Does Separate Account Refer To The Actual Funding Vehicle Or Does It Refer To Separate Accounting Within The Plan’s Trust

Under IRC Section 402A, the separate account requirement can be satisfied by any means by which an employer can separately and accurately track a participants designated Roth contributions, along with corresponding gains and losses.

For A Traditional Ira

Contributions to a traditional IRA are often tax-deductible. But if you are covered by a 401 or any other employer-sponsored plan, your modified adjusted gross income will determine how much of your contribution you can deductif any. The following table breaks it down:

| Deductibility of IRA Contributions If You Also Have an Employer Plan | |

|---|---|

| Tax-filing status | |

| More than $10,000 | $6,000 + $1,000 more if you’re 50+ |

IRS Publication 590-A explains how to calculate your deductible contribution if either you or your spouse is covered by a 401 plan.

Even if you don’t qualify for a deductible contribution, you can still benefit from the tax-deferred investment growth in an IRA by making a nondeductible contribution. If you do that, you will need to file IRS Form 8606 with your tax return for the year.

Can You Have A Pension And 401 And Ira

Yes. You can contribute to a 401, as well as a traditional Roth IRA, if you have a pension. In fact, its probably in your best interest to have all of these accounts to reduce any potential risk associated with pensions.

As discussed several times above, pensions are offered by fewer companies these days. More concerning for the public sector is that funds may run dry.

Recommended Reading: Can Anyone Open A 401k

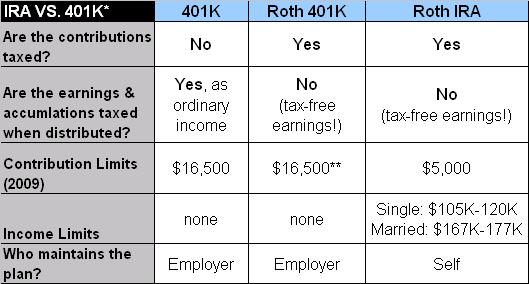

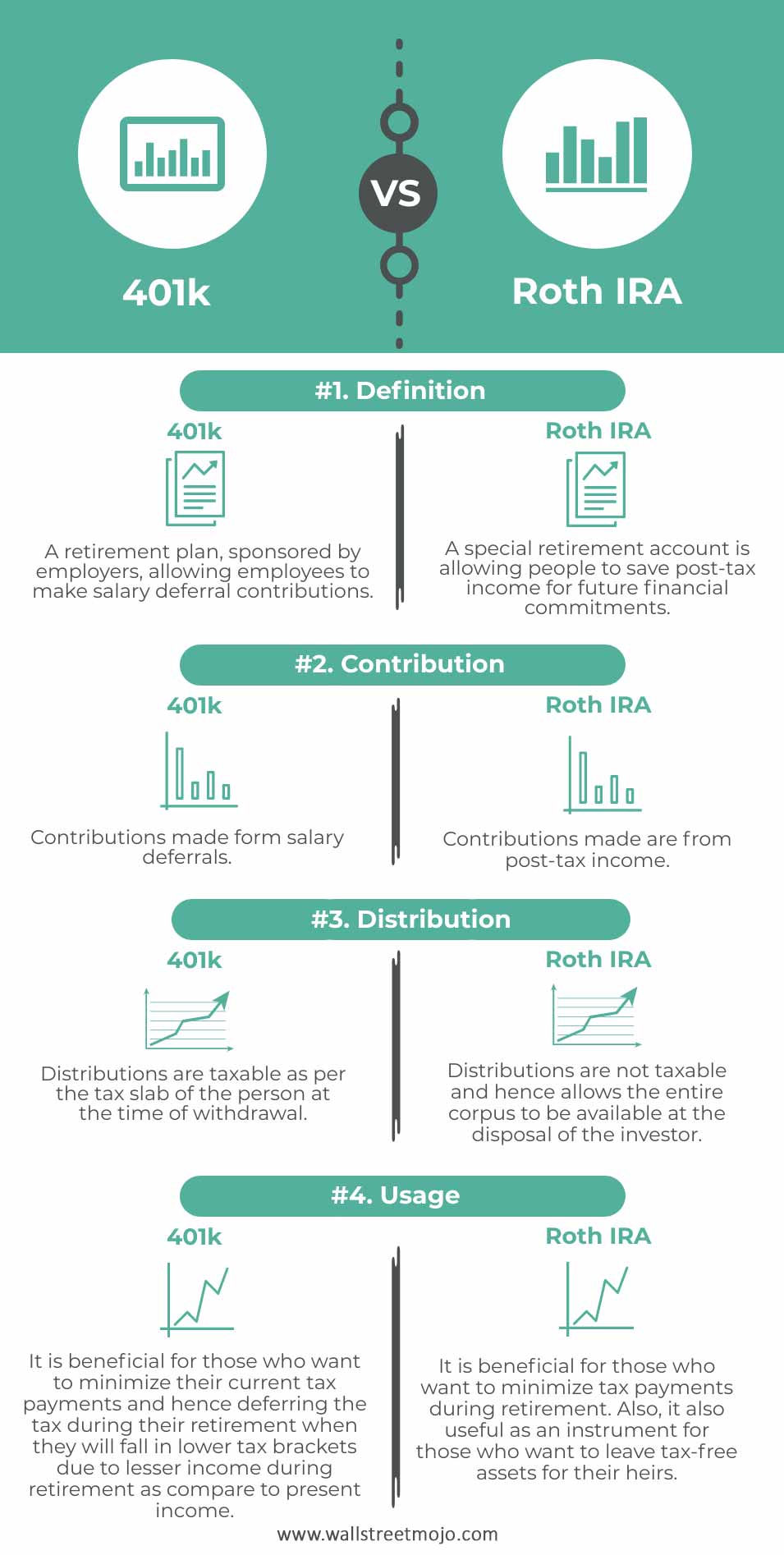

Vs Roth : How Are They Different

The biggest difference between a traditional 401 and a Roth 401 is how the money you contribute is taxed. Taxes can be kind of confusing , so lets start with a simple definition and then well dive into the details.

A Roth 401 is a post-tax retirement savings account. That means your contributions have already been taxed before they enter your Roth account.

On the other hand, a traditional 401 is a pretax savings account. When you invest in a traditional 401, your contributions go in before theyre taxed, which makes your taxable income lower.

Roth 401 vs. Traditional 401: Pros and Cons

| Contributions | Contributions are made with after-tax dollars . | Contributions are made with pre-tax dollars . |

| Withdrawals | The money you put in and its growth are not taxed. However, your employer match is subject to taxes. | All withdrawals will be taxed at your ordinary income tax rate. Most state income taxes apply too. |

| Access | If youve held the account for at least five years, you can start taking money out once you are age 59 1/2. You or your beneficiaries can also receive distributions due to disability or death. | You can start receiving distributions at age 59 1/2, no matter how long youve had your 401. You or your beneficiaries can also receive distributions due to disability or death. |

Contribution Limits For Iras

According to the IRS, income limits are based on modified adjusted gross income, explains Chalmers Brown in another Due article. For instance, if youre single, youre eligible as long as you have a MAGI of less than $124,000. If so, then you are permitted to contribute the maximum amount of $6,000 to a Roth IRA.

If you earn more than that, you can still contribute to a reduced amount, adds Chalmers. The catch? Your MAGI must be between $124,000 and $139,000. But, once you cross that $139,000 amount, youre no longer eligible.

Married couples with a modified Adjust Gross Income of less than $196,000 can also contribute up to the limit, Chalmers says. If your AGI is between $196,000 and $206,000, then you may qualify to make reduced contributions. Couples with an AGI of $206,000 or higher do not meet the criteria.

Recommended Reading: What Is The Tax Rate On 401k Withdrawals

Advantages Of A Roth Ira

Here are some advantages a Roth IRA has over a 401:

- Tax-free growth. The biggest benefit is the tax break. Since you invest in your Roth IRA with money thats already been taxed, the growth isnt taxed, and you wont pay any taxes when you withdraw your money at retirement.

- More investing options. With a Roth IRA, you dont have a third-party administrator deciding which funds you can invest in, so you can choose any mutual fund you like. But be careful: Always seek good advice when choosing mutual funds, and make sure you fully understand how they work before you invest any money.

- Set up apart from an employer. Unlike a workplace retirement plan, you can open a Roth IRA at any time as long as you deposit the minimum amount. The amount will vary based on who you open your account with.

- No required minimum distributions . With a Roth IRA, you wont be penalized if you leave your money in your account after age 72 as long as you hold the Roth IRA for at least five years. But like the 401, youll be penalized for taking money out of a Roth IRA before age 59 1/2 unless you meet specific requirements.

- The spousal IRA. If youre married but only one of you earns money, you can still open an IRA for the non-working spouse. The spouse who earns money can invest in accounts for both spousesup to the full amount! A 401, on the other hand, can only be opened by someone earning an income.

Ira Benefits And Drawbacks

The investment choices for IRA accounts are vast. Unlike a 401 plan, where you’re likely to be limited to a single provider, you can buy stocks, bonds, mutual funds, ETFs, and other investments for your IRA at any provider you choose. That can make finding a low-cost, solid-performing option easy.

However, the amount of money you can contribute to an IRA is much lower than with 401s. For 2020 and 2021, the maximum allowable contribution to a traditional or Roth IRA is $6,000 a year, or $7,000 if you are age 50 or older. If you have both types of IRAs, the limit applies to all of your IRAs combined.

An added attraction of traditional IRAs is the potential tax-deductibility of your contributions. But, as discussed above, the deduction is only allowed if you meet the modified adjusted gross income requirements.

Your MAGI may also limit your contributions to a Roth IRA. In 2020, single filers have to make below $139,000, while married couples filing jointly must make less than $206,000 to be eligible for a Roth. These amounts rise for 2021 when single filers must make below $140,000, and married couples filing jointly must make less than $208,000 to be eligible for a Roth IRA .

Having earned income is a requirement for contributing to an IRA, but a spousal IRA lets a working spouse contribute to an IRA for their nonworking spouse, making it possible for the couple to double their retirement savings.

Also Check: How To Avoid Penalty On 401k Withdrawal

Can I Contribute To A Roth Ira And A 401

Most retirement savings are made through employer-sponsored 401 plans. If your employer offers to match a percentage of your contributions, it’s a great way to increase your retirement savings with free money.

In addition to your 401 contributions, you can contribute to a Roth IRA. A Roth IRA will be held outside of your employer-sponsored plan but is just as easy to set up.

Adhere to the contribution limits bothâ$19,500 and $6,000 respectivelyâand you can grow your retirement savings by $25,500 annually plus any employer contributions.

A good strategy would be to contribute to your 401 up to the amount your employer matches. Then, contribute as much as you can towards your Roth IRA until you reach the limit. This way, you’ll maximize the free money you’ll receive from your employer and increase the amount of tax-free distributions you’ll have during retirement.

Can I Take A Loan From My Designated Roth Account

Yes, if the plan permits, you can identify from which account in your 401, 403 or governmental 457 plan you wish to draw your loan, including from your designated Roth account. However, you must combine any loans you take from your designated Roth account with any other outstanding loans from that plan and any other plan maintained by the employer to determine the maximum amount you are permitted to borrow. The repayment schedule for your loan from your designated Roth account must separately satisfy the amortization and quarterly payment requirements.

Also Check: Can 401k Be Transferred To Roth Ira

How Is The 5

When you roll over a distribution from a designated Roth account to a Roth IRA, the period that the rolled-over funds were in the designated Roth account does not count toward the 5-taxable-year period for determining qualified distributions from the Roth IRA. However, if you had contributed to any Roth IRA in a prior year, the 5-taxable-year period for determining qualified distributions from a Roth IRA is measured from the earlier contribution. So, if the earlier contribution was made more than 5 years ago and you are over 59 ½ a distribution of amounts attributable to a rollover contribution from a designated Roth account would be a qualified distribution from the Roth IRA.

Are There Any Examples To Help Explain The Rollover Rules

Yes, the following examples illustrate the rollover rules.

Recommended Reading: How Do I Find Out Where My Old 401k Is

When Must I Be Able To Elect To Make Designated Roth Contributions

You must have an effective opportunity to make an election to make designated Roth contributions at least once during each plan year. The plan must state the rules governing the frequency of the elections. These rules must apply in the same manner to both pre-tax elective contributions and designated Roth contributions. You must make a valid designated Roth election, under your plans rules, before you can place any money in a designated Roth account.

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Read Also: Can I Manage My Own 401k

Understand The Rules For Contributing To A 401k And A Roth Ira

If your employer offers a 401 plan, there may still be room in your retirement savings for a Roth IRA. Yes, you can contribute to both a 401 and a Roth IRA, but there are certain limitations you’ll have to consider.

This article will go over how to determine your eligibility for a Roth IRA. You’ll also learn how much you can contribute to that Roth IRA, how to work around the eligibility restrictions, the flexibility of saving in a Roth IRA versus other individual retirement accounts, and the benefits of saving in both a 401 and a Roth IRA.

How Does A Roth Ira Work

Roth IRAs are individually-owned retirement funds that anyone can open as long as they meet the income requirements. In 2019, single individuals making $122,000 or less can contribute to a Roth IRA. However, if they make $137,000 or more, they cannot contribute at all. A reduced contribution rate applies if they make more than $122,000 but less than $137,000. Couples who file jointly can’t contribute if they make more than $193,000 combined.

Like a 401, there are limits to how much you can invest annually in your Roth IRA. You cannot contribute more than your taxable compensation for the year, and the maximum contribution for 2019 is $6,000 if you’re age 50 or over, it’s $7,000. And whether you can put in the full amount depends on your tax filing status and how much you earn annually.

Roth IRA contributions are made using after-tax dollars and, as a result, are not taxed when you withdraw the money, as long as your account has been active for five years.

While you can withdraw any Roth IRA contributions at any time, regardless of the reason, without receiving a penalty, you will be penalized if you withdraw any investment earnings from your Roth IRA prior to the age of 59½, unless it’s for a qualifying reason.

You May Like: Should I Roll 401k To Ira

Yes If You Can Max Out Both Accounts

Heres a simple question to ask yourself: Can I contribute to 401 and IRA plans up to the annual limits, based on my income and spending? If so, this can go a long way in funding your dreams for retirement.

This assumes, of course, that you can realistically afford to contribute $19,500 to a 401 each year along with up to $6,000 to an IRA. If youre trying to pay down debt, save for your childs college expenses, or reach other financial goals, then fully funding multiple retirement accounts may not be realistic.

If you are planning to contribute the maximum to both a traditional IRA and a 401, consider your budget and spending. And youll need to do some research into how that may affect your retirement tax deductions.

What Kinds Of Mutual Funds Should I Choose For My Roth 401

Diversifying your portfolio is key to maintaining a healthy amount of risk in your retirement savings. Thats why it’s important to balance your investment among four types of mutual funds: growth and income, growth, aggressive growth, and international funds.

If one type of fund isnt performing as well, the other ones can help your portfolio stay balanced. Not sure which funds to select based on your Roth 401 options? Sit down with an investment professional who can help you understand the different types of funds, so you can choose the right mix.

Don’t Miss: How To Know If You Have A 401k

How Are They Different

| Employers provide a 401 to employees as a benefit | An IRA is an individual retirement account, so it belongs to you individually |

| Lowers your taxable income because most 401 contributions are made before taxes are taken out | Your traditional IRA contributions are made from your taxable earnings, you are then permitted to deduct the contributions from your income in certain situations |

| The employer selects the investment options offered in the plan | Typically offers a wider range of investment options than a 401 |

| The employer may match up to a certain percentage of your contribution | Isnt tied to your employer, so you dont get a match on your contributionhowever, you have more control and flexibility when and how you contribute |

| You may be able to roll over an old 401 from a previous job into the 401 at your current job | You can roll multiple outside accounts like old 401s or other IRAs into one IRA to simplify your savings |

Differences Between A Traditional And Roth Ira

The differences between the two types of IRA mainly focus on tax deductions, eligibility criteria, and accessibility of funds. One significant difference between a traditional IRA and Roth IRA is that with a Roth IRA, you make your contributions using the money you have already paid taxes on.

In other words, your contributions are tax-exempt . However, upon retirement, your withdrawals become tax-free. This means that if you meet Roth IRA conditions, you can avoid paying taxes on your investment earnings.

The other difference is that while Roth IRA has no required minimum distributions, you must start taking distributions at 72 years with a traditional IRA. In addition:

- Your contribution to Roth IRA is not tax-deductible but your withdrawals at retirement are tax-free.

- If you make withdrawals from your traditional IRA, you attract income taxes on the amount withdrawn, but this does not apply to withdrawals from Roth IRA.

- Unlike a traditional IRA, a Roth IRA account doesnt offer you a tax deduction in the year you make your contribution.

You May Like: Can You Roll A 401k Into A Self Directed Ira