Which Celebrity Investor Are You Take Our Quiz To Find Out

3. Open a brokerage account

If your emergency savings is up to snuff and you’ve looked into an HSA as another pre-tax savings option, consider opening a taxable brokerage account.

Brokerage accounts provide investors with another way to invest money in the stock market similar to a traditional 401k, except you’re investing after-tax dollars. Any capital gains are taxed upon withdrawal.

Investors pay a fee to the brokerage house with each transaction.

My wife and I have a brokerage account with Vanguard with holdings in stocks, bonds as well as mutual funds. Less experienced investors who wish to invest their money in something without needing a lot of knowledge might consider the Vanguard LifeStrategy Growth Fund, which is a broadly diversified 80/20 stocks to bonds collection of funds.

A wide variety of companies offer brokerage accounts, like Vanguard, Fidelity, Charles Schwab, T.Rowe Price, Scottrade and many others.

What say you? What would you do with your extra cash after maxing out your 401k and Roth IRA?

Note: This article was originally written in November of 2015 but has been updated in May 2019.

> > > Get Your Free Gold Investor Kit Here

An individual retirement account is one of several types of IRAs. This type of IRA allows you to invest in bonds, stocks, and other assets, instead of having to invest in mutual funds and other products. A good gold IRA has a lower cost of investment than a standard or Roth IRA which invests solely in bonds, stocks, and mutual funds. However, there are differences between a standard and a hedge against inflationary climate.

There are several types of IRAs that an individual can open for investing. The most common IRA types include a standard IRA, a hedge against inflation, and a gold IRA. If you want to have the most flexibility with your investments, then you should invest in a standard IRA. To learn more about these different IRAs, as well as the pros and cons, we have looked at some of the more popular options.

The Rich Do Not Need A 401k

The rich do not want to leave it up to other people to control how their money is being handled. Also, they want to be paid now, tomorrow, and when they retire.

Waiting until retirement age will not work because they are already retired and want the money now so they can invest and spend the way they want to.

All of these reasons the Way of the Rich is to not throw your money into a Plan that someone else controls and you dont get to touch until age 65.

If you invest in passive income with monthly cash flow in real estate, you will have the ability to retire now, get paid now, and live the life you want now.

Not when you are 65

Many people dont know what is an IRA. People invest their money in an IRA and do not really look into all the problems associated with them.

Read Also: How Do You Roll A 401k Into An Ira

Best Ways To Invest In Retirement

Covering your retirement expenses will probably be the biggest financial goal in your life. Your retirement can potentially last for decades, and once you stop earning a paycheck, your savings and investments are likely to cover a huge chunk of your expenses.

With this in mind, its incredibly important to start saving for retirement as early as possible, using tools designed to help you achieve this effectively and efficiently. These three approaches are some of the best ways to invest in retirement.

What You Need To Know About Gold Iras

A standard IRA allows you to invest in funds and other products with a wide range of eligibility requirements. With these types of IRAs, you will pay both a brokerage and a management fee, depending on which company you use. There are also some IRA companies that offer the option to invest in gold iras and there may be a discount or no service charge. When you buy a gold IRA, the company will typically provide a full disclosure of their brokerage and management fees and charges.

Investing in gold IRAs provides you with tax benefits over other forms of investing in a retirement plan. The most popular form of IRA investing is the Roth IRA, which allows you to invest in any form of income, without having to pay taxes on them. In order to contribute to a Roth IRA, you need to have an employer-sponsored retirement plan. The tax benefits that you receive from the investment will depend on the type of income that you have and the tax rate that you are paying.

Recommended Reading: How To Recover 401k From Old Job

Understand The Rules For Contributing To A 401k And A Roth Ira

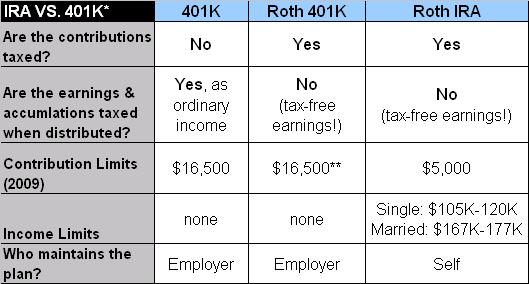

If your employer offers a 401 plan, there may still be room in your retirement savings for a Roth IRA. Yes, you can contribute to both a 401 and a Roth IRA, but there are certain limitations you’ll have to consider.

This article will go over how to determine your eligibility for a Roth IRA. You’ll also learn how much you can contribute to that Roth IRA, how to work around the eligibility restrictions, the flexibility of saving in a Roth IRA versus other individual retirement accounts, and the benefits of saving in both a 401 and a Roth IRA.

Companies Who Dont Match The 401k Contribution Pay More In Wages

Your employer does not give you money out of the kindess of their hearts. It is to keep you working so you can make them money. They pay you money as an incentive to keep working and not quit.

They will only pay you enough to keep you working and not a penny more.

Companies that match your contributions are ones that pay less in wages.

If you didnt get contribution in your 401k, you will see a larger paycheck than otherwise. I personally would rather have the money now than have it many, many years in the future.

Don’t Miss: How Much Can I Put In My 401k Per Year

Should You Convert Your Traditional 401 To A Roth 401

The law now allows employees to convert funds from a traditional 401 plan to a Roth 401, if the plan allows it. About half of employers offer a Roth 401, according to 2017 data from Transamerica Center for Retirement Studies.

You’ll have to pay taxes in the year you convert, just as you would if you converted a traditional IRA to a Roth. Plus, a large conversion could bump you into a higher tax bracket. Note that unlike converting from a traditional IRA to a Roth, you can’t change your mind and undo a 401 conversion to a Roth.

What To Do After Maxing Out Your 401 Plan

Eric is currently a duly licensed Independent Insurance Broker licensed in Life, Health, Property, and Casualty insurance. He has worked more than 13 years in both public and private accounting jobs and more than four years licensed as an insurance producer. His background in tax accounting has served as a solid base supporting his current book of business.

Marcus Reeves is a writer, publisher, and journalist whose business and pop culture writings have appeared in several prominent publications, including The New York Times, The Washington Post, Rolling Stone, and the San Francisco Chronicle. He is an adjunct instructor of writing at New York University.

If you’ve already reached your 401 contributions limit for the yearor soon willthat’s a problem. You can’t afford to fall behind in the funding-retirement game. Also, losing the contribution’s reduction in your gross income isn’t going to help your tax bill next year, either. These pointers will help you decide how to handle maxing out your contributions and hopefully avoid a large tax burden.

Read Also: Should I Do Roth Or Traditional 401k

Saving For Retirement In A Roth Ira

If you meet the income requirements for contributions, there are two compelling reasons to use a Roth IRA for retirement savings.

The Money You Put Into Your 401k Lowers Your Tax Rate Now But Also Lowers Your Tax Breaks For Deductions Like Mortgage Interest And Others

If you put your money into a 401k, you are taking less in income per year because that money is not being given to you directly.

It is being placed, before tax, into a plan that you hope will go up in value.

Because you are not taking the money now, your annual income is lowered by the amount you put into the plan. So your tax rate may be lower because you show less annual income.

You May Like: Can I Contribute To Traditional Ira And 401k

Disadvantages Of A 401

While a 401 is a great way to save for retirement, here are a few drawbacks to be aware of:

- Fewer options for mutual funds. Your employer hires a third-party administrator to run the companys retirement plan. That administrator determines which mutual funds you can invest in, limiting your options.

- Waiting period. If youre new to a company, you may have to wait a certain length of time to participate in a 401 plan.

- Required minimum distributions . You cant leave your money in your 401 forever. Beginning at age 72, you must start withdrawing a certain amount of your savings each year, or youll pay a penalty.2 Alsothere are penalties for withdrawing money before age 59 1/2. Either way, Uncle Sam wants his share!

Lets turn to the Roth IRA, and then well compare the two.

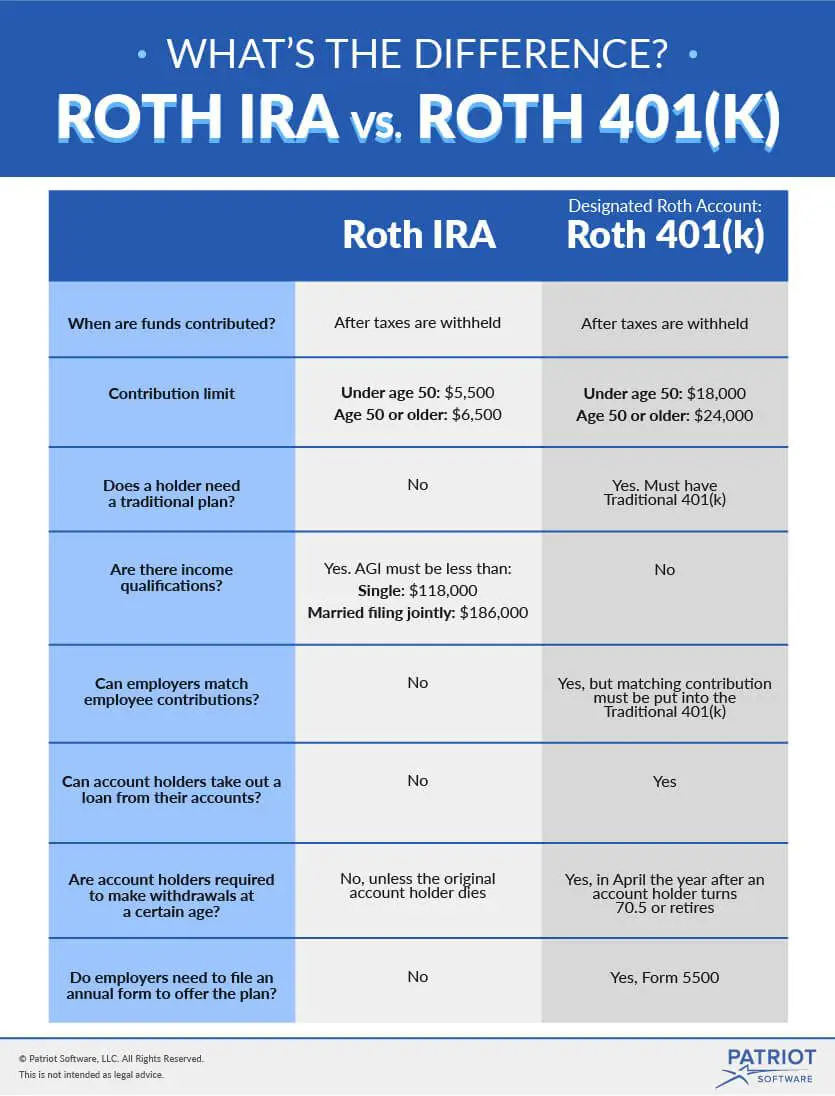

You Can Have A Roth Ira And A Roth 401

It is possible to have both a Roth IRA and a Roth 401 at the same time. However, keep in mind that a Roth 401 must be offered by your employer in order to participate. Meanwhile, anyone with earned income can open an IRA, given the stated income limits.

If you dont have enough money to max out contributions to both accounts, experts recommend maxing out the Roth 401 first to receive the benefit of a full employer match.

Don’t Miss: Can You Use Your 401k To Buy Real Estate

Can I Contribute To A 401k And An Ira

It is a question that comes up frequently when it comes to retirement planning: Can I contribute to a 401k and an IRA? The simple answer is yes, you can. However, there are some caveats when it comes to deducting your IRA contributions if you participate in both types of plans.

Fortunately for your retirement nest egg, you can contribute to both types of retirement accounts. In fact, both workplace and individual retirement accounts represent important building blocks in your retirement savings. Supplementing your workplace retirement account is a great way to boost your retirement savings and put even more of your money to work in tax-advantaged accounts.

An added bonus: IRAs also often offer more investment options than the typical 401k plan. Just as with your traditional 401k, you may contribute pretax dollars to a traditional IRA and then benefit from tax-deferred growth and distributions. As I later cover, be aware that you can only contribute pretax dollars up to certain income levels.

Read More: When is the IRA Contribution Deadline?

Should I Invest In The 401k Or Roth Ira

Ideally, you should contribute the maximum to both the 401k and Roth IRA. However, most new investors dont have that much income. To max out both accounts, youd need to save $25,000. Thats a lot of money. If you cant save that much, then do this.

First, contribute to the 401k up to the employer matching. This is the best investment you can make because your investment will double right away. If youre not contributing this much, youre giving up free money. Lets calculate and see where to invest after that. Ill use an excel spreadsheet to do this.

Here are some assumptions.

- The investor is in the 22% tax bracket. He can invest $6,000 in Roth IRA or $7,690 pretax in 401k.

- 8% annual gain.

- The investor starts at 22, retires at 60, and lives until 86.

- The withdrawal rate is 7% at 60. I made the money run out at 86.

- After retirement, the investor will have a lower effective tax rate due to not having a job. I assume the investor will pay 12% tax. This is a big assumption, but it should be valid. Most retirees make less money after they retire and pay less tax.

Here is the graph of the 401 vs Roth IRA.

As we expected, the 401 portfolio grows much more than the Roth IRA. Thats because you dont have to pay tax initially and can invest more. The 401k grows to $1,829,768 by the time were 60 years old. The Roth IRA grows to $1,427,647. Thats a big difference.

Recommended Reading: How To Take Money From 401k Without Penalty

We Ran Through The Similarities And Differences Between Roth 401 Vs Roth Ira

Both are great ways to save for retirement, and each has its pros and cons. If you need help deciding, or just want to talk to someone about getting your finances on the path towards financial freedom, schedule a free Discovery Call today.

Bonus: Does your income put you above contribution limits for a Roth IRA? Check out our video on the Backdoor Roth IRA technique.

Benefits Of Having Both A 401 And A Roth Ira

Using both a 401 and a Roth IRA to save can be a great option for someone looking to put as much money as possible into tax-advantaged retirement accounts.

If you’re a higher-income earner on the edge of qualifying for a Roth IRA contribution, making a 401 contribution could push you under the income limitations, since those contributions don’t count toward your AGI. That would open the door for more flexibility with short-term savings in a Roth IRA.

Ultimately, an employer-sponsored 401 shouldn’t prevent you from getting money into a Roth IRA. While you should consider any other options at your disposal, maximizing the amount of money in your tax-advantaged savings accounts is usually a good strategy for a healthy retirement.

You May Like: How Do I Find Previous 401k Accounts

We Have All Been Lied To

All of our lives, we are taught to work our lives away for someone else, and then retire when we are 65 years old.

Here is the plan that is taught us from the time we started government school:

This is a horrible plan that NO ONE should follow.

I realized this plan was repulsive when I was 27 years old. This is when I decided to make a change.

Fast forward 10 years to my being successfully unemployed, firing my boss, living the dream life, and never working another job again. At age 37, I quit my job to live the life of my dreams.

Well, you were also lied to that these Investment accounts, like the 401K and IRA were created to help you retire.

NO! This was not created to help you retire or be wealthy and rich. It was created to help others become wealthy and rich.

You need to learn how the Rich get rich and stay rich.

Andrew Carnegie said: 90% of all millionaires became so through owning real estate.

This was how I became wealthy and rich.

Real Estate Investing.

Now this is true investing. Buying properties that make you money each month weather you work or not.

Check out my article on the 6 ways rental properties make you money. This will open your eyes on how the Rich truly stay rich.

Invest In A Traditional Or Roth Ira

Yep, you may be able to put money into a traditional or Roth IRA even if you have a workplace 401. You can invest $6,000 a year . If you go with a traditional IRA, You might be able to deduct the full amount of the contributions if you or your spouse participated in a retirement plan at work. If thats the case, and you want to contribute to an IRA, you can opt for a Roth IRA instead.

A Roth IRA is funded with money thats already been taxed, so youre not limited by the contributions youve made in other funds. However, not everybody can go the Roth IRA route. If your modified adjusted gross income doesnt exceed IRS limits , you can contribute to a Roth IRA. Thats good for you, since that money grows tax-free and it wont be taxed when you take it out in retirement!

Don’t Miss: How Do I Find Out Where My Old 401k Is

Pros Of Having Both Plans

It makes sense to contribute to both these accounts if you qualify, you can afford it, and you want to invest more than the 401 or Roth IRA limits. Both accounts offer unique incentives when they’re combined, allowing you to make the most of your savings.

You can deduct the contribution from your taxable income, because 401 plans are tax-deferred accounts that you pay into with pre-tax dollars. This lowers your tax liability in the present. But both your contributions and their earnings are subject to taxes when you take the money out. The withdrawal will also be subject to an early-withdrawal penalty of 10% if you take it before age 59 1/2, with certain exceptions.

You don’t have to pay any taxes on either the contributions or the earnings with a Roth IRA when you take the money out, as long as you’ve held the account for five years. Again, you must wait until age 59 1/2 to take the earnings. Your original contributions can also be withdrawn tax-free at any time before you reach retirement.

This tax arrangement lets you save for other goals, such as buying a house or paying for a child’s college education. Some people even use Roth IRAs as emergency savings accounts.

Invest at least the minimum amount in your 401 to qualify for your employer’s matching program, if one is offered.