking Down A Paycheck 50/30/20

So, what does that strong yet sustainable balance look like? And how do you implement it? Poorman suggests the popular 50/30/20 rule of thumb for paycheck allocation:2

- 50% of gross pay for essentials like bills and regular expenses

- 30% for spending on dining/ordering out and entertainment

- 20% for personal saving and investment goals

Lets break it down: essentials first, savings and investments second, and entertainment third.

Read Also: What Percent Should You Put In 401k

How Much Can You Contribute To A 401

The most you can contribute to a 401 is $19,500 for 2021 . Employer contributions are on top of that limit. These limits are set by the IRS and subject to adjustment each year.

That limit dictates how much you can contribute, but it doesnt tell you how much you should contribute. To figure that out, consider the following.

How Much Do I Deduct From My Paycheck To Be Ok In Retirement

Tweet This

In America you are mostly on your own for retirement. You would be totally on your own if it werent for Medicare, Medicaid and Social Security. But Social Security replaces only about 40-50% of income and you will need about 70-80% in retirement. *

How much do you need to save to be OK in retirement? You need to calculate a target “number” for retirement how much you’ll need to have saved and then translate that target number into a weekly amount to be deducted from your paycheck.

You have to make a lot of assumptions in determining how much to deduct from every paycheck in order to retire well. If you are a median worker, you need about $350,000 in addition to Social Security. If you are a typical college-educated professional, you will need over a million or two.

Lets assume that you replace 80% of your preretirement income in retirement you earn a little above average you work and save consistently for 42 years no taking breaks, no getting laid off or fired, no divorces, no getting sick you earn 5% on your investments after fees you live until 95 and you collect Social Security. Whew, lots of assumptions.

People don’t have enough saved for retirement

The New School for Social Research

You need to save 5% of every paycheck if you start at age 25. You need to save 10% if you start at age 35, 22% if you start at age 45, and 52% of every paycheck if you start at age 55.

The Fantasy Play in American Retirement Planning

Bottom line

Don’t Miss: Can I Rollover My 401k To An Existing Ira

The Power Of Compound Returns

The earlier you start saving for retirement, the less youll need to save each month. You can thank compounding, which is basically the returns you make on returns. Once youre making money on your earnings, your returns compound at an accelerated rate.

Suppose you want to retire at age 60 with $2 million and that you get average returns of 10%. Thats slightly less than what the S& P 500 index has delivered before inflation over the past 60 years with dividends reinvested.

Heres what youd need to invest, between your own contributions and your employers match, if you have a $50,000 annual salary.

- If you started investing at 20: Youd need to invest $316.25 per month, or 7.6% of your salary.

- If you started investing at 30: Youd need to invest $884.76 per month, or 21.2% of your salary.

- If you started investing at 40: Youd need to invest $2,633.76 per month, or 63.2% of your salary.

The examples above show not only how much more youll have to contribute to your 401 each month if you start saving later, but also how much more youll have to save overall. In the first example, youd invest just under $152,000 total by starting at 20. But if you didnt get started until 40, youd wind up investing more than $632,000 to reach your goal.

Keep in mind that 10% is an average, not the 401 rate of return you should expect every year. Your returns will vary, based on how your investments perform, along with the risk tolerance you indicate when you choose your investments.

The 401 Contribution Limit Increased By $500 For 2020 Plus Workers 50 And Older Can Also Save An Extra Amount For Retirement

One of the best and most tax-friendly ways to build a nest egg for retirement is by contributing to an employer-sponsored 401 account. If your employer offers this benefit, jump in as soon as you can, because it’s never too early to start saving for retirement.

> > For more 2020 tax changes, see Tax Changes and Key Amounts for the 2020 Tax Year.< <

Also Check: How To Rollover 401k To Charles Schwab

How Do I Invest 15% For Retirement

The first place to start investing is through your workplace, especially if it offers a company match. If your employer offers a Roth 401 or Roth 403, then you can invest the entire 15% of your income there and youre done. With a Roth option, you contribute after-tax dollars. That means your money grows tax-free, plus you dont pay taxes on that money when you take it out at retirement . Talk about making investing super easy!

If your employer matches your contributions to your 401, 403 or Thrift Savings Plan , you can reach your 15% goal by following these three steps:

For example, if your company will match 3% of your 401 contributions, invest 3% in that account and then put the remaining 12% in a Roth IRA. If that remaining 12% would put you over the annual contribution limit for a Roth IRA , max out the Roth IRA and then go back to your workplace 401 to finish out investing 15%.7

Here are two key takeaways: First, you need to invest 15% of your gross salary, not your take-home pay. Second, do not count the company match as part of your 15%. Consider that extra icing on the cake!

Best Places For Employee Benefits

SmartAssets interactive map highlights the counties across the country that are best for employee benefits. Zoom between states and the national map to see data points for each region, or look specifically at one of four factors driving our analysis: unemployment rate, percentage of residents contributing to retirement accounts, cost of living and percentage of the population with health insurance.

You May Like: How To Search For Unclaimed 401k

When Should You Max Out Your 401

In 2020 and 2021, the most you can contribute to a 401 plan is $19,500 each year . If you can easily afford to max out your contribution based on the yearly limits, without it causing a large impact to your budget, you might want to do so.

Some personal finance experts suggest saving at least 15% of your annual income for retirement in your working career. If you’re making at least $130,000 in 2021, and if you have a good handle on your current finances, chances are you could likely max out comfortably at the $19,500 limit.

This advice is general, so when planning for your own retirement, think about when you might retire, how much you have saved, what your lifestyle might look like during retirement, and how much you’ll need each month to sustain that lifestyle. Once you have a rough target, work backward to figure out how much you should contribute to a retirement fund. What is your current budget like? Can you live comfortably if you contribute the max amount?

One other common best practice is to contribute at least the minimum required to capture your employer’s 401 match, if one is provided. That way, you’re gaining the full benefit of the match without losing a penny.

When Is An Ira A Better Option

An IRA and a 401 are both retirement saving vehicles and the two share commonalities. But there are a few important differences that make IRAs the better choice in some situations.

A 401 is only available through your employer. If you work at a company that doesnt offer a 401, you cant get one. People in work situations where the employer does not offer 401 accounts can still get retirement savings accounts with tax benefits thats where the IRAs come in.

IRAs are another type of retirement savings account. Unlike a 401, an IRA is not tied to your employer. You can sign up for an IRA at online brokerage like E*Trade, Vanguard, or Fidelity and open an account.

Another reason why someone might choose an IRA is for the investment options. IRAs are generally known to have a wider selection of investment opportunities than what youll find with a 401. But keep in mind that the contribution limits with an IRA account is much lower than the limits with a 401.

Read Also: Can I Invest In 401k And Ira

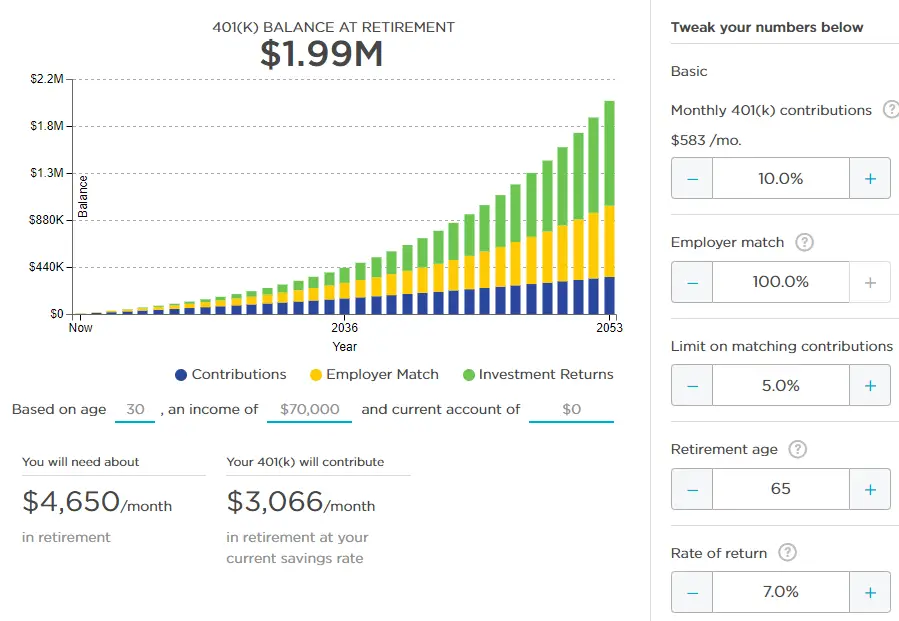

What Percentage Of My Income Should I Contribute To My 401

You can use the 401 calculator to get straightforward, dollars-and-cents answers to many important questions about your retirement. When it comes to how much you ought to be saving, however, things arent quite so simple. It depends on your age, how many years you plan to work and, ultimately, on the kind of lifestyle you want to have after you retire.

Some advisors recommend saving 10-15% of your income as a general rule of thumb. If you save that much from the time you first start working in your 20s until you retire, that may be fine. If youre starting your retirement savings later in life, however, you will want to save more than that to try to catch up. While there are few hard and fast rules on exactly how much you should save, here are some general guidelines:

Max Out Your Contributions If You Can

If youre able, consider contributing the maximum allowed by the IRS. The more you can contribute, the more you can benefit from the HSAs triple tax advantages1 to help build your balance for the future. Keep in mind: You dont lose any unspent funds at the end of the year. All remaining funds roll over to the next year and can potentially keep growing.

Don’t Miss: When Can You Take Out 401k Without Penalty

How Much Should You Contribute To Your 401 Rule Of Thumb

As a rule of thumb, experts advise that you to save between 10% and 20% of your gross salary toward retirement. That could be in a 401 or in another kind of retirement account. No matter where you save it, you want to save as much for retirement as you can while still living comfortably.

Its important to say that this is just a general rule. The actual amount you should save depends on your individual situation. For example, if you are 50 years old and dont have any retirement savings, you should save more than 20% of your gross annual salary. If youre 30 years old and already have $100,000 in retirement savings, you could probably decrease your contributions for a bit in order to pay off a mortgage or loan. Its difficult to create a one-size-fits-all plan, because everyone is in a different place with his or her finances.

Saving 10% to 20% of your salary every year might sound like a lot. Luckily, you dont have to do it all at once. You can spread your contributions out throughout the year and you can contribute more or less some years. You also dont have to save all that money through your 401. Lets take a step back and talk about other factors you should consider when you think about how much to contribute to your 401.

Invest In Iras And Roth Iras

If you remember the rule of thumb earlier, experts advise saving 10% to 20% of your gross salary each year for retirement. You could put this all in your 401, but you should consider some other options once you cover your 401 match.

If you earn less than $122,000, you qualify for a Roth IRA in 2019. Youll qualify for a Roth IRA in 2020 if you earn less than $124,000. This is a retirement savings vehicle that you can open at virtually any bank or financial institution. You fund these with after-tax dollars. So your contributions wont reduce your taxable income. However, eligible withdrawals you make after turning 59.5 are tax free. Its good to have a mix of taxable and non-taxable income in your retirement.

Roth IRAs are particularly useful for young people who are just starting their careers. Chances are that if you just graduated from college, youre in a lower tax bracket than you will be in when you retire. Paying the income tax now instead of later can save you money, especially when you need it the most

In 2019, you can contribute up to $6,000 to a Roth IRA. The $1,000 catch-up contribution for those who are at least 50 years old applies here too. You can also contribute up to $6,000 in 2020.

You can also invest in a traditional IRA, which takes pre-tax dollars and lessens your taxable income just like a 401. Some people also have an IRA because when they left a previous employer, they moved their 401 funds into an IRA via an IRA rollover.

You May Like: How To Find Old Employer 401k

How Much Will Your 401 Be Worth

We all have ideas for how wed like to spend our retirement. Whether you hope to travel the world, buy an RV, or just spend more time with your family, the choices you make today will dictate the options available to you when you retire.

Fortunately, you dont have to fly blind. Use Ubiquitys 401 calculator to get a clear picture of how your savings will stack up when you retire and how much you should be saving now to realize your goals.

Provisions For Changing Jobs

Most 401 plans permit the employee who terminates employment the options of receiving the 401 balance in a lump sum or to receive periodic payments or to roll over the proceeds to an IRA or other employer-sponsored retirement plan. Additionally, some 401 plans permit the terminated employee to retain their 401 balance in their former employer’s plan. Amounts that are retained in a former employer’s 401 plan or transferred to another employer’s plan or IRA postpone the taxation until amounts are subsequently distributed from the plan or IRA the money was rolled into.

When receiving funds from a 401 with the intention to roll the amount to an IRA:

- The rollover must be completed in 60 days.

- Employers must withhold 20% of the proceeds as a withholding tax. It is up to the participant to make up this 20%, or it will be treated as a distribution. The money withheld will be used as a credit against any income tax liability.

- Neither the 60-day rule nor the 20% withholding apply to amounts directly transferred to an IRA or other qualified plan.

Also Check: Where Can I Find My 401k Balance

How To Invest When To Withdraw

Pfau’s research highlights two other important variables. First, he notes that over time the safe withdrawal ratethe amount you can withdraw after retirement to sustain your nest egg for 30 yearswas as low as 4.1% in some years and as high as 10% in others. He believes that “we shift the focus away from the safe withdrawal rate and instead toward the savings rate that will safely provide for the desired retirement expenditures.”

Second, he assumes an investment allocation of 60% large-cap stocks and 40% short-term fixed-income investments. Unlike some studies, this allocation doesnt change throughout the 60-year cycle of the retirement fund . Changes in the persons portfolio allocation could have a significant impact on these numbers, as can fees for managing that portfolio. Pfau notes that “simply introducing a fee of 1% of assets deducted at the end of each year would increase the baseline scenarios safe savings rate rather dramatically from 16.62% to 22.15%.”

This study not only highlights the pre-retirement savings needed but emphasizes that retirees have to continue managing their money to prevent spending too much too early in retirement.