How To Bring 401s And Iras To Canada

Ways to avoid common tax pitfalls

- 00:11

Crossing borders for work often means cross-border tax issues, especially when it comes to retirement accounts.

Moving 401s and IRAs to Canada must be done with plenty of forethought otherwise, owners could face big tax bills on both sides of the border. In a case that got accountants buzzing, CBCs Go Public reported that an Ontario couple lost almost a quarter of their U.S. retirement savings to taxes when they followed improper advice about making the transfer.

And even if clients dont want to move their money, they may be forced to. Plans have the ability to kick a participant out either due to account size or non-residency in the U.S., says Debbie Wong, a CPA and vice-president with Raymond James in Vancouver. That means Canadian residents could be out of luck.

Jacqueline Power of Mackenzie Investments in Toronto agrees. A lot of U.S. suppliers dont want to deal with Canadians anymore, she says. Weve had lots of advisors saying their clients are being essentially forced out of the U.S.

L.J. Eiben, president and CEO of Raymond James Ltd. in Vancouver, says a U.S. firm usually gives the individual 30 to 60 days to transfer out. If not done by that date, the firm will liquidate the retirement account and send the participant a cheque for the remaining proceeds minus withholding tax, penalties, et cetera.

How To Set Up A 401 Plan

Now that you know the landscape, youre ready to set up a plan as an employer or self-employed individual. Whether youre establishing a plan for a large enterprise or or on your own the next steps are:

- If youre self employed, decide if you want a SoloK, SEP, or SIMPLE providers).

- Decide which plan provisions you want , Safe Harbor, matching, vesting schedules?).

- Choose a vendor .

- Complete the adoption agreement along with other agreements and submit to your vendor.

- Communicate and educate: Inform employees of the plans existence and features.

- Set up individual participant accounts.

- Fund the plan through payroll or any employer contributions.

- Review the plan regularly to ensure its meeting the needs of plan participants.

- Monitor and adjust the plan as regulations change and your needs evolve.

- Provide required information to participants on an ongoing basis.

Review The Investment Choices

The 401 is simply a basket to hold your retirement savings. What you put into that basket is up to you, within the limits of your plan. Most plans offer 10 to 20 mutual fund choices, each of which holds a diverse range of hundreds of investments that are chosen based on how closely they hew to a particular strategy or market index .

Here again, your company may choose a default investment option to get your money working for you right away. Most likely it will be a target-date mutual fund that contains a mix of investments that automatically rebalances, reducing risk the closer you get to retirement age. Thats a fine hands-off choice as long as youre not overpaying for the convenience, which leads us to perhaps the most important task on your 401 to-do list …

Also Check: What Is A Robs 401k

Covering Your Spouse Under Your Solo 401

The IRS allows one exception to the no-employees rule on the solo 401: your spouse, if he or she earns income from your business.

That could effectively double the amount you can contribute as a family, depending on your income. Your spouse would make elective deferrals as your employee, up to the $19,500 employee contribution limit . As the employer, you can then make the plans profit-sharing contribution for your spouse, of up to 25% of compensation.

Saving For Retirement If Youre Self

Okay, if youre self-employed and don’t have any employees, a one-participant 401also known as a solo 401may be right up your alley. Contributions are tax-deductible, and you can contribute up to $19,500 every year . Then, on top of that, you can put in up to 25% of your incomeas long as what you contribute is less than $58,000 per year.6

Another option is the are primarily used by small-business owners who want to help their employees with retirement, but freelancers and the self-employed can also use this option. You can contribute to your own retirement this way, but again, you cant exceed either 25% of your income or $58,000 .7

Read Also: What Is Qualified Domestic Relations Order 401k

Who Oversees Retirement Plans

The IRS qualifies, or approves, plans and regulates them from a taxation standpoint. The U.S. Department of Labor oversees employer-sponsored retirement plans, following the Employee Retirement Income Security Act of 1974 . They deal with fiduciary responsibilities of plan sponsors, participant rights, and the guarantee of benefits.

Deadline To Set Up And Fund

- For taxable years 2020 and beyond, individual 401 plans may be set up by tax filing deadlines plus extensions. Note: It can take 30 or more days to establish a plan.

- Salary deferral portion of the contribution must be deducted from a paycheck prior to year end, with some exceptions for certain business structures.

- Business owner contribution may be made up through the business tax filing due date plus extensions.

Read Also: Can I Transfer Money From 401k To Ira

How Much Should Employees Contribute

Like the employer, employees are free to contribute as much as they like to the plan, within IRS limitations. For 2021, salary deferrals are $19,500, plus a catch-up contribution limit of $6,500 for employees 50 and older. Consider ways to help employees improve their financial wellness and increase their 401 participation. Doing so could benefit your business in the form of happier, less-stressed employees who are more engaged and productive.

S To Managing Your 401

Even though 401s are called employer-sponsored retirement plans, employers are pretty hands-off when it comes to the setup process. Each worker is in charge of making the investment decisions in their own account.

Your human resources department will make the introduction and explain the high points of how the plan works. HR will pass the baton to the companys 401 plan administrator an outside financial firm to handle the administrative details, such as enrollment, plan management, account statements and so on.

Next, its your turn. Heres your 401 to-do list:

Recommended Reading: How Do I Find Out Where My Old 401k Is

Why Employers May Not Offer A 401

Facilitating a 401 plan can be expensive for a company. The IRS requires testing and reporting to ensure retirement plans keep up with regulations. As a result, many small businesses simply can’t afford to administer a 401 plan.

If a company is brand new and trying to get off of the ground, they may not have the time to organize a retirement plan for their employees. Since bringing in an outside firm costs even more money, usually, small businesses don’t have a 401 plan in place.

And because nearly a half of Americans work for small businesses, the amount of people left to their own means to save for retirement is significant.

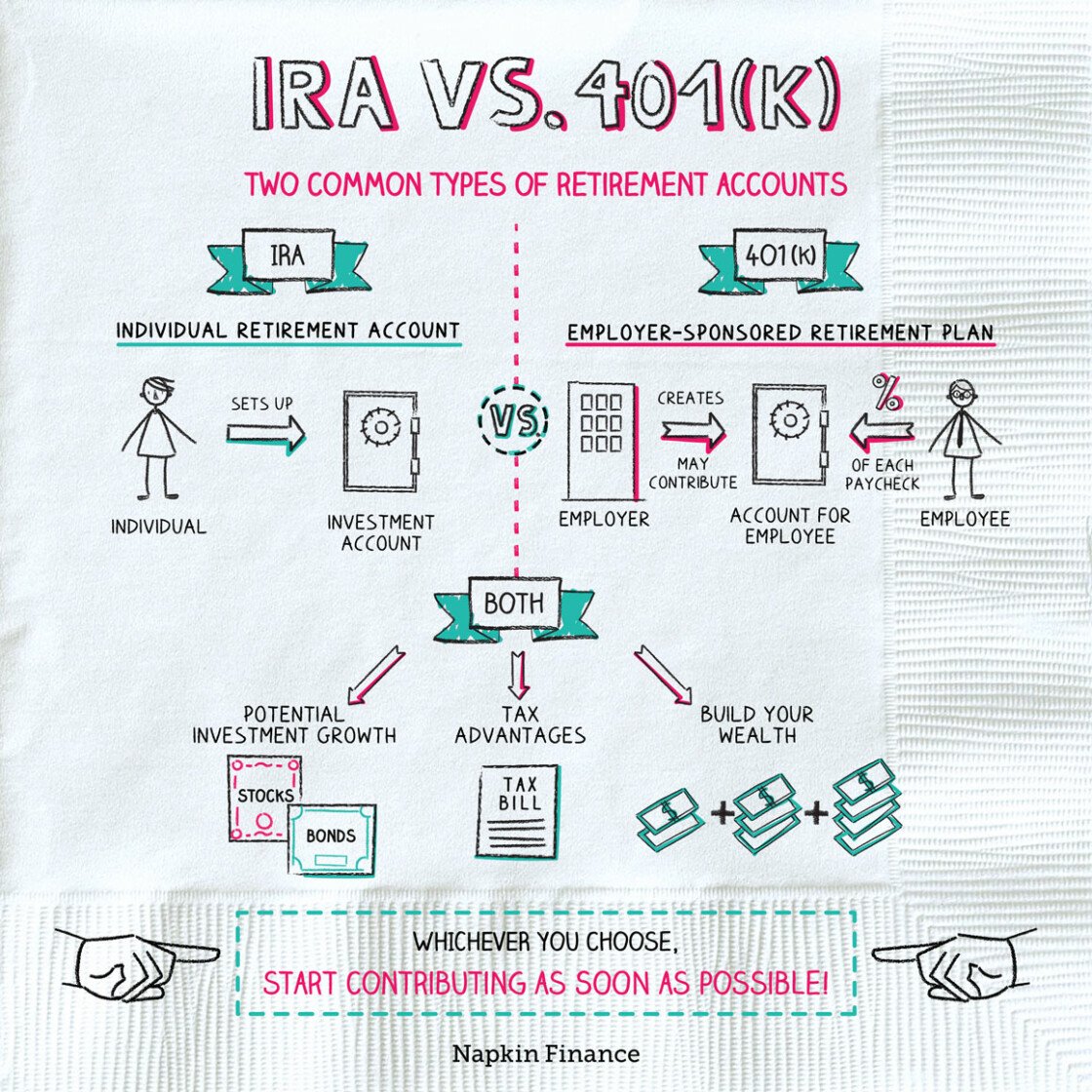

Types Of Retirement Accounts: Iras And 401s

We can help. By learning about your options, you can choose the type of savings account thats right for your life, now and in the future.

Lets start with the two most common ways to saveIndividual Retirement Accounts and 401 accounts. Well break down the similarities and differences between traditional 401s and traditional IRAs, then share details around Roth IRAs and Roth 401s, giving you a basic understanding of each.

Read Also: What Employees Can Be Excluded From A 401k Plan

Registered Retirement Income Fund

A registered retirement income fund is an arrangement between you and a carrier that we register. You transfer property to the carrier from an RRSP, a PRPP, an RPP, an SPP, or from another RRIF, and the carrier makes payments to you.

The minimum amount must be paid to you in the year following the year the RRIF is entered into. Earnings in a RRIF are tax-free and amounts paid out of a RRIF are taxable on receipt.

You can have more than one RRIF and you can have self-directed RRIFs. The rules that apply to self-directed RRIFs are generally the same as those for RRSPs. For more information, see Self-directed RRSPs.

Starting A 401 Without A Job

If you dont currently have a job, you may have some challenges. 401 plans are employer-sponsored plans, meaning only an employer can establish one. If you dont have your own organization and you dont have a job, you may want to evaluate contributing to an IRA instead. However, those accounts may require earned income during the year to contribute, so its not as simple as you might hope. That said, a spousal IRA may allow certain couples to contribute to a retirement account with no job.

Recommended Reading: Should I Get A 401k

How To Open A Traditional And Roth Solo 401k

There are thousands of financial products and services out there, and we believe in helping you understand which is best for you, how it works, and will it actually help you achieve your financial goals. We’re proud of our content and guidance, and the information we provide is objective, independent, and free.

But we do have to make money to pay our team and keep this website running! Our partners compensate us. TheCollegeInvestor.com has an advertising relationship with some or all of the offers included on this page, which may impact how, where, and in what order products and services may appear. The College Investor does not include all companies or offers available in the marketplace. And our partners can never pay us to guarantee favorable reviews .

For more information and a complete list of our advertising partners, please check out our full Advertising Disclosure. TheCollegeInvestor.com strives to keep its information accurate and up to date. The information in our reviews could be different from what you find when visiting a financial institution, service provider or a specific product’s website. All products and services are presented without warranty.

The Most Important Thing Is Simply To Begin

Unless you are independently wealthy, setting aside money today to see that you have enough for the years down the road by starting a retirement fund is not an optionits mandatory.

Unfortunately, inertia can be a powerful force, and going from not saving to saving can be daunting to most people. So much investment and financial advice are designed for people who have already begun saving and investing for the future. Below are some strategies for those looking to start the process.

Recommended Reading: When Do You Need A 401k Audit

What Are The Benefits Of Offering A 401 To Employees

When it comes to 401 plans, there are often common misconceptions around the time, resources, and costs it takes to establish and set up a plan. Business owners may believe that a 401 plan isn’t right for them, are unclear of the benefits, or believe the administrative responsibilities are too cumbersome. In truth, there are some significant advantages in offering a 401 plan to employees:

- A 401 can help make your business more competitive in attracting and retaining top talent.

- Employers can take advantage of an annual tax credit of up to $5,000 for the first three years of the plan.

- Plan expenses are tax-deductible, along with employer contributions such as an employee match or profit-sharing.

- Advances in payroll integration and recordkeeping make the implementation and maintenance of offering a retirement plan more affordable than ever.

How Much Does It Cost To Set Up A 401 For A Small Business

Costs to set up a 401 plan will vary depending on the size of your business and the types of benefits you select. Initial setup fees can generally run anywhere from $500 to $3,000, depending on the chosen retirement service provider. Other costs to consider are fees associated with rolling assets over from another plan and initial consulting costs for investment advice.

Also Check: What Is Max Amount To Contribute To 401k

To Mail Contributions To Fidelity

Fidelity InvestmentsCincinnati, OH 45277-0003

What Are The Benefits Of A 401 Plan Compared To Other Retirement Options

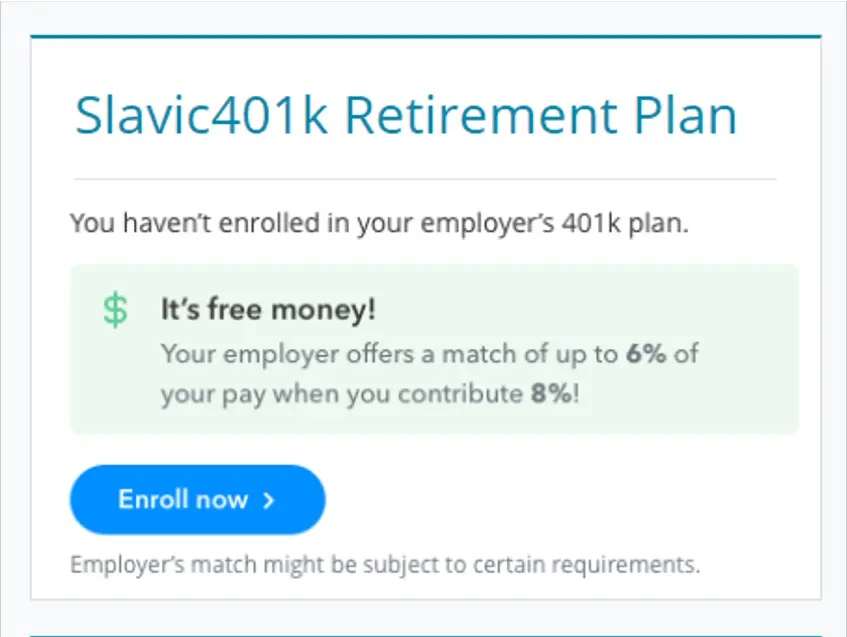

When compared to other retirement options , the benefits of a 401 retirement plan include a broad range of advantages for both employers and employees. Along with a vesting schedule to incentivize retention, both business owners and staff can benefit from:

Tax-advantaged retirement saving: With a 401, employees can save upfront with pre-tax dollars while they are working. By the time they need their savings to fund their retirement, they will likely be in a lower tax bracket, which can generate long-term tax savings.

Employer match: Matching contributions are among the top benefits of 401 plans for employees. Employers can either match a percentage of employee contributions up to a set portion of total salary, or contribute up to a certain dollar amount, regardless of employee salary.

Defrayed 401 plan startup costs: Eligible employers may be able to claim a tax credit of up to $5,000 for the first three years to pay for associated costs of starting a qualified plan such as a 401 for employees. Claiming the credit requires completing Internal Revenue Service Form 8881, Credit for Small Employer Pension Plan Startup Costs.

Don’t Miss: Can I Transfer My Ira To My 401k

How To Start A 401

Setting up a 401 plan can be as simple or as complicated as you like. Most people outsource at least some portion of the process. In particular, they use a template legal document to establish the 401 plan, which is substantially less expensive than hiring attorneys to draft original documents. Unless your retirement plan is especially complicated or youre trying to get fancy , youll probably use preconfigured programs from 401 vendors. These programs are often called volume submitter or prototype plans, and theyre an excellent choice for most companies and nonprofits.

Here are the crucial pieces of any 401 plan. While this list seems extensive, in some cases, a single company provides several of these services.

The plan document is a legal document that details the rules of your 401 plan. It defines specific terms, and provides a roadmap for any questions that come up when administering the plan. The plan document is a long legal document that most people never see. Instead, employees receive a shorter version of the document, known as the Summary Plan Description , when they enroll in the plan. For reference, heres a sample of a plan document.

What To Lookout For How Do I Open Roth Ira Account

There are some drawbacks to investing in gold IRAs. The main drawback is that the IRA cannot hold both platinum and palladium. Another limitation is that the IRA cannot hold bullion or silver in amounts higher than $100. Investors interested in these types of investments must diversify their portfolios so that they are invested in gold IRAs with smaller amounts of each metal. It would be impractical to attempt investing in more than one type of investment through a self directed IRA.

As gold has become more valuable, so has the demand for IRAs that hold precious metals. Because of this, the IRS has implemented several rules that restrict where precious metals can be deposited and taken out of the country. When considering your retirement planning objectives, this rule should be the first thing you look into.

When you take advantage of a self-directed gold IRA you do not have to pay taxes on the gains. You do have to pay taxes on your regular income from your job, however, since the gains are in your own funds you do not have to report them to the IRS. If you choose an IRA that allows for direct transfer of funds, you will have to pay taxes on the full amount of the transactions even if they take place outside of your retirement account. For example, if you sell a product you made in your home town to purchase a new one, you will need to report the full sale amount as income to your tax return.

Recommended Reading: How To Transfer 401k Accounts

Start Your Own Retirement Plan

When youre an employee, you can only use a 401 plan if your employer establishes a plan and youre eligible to contribute. All too often, thats not the case. But you still have options.

Ask for a 401: Your employer might be willing to set up a 401 they just havent done it yet. Start the conversation by asking why there isnt one, why you want one, and that there are potential tax benefits for employers. Explain that valuable employees like yourself would be even more valuable with excellent benefits. Offer to do some of the legwork required to get the plan up and running. In some cases, especially with small organizations, your employer simply doesnt have time to set up a plan. Cost is another factor companies and small nonprofits might be hesitant to pay plan costs . If cost is the primary concern, discuss less-expensive options like SIMPLE plans. Only time will tell if itll actually happen, but it never hurts to ask.

IRAs: If you dont have a 401, you may still be able to save in an individual retirement account , and you might even receive tax benefits similar to a 401. Unfortunately, the IRS sets maximum annual limits much lower for IRAs. Still, something is better than nothing. Evaluate traditional IRAs for potential pre-tax saving, and Roth IRAs for possible tax-free withdrawals . Another drawback of IRAs ) is that you may need to qualify to make contributions or receive a deduction. Speak with a tax expert before you do anything.