The Cost Of Using Your 401k For Home Improvements

There are a few benefits to using your IRA or 401k to pay for home repairs and renovations, as well as some added risks. When borrowing from your 401k, youre ultimately borrowing from yourself and paying yourself back at lower interest rates than a credit card. Still, borrowing from a 401k greatly reduces your retirement savings. Employees who lose their job for whatever reason are also required to pay the entirety of the loan back within 30 to 60 days of termination.

Repayment Terms On 401 Loans

- You must pay back your loan within five years. You can do so via automatic payroll deductions, the same way you fund your 401 in the first place. There is no penalty for paying off the loan sooner than that.

- You must pay interest on the loan, at a rate specified by your 401 fund administrator. Typically the rate is calculated by adding one or two percentage points to the current prime interest rate.

Alternatives To Borrowing From Your 401

Before you borrow from a 401 to buy a home, consider whether there are other options available. For example:

- Down payment assistance programs: Down payment assistance programs are designed to help eligible buyers with down payment and closing costs. Some programs offer grants to qualified buyers that don’t have to be repaid. Others offer matching savings programs, similar to a 401, that match every dollar you save towards your down payment, up to a certain amount.

- Down payment gifts: If you have family members who want to support your efforts to buy a home, consider asking them to gift money for a down payment. The amount of money that can be gifted and the amount you have to put towards the down payment out of your own funds may vary based on the type of mortgage. The most important thing to remember with down payment gifts is that they must be thoroughly documented. Otherwise, the lender might not allow you to use those funds for your down payment.

- IRA withdrawal: If you have an IRA, you can withdraw up to $10,000 from your account towards a down payment on a home without incurring the 10% early-withdrawal penalty. Be aware that if you’re withdrawing from a traditional IRA, you’ll still owe income tax on the amount you withdraw.

Recommended Reading: What Is Max Amount To Contribute To 401k

Ira Rollover Bridge Loan

There is one final way to borrow from your 401k or IRA on a short-term basis. You can roll it over into a different IRA. You are allowed to do this once in a 12-month period. When you roll an account over, the money is not due into the new retirement account for 60 days. During that period, you can do whatever you want with the cash. However, if its not safely deposited in an IRA when time is up, the IRS will consider it an early distribution. You will be subject to penalties in the full amount. This is a risky move and is not generally recommended. However, if you want an interest-free bridge loan and are sure you can pay it back, its an option.

Is It Better To Borrow From 401k Or Home Equity Loan

The cost of borrowing from your 401 is the amount you would have earned if youd kept the money in the 401K, also known as an opportunity cost. If you plan to use a HELOC or Cash-Out Mortgage Refinance, you avoid having the funds taxed as income and early withdrawal penalties associated with a 401 loan.

Recommended Reading: Where Can I Get A 401k Plan

Using 401 Loan To Buy A Home

If you are cash-strained and you are looking for ways to fund the purchase of your house, taking a 401 loan can help you pay these costs. Usually, IRS rules require participants to pay 401 loans on an amortizing basis for not more than five years. However, if you plan to use the 401 loan to buy a primary residence, you may be allowed a longer repayment period. The repayment terms are determined by the plan administrator, and you could be allowed to repay the money for a longer period than the prescribed 5 years.

You can borrow up to $50,000 to pay the down payment for your primary residence or the closing costs. The loan will not appear on your credit report, and it will not have any impact on your credit score or debt-to-income ratio, since you are borrowing your own money. However, taking a 401 loan to completely finance the purchase of a house may not be feasible compared to using a mortgage loan. 401 loans do not allow tax deductions for interest payments, and you would be better off with a mortgage loan to get tax deductions and lower your tax bill. Also, taking a larger loan could affect the future potential for growth since the loan will be paid over many years.

Borrowing From An Old 401

If you are no longer working for the company where your 401 plan resides, you may not take out a new 401 loan unless your plan specifically allows for it. You may transfer the balance from a former employer to your new 401 plan, and if your current employer plan allows for loans, then you can borrow from there. If you transfer your old 401 to an IRA, you cannot borrow from the IRA. It is best to know all the rules before you cash out or transfer an old 401 plan.

Also Check: How To Find My Fidelity 401k Account Number

What To Do Before Withdrawing From Your 401

Even if you qualify for an early distribution, you should be wary of withdrawing from your 401.

So before borrowing from your 401, where should you look for money? The first and obvious place to look is liquid, cash savings, Levine says. Ideally, everyone would have an emergency fund for situations like this.

If you dont have enough saved up, then take a look at your current spending you may find areas where you can scale back to save money while times are tough.

Do you have a car payment or lease that you could reasonably get rid of by buying a cheaper or used car? Are you living in a rental that you could move out of and into something cheaper? Those are obviously serious steps, and just examples, but withdrawing from a 401 will permanently reduce your savings, says Renfro.

If you cant cut anything out of your budget, you could try to get discounts. Levine suggests calling providers, like your cable and insurance companies, and explaining that you need to cut back due to coronavirus-related cash flow issues. Theyll almost definitely offer a discount, he says.

You could also consider taking out a small loan, but be careful not to get yourself further behind with a high-interest debt payment, Renfro says.

Don’t Borrow From Your Retirement Plan Unless You Know These Things

When you need some fast cash, it can be tempting to look to your retirement plan. You’re allowed to borrow up to the lesser of $50,000 or 50 percent of your vested account balance, and while you will have to pay interest, that money will go toward your retirement instead of into a creditor’s pocket. It seems like a win-win, but there are some drawbacks to this approach that you should know before you use it. Here’s a closer look at the most important things to keep in mind before borrowing from your retirement plan.

1. You could be taxed on the money

You typically have five years to pay back the amount that you borrowed, plus interest, though the repayment period may be longer if you use the money for a down payment on a home. If you can’t pay back the full amount by the end of this period, the outstanding balance will be considered a distribution.

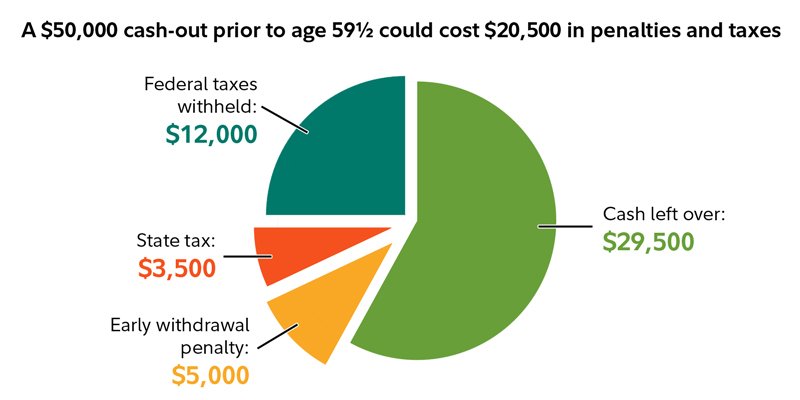

The distribution will be subject to income tax, which for most people will be either 12 percent or 22 percent in 2021. If you’re on the bubble between two tax brackets, it’s possible that this distribution could push you over into the higher bracket, requiring you to pay even more in income tax than you had originally anticipated. And if that isn’t bad enough, individuals under age 59 1/2 must also pay a 10 percent early withdrawal penalty.

2. You have to pay the loan back when you leave your job

3. You’ll hurt your retirement savings

Alternatives to borrowing from your retirement plan

Don’t Miss: Can You Roll Over 401k From One Company To Another

What Not To Do

In the worst of scenarios, you’ll borrow from your retirement plan, fail to repay it and end up with your finances in even worse shape.

Don’t borrow if you’re planning on leaving. Whether you quit your job or you’re fired, you may need to repay the whole balance of your loan within 60 days or else the amount borrowed is considered a taxable distribution.

Don’t ignore your debt-to-income ratio. Treat your plan loan the way you would any other extension of credit. The classic rule of thumb is that no more than 36 percent of your gross monthly income should go toward servicing debt.

This is known as the debt-to-income ratio.

Don’t blow off your plan’s rules for loans. A 2016 study from Aon Hewitt revealed that six in 10 employers have said they’d take steps to curtail the leakage of assets from retirement plans. Those actions include limiting the number of loans available or the amount of money that’s eligible for borrowing.

Plans can also establish their own repayment and schedules, which you’ll need to follow.

“When you take a 401 loan, it comes out of payroll and reduces your take home pay,” said Cox. “Either you follow the payment schedule or you fully remit the balance due.”

More from Personal Finance

Tips For Retirement Savings

- Finding a qualified financial advisor doesnt have to be hard. SmartAssets free tool matches you with up to three financial advisors in your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- Prefer to take a DIY approach to investing and retirement planning? You can start by using this retirement calculator to see if youre on pace for a comfortable retirement. If youd like to invest more to grow that nest egg, check out one of these brokerages where you can open an IRA. You might also use a robo-advisor, which generates an investment plan for you for less than youd pay a traditional advisor.

- If youre over the age of 50, take advantage of catch-up contributions. Catch-up contributions are a great way to boost your savings. Use SmartAssets retirement calculator to ensure youre saving enough to retire comfortably.

Read Also: Should I Pay Someone To Manage My 401k

Do The New Rules Apply To You

Before you make any moves, youll have to find out if your employer has adopted the new relaxed CARES Act provisions in your 401 or 403 plan. loan rules.) Some plans also limit the number of loans a participant has outstanding at one time. Employers can amend the rules at their discretion.

Borrowers also must show that they qualify for loans under the new rules. That means that you or a member of your family is diagnosed with Covid-19 and/or are experiencing financial hardships related to the pandemic.

More from HerMoney:

How Do You Prove Need For 401k Hardship Withdrawal

Each plan administrator can specify what documentation is required for proof of the financial need for a hardship withdrawal.

If the money is used to prevent home foreclosure, the administrator may require documentation from the mortgage company that the home is about to enter foreclosure, for example.

Also Check: How To Take Out 401k Early

When Should I Take Out A 401 Loan

Most employer-sponsored 401 retirement plans allow employees to borrow against their accounts, but employers can restrict what you’re allowed to use the funds for. You’re also putting your retirement savings at risk, so be careful about what you’re borrowing for regardless of if there’s a restriction.

Situations that may necessitate a 401 loan include:

- Funeral expenses

- Making a down payment on a house

- Covering costs to prevent foreclosure or eviction

- Paying education costs for yourself or your family members

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Recommended Reading: How To Transfer 401k From Old Job

Can I Use My 401 To Buy A House

For many would-be homeowners, the down payment is the biggest entry barrier to buying a house. While down payments can be as low as 3.5%, 20% is ideal if you want to secure a mortgage without monthly mortgage insurance fees.

If youre having trouble gathering funds for a down payment, you might find yourself considering using your 401 retirement fund as a convenient source of cash. While this is technically allowed, and could help you cover your down payment, there are some factors and drawbacks that you might want to consider.

Well break down the pros and cons of making a 401 withdrawal for a home purchase, as well as some alternatives.

Can You Borrow From Your 401

Plan offerings: Before you count on a loan, verify that you actually can borrow from your 401 under your plans rules. Not every plan allows loans its just an option that some employers offer and theres no requirement that says 401 plans need to have loans. Some companies prefer not to. Employers might want to discourage employees from raiding their retirement savings, or they may have other reasons. For example, they dont feel like processing loan requests and repayments. How do you find out if you can borrow from your 401 plan? Ask your employer, or read through your plans Summary Plan Description . If loans are not allowed, there might be other ways to get money out.

Former employees: 401 loans are generally only allowed while youre still employed. If you no longer work for the company, youd have to take a distribution from the plan instead. Former employees dont have any way to repay the loan: You cant make payments through payroll deduction because youre not on the payroll any more.

You May Like: What Is A 401k Profit Sharing Plan

Factor In Whenand Howyou Have To Pay It Back

Youre borrowing your own money, but you do have to pay it back on time. If you dont, the loan is considered a taxable distribution and youll pay ordinary income taxes on it. If youre under 59½, youll also be hit with a 10 percent penalty. Put that in real dollars: If youre 55, in the 25 percent tax bracket, and you default on a $20,000 loan, it could potentially cost you $5,000 in taxes and $2,000 in penalties. Thats a pretty hefty price to pay for the use of your own money!

Before borrowing, figure out if you can comfortably pay back the loan. The maximum term of a 401 loan is five years unless youre borrowing to buy a home, in which case it can be longer. Some employers allow you to repay faster, with no prepayment penalty. In any case, the repayment schedule is usually determined by your plan. Often, paymentswith interestare automatically deducted from your paychecks. At the very least, you must make payments quarterly. So ask yourself: If youre short on cash now, where will you find the cash to repay the loan?

Series Of Substantially Equal Payments

If none of the above exceptions fit your individual circumstances, you can begin taking distributions from your IRA or 401k without penalty at any age before 59 ½ by taking a 72t early distribution. It is named for the tax code which describes it and allows you to take a series of specified payments every year. The amount of these payments is based on a calculation involving your current age and the size of your retirement account. Visit the IRS website for more details.

The catch is that once you start, you have to continue taking the periodic payments for five years, or until you reach age 59 ½, whichever is longer. Also, you will not be allowed to take more or less than the calculated distribution, even if you no longer need the money. So be careful with this one!

Recommended Reading: How Do I Find My Old 401k Account

Loans That Do Not Meet Legal Requirements

Loans that exceed the maximum amount or don’t not follow the required repayment schedule are considered “deemed distributions. If the loan repayments are not made at least quarterly, the remaining balance is treated as a distribution that is subject to income tax and may be subject to the 10% early distribution tax. If the employee continues to participate in the plan after the deemed distribution occurs, he or she is still required to make loan repayments. These amounts are treated as basis and will not be taxable when later distributed by the plan.

Next Steps To Consider

This information is intended to be educational and is not tailored to the investment needs of any specific investor.

Fidelity does not provide legal or tax advice. The information herein is general in nature and should not be considered legal or tax advice. Consult an attorney or tax professional regarding your specific situation.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917

Read Also: Should I Roll My Old 401k Into My New 401k