Overall Limit On Contributions

Total annual contributions to all of your accounts in plans maintained by one employer are limited. The limit applies to the total of:

- elective deferrals

The annual additions paid to a participants account cannot exceed the lesser of:

However, an employers deduction for contributions to a defined contribution plan cannot be more than 25% of the compensation paid during the year to eligible employees participating in the plan .

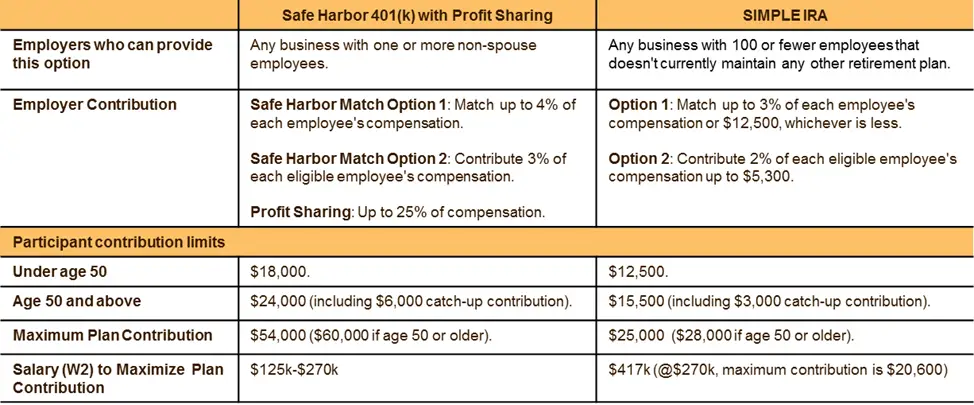

There are separate, smaller limits for SIMPLE 401 plans.

Example 1: In 2020, Greg, 46, is employed by an employer with a 401 plan, and he also works as an independent contractor for an unrelated business and sets up a solo 401. Greg contributes the maximum amount to his employers 401 plan for 2020, $19,500. He would also like to contribute the maximum amount to his solo 401 plan. He is not able to make further elective deferrals to his solo 401 plan because he has already contributed his personal maximum, $19,500. He would also like to contribute the maximum amount to his solo 401 plan.

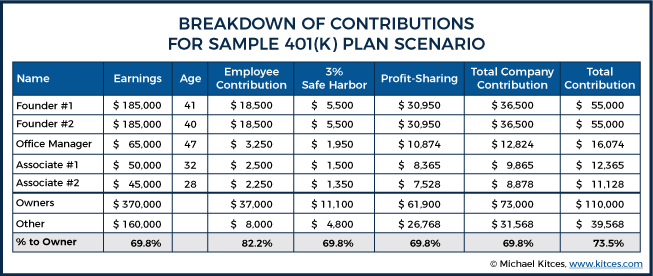

Critical Difference #: Assigning A Criterium For Which Employees Receive Employer Contributions

While profit-sharing plans that give every employee a contribution do exist similar to an employer 401 match, being able to tailor contribution amounts to specific employees is a differentiator with the profit-sharing plan.

- Use the profit-sharing plan to help attract and retain specific, key talent.

- Get all key employees motivated to contribute to the companys bottom line, allowing employers to share profits amongst a mix of rank-and-file employees and owners/managers.

Features Of A 401 Profit Sharing Plan

A 401 PS plan offers four primary advantages over the SEP:

Contributions are flexible for either program. You can make them in some years and not in others.

The term Profit Sharing is actually a misnomer. It is not based on profit but on compensation . In fact, you can have a net loss on the corporation and still make profit sharing contributions.

Example:

Owner pays themself $125,000 salary

- The contribution to a SEP:25% of $125,000 = $31,250 Total contribution: $31,250

- The contribution to a 401 Profit Sharing Plan:Profit Sharing: 25% of $125,000 = $31,250Salary Deferral 401: $18,500 Total contribution = $49,750*

Don’t Miss: What Are The Best 401k Funds To Invest In

Employer Pro: Flexibility Of Employer Contributions

Flexibility with plan contribution amounts is one reason profit share plans are popular with employers. An employer can set aside a portion of their pre-tax earnings to share with employees at the end of the year. If the business doesnt do well, they may not allocate any dollars. But if the business does do well, they can allow employees to benefit from the additional profits.

Contributing To Your 401 Retirement Plan

Contributing to a 401 plan is traditionally done through ones employer.

Typically, the employer will automatically enroll you in a 401 that you may contribute to at your discretion.

If you are self-employed, you may enroll in a 401 plan through an online broker, such as TD Ameritrade.

If your employer offers both types of 401 accounts, then you will most likely be able to contribute to either or both at your discretion.

To reiterate, with a traditional 401, making a contribution reduces your income taxes for that year, saving you money in the short term, but the funds will be taxed when they are withdrawn.

With a Roth 401, your contributions can be made only after taxation, which costs more in the short term, but the funds will be tax free when you withdraw them.

Because of this, deciding which plan will benefit you more involves figuring out in what tax bracket you will be when you retire.

If you expect to be in a lower tax bracket upon retirement, then a traditional 401 may help you more in the long term.

You will be able to take advantage of the immediate tax break while your taxes are higher, while minimizing the portion taken out of your withdrawal once you move to a lower tax bracket.

On the other hand, a Roth 401 may be more advantageous if you expect the opposite to be true.

In that case, you can opt to bite the bullet on heavy taxation today, but avoid a higher tax burden if your tax bracket moves up.

Read Also: How To Withdraw My 401k From Fidelity

How Does A Dpsp Work

Heres how a DPSP works. The company goes over their accounting for the year and reports a profit. This can happen on a regular or irregular basis.

They decide to share part of the profit with their employees in the form of distributions to their Deferred Profit Sharing Plans. The money they distribute is tax-deductible for them and tax-deferred for the employees. Companies have 120 days after the end of the fiscal year to make contributions.

The employees receive these proceeds, which they can use to invest in various funds, stocks, or bonds. They can also buy company stock with the money. Employees dont have to pay taxes on these contributions unless they withdraw and claim the income on their taxes.

When the employee signs up for the DPSP, theyll designate someone as their beneficiary, most often a spouse or long-term partner.

Who Can Contribute To A Profit

Only employers are allowed to contribute to a profit-sharing plan. The amount is flexible, but the employer must develop a formula that applies across the board to all employees. The formula can be designed simply based on a percentage of the employees salary. Its also flexible in the sense that the formula may change from year to year if the employer deems it appropriate.

You May Like: How Do I Open A 401k Account

Disadvantages For The Employee

A possible disadvantage for the employees is that the employer can require the employee to purchase company stock with their DPSP funds. This isnt true for all DPSPs, but can be a possibility. Employees who dont have full control of their DPSP investments should make sure theyre diversified in their RRSP or other retirement accounts.

If the employee purchases company stock and the value drops significantly, their DPSP could be rendered worthless. This is why a DPSP that has little control for the employee isnt as valuable as a DPSP without excess oversight.

Employers arent required to contribute to a DPSP if they didnt produce enough revenue or have lower profit margins. This can make retirement planning more volatile for employees who are solely relying on their DPSP. If the DPSP is your main source of investing income, consider what youll do if your company cant afford contributions in a given year.

The DPSP is an employee-only plan, so you cant split the funds with your spouse. This is a major difference between a DPSP and an RRSP.

How Are 401s And Profit

401s and profit-sharing plans are two types of retirement accounts that are offered to employees from their employer. 401 plans are typically funded by deferring employee wages into the account. Some employers provide matching contributions for employees, so there is a combination of funding derived from both the employee and the employer. A profit-sharing plan is funded entirely by the employer, with no employee contribution at all. Contributions to a profit-sharing plan are discretionary and based on company profits.

The Internal Revenue Service notes that there are certain limits on both plans. Both types of plans follow the IRS age-based guidelines on penalties and distributions for retirement accounts.

Also Check: Should You Always Rollover Your 401k

Profit Sharing Plan Rules

401 plans with profit sharing have some key rules for maximum contributions, tax deduction limits, reporting, and timing:3

- Total Contribution Limits: Employers can only contribute up to 100% of an employees compensation, or up to $56,000 as of 2019, whichever is lower.

- Calculation Rules: When calculating a single employees profit sharing contribution, only compensation up to $280,000 per year can be considered more than that would increase total contributions beyond the $56,000 annual limit.

- Tax Deduction Limits: Employers can deduct profit sharing contributions from their taxes up to maximum contribution limits.

- Disclosures and Forms: As with many other 401 plans, employers are required to issue disclosures to employees and anyone else who participates in a 401 profit sharing plan. Additionally, the form 5500 must be filed with the Department of Labor annually.

- Funding Deadline: All employer contributions to a profit sharing plan have an annual funding deadline of April 15 . Review our 2019 compliance calendar for more information on funding deadlines.

How Does A Profit

A profit-sharing plan is a feature that is added to a normal 401 plan. In this arrangement, employers have flexibility in making contributions. Employers can offer but are not required to contribute matches to a 401 plan. In a profit-sharing plan, employers can contribute a set amount of percentage to all contributors that amount is adjustable and purely at the employers discretion. Employers can change that amount every year. In fact, an employer can decide to contribute nothing at all in a given year to an employees profit-sharing plan. For example, if an employer does not make a profit in a given year, they do not have to make contributions that year . Because the companys financial performance influences the employers decision to make a contribution one year but not the next, this is called a profit-sharing plan!

Here are some factors employers can consider when creating their profit-sharing plan:

In the years when a company makes contributions in its profit-sharing plan, the company must come up with a set formula for profit allocation. The most common way to determine contributions in profit-sharing plans is referred to as the comp-to-comp method.

Recommended Reading: Can An Llc Have A Solo 401k

Definitions And Examples Of Profit

Profit-sharing plans are a way for a company to share profits with its workers. Contributions from the company are discretionary. The company can decide how much it will put into the plan from year to year. It can even decide not to contribute at all.

This flexibility makes it a nice option for both small and larger businesses. A profit-sharing plan aligns the financial well-being of workers with the company’s success.

A company doesn’t have to make contributions to a profit-sharing plan if it doesn’t make a profit. But, it doesn’t have to be profitable in order to provide workers with this type of plan.

Unlike 401 plan participants, workers with profit-sharing plans don’t make their own contributions. A company can offer other types of retirement plans, such as a 401, along with a profit-sharing plan.

A company can legally exclude certain employees from the plan. These include nonresident aliens, those who are younger than age 21, and those who are covered by collective bargaining agreements that don’t provide for participation. Employees with a short tenure can also be excluded. This depends on the plan.

Employees who are age 21 or older cannot be excluded because of age.

What Is A 401 Profit

A 401 plan with a profit-sharing feature allows an employer to make contributions to their employees 401 accounts based on the companys profits. This is more flexible than an employer match, which is a fixed contribution. The employer has the discretion to make a contribution or not, based on company profitability or business needs.

In other words, if a business has a good year, an employer may want to make a generous contribution. But if the company underperforms or needs to make capital investments, the contribution can be adjusted. Some employers use profit sharing instead of an annual bonus, which makes it attractive to employees because it may sometimes be a greater amount.

You May Like: Can You Roll A 401k Into A Roth

What Is A Profit Sharing 401 Plan

A 401 with profit sharing enables both you and your employees to contribute to the plan. Heres how it works:

- The 401 plan allows employees to make their own salary deferralsup to $19,500 per year

- The profit sharing component allows employers to contribute up to $58,000 per employee , or 100% of their salary, whichever is lower. However, this limit includes employees 401 contributions, so typically, employers calculate their contributions keeping the $19,500 401 employee salary deferral maximum in mind.

- After the end of the year, employers can make their pre-tax profit sharing contribution, as a percentage of each employees salary or as a fixed dollar amount

- Employers determine employee eligibility, set the vesting schedule for the profit sharing contributions, and decide whether employees can select their own investments

Are Profit Sharing Contributions Right For Your 401 Plan

Retirement Plan Types | Plan Design

Bar none, profit sharing contributions are the most flexible type of employer contribution a company can make to their 401 plan. These contributions are not only discretionary, but they can be made to any eligible plan participant even if the participant fails to make 401 deferrals themselves. They can also be allocated using dramatically different formulas allowing employers to meet a broad range of 401 plan goals with them.

Yet, despite their flexibility, profit sharing contributions are not a good choice for every 401 plan. Matching contributions can be more effective in meeting certain 401 plan goals. Further, not all employers will qualify for the most flexible types of profit sharing due to IRS nondiscrimination test limitations. If youre a 401 plan sponsor, you want to understand your companys profit sharing contribution options. To meet certain 401 goals, they can be tough to beat.

Profit sharing contribution basics

401 profit sharing contributions are a type of nonelective employer contribution. That means employees do not need to make 401 deferrals themselves to receive them. In contrast to safe harbor nonelective contributions, profit sharing contributions are discretionary which means you dont have to make them every year.

When to choose profit sharing contributions

Also Check: Can I Roll Over My 401k To An Ira

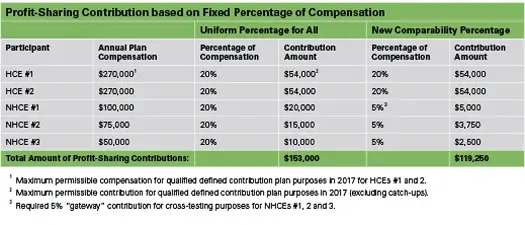

What Is New Comparability Profit Sharing

Companies like 401 profit sharing plans because theyre a great way to reward employees without increasing their taxable income. However, because of IRS requirements, most plans require that you contribute the same percentage of pay to each employees account to avoid discrimination, meaning business owners cant pay more into their own accounts. Thats where new comparability plans come in.

New comparability plans are special because you can judge each employee separately, and essentially customize the profit sharing contribution for each one, so long as certain tests show that the contributions dont discriminate against non-highly compensated employees, known as NHCEs, in the long run.

Who Should Offer This Plan

Any company offering a profit-sharing 401k should be in a stable trajectory financially.

Its not a one-and-done situation. You have to intend to keep the plan in perpetuity. Even though you can change the formula on a year-by-year basis, you cant be carrying out the program one year, skipping the next, and getting back into it later whenever you feel like it.

If a company is waiting to see a positive ROI for years on end, employees arent going to be happy seeing nothing contributed during that time. Especially if your company doesnt offer a regular 40k plan alongside it. Remember, these factors affect each employees ability to retire. For some, 401k plans are their entire retirement plan, and if thats what they truly depend on, you can bet theyre not going to stick around with a company performing negatively year over year.

You May Like: Can I Borrow From My 401k

Investing Profit Sharing Plan Monies

After you decide on a profit sharing plan, you can consider the variety of investment options. One decision you will need to make in designing a plan is whether to permit your employees to direct the investment of their accounts or to manage the monies on their behalf. If you choose the former, you also need to decide what investment options to make available to the participants. Depending on the plan design you choose, you may want to hire someone either to determine the investment options to make available or to manage the plan’s investments. Continually monitoring the investment options ensures that your selections remain in the best interests of your plan and its participants.

How Do Profit Sharing 401 Plans Work

Profit sharing 401 plans work like this: A business sets aside a portion of its pre-tax profits to contribute to their employees retirement accounts. Business owners can award that money to their employees as a percentage of their salary or as a set dollar amount. For profit sharing 401 plans, the yearly contribution limit is $58,000 per employee . Profit sharing can be added to a 401 plan with a simple plan amendment.

Recommended Reading: Is There A Fee To Rollover 401k To Ira

Background: What Is A Profit Sharing Plan

If youre just starting your research into profit-sharing plans, it may appear that profit-sharing plans are much like a 401 plan with a match from an employer. Both involve employers giving employees a certain amount of money in a given year. These contributions are put into a tax-deferred account, which means both the employer contributions and the investment earnings an employee might make are tax-deferred until the employee starts withdrawing money from the account, usually after retirement.

Create A Written Plan Document

Each profit-sharing plan is bound by a plan document. Because that document will govern your plan, its important to have it in place from the beginning. You can prepare the plan document yourself, but if youve hired a company or individual to establish your profit-sharing plan, then they will likely create your plan document for you.

Read Also: Can You Have Your Own 401k