Doing A Roth Rollover Beware The 5

The Roth IRA has been called “the Swiss Army knife” of personal finance because of its flexibility and the tax-free status of its earnings. That’s the reason so many retiring workers move to roll their workplace 401 accounts into a Roth, and why so many financial advisors recommend converting a traditional IRA to a Roth.

The idea is that if you pay income tax on your retirement money now especially when many account balances are significantly down your tax-free Roth gains will make up the difference and possibly more.

But beware the 5-year Rule.

Below we’ll guide you through the ins and outs of the 5-year-Rule, but consider matching with a vetted financial advisor for free for more help managing a Roth rollover and other retirement needs.

The 5-year Rule: What You Need to Know

While the contributions to a Roth can be withdrawn at any time, you can’t touch the earnings unless the account’s been open for at least five years. So, if you’re rolling another retirement account into a Roth IRA in 2023, make sure you don’t need the earnings until at least 2028. If the account for the rollover is your first Roth IRA account or you opened your first Roth less than five years ago, the earnings will be taxed when withdrawn. One break is that even if a Roth you opened more than five years ago is closed, it still counts toward the 5-year rule.

And, yes, the 5-year rule counts even if you’re older than 59.5 you need to satisfy both requirements or you lose the tax break on gains.

Can Retired Persons Transfer A 401 To A Roth Ira

While traditional IRAs and 401 plans have been around since 1974, the Roth IRA is just a baby, created in 1997. This relative newness, combined with Roth income restrictions, means that many people may reach retirement without the benefits of Roth IRA savings options. Retirees can convert traditional 401 accounts to Roth IRAs, but there are a number of factors to consider when deciding if it is the right thing for you.

How To Transfer From Your 401 To An Ira

When youre ready to make the transfer, you need to do three things:

I often help clients prepare these requests and do a three-way call with them , making it quick and easy to get things done. But if you prefer, you can probably figure this out on your own.

Unfortunately, you typically have to go through your former employer or a vendor they use. With many 401 plans, you cannot request a transfer using paperwork from the receiving IRA custodian.

Who to Contact

If you work for a large company, you can most likely contact your 401 provider directly. For example, contact Fidelity, Vanguard, or whatever website you use to manage your account. Alternatively, call whoever prints your 401 statements. If you work for a small company, you may need to contact the human resources department, which might just be the person who hired you. Either way, you eventually need one of the following:

What to Say

Don’t Miss: Can You Get 401k If You Quit

Find Out If Youll Be Able To Convert Your 401

According to the IRS, in order to be eligible for a 401 conversion, the money must be vested .3 All the money you put into your 401 is immediately vested, but your employers contributions are usually vested over time. Depending on the vesting schedule set up by the company and how long youve been there, your existing 401 might not be fully vested yet.

Companies sometimes have their own additional restrictions on who can convert their 401, so ask your employer if you are eligible.

Read Also: How To Roll 401k Into Roth Ira

Rollover To Another 401

If you value the simplicity of having all your retirement funds in one place, are looking to minimize account maintenance fees or want to prepare yourself to take advantage of the Rule of 55, a 401-to-401 rollover can be a good choice. By rolling over an old 401 into a plan with your new employer, you can keep everything in one place. Evaluate investment options carefully, though, to make sure there arenât high fees and that the investments available work for you.

Read Also: Can You Invest Your 401k In Stocks

Also Check: How Does 401k Match Work

Reasons You May Want To Wait To Roll Over Your 401

- Temporary ban on contributions. Some plan sponsors impose a temporary ban on further 401 contributions for employees who withdraw funds before leaving the company. You’ll want to determine if the gap in contributions will significantly impact your retirement savings.

- Early retirement. Most 401s allow penalty-free withdrawals after age 55 for early retirees. With an IRA, you must wait until 59 ½ to avoid paying a 10% penalty.

- Increased fees. IRA investors may pay more fees than they would in employer-sponsored plans. One reason: The range of more sophisticated investment options you may choose can be more expensive than 401 investments. Your advisor can help identify what extra cost a rollover may incur and if the benefits of the rollover justify those additional costs.

- Can take loans out. Your 401 may permit you to take out a loan from the account, but this is typically only for active employees. And you may have to pay in full any outstanding loan balances when you leave the company. You cannot take loans from IRAs.

Considerations For Owners Of Roth Iras

Distributions from a Roth IRA are qualified, and thus tax-free and penalty-free, provided that the 5-year aging requirement has been satisfied and at least one of the following conditions has been met:

- You reach age 59½

- You are disabled

- You make a qualified first-time home purchase

All other distributions are non-qualified. Non-qualified distributions of converted balances are not taxed again , but they may be subjected to a 10% penalty unless it’s been at least five years since the beginning of the year of your conversion, you’ve reached age 59½, or one of the other exceptions applies.

RMDs are not required during the lifetime of the original owner of a Roth IRA. RMD amounts are not eligible to be converted to a Roth IRA.

Don’t Miss: Should I Move 401k To Roth Ira

When It Might Make Sense

Here are some of the most common reasons people roll IRAs into 401 accounts.

Continue reading below, or watch this video with the same information:

Avoid required minimum distributions :

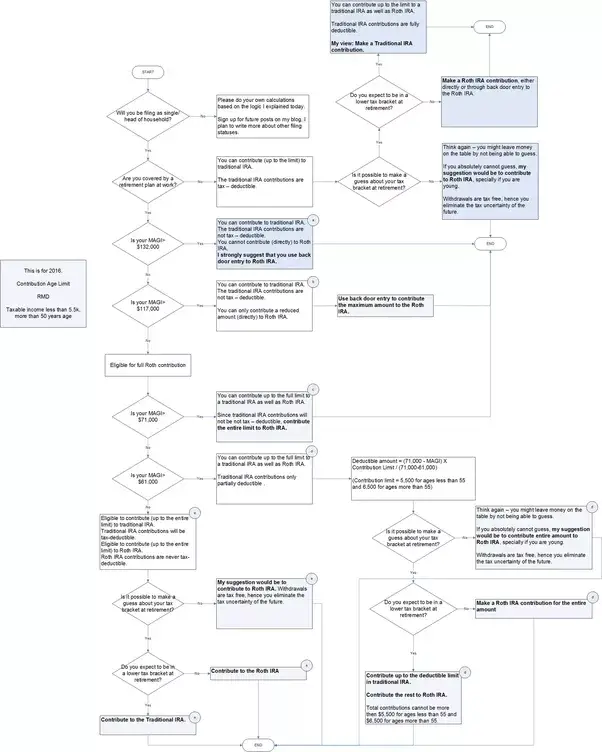

Backdoor Roth and conversions: If you plan to convert traditional IRA money to Roth IRA money or make back door Roth contributions you might want to minimize pre-tax money in IRAs. Doing so may neutralize the pro-rata rule, which causes complications and taxes when you have pre-tax money in an IRA. By shifting that pre-tax IRA money to your 401, only post-tax money remains in the IRA, which simplifies things substantially.

401 loans: Some 401 plans allow loans, but IRAs do not. Is there any way to borrow against the money in your IRA? If your 401 plan allows loans, you could potentially roll your IRA into the 401, increasing the amount of money available to you via 401 loan. Check with your plan administrator to learn about plan rules and logistics before you get your heart set on anything. Also, just because its possible doesnt mean its a good idea. Its risky to raid your retirement funds.

Can You Convert A Roth 401k To A Roth Ira

A Roth 401 can be rolled over to a new or existing Roth IRA or Roth 401. As a rule, a transfer to a Roth IRA is most desirable, since it facilitates a wider range of investment options. If you plan to withdraw the transferred funds soon, moving them to another Roth 401 may provide favorable tax treatment.

Recommended Reading: Can I Transfer Funds From My 401k To An Ira

Does Time Of Year Matter

Converting earlier in the year generally gives you more time to pay taxes. Taxes arent due until the tax deadline of the following year, so you may have more than 15 months to pay the taxes on your converted balances.

But there are also some advantages to converting later in the year:

- You can still start the clock on the 5-year rule as of the beginning of the year. This IRS rule requires a waiting period of 5 years before withdrawing converted balances or you may pay a 10% penalty. But the clock starts on January 1 of the year you do the conversionno matter when during the year it actually happened. The 5-year rule is counted separately for each conversion.

- Youll have more information about your income for the year. Since the amount you convert is considered taxable income, you may want to consider converting only the amount that would bring you to the top of your current tax bracket.

A conversion must be completed by December 31 to be included in that years taxable income. Managing the tax impact of a Roth IRA conversion requires careful analysis. A review with a financial or tax advisor is always a good idea.

Recommended Reading: Best Places To Live Retire In Us

Next Steps To Consider

A qualified distribution from a Roth IRA is tax-free and penalty-free. To be considered a qualified distribution, the 5-year aging requirement has to be satisfied and you must be age 59½ or older or meet one of several exemptions .

Fidelity does not provide legal or tax advice. The information herein is general and educational in nature and should not be considered legal or tax advice. Tax laws and regulations are complex and subject to change, which can materially impact investment results. Fidelity cannot guarantee that the information herein is accurate, complete, or timely. Fidelity makes no warranties with regard to such information or results obtained by its use, and disclaims any liability arising out of your use of, or any tax position taken in reliance on, such information. Consult an attorney or tax professional regarding your specific situation.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917

Recommended Reading: How To Tell If You Have A 401k

Who Are Roth Iras Best For

Roth IRAs are best for those whose modified adjusted gross income are below or within the ranges, but the contribution space is reduced as you reach the upper bounds of the ranges. The limits for 2022 are:

- $6,000 for those earning equal or less than $129,000 as single filers with a phase out to zero contributions at $144,000

- $6,000 for taxpayers earning up to $204,000 with a phase out to zero at $214,000

Roth IRAs also make sense if you expect to have significant income into retirement. A common strategy is to withdraw any taxable contributions from other plans to stay within a set tax bracket and then use the Roth IRA as a top up when needed for lifestyle reasons. From a tax perspective, your goal into retirement is to have accounts with a tax burden drawn down to zero by the end of your life and have your financial legacy set up in such a way that it minimizes the estate taxation for your heirs. The Roth IRA is an ideal tool for that role.

How Much Can I Roll Over If Taxes Were Withheld From My Distribution

If you have not elected a direct rollover, in the case of a distribution from a retirement plan, or you have not elected out of withholding in the case of a distribution from an IRA, your plan administrator or IRA trustee will withhold taxes from your distribution. If you later roll the distribution over within 60 days, you must use other funds to make up for the amount withheld.

Example: Jordan, age 42, received a $10,000 eligible rollover distribution from her 401 plan. Her employer withheld $2,000 from her distribution.

If you roll over the full amount of any eligible rollover distribution you receive :

- Your entire distribution would be tax-free, and

- You would avoid the 10% additional tax on early distributions.

You May Like: How To Open A Solo 401k

Don’t Miss: How Do I Stop My 401k

Direct And Indirect 401 Rollovers

Before you roll over your 401, youll need to open an IRA account. You can do this at virtually any major brokerage firm, mutual fund company or robo-advisor. Do some research, then head to your financial institutions website to open your account. At some point, youll want to talk to a customer representative to find out whether the rollover and conversion can be done at once or if they are done sequentially. If its the former case, youll just have to pick your investments once. If its the latter, youll want to keep the money liquid in the IRA before converting to a Roth.

Once youve opened the IRA, you can contact the company managing your 401 account to begin the rollover process. You can do this online or over the phone. Your 401 plan administrator will then transfer your funds into your new IRA account. This is called a trustee-to-trustee or direct rollover, and its the easiest way to do it.

Another path is an indirect rollover. In this case, the balance of the account is distributed directly to you, typically as a check. Youll have 60 days from the date you receive the funds to transfer the money to your custodian or IRA company. If you dont deposit the funds within the 60 days, the IRS will treat it as a taxable withdrawal, and youll face a 10% penalty if youre younger than 59.5. This risk is why most people choose the direct option.

You Think Your Tax Rate Is Going To Go Up

If you believe your current tax rate is lower than it might be in the future, you may want to convert your investments into a Roth IRA, pay your fair share of taxes now, and then let that money grow tax-free until you need it.

Converting a pre-tax 401 into a post-tax Roth IRA will trigger a tax bill, but a financial professional might recommend it anyway. Its a way to hedge against the risk of taxes going up in the future, says Hernandez. In a general sense, if youre still in the early stages of your earning career, it makes sense to go ahead and pay the taxes upfront and do the Roth contributions.

Of course, no one knows for sure what their tax rate will look like in the future. Thats why many experts recommend diversifying your long-term investments into different buckets: some in a tax-deferred account like a 401, and others in a post-tax account like a Roth IRA. If all your money is one bucket, a conversion could make sense.

You May Like: How To Borrow From My 401k

Read Also: How To Retrieve 401k Money

A Roth Conversion Could Trigger Other Taxes

Look at the big picture if you plan a conversion. The added taxable income could boost you into a higher tax bracket, at least temporarily. A big jump in income could trigger one-time taxes, too, such as the 3.8% net investment income tax, or also called the Medicare surtax.

A series of small conversions over several years could keep the tax bill in check. For instance, you may want to convert just enough to take you to the top of your current tax bracket.

Roth Ira Income Limits

Anyone can contribute to a traditional IRA, but the IRS imposes an income cap on eligibility for a Roth IRA. Fundamentally, the IRS does not want high earners benefiting from these tax-advantaged accounts. In 2021 and 2022, the annual contribution limit for IRAs is $6,000 or $7,000 if you are age 50 or older. For 2023, the limit increases to $6,500, or $7,500 if you are 50 or older.

The income caps are adjusted annually to keep up with inflation. In 2022, the phaseout range for a full annual contribution for single filers is a modified adjusted gross income ranging from $129,000 to $144,000 for a Roth IRA. For , the phaseout begins at $204,000, with an overall limit of $214,000.

In 2023, the income phase-out range for taxpayers making contributions to a Roth IRA increases to $138,000 to $153,000 for singles and heads of households. For married couples filing jointly, the income phase-out range is increased to $218,000 to $228,000.

And this is why, if you have a high income, you have another reason to roll over your 401 to a Roth IRA. Roth income limitations do not apply to this type of conversion. Anyone, regardless of income, is allowed to fund a Roth IRA via a rolloverin fact, it is one of the only ways. The other way is converting a traditional IRA to a Roth IRA, also known as a backdoor conversion.

You May Like: How Should I Set Up My 401k