Deadline To Contribute To A Self

The employee deferral contribution must be elected by December 31 of the year you want to make the contribution. However, some 401k third party administrators may allow you to set up your 401k plan now and backdate your election. The actual contribution can be made up to the tax filing deadline including extensions.

Therefore, the contribution for your 2020 self-employed 401k can be made as late as October 15, 2021 if thats the date you file your tax return. To be safe, after your CPA has calculated your self-employed net income, give your financial advisor one month to work with the TPA to set up the 401k plan.

Electronically Filing Form 5500

Instead of filing by mail, you can file electronically. The IRS says electronic filing makes the process easier for the filer and increases data accuracy. However, it is more complicated than filing on paper. You can’t electronically file Form 5500-EZ instead, you file Form 5500-SF, Short Form Annual Return/Report of Small Employee Benefit Plan. To file, you must use the Department of Labor’s EFAST2 web-based filing system . The IRS has a free online software application called IFILE that you can use. You’ll need to register and set up an account. For more information, see the EFAST2 website. For telephone assistance, call the EFAST2 Help Line at 1-866-463-3278.

Visit the IRS’s Form 5500 Corner web page, and see the instructions for Form 5500-SF and the instructions for Form 5500-EZ for additional information.

How Do I Maximize Individual 401 Contributions

The Individual 401 plan allows participants under 50 years old to defer through salary withholding $18,500 in 2018 per person. Participants 50 years old and over can contribute an additional $6,000. Employers can contribute up to 25% of each employees compensation to the Individual 401 plan, up to a combined maximum of $55,000. This maximum increases to $61,000 for participants over 50 years old . More details and guidelines can be found on the IRS website at .

Individual 401 plans do not need to file a 5500 IRS tax form unless their total plan assets are over $250,000. Many Solo 401 plans do not hire a third party administrator until theyre required to file the Form 5500. The complexities of these small 401 plans are much smaller with only one or two participants, which reduce the need to have a TPA until youre required to file the Form 5500. Its a good idea to discuss the tax implications with your CPA or financial advisor.

Recently Individual 401 plans have become popular with oil and gas consultants. There are other tax deductions and retirement strategies to take advantage of beyond an Individual 401 plan. We can help if youre looking to set up an Individual 401 / Solo 401, or if you have a 401 from a previous employer that youd like to rollover to an IRA! Colorado Financial Management has been assisting clients with retirement and 401 solutions for over 20 years.

Also Check: Can Anyone Have A 401k

How Should You Choose Your Investments

If you decide to use a robo-advisor for your IRA, you dont actually need to choose your investments. Your robo-advisor will ask you for your goals and preferences and select investments that match up with them, and even adjust those investments over time. Thats it youre done.

If youre going the hands-on route with an online broker, consider building a portfolio out of low-cost index funds and ETFs. This approach makes it easier to ensure adequate diversification in your portfolio and helps minimize the fees youll pay.

You can explore this topic in more detail in our article on investing your IRA.

Can You Set Up An Ira Outside Of Work

Anyone who earns can invest money in an IRA. Couples can also put money into the IRA for a non-working spouse.

Does an IRA have to be through an employer?

Although both accounts are retirement savings funds, 401 is a type of plan sponsored by an employer with its own set of rules. A traditional IRA, on the other hand, is an account that the owner opens without the involvement of the employer.

Can I set up an IRA on my own?

Starting Your Own Auto-IRA If you have earned income, you are eligible to participate in the IRA. Self-deployment gives you the freedom to choose the type of IRA that is best for your situation and to choose your own service provider. Once youve set up an account, you can add an automatic financing feature to your IRA.

Don’t Miss: What Is A 401k Profit Sharing Plan

Who Can Participate In The Plan

In general, employees who are aged 21 or over who have completed one year of service can enroll in the plan. You cant exclude an employee because he or she has reached a specified age.

The IRS sets restrictions to make sure that retirement plans benefit all employees, not just highly compensated employees such as company executives, owners, and high-earning staff members. The IRS defines HCEs as those who:

- Owned more than 5% of the interest in the business the previous year, or

- Received compensation during the preceding year of more than a specific amount .

Youll see restrictions in the plan documents in various places that limit participation by well-compensated employees. For example, employee and company matching contributions for HCEs must be proportional to those for other employees. You can participate in your companys 401 plan as an owner, with some caps on the amount you can contribute each year.

If you have no employees and are the only person in your business, you might be able to qualify for whats known as a Solo 401. It allows a one-owner business to contribute to the plan. You may be able to contribute as both an employee and an employer.

Read more from the IRS about one-participant 401 plans.

Solo 401 Withdrawals And Details

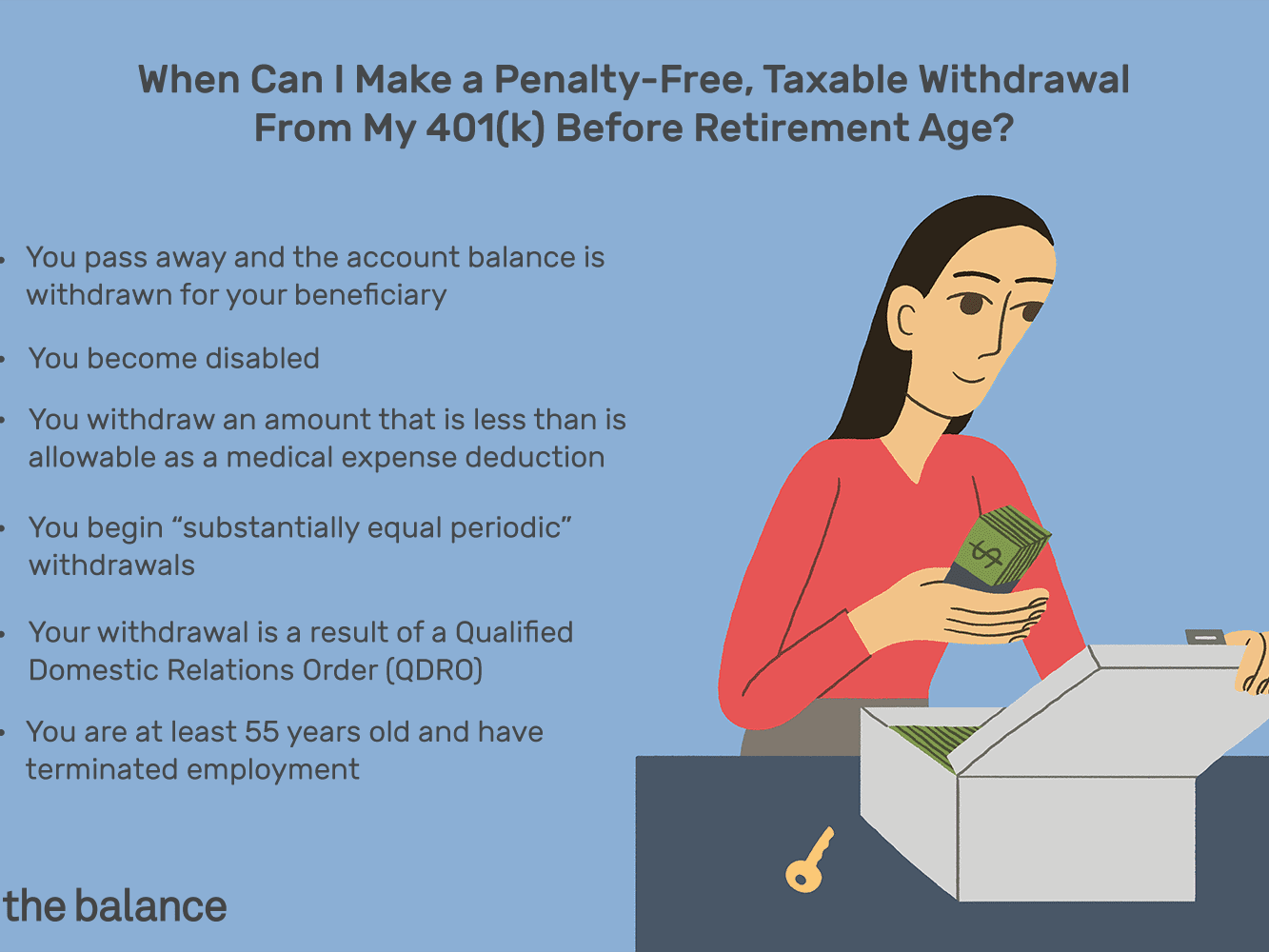

As with all qualified retirement plans, there are rules to when you can and must start taking withdrawals from your Solo 401 plan. You must begin taking the minimum required distribution no later than age 72 . There is a 10% early withdrawal penalty for distributions take before age 59 1/2, but exceptions may apply.

Please refer to the IRS page on individual 401s and review our Solo 401 Guide for additional details.

Read Also: Can You Pull From 401k To Buy A House

Talk To A Tax Attorney

Need a lawyer? Start here.

Self-help services may not be permitted in all states. The information provided on this site is not legal advice, does not constitute a lawyer referral service, and no attorney-client or confidential relationship is or will be formed by use of the site. The attorney listings on this site are paid attorney advertising. In some states, the information on this website may be considered a lawyer referral service. Please reference the Terms of Use and the Supplemental Terms for specific information related to your state. Your use of this website constitutes acceptance of the Terms of Use, Supplemental Terms, Privacy Policy and Cookie Policy. Do Not Sell My Personal Information

What Is A Solo 401

A Solo 401 is a tax-advantaged retirement plan for self-employed business owners and spouses who work for them at least part-time. The Solo 401 is also known as an individual 401, one-participant 401 plan or a self-employed 401. People who have full-time jobs with access to workplace retirement plans may also save for retirement in a Solo 401, using money earned from a side hustle.

A Solo 401 is not the only retirement plan available for the self-employed. When deciding how to invest for retirement, small-business owners with no employees besides their spouses often face a choice between a Solo 401 and a simplified employee pension individual retirement account .

Don’t Miss: Can You Transfer 403b To 401k

What If I Run A Small Business With Employees

Once you have employees, the rules of the road change a bit. A great choice is a SIMPLE IRA, which requires you to offer up to a 3% match for your employees every yearand contributions are tax-deductible. SIMPLE IRAs come with an individual limit of $13,500 a year.8

|

Retirement Option |

|

25% of earned income |

Managing Your Retirement Funds

Make no mistake, you need to start saving for retirement as soon as you start earning income, even if you cant afford much at the beginning. The sooner you start, the more youll accumulate, thanks to the miracle of compounding.

Let’s say you save $40 per month and invest that money at a 3.69% rate of return, which is what the Vanguard Total Bond Market Index Fund earned across a 10-year period ending in December 2020. Using an online savings calculator, an initial amount of $40 plus $40 per month for 30 years adds up to just under $26,500. Raise the rate to 13.66%, the average yield of the Vanguard Total Stock Market Index Fund over the same period, and the number rises to more than $207,000.

As your savings build, you may want to get the help of a financial advisor to determine the best way to apportion your funds. Some companies even offer free or low-cost retirement planning advice to clients. Robo-advisors such as Betterment and Wealthfront provide automated planning and portfolio building as a low-cost alternative to human financial advisors.

Recommended Reading: What To Do With Your 401k

Can I Open A Traditional Ira Without A Job

To contribute to a traditional or Roth IRA, you must have what the IRS defines as earned income. The only exception is a spouses IRA for a non-working spouse. If you do not qualify for an IRA but have other sources of income, you should still make retirement savings a priority.

Do you need an employer for a traditional IRA? Not. Despite both accounts being pension savings funds, 401 is a type of plan sponsored by an employer with its own set of rules. A traditional IRA is an account that the owner opens without involving the employer.

Can An Llc Establish A Solo 401k Plan

BANCKGROUND: I own an LLC but also have a $130K IRA at Charles Schwab & Co., Inc. Since I am a sole owner/member of my LLC, I wanted to open a solo 401k that has a loan provision along with the opportunity to have checking account ability to invest in non-traditional assets in addition to with the ability to own stock/bonds/mutual funds like my current positions at Schwab.

Your paperwork to establish a solo 401k plan seems straight forward however, since I know that I will need a separate EIN number for that retirement plan, my question would be the name that I file with the IRS to set up the EIN. This retirement plan name would be the same I would use for the account at Schwab, a bank, or other ownership of investments that qualify for investment within a 401k plan, and with your organization to create the necessary documentation to create a Solo401k.

Read Also: How Much Can You Borrow From 401k

What Else Do I Need To Know

Here is some more important information that you need to know as a business owner when considering starting a 401 plan.

A 401 plan is considered a qualified plan, under IRS rules. That means it must meet the requirements of the Internal Revenue Code for this type of retirement plan, which include issuing periodic reports about the plan to participants and the IRS.

The 401 and some other types of employer-sponsored retirement plans are called defined contribution plans because the contributions are defined, but not the benefits, as is the case with traditional pensions. The value of the account changes with the level of contributions and the performance of the persons investments.

Contributions to deferred retirement plans, including 401 plans, are not taxed initially. But the account owner must pay tax on the investment and earnings when they are taken out of the plan, at retirement or under specially allowed circumstances.

Can I Open An Ira With $500

You can open a Roth IRA account with just $ 500. Your account is professionally managed with a very low fee of 0.25% of your account balance. The first $ 5,000 in your account is managed for free.

Whats the minimum amount to open a Roth IRA?

What is the minimum to open a Roth IRA? The good news is that the IRS does not require a minimum amount to open a Roth IRA. Although there is a Roth IRA maximum amount of contributions, there is no minimum amount, according to the rules of the Tax Administration.

Can I open an IRA with $200?

If you want to open a Roth IRA in a bank and / or credit union, you will most likely be limited to savings and CDs as your investment options. If you plan to just keep your savings, youll need at least $ 200 to get started. If you want to buy a CD, you will need a minimum of $ 1,000.

Read Also: How To Take Money Out Of 401k Without Penalty

How Do I Create A 401 Plan

Creating a 401 plan for a companyeven a small oneis a complex process. The following is a basic overview of the steps for getting approval and starting the plan:

- Write a plan with the help of a plan adviser and send it to the IRS for a determination letter .

- Find a trustee to help you decide how to invest contributions and manage individual employee accounts.

- Begin making employer contributions, if offered, and allowing employee contributions through your payroll system.

Use Assessed Value Of Property For In

No. The taxes owed on the in-kind distribution of the land will be based on the fair market value of the land. As such, it would not necessarily be appropriate to use the assessed value . The most conservative approach would be to obtain a third party valuation such as an appraisal or at least an assessment from a professional such as an experienced realtor based on comps, etc. Ultimately, the governments concern is the underpayment of taxes especially from the distribution of property owned inside a solo 401k plan or a self-directed IRA.

Don’t Miss: Is There A Limit For 401k Contributions

What Paperwork You Need To Fill Out To Open Your Account

I was surprised at how much paperwork is required to open a solo 401k account. You’d think it would be simple, with very common forms to fill out. However, it’s completely the opposite. It becomes even more challenging if you add a Roth solo 401k, and you have to do double the paperwork if you’re adding a spouse to your plan.

When opening your solo 401k plan, you will need to create the following documents. You will need to create separate plan documents for both your Traditional and Roth Solo 401ks. They are both considered separate plans for tax purposes.

Plan Documents For Traditional Solo 401k

- 401k Plan Adoption Agreement

- Designation of Successor Plan Administrator

Plan Documents For Roth Solo 401k

- 401k Plan Adoption Agreement

- Designation of Successor Plan Administrator

Required Documents For Individual

- Brokerage Account Application for 401k Account

- Brokerage Account Application for Roth 401k Account

- Designation of Beneficiary Form for Account

- Power of Attorney

Required Documents For Spouse

- Brokerage Account Application for 401k Account

- Brokerage Account Application for Roth 401k Account

- Designation of Beneficiary Form for Account

- Power of Attorney

When you’re done with all these documents, you’ll have two solo 401k plans, and 4 accounts .

What Is The Minimum Amount Needed To Open An Ira

The IRS does not require a minimum amount to open an IRA. However, some service providers require minimum account amounts, so if you only have a small amount to invest, find a provider with a low or minimum amount of $ 0. Also, some mutual funds have a minimum of $ 1,000 or more, so you need to consider this when choosing an investment.

Can I open a Roth IRA with $ 100? Generally speaking, there is no minimum balance needed to start funding a Roth IRA. Whether youre willing to pay $ 100 or $ 1,000, you can do so without any penalties or fees.

Also Check: How Do I Get A Loan From My 401k

What Features Should I Have In A 401

Matching Contributions. Your company isnt required to make contributions to the plan, but you can choose to contribute a percentage of each employees pay, you can match the amount each contributes , or you can do both. Under a traditional 401, you can change the amount the company matches each year.

Automatic Enrollment. One increasingly popular feature of workplace retirement plans is automatic enrollment, as a way to increase employee participation. You can set up an individual plan for each employee, and automatically deduct retirement plan contributions from their paychecks. Each employee can opt out or change the amount over time.

Beginning Jan. 1, 2020, your business can qualify for a new tax credit of up to $500 for setting up a new auto-enrollment account, thanks to the SECURE Act law, which stands for Setting Every Community Up for Retirement Enhancement. It put into place numerous provisions intended to strengthen retirement security across the country. This auto-enrollment tax credit for employers is in addition to the startup credit described above, and its available for three years.

All employees must be 100%-vested by the time they attain normal retirement age, or when the plan is terminated.