Take Advantage Of The Maximum Allocation

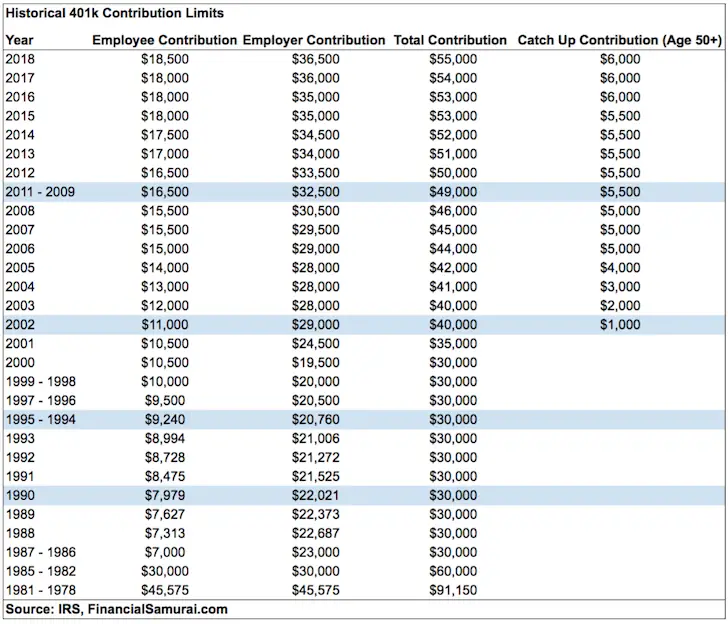

The biggest number on the chart above for each year is in the Maximum Allocation column. That is the maximum amount of money that you can contribute to all tax-sheltered retirement plans that you have available to you. Its actually a more important factor than most people realize.

Despite the increasing 401 contribution limits, the average person isnt coming close to maximize their potential contributions to retirement plans of all types. The 2021 maximum allocation for all plans is a very generous $57,000, or $63,500 for workers 50 and older.

Thats the amount of money that you can contribute even beyond your 401 plan. You may be able to make tax-deductible contributions to a traditional IRA, or non-tax-deductible contributions to a Roth IRA, if your income is within the limits for either plan.

Total 401 Employer And Employee Annual Contribution Limits

| 2020 | ||

|---|---|---|

|

Total with Catch-Up Contributions for those 50 or Older |

$63,500 |

$64,500 |

Vanguard data from 2018 show that among 401 plans the firm administered, 95% of employers provided matching or non-matching contributions to their employees. Approximately 85% of employers provided a 401 match to their employees. Approximately 10% of employers provided non-matching 401 contributions, with no requirement that employees also contribute.

While the annual limits for individual contributions are cumulative across 401 plans, employer contribution limits are per plan. If you were to participate in multiple 401 plans in one calendar year , each of your employers could max out their contributions.

Recommendation To Better Plan For Retirement

Manage Your Money In One Place. Sign up for Personal Capital, the webs #1 free wealth management tool to get a better handle on your finances. After you link all your accounts, use their Retirement Planning calculator that pulls your real data to give you as pure an estimation of your financial future as possible using Monte Carlo simulation algorithms. When it comes to retirement planning, its much better to end up with a little too much than a little too little.

Ive been using Personal Capital since 2012 and have seen my net worth skyrocket during this time thanks to better money management.

Also Check: Can You Convert A Roth 401k To A Roth Ira

Work With A Financial Advisor

Whether you have questions about your 401 investment options or want to open up a Roth IRA, working with a trusted and qualified financial advisor can go a long way. They can help answer all your investing questions and give you the guidance you need to start investing for retirement and building wealth.

Dont have an advisor? We can help with that! Our SmartVestor program can connect you with up to five financial advisors who are ready to help you take the next step toward the retirement youve always dreamed about.

Ready to get started? Find your SmartVestor Pro today!

About the author

Ramsey Solutions

Ramsey Solutions has been committed to helping people regain control of their money, build wealth, grow their leadership skills, and enhance their lives through personal development since 1992. Millions of people have used our financial advice through 22 books published by Ramsey Press, as well as two syndicated radio shows and 10 podcasts, which have over 17 million weekly listeners.

Limits For Highly Compensated Employees

All 401s are subject to annual nondiscrimination tests to ensure the plans don’t provide unfair advantages to HCEs and key employees that lower-earning employees don’t get. These tests ensure HCEs aren’t contributing substantially more of their earnings or receiving more in employer contributions compared to non-HCEs. They also place limitations on how much of a 401 plan’s assets can be in the hands of HCEs. Failing a nondiscrimination test could result in the 401 plan losing its tax benefits, so companies want to avoid this at all costs.

Companies that fail can remedy the situation in a few ways. First, they can provide additional nonelective contributions to lower-earning employees to bring the plan into compliance, or they can place additional limits on HCE contributions, refunding them in some cases if employees have already contributed too much for the year. They can also do a combination of the two.

If a company has to limit HCE contributions, they may not be able to contribute the full sums listed in the table above. Their maximum contribution limits depend in part on how much lower-earning employees are contributing to their 401s. HCEs should talk to their company’s HR department to learn about how much they’re eligible to contribute annually.

Don’t Miss: Can I Take Money Out Of My Fidelity 401k

Heres The Maximum You Can Save In Your 401 Plan In 2021

- Next year, workers can defer up to $19,500 into a 401 plan at work, plus $6,500 if theyre aged 50 and over. Those levels are unchanged from 2020.

- In 2021, you can contribute up to $6,000 to a traditional or Roth individual retirement account. Add in an extra $1,000 if youre 50 and over. These limits are also unchanged from 2020.

- Got a high deductible health plan? Contribute up to $3,600 in your health savings account next year if you have self-only coverage. That number goes up to $7,200 for family plans. Add $1,000 if youre over 55.

If you’re signing up for next year’s workplace benefits, now is the best time to develop a strategy for increasing your savings.

Benefits season also happens to coincide with the annual IRS release of the 2021 maximum contribution limits for certain tax-advantaged accounts, including your 401 plan, individual retirement account and healthcare flexible spending accounts.

Uncle Sam updates these figures around this time each year to reflect inflation.

Be aware that while these maximum amounts may be something for savers to strive for, they’ll need to balance their long-term savings goals with daily cash needs.

You don’t want to shortchange your emergency fund so that you can squirrel away a few more dollars in your 401 plan.

“Being able to contribute the maximum is a fantastic place to be, but most people aren’t there,” said Dave Stolz, CPA and chair of the American Institute of CPAs’ personal financial specialist committee,

Limits For Highly Paid Employees

If you earn a very high salary, you may be considered a highly compensated employee , subject to more stringent contribution limits. To prevent wealthier employees from benefiting unfairly from the tax benefits of 401 plans, the IRS uses the actual deferral percentage test to ensure that employees of all compensation levels participate proportionately in their companies’ plans.

If non-highly compensated employees do not participate in the company plan, the amount that HCEs can contribute may be restricted.

You May Like: How To Make 401k Grow Faster

How Much You Should Contribute With The New Contribution Limits

The IRS determines whether or not to increase its contribution limits based on an annual basis. Sometimes changes in the Consumer Price Index have been very small, like on the order of 2% per year. Congress prefers to increase contributions in increments of at least $500, which they did this year.

With the ability to increase your contributions by $500 in 2020, you may be wondering if you should. My answer is a resounding yes.

If you divide that amount into monthly contributions, youre making only slightly smaller payments which will benefit you in the long run. Continuing to max out your 401k at this level is an ideal strategy,

Retirement Plan Contribution Limits

By Dr. James M. Dahle, Emergency Physician, WCI Founder

Contribution limits for 401s, 403s, 457s, IRAs, Roth IRAs, HSAs, FSAs, SIMPLE IRAs, and SEP IRAs are all indexed to inflation. While the contribution limits do not go up every year and while every account does not use the same formula for when there will be an increase, you will generally see an increased contribution every year or two.

Inflation was relatively high in the first half of 2021, so the 2022 contribution limits for many of these accounts will be increased. In fact, if you know the latest inflation numbers, it is possible to calculate the increase even before the IRS announces it in October or November. The closer you get to October, the more accurate your projection can be.

Don’t Miss: How To Transfer My 401k To My Bank Account

Youre Our First Priorityevery Time

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

A High Bar For Maxing Retirement

In 2021, if your adjusted gross income exceeds $125,000 and you’re single , you won’t be able to contribute the full amount directly to your Roth IRA.

As an alternative, these savers can consider using a strategy known as the “backdoor Roth,” where they make a non-deductible contribution with after-tax dollars to a traditional IRA and then convert it to a Roth.

They could also direct money to a Roth 401 plan at work, provided their employer offers it.

There’s a tax benefit to sprinkling some of your cash across Roth, tax-deferred accounts and taxable brokerage accounts: You’re diversifying your tax treatment, which can help you manage your tax bill in retirement.

“Most people would simply save some money in both the tax-deferred and tax-free accounts,” Stolz said. “We don’t know what the future tax brackets will be, but you’re adding some opportunity to get tax favorable treatment across your portfolio.”

Read Also: How Much Money Should I Put In My 401k

Solo 401 Establishment Deadline:

For 2020, in order to make employee contributions for 2020, the self-employed business owner had to establish the solo 401k plan by December 31, 2020. However, if the plan was established on January 1, 2021 or after by your business tax return due date including the business tax return extension, then you cam make employer profit sharing contributions for 2020 but cannot make employee contributions. For example, an employer operating the plan on a calendar-year basis had to complete the solo 401k plan documentation no later than .

For makin 2021 solo 401k plan contributions, the solo 401k has to be adopted by December 31, 2021 for self-employed businesses operating the plan on a calendar-year basis in order to preserve the right to make both employee and employer contributions in 2022 for 2021 by the business tax return including business tax return extensions. Otherwise, if the solo 401k plan is adopted on January 1, 2022 or after but by your business tax return due date including extensions, you will only be allowed to make employer contributions not employee contributions to the solo 401k plan. To learn more about the December 31, 2021 plan adoption/establishment deadline VISIT HERE.

What Are The 401 Contribution Limits For 2021

7 Minute Read | September 27, 2021

Do you know what simple step most millionaires took to help them build their wealth? Believe it or not, they didnt roll the dice on flashy investment trends or inherit most of their seven-figure net worth. Nope! More than anything else, they put money in their 401.

Thats right! According to the National Study of Millionaires, eight out of 10 millionaires invested in their companys 401 plan. They put money into their accounts month after month, year after year, until one day they looked up and their net worth was in the seven figures. And if they can do it, you can too!

One of the amazing things about a 401 is that it lets you put thousands of dollars away each year for retirement. So if youre one of the millions of Americans with access to a 401, dont take it for granted!

But just how much can you put into your 401 in 2021? Lets take a look.

401 Contribution Limits For 2021

| The 401 contribution limit is $19,500. |

| The 401 catch-up contribution limit for those age 50 and older is $6,500. |

| The limit for employer and employee contributions combined is $58,000. |

| The 401 compensation limit is $290,000. |

You May Like: How Much Money Do I Have In My 401k

In My Case I Stay Active In Post

Youll discover that once you retire from traditional full-time work, it becomes impossible to drawn down principle that took you decades to built. It just feels dirty.

Being a stay at home dad allows us to save ~$3,000 a month on childcare. Coaching high school tennis brings in about $1,250 a month and allows me to build relationships with other members of the community. While writing daily on Financial Samurai keeps my mind fresh and brings in advertising revenue.

Working for a profitable employer with a healthy retirement savings plan cannot be underestimated. Dont just focus on the income figure of your compensation package. Also look into your benefits package to see what type of health, education, and retirement benefits your employer offers.

Contribution Limits For 2020 And 2021

When most people think of 401 contribution limits, they are thinking of the elective deferral limit, which is $19,500 in 2020 and 2021. This is the maximum amount you are allowed to voluntarily defer to your 401 for the year. Adults 50 and older are also allowed $6,500 in catch-up contributions, which are additional elective deferrals, in 2020 and 2021. This brings the maximum amount they can contribute to their 401s each year to $26,000.

The IRS also imposes a limit on all 401 contributions made during the year. In 2020, that limit is $57,000, or $63,500 if you’re 50 or older and therefore eligible for catch-up contributions. In 2021, it rises to $58,000 and $64,500, respectively. This includes all your personal contributions and any money your employer contributes to your 401 on your behalf. contributions, see the following section.)

Highly paid employees have some additional limitations to keep in mind. Companies can elect to stop a participant’s salary deferrals once that person has earned $285,000 in 2020 or $290,000 in 2021, and companies use only that first amount to calculate employer matching contributions.

For example, say your company matches up to 6% of your salary and you earn $300,000 in 2021. Six percent of $300,000 is $18,000 however, your company can only match you up to 6% of $290,000, the maximum employee compensation limit for 2021. So rather than up to $18,000, you’d get up to $17,400 as an employer match.

|

Type of Contribution |

|---|

Data source: IRS.

Recommended Reading: Can I Roll My Roth 401k Into A Roth Ira

How To Claim Your Retirement Savings

Normally, getting at your money can be difficult, and the rules are often imposed by the plan design rather than regulations.

For instance, regulations allow you to access the money without a bonus penalty by:

- Taking out a loan.

- Getting a hardship withdrawal before age 59 ½.

- Waiting until age 59 ½.

- Leaving your employer in the year you turn 55 or after

While most plans do have loan provisions, many dont allow hardship withdrawals, and some plans require that a person be terminated before accessing their money, even if they are 59 ½ or older.

Last year, due to COVID-19, the Coronavirus Aid, Relief, and Economic Security Act, or CARES Act, made it easier to get at your money up to $100,000 in loans or distributions, if the plan allows. These withdrawals had to be before the end of 2020. If you took a hardship loan in 2020, you can avoid paying the 10 percent penalty on the money, as well as take the option to repay the loan tax-free over the next three years. Consider consulting with a tax professional as you prepare your taxes if youre in this position, since it involves filing amended returns.

Unless youre really in a bind, Brewer advises against taking a distribution or a loan. Theres no replacing time in the market, she points out, and consistent saving over time is one of the best ways to build wealth for the future.

Investing In A Business

“An employee who has maxed out their 401 might want to consider investing in a business,” says Kirk Chisholm, wealth manager at Innovative Advisory Group in Lexington, Mass. “Many businesses, such as real estate, have generous tax benefits. On top of these tax benefits, business owners can decide what type of retirement plan they want to create. If, for example, they wanted to set up a 401 plan for their company, they would be able to expand their 401 contributions beyond what they may have at their employer.”

Don’t Miss: Should I Convert My 401k To A Roth Ira

Retirement Contribution Limits At A Glance

Contribution limits didnt increase for the 2021 tax year, but you can still continue to make good progress toward retirement.

Savers 50 and older can continue to set aside more money in their employers plan to help reach their retirement goals, called catch-up contributions.

And if youre not quite ready to max out your retirement savings this year, consider gradually increasing your contributions to save more for a secure retirement.

| Account |

|---|

| Catch-up limit $6,500 |

| Catch-up limit $1,000 |

| Catch-up limit $1,000 |

Some retirement plans have set a lower limit, so check the details of your own employers plan.