Calculations For An S Corporation C Corporation Or An Llc Taxed As A Corporation

The annual Solo 401k contribution consists of a salary deferral contribution and a profit sharing contribution. The total allowable contribution adds these 2 parts together to get to the maximum Solo 401k contribution limit. The 2021 Solo 401k contribution limit is $58,000 and $64,500 if age 50 or older.

Calculations for an S corporation and C corporation are based on the W-2 salary that is paid to the business owner. For example, S corporation K-1 distributions are not included when making the contribution limit calculation. Also, the calculation is only based on W-2 wages for an LLC which pays W-2 wages to the business owner.

Can A 1099 Employee Contribute To A 401k

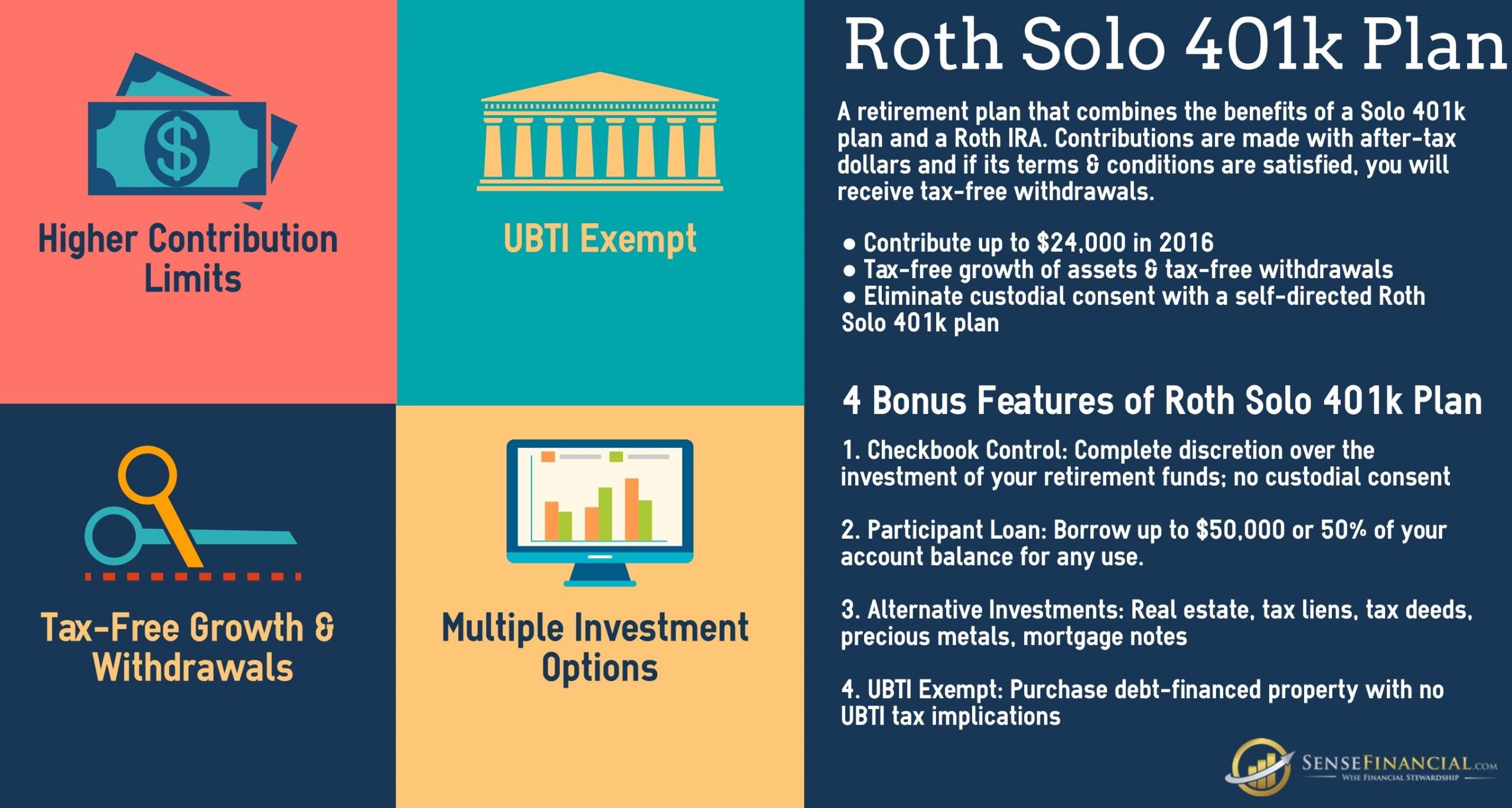

A solo 401 can also have a Roth feature. SEP IRA. The simplified employee pension plan allows 1099 workers to contribute up to 25 percent of their net earnings from self-employment or $53,000, whichever is lower, in 2016. It works similarly to a traditional IRA, and all contributions are tax-deductible.

IF YOURE A FREELANCER, contractor or 1099 employee, you may not have the structure of a steady paycheck, health insurance or corporate matching retirement program that your staffer friends have.

You may also be going through work dry spells and windfalls, which can make it very difficult to plan a budget for health insurance and rent, let alone set aside money for retirement. You might be caught in a devils bargain feeling that you need to hang on tightly to money when you get it, yet if you dont set some aside for retirement, you may have to work forever.

The good news is that youre not alone. As many as 53 million Americans are working as freelancers, according to a 2014 study by Freelancers Union and Elance-oDesk. That workforce is adding $715 billion to the economy through freelance work, according to the study.

Yet seven in 10 entrepreneurs arent saving regularly, if at all, for retirement, according to a 2013 study by Ameritrade.

Solo Contributions Vs Other Plans

In comparison with other popular retirement plans, the solo 401 plan has high contribution limits as outlined above, which is the key component that attracts owners of small businesses. Some other retirement plans also limit the contributions by employers or set lower limits on salary-deferred contributions.

The following is a summary of contribution comparisons for the employer plans generally used by small businesses.

| Account |

| $3,000 for 2020 and 2021 |

You May Like: How To Find My Fidelity 401k Account Number

Checkbook Control And No Custodian Fees

With a Solo 401k Plan, you can serve as trustee of the Plan giving you checkbook control over the Plans funds. Another significant benefit of the plan is that it does not require the participant to hire a bank or trust company to serve as trustee. This flexibility allows the participant to serve in the trustee role. As a result, all assets of the 401 trust are under the sole authority of the plan participant. A Solo 401 plan allows you to eliminate the expense and delays associated with an IRA custodian, enabling you to act quickly when the right investment opportunity presents itself.

Because you can open the Solo 401k Plan trust at any local bank or credit union, such as Capital One, theres no requirement to pay custodian fees for the account. This would be the case, however, for an IRA.

Administering A Solo 401 Plan

Once your Solo 401 plan exceeds $250,000 in assets at the end of the year, the IRS requires you file an annual Form 5500 EZ. Or if you ever terminate the plan, you must also file a Form 5500 EZ.

Unlike Traditional 401 plans, there are no compliance testing requirements to ensure Solo 401 plans do not favor highly compensated employees and are non-discriminatory, as long as you have no employees participating in the plan.

These plans can be called Self-Directed 401, Individual 401, Individual Roth 401, Self-Employed 401, Personal 401 or One-Participant 401 depending upon the vendor offering the plan services.

Also Check: Can I Contribute To Traditional Ira And 401k

Benefits Of Using A Solo 401k

Solo 401k plans offer benefits that can only be reaped by their plan owners. They have high contribution limits because monies can be put in as both the employer and the employee. Solo 401k plans can be used to invest in real estate. And Solo 401k plans can be set up to establish checkbook control. Without employees other than a spouse, the Solo 401k is an amazing opportunity for business owners.

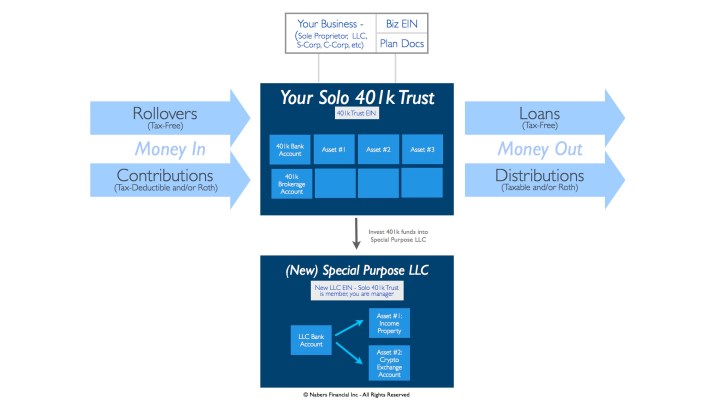

The Solo 401k should be set up at a trust rather than a bank, as this will enable the most control over the business owners money by the business owner. It can be difficult for banks to relinquish control, and as a business owner, money that belongs to the business should be directed by the business itself.

How To: Purchase Real Estate In Solo 401k Using A Partnership Llc

September 14, 2021 by Madeline DeFrank

Do you have an investment goal to purchase real estate? Maybe a small apartment building, a multi-plex, or a commercial property? There are several powerful ways you can do this. One that you may want to consider is using your retirement account to fund an LLC Partnership. This keeps you and a trusted partner in control of your investment . Another is investing your retirement funds in an LLC Partnership where you have little or limited control of the investments .

Don’t Miss: Can You Convert A Roth 401k To A Roth Ira

Common Solo 401k Misconceptions

Disqualifying investments for a Solo 401k plan can include passive rental income. If an LLC has been set up and only collects and distributes rental income to the owner, this will not be considered wages. This means that there is no acceptable process to set up an LLC for a rental business that will only collect and distribute rents as this is considered a passive income, it does not register as wages and cannot be contributed to a retirement account.

Solo 401ks, then, are for business owners as well as contractors or consultants. Solo 401ks are able to be used to invest in real estate, but again, there is a Solo 401k misconception that individuals, such as real estate investors, can setup an LLC to collect rental income. Because this is considered passive income, you cannot contribute rental income to the Solo 401k.

More Options To Maximize Your Investments

A solo 401k plan includes both an employee and profit sharing contribution option. Whereas a Traditional IRA has a very low annual contribution limit. Under the 2017 solo 401k contribution rules, if youre under the age of 50 you can make a maximum employee deferral contribution in the amount of $18,000.On the profit sharing side, your business can make a 25% profit sharing contribution up to a combined maximum, including your employee deferral, of $54,000.If youre over the age of 50, you can make a maximum employee deferral contribution in the amount of $24,000. Up to a combined maximum of $60,000.Note: If your plan has more than $250,000, a simple 2 page IRS Form 5500-EZ is required to be filed.

Recommended Reading: How To Transfer 401k From Old Job

Both An Employee And Self

You can be an employee of a business and also be separately self-employed. In this case, you are still eligible to establish a Solo 401 for your own business, even if you may also be participating in a 401 or other retirement plan through your primary employment. In such cases, your ability to make employee contributions will be capped at the overall limit of $19,500 if you are under age 50 or $26,000 if you are 50 or older. Your business that sponsors the Solo 401 can make a profit sharing employer contribution up to the plan maximum, independent of the other employer plan, however.

What Are Some Regulations On Self

The self-employed 401 plans have several regulations designed to help you contribute towards retirement. Here are the main solo 401 rules:

-

If you withdraw from the account before age 59½, you may pay a 10% early withdrawal penalty and applicable income taxes.

-

Once you reach age 72, in accordance with the SECURE Act,* you must take Required Minimum Distributions .

-

You may structure the plan to fund loans and hardship distributions.

-

They may transfer savings from another compatible 401 plan or an IRA account into a self-employed 401.

-

If your business adds employees later, you must either convert the solo 401 to a standard 401 or close the account.

Recommended Reading: What Is The Tax Rate On 401k Withdrawals

Solo 401 Plan Components

There are two components to the solo 401 plan: employee elective-deferral contributions and profit-sharing contributions.

- Employee Contribution Limits: You may make a salary-deferral contribution of up to 100% of your compensation but no more than the annual limit for the year. For both 2020 and 2021, the limit is $19,500, plus $6,500 for people age 50 or over.

- Employer Contribution Limits: The business may contribute up to 25% of your compensation but no more than $58,000 for 2021 . An employee age 50 or above can still contribute an additional $6,500 for 2020 and 2021.

Can My Spouse Participate In My Solo 401

Dylan Telerski / 10 Dec 2020 / Business

One of the benefits of a Solo 401 is that your spouse can also participate in the plan. If you both take taxable income from the same sole proprietorship, your spouse can make equal contributions.

A Solo 401 is designed for a business owner with NO employees. However, you may add a spouse to your plan as an exception to the rule. You may also employ:

- 1099 contractors

- Nonresident aliens, and

- Part-time workers who put in less than 1,000 hours per year

If you plan to hire full-time W2 employees, you will need to stop making contributions and rollover your self-directed Solo 401 to a self-directed IRA or small business 401k within a year.

Recommended Reading: Can 401k Be Transferred To Roth Ira

Set Up A 401k For An Llc

Related Links

Benefits are an important part of an employees compensation package. One popular benefit you can offer is a retirement plan for employees. In the private industry, about 66% of workers have access to retirement benefits. Of the retirement plans you could offer, 401 plans are the most popular. Learn how to set up a 401 plan for small business.

How To Set Up A 401k For An Llc

To set up a 401 plan, there are different steps you need to follow:

A Simplified Employee Pension Individual Retirement Arrangement has traditionally been the most popular retirement plan for the self-employed and small business owner. A SEP IRA is a pure profit sharing plan that allows the employer to make up to a 25% profit sharing contribution to all eligible employees up to a maximum of $53,000 for 2015 and 2016. While a SEP IRA does offer high annual contribution limitations, there is another retirement plan that offers better retirement options for the self-employed or small business with no employees the Solo 401 plan, also know as the individual 401 or self-employed 401 plan.

Before the Economic Growth and Tax Relief Reconciliation Act of 2001 became effective in 2002, there was no compelling reason for an owner-only business to establish a Solo 401 plan because the business owner could generally receive the same benefits by adopting a profit sharing plan or a SEP IRA. After 2002, EGTRRA paved the way for an owner-only business to put more money aside for retirement, gain additional options, as well as operate a more cost-effective retirement plan than a SEP IRA.

Don’t Miss: How Much Money Should I Put In My 401k

Fourth Step: Draft The Special Purpose Solo 401k Llc Operating Agreement

After the above steps have been completed, the next step is to have the LLC operating agreement prepared. This is a vital step as the LLC operating agreement will need to outline both the solo 401k rules and IRS rules. For this reason, it is not recommended to use an off-the-shelf LLC operating agreement. For example, regulatory language surrounding the 401k prohibited transaction rules, disallowed investment rules, decedent account rules, QDRO rules, distribution rules, RMD rules, UBIT and UDFI rules will need to be included in the LLC operating agreement.

Solo 401k Llc And Partnership Contributions

A Limited Liability Company is a very popular business structure. Its easy to setup and simple to maintain. The owner of the LLC is known as the member. An LLC can be a single-member or multi-member company. Further, the LLC may be taxed as a partnership or taxed as a corporation.

LLCs are formed at the state level with the secretary of state. LLCs are a popular business structure because they create a fictitious entity. All business is done under the LLC name, using the LLC tax ID number. This can provide a layer of liability protection for the LLC owner. In the case of a lawsuit, the members assets are generally protected. Only the LLC assets are involved in the suit.

Once your business is generating revenue, you can start contributing to a retirement plan. The easiest way to do this is to setup a Self-directed Solo 401k plan.

The LLC contribution limits may change according to a couple factors:

- Is the LLC single or multi member?

- Is the LLC taxed as a partnership or a corporation

Read Also: Can I Transfer My Ira To My 401k

S To Invest In Partnership For Real Estate

These are the simple steps you take to invest your retirement funds in an LLC Partnership to purchase real estate:

- Choose the other LLC partner and establish the LLC Partnership.

- Enter into a real estate purchase agreement.

- Fund your portion of the closing by transferring funds from your Solo 401k to the LLC Partnership per the LLC partnership allocation.

Follow this link for more information about forming an LLC, including a Partnership LLC.

The Advantages Of Using An Llc To Make Investments With A Solo 401k Plan

With a Solo 401k Plan, you as trustee of the Solo 401k Plan, will have “checkbook control” over the funds allowing you to make 401k Plan investments by simply writing a check. When making an investment with your Solo 401k Plan, you have the option of making the investment directly with your Solo 401k plan, or, alternatively, you can invest the funds in an entity, such as an LLC, which will be owned 100% by the Solo 401k plan to make the investment.

There are a number of advantages of using an LLC to make an investment using your Solo 401k Plan.

Limited Liability Protection: The LLC offers its members, in the case of a Solo 401k Plan, limited liability. Owners and members of the LLC are not liable for the debts, obligations, and liabilities of the LLC. Since, in most cases, your retirement account may be your most valuable asset, protecting them from attack from creditors is essential. By using an LLC, you would be able to shield all your 401k assets held outside the LLC from creditor attack. The following are several examples that illustrate the limited liability benefits of using an LLC to make a Solo 401k Plan investments:

To learn more about the benefits of using an LLC to make a Solo 401k plan investment please contact one of our Solo 401 Plan Experts at 800-472-0646.

You May Like: How To Diversify 401k Portfolio

Round #4 Which Is Better For Taxes: Solo 401 Or Sep Ira

Say youre an interior designer and you contribute to a SEP IRA. You get to deduct those contributions from your tax return. But once you withdraw from your SEP IRA during retirement, youll have to pay federal & maybe state taxes on the amount you withdraw.

For a solo 401, you can usually choose the tax treatment. If you want to take the tax deduction now, you can contribute to a traditional solo 401. If you want to let your money grow tax-free, you can contribute to a Roth solo 401. You pay the taxes now, but when you withdraw from a Roth solo 401 during retirement, you dont pay a single dime in taxes.

Round 4 Winner: Solo 401 wins again.

What Are The Ways To Contribute To Self

You can contribute to an individual 401 account as an employee and an employer. As an employee, the solo 401 limits for 2020 allow you to contribute the lesser of either $19,500 or 100% of your income. Participants who are 50 years and older can increase their contributions by $6,500 each year for a total of $26,000.

As an employer, the 2020 guidelines permit you to contribute up to 25% of your annual compensation, and up to a maximum of $57,000 in combined contributions per year. For 2020, the IRS limits the self-employed 401 contribution of participants 50 years and older to $63,500.

A solo 401 plan offers tax breaks if you are eligible. You can deduct the contributions from your personal income if you did not incorporate the business. If you run a corporation, you can classify the contributions as a business expense.

Recommended Reading: What Is Qualified Domestic Relations Order 401k

Round #1 Who Can Participate In Solo 401 And Sep Ira

So lets say youre a TikTok influencer. You just hit 1 million followers. Your income from ads and sponsorships are coming in and you want to invest that money wisely. The good news is you can contribute to either a solo 401 or SEP IRA. But the very important difference is this: With a solo 401, you can contribute both as an employer AND employee. With a SEP IRA, you can only contribute as the employer. Why should you care? If youre the only one in the company, youre not going to care, since youre both the employer & employee. But if you have a W2 employee, say you hired a virtual assistant to help you out, you cannot contribute to a solo 401. Thats why they call it a solo 401. You need to be flying solo. If you have contractors who are 1099 employees, you can still contribute to a solo 401.

Here is one important consideration for the SEP IRA: Because youre contributing as the EMPLOYER, if you contribute 10% of your income to your SEP IRA and you have a W2 employee, then you as the Employer are also required to contribute 10% of your employees income into his/her SEP. The contribution has to be equal across the board.

Round 1 Winner: Its a tie. You can use both if youre self-employed. There is also a con to both if you have a W2 employee.

Bonus Question: What if youre a TikTok influencer, and you set up an S Corp. Can you set up a solo 401 for S corporations?