Why Transfer Your 401 To An Ira

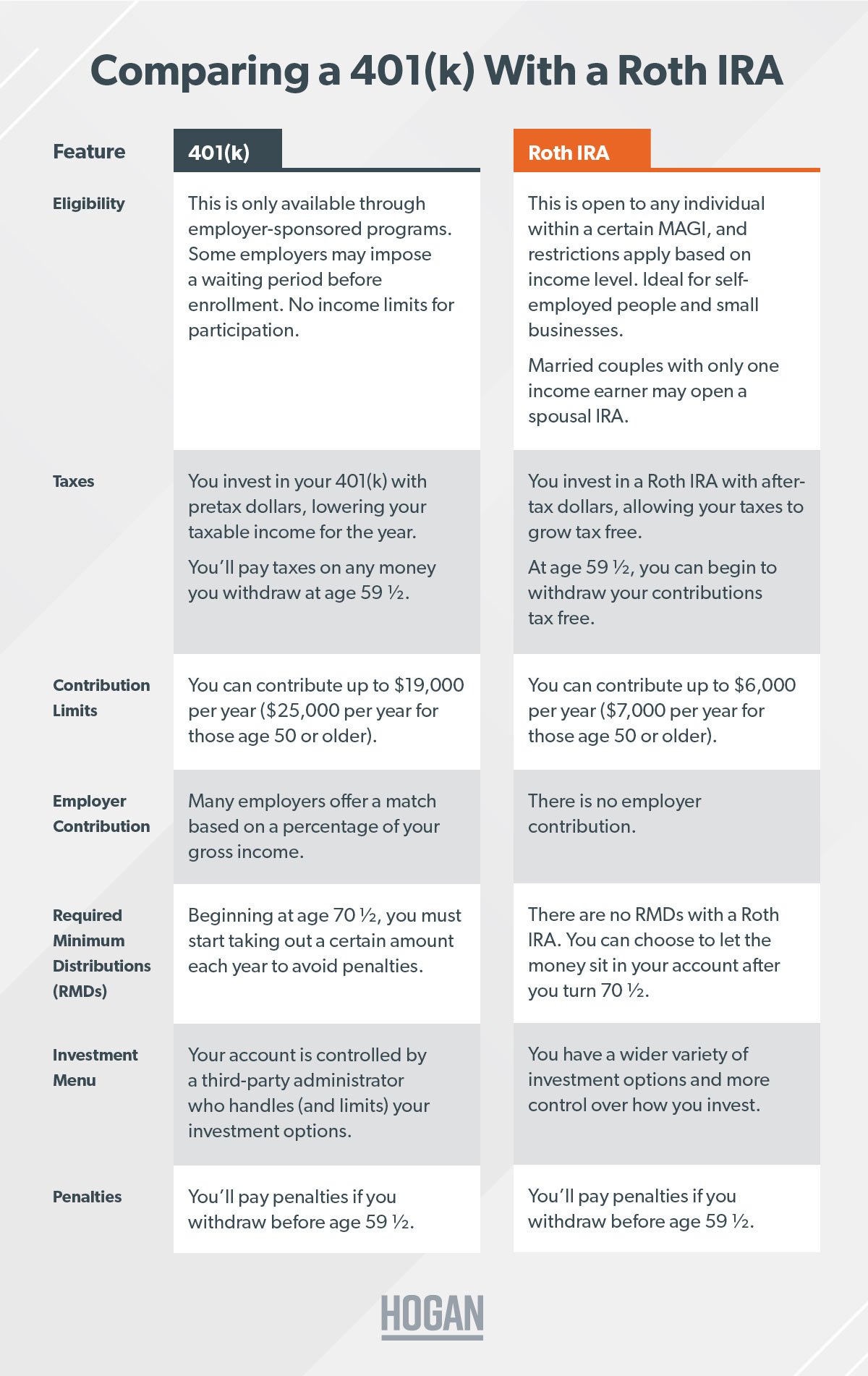

Why would you move savings from an old 401 plan to an IRA? The main reason is to keep control of your money. In an IRA, you get to decide what happens with the funds: You choose where to invest and how much you pay in fees, and you dont need anybodys permission to take money out of the account.

More Control

Cost and providers: In your 401, your employer controls almost everything. Employers choose vendors for the plan, which determines the investment lineup available. Those might not be investments you like, and they might be more expensive than you want. If you want to practice socially-responsible investing, the 401 may lack options for that.

Timing: 401 plans also require extra steps when you want to withdraw funds: An administrator needs to verify that you are eligible to access your money before youre allowed to take a distribution. Plus, some 401 plans dont allow partial withdrawalsyou might need to take your full balance.

Easy Withdrawals

If you need access to your 401 savings for any reason, its easier when the money is in an IRA. In most cases, you call your IRA provider or request a withdrawal online. Depending on what you own in your account, the funds might go out as soon as the next business day. But 401 plans might need a few extra days for everybody to sign off on the distribution.

Complicated Situations

Control Tax Withholding

Cons Of Rolling Your Roth 401 Funds Into A Roth Ira

When it comes to Roth IRAs, the most important thing to keep in mind is the five-year rule. The clock starts ticking when you make your first contribution into your Roth IRA, not when you open the account. So even if youve had a Roth IRA for more than five years, you may still have to hold off withdrawals if it took you a few years to start contributing. Any Roth 401 contributions youve made dont make any difference in relation to this timeline.

If you need the money and dont plan to change jobs any time soon, remember that you may be able to get a Roth 401 loan from your plan administrator. To clarify, you could borrow up to $50,000 or 50% of your vested account balance, whichever is less, though the loan must be repaid within five years or immediately upon leaving your employers service to avoid it being treated as a taxable distribution. Roth IRAs dont offer this kind of flexibility, so a rollover would eliminate this option.

You should consider the investment options and fees of a Roth IRA before definitively deciding on a rollover. It may be that your Roth 401 program offers a better selection of possible investments or charges fewer fees than a Roth IRA would.

What Are The Advantages Of Rolling Over A 401 To An Ira

Doing a 401 rollover to an IRA offers perks that can include more diverse investment selections than a typical 401 plan, perhaps cheaper investments and lower account fees. It’s also a way to keep your retirement funds organized and ensure you have easy access to them. And while some 401 plans pass account management fees along to the employees, many IRAs charge no account fees.

In summary, it’s a good way to save money, stay organized and make your money work harder.

Also Check: Can You Roll A 401k Into A Roth

Roth Ira Rollover Rules From 401k

As a reminder, you must generally be separated from your employer to roll your 401k into a Roth IRA. However, some employers do permit an in-service rollover, where you can do the rollover while still employed. Its permitted by the IRS, but not all employers participate.

Before January 1, 2008, you werent able to roll your 401 into a Roth IRA directly at all. If you wanted to do so you had to complete a two-step process.

However, the law changed shortly after and this option became available. Still, just because the law has made this option available doesnt mean you can definitely roll your old 401 into a Roth IRA no matter what. Unfortunately, it all depends on your plan administrator.

For example, recently I had two clients who intended to roll their old retirement plans into a Roth IRA.

One client had an old military retirement plan- Thrift Savings Plan and the other had an old state retirement plan. After helping each of them complete the required paperwork, I came across an interesting discovery.

The TSP rollover paperwork had a box you could mark if you wanted to roll over the plan into a Roth IRA . However, the state retirement plan did not give that option.

The only option was to open a traditional IRA to accept the rollover then immediately convert it to a Roth IRA. That certainly seemed like a hassle at the time, and it definitely was.

How To Transfer From Your 401 To An Ira

When youre ready to make the transfer, you need to do three things:

Unfortunately, you typically have to go through your former employer or a vendor they use. With many 401 plans, you cannot request a transfer using paperwork from the receiving IRA custodian.

Who to Contact

If you work for a large company, you can most likely contact your 401 provider directly. For example, contact Fidelity, Vanguard, or whatever website you use to manage your account. Alternatively, call whoever prints your 401 statements. If you work for a small company, you may need to contact the human resources department, which might just be the person who hired you. Either way, you eventually need one of the following:

A financial advisor like me can guide you through the process if you have questions.

What to Say

Where to Deposit

Indirect vs. Direct Rollovers

Don’t Miss: How To Find My 401k Money

Keeping Your Current 401 Plan

First off: Whatever you do, dont take the cash out. This means cashing out your 401 and depositing that amount into your checking account and using it toward other expenses. This is a bad idea. If you do, youll get hit with a penalty from the IRS, and the money will count as income that increases your federal taxes for the year. Although it may be tempting, try other options instead.

One of the easiest things you can do instead is simply leave your current 401 balance where it is, even though you wont be able to make any additional contributions.

This option might be right for someone who is happy with the fees and performance of their current 401 plan and who doesnt have another retirement account to move the balance to.

But this option may not be the best because in a decade or two, you may have a handful of 401 plans sitting with previous employers, making them easy to lose track of and difficult to manage.

Also, not every employer allows you to keep your 401 open after you leave. Some might have a minimum balance requirement or require that you rehome your retirement funds into a new account with the same investment manager.

How A 401 To Roth Ira Conversion Works

Converting a 401 to a Roth IRA is essentially the same process as rolling your 401 funds over to a traditional IRA, but there’s the extra step of paying taxes on your converted funds, as most 401s are taxed differently from Roth IRAs.

First, make sure you’re allowed to do a 401 to Roth IRA conversion. Many companies will allow only former employees to do rollovers or conversions, but a few may permit current employees to roll some of their savings over to an IRA as well. You should also check to see whether you’re allowed to roll over your 401 funds directly to a Roth IRA. Some plans permit you to roll your 401 savings only into a traditional IRA. Then you can open a Roth IRA and do your conversion.

Second, you must decide how much you’d like to convert. You can convert the full value of your plan, or you may be able to convert just a portion if your plan allows it. If you can’t do a partial conversion but don’t want to convert everything to Roth savings, you can always roll part of your savings into a Roth IRA and the other part into a traditional IRA.

There aren’t any limits on how much you can convert to a Roth IRA in a single year, but most people try to keep themselves from jumping up to the next tax bracket, which we will discuss below.

Also Check: How To Know If You Have A 401k

Next Steps To Consider

This information is intended to be educational and is not tailored to the investment needs of any specific investor.

Recently enacted legislation made a number of changes to the rules regarding defined contribution, defined benefit, and/or individual retirement plans and 529 plans. Information herein may refer to or be based on certain rules in effect prior to this legislation and current rules may differ. As always, before making any decisions about your retirement planning or withdrawals, you should consult with your personal tax advisor.

The change in the RMD age requirement from 70½ to 72 only applies to individuals who turn 70½ on or after January 1, 2020. Please speak with your tax advisor regarding the impact of this change on future RMDs.

Fidelity does not provide legal or tax advice. The information herein is general and educational in nature and should not be considered legal or tax advice. Tax laws and regulations are complex and subject to change, which can materially impact investment results. Fidelity cannot guarantee that the information herein is accurate, complete, or timely. Fidelity makes no warranties with regard to such information or results obtained by its use, and disclaims any liability arising out of your use of, or any tax position taken in reliance on, such information. Consult an attorney or tax professional regarding your specific situation.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917

Rolling Over Your 401 To An Ira

You have the most control and the most choice if you own an IRA. Unless you work for a company with a very high-quality planthese are usually the big, Fortune 500 firmsIRAs typically offer a much wider array of investment options than 401s.

Some 401 plans have only a half dozen funds to choose from, and some companies strongly encourage participants to invest heavily in the company’s stock. Many 401 plans are also funded with variable annuity contracts that provide a layer of insurance protection for the assets in the plan at a cost to the participants that often run as much as 3% per year. Depending on which custodian and which investments you choose, IRA fees tend to run cheaper.

With a small handful of exceptions, IRAs allow virtually any type of asset: stocks, bonds, certificates of deposit , mutual funds, exchange traded funds, real estate investment trusts , and annuities. If you’re willing to set up a self-directed IRA, even some alternative investments like oil and gas leases, physical property, and commodities can be purchased within these accounts.

If you opt for an IRA, then your second decision is whether to open a traditional IRA or a Roth IRA. Basically, the choice is between paying income taxes now or later.

Don’t Miss: Can You Convert Your 401k To A Roth Ira

What Is A Tax Rate

A tax rate is the percentage at which an individual or corporation is taxed. The United States uses a progressive tax rate system, in which the percentage of tax charged increases as the amount of the person’s or entity’s taxable income increases. A progressive tax rate results in a higher dollar amount collected from taxpayers with greater incomes.

Pros Of Roth 401 To Roth Ira Rollovers

A unique fact that only applies to Roth 401s is that, beginning at age 70.5, you must take required minimum distributions from your account. This is similar to a traditional 401 or IRA. So if you would rather let your retirement funds grow tax-free until you need them, rolling them into a Roth IRA might be the best move for you.

In fact, you can leave rollover funds in a Roth IRA indefinitely if need be. That may be something of interest to you, particularly if youre looking to maximize the assets you leave for your beneficiaries.

Recommended Reading: How Do I Get My 401k

When You Don’t Roll Over

Cashing out your account is a simple but costly option. You can ask your plan administrator for a checkbut your employer will withhold 20 percent of your account balance to prepay the tax youll owe. Plus, the IRS will consider your payout an early distribution, meaning you could owe the 10 percent early withdrawal penalty on top of combined federal, state and local taxes. That could total more than 50 percent of your account value.

Think TwiceThe repercussions of taking money out now could be enormous: If you took $10,000 out of your 401 instead of rolling it over into an account earning 8 percent tax-deferred earnings, your retirement fund could end up more than $100,000 short after 30 years.

If your former employers plan has provided strong returns with reasonable fees, you might consider leaving your account behind. You dont give up the right to move your account to your new 401 or an IRA at any time. While your money remains in your former employers 401 plan, you wont be able to make additional contributions to the account, and you may not be able to take a loan from the plan. In addition, some employers might charge higher fees if youre not an active employee.

Further, you might not qualify to stay in your old 401 account: Your employer has the option of cashing out your account if the balance is less than $1,000 though it must provide for the automatic rolling over of your assets out of the plan and into an IRA if your plan balance is more than$1,000.

Rollovers To Multiple Destinations

Distributions sent to multiple destinations at the same time are treated as a single distribution for allocating pretax and after-tax amounts . This means you can roll over all your pretax amounts to a traditional IRA or retirement plan and all your after-tax amounts to a different destination, such as a Roth IRA.

Example: You withdraw $100,000 from your plan, $80,000 in pretax amounts and $20,000 in after-tax amounts. You may request:

A direct rollover of $80,000 in pretax amounts to a traditional IRA or a pretax account in another plan, A direct rollover of $10,000 in after-tax amounts to a Roth IRA, and A distribution of $10,000 in after-tax amounts to yourself.

Don’t Miss: How Do I Use My 401k To Start A Business

How Do I Convert My Traditional Ira To A Roth Ira

You can convert your traditional IRA to a Roth IRA by:

- Rollover â You receive a distribution from a traditional IRA and contribute it to a Roth IRA within 60 days after the distribution

- Trustee-to-trustee transfer â You tell the financial institution holding your traditional IRA assets to transfer an amount directly to the trustee of your Roth IRA at a different financial institution

- Same trustee transfer â If your traditional and Roth IRAs are maintained at the same financial institution, you can tell the trustee to transfer an amount from your traditional IRA to your Roth IRA.

A conversion to a Roth IRA results in taxation of any untaxed amounts in the traditional IRA. The conversion is reported on Form 8606 PDF PDF, Nondeductible IRAs. See Publication 590-A, Contributions to Individual Retirement Arrangements , for more information.

If My Ira Invests In Gold Or Other Bullion Can I Store The Bullion In My Home

Gold and other bullion are “collectibles” under the IRA statutes, and the law discourages the holding of collectibles in IRAs. There is an exception for certain highly refined bullion provided it is in the physical possession of a bank or an IRS-approved nonbank trustee. This rule also applies to an indirect acquisition, such as having an IRA-owned Limited Liability Company buy the bullion. IRA investments in other unconventional assets, such as closely held companies and real estate, run the risk of disqualifying the IRA because of the prohibited transaction rules against self-dealing.

Read Also: How To Withdraw My 401k From Fidelity

Should I Roll My Roth 401 Into A Roth Ira

- Print icon

- Resize icon

Q.: Im thinking of retiring and rolling my Roth 401 to a Roth IRA. A co-worker says if I roll it to a Roth IRA, I cant touch it for five years without penalty. I thought penalties ended at 59½. Im 68. Can you clear this up for me?

Sam in Dallas

A.: Sam, Ill try. My suspicion is your coworker is mixing bits of different rules together.

First, the penalty most people refer to with respect to IRAs, Roth accounts, and retirement plans is the 10% penalty assessed for taxable distributions prior to age 59 ½. There is also a five-year rule that affects conversions from traditional IRAs and retirement plan accounts to Roth accounts that can trigger a penalty but it, too, is only applicable prior to age 59½. At 68, you do not need to worry about these penalties.

Second, there is another five-year rule regarding earnings in a Roth IRA. It needs to be satisfied only once in a taxpayers lifetime. Before you can take earnings tax-free from a Roth IRA, you must be 59½ years old AND it must be at least five tax years since the tax year for which you put the first dollar in your first Roth IRA. That first Roth IRA account does not even need to exist today. You are older than 59½ so if your first Roth IRA was opened more than five years ago, you can access the earnings tax-free. This includes any funds you roll into the Roth IRA from your Roth 401.

If you have a question for Dan, please with MarketWatch Q& A on the subject line.