Engage Employees And Encourage Them To Save With A 401 Match This Year

The employer match is an excellent incentive tool to encourage employees to participate in your small business 401 plan. Matching not only helps employees create better financial security, but allows you and higher-paid executives the opportunity to max out your retirement savings as well.

Ubiquity is a leading provider of 401 plans geared specifically to small businesses. We are happy to help you set up an easy and affordable small business retirement plan with matching and educate your workforce so they understand what a great and valuable benefit youre offering. Contact us to learn more.

Does Matching Count Towards Contribution Limits

The short answer is no, says Winston. But theres a separate IRS rule that limits the amount of total contributions to a 401 from both the employee and employer combined.

In 2022, most people can divert up to $20,500 per year to a 401 account$1,000 higher than in 2021. If youre age 50 or older by year-end, you can add an additional $6,500 in catch-up contributions.

However, the overall limit from all sources is $61,000 in 2022. That means that no matter who contributes to your account, you cant exceed that amount for the year. If your employer offers a match in the above scenario, the maximum amount youd reach is $41,000. Its therefore unlikely that youll exceed the overall contribution limit.

If your companys 401 plan offers a match, try to contribute enough to capture the full amount. From there, you can assess whether you want to contribute above that amount toward your retirement fund.

Other Factors To Consider Beyond A Match

Although a matching contribution is very valuable, it is still one of several factors in retirement accounts like a 401k. This includes other contributions your employer might make, fees, investment options, services offered, and more. A match alone, or lack thereof, does not tip the scales for whether you have a good 401k or not. Ask questions and educate yourself on the specifics, just like your other work benefits so you family can get the most out of what is offered.

Don’t Miss: How Do You Get Your 401k Money When You Retire

More From The New Road To Retirement:

Here’s a look at more retirement news.

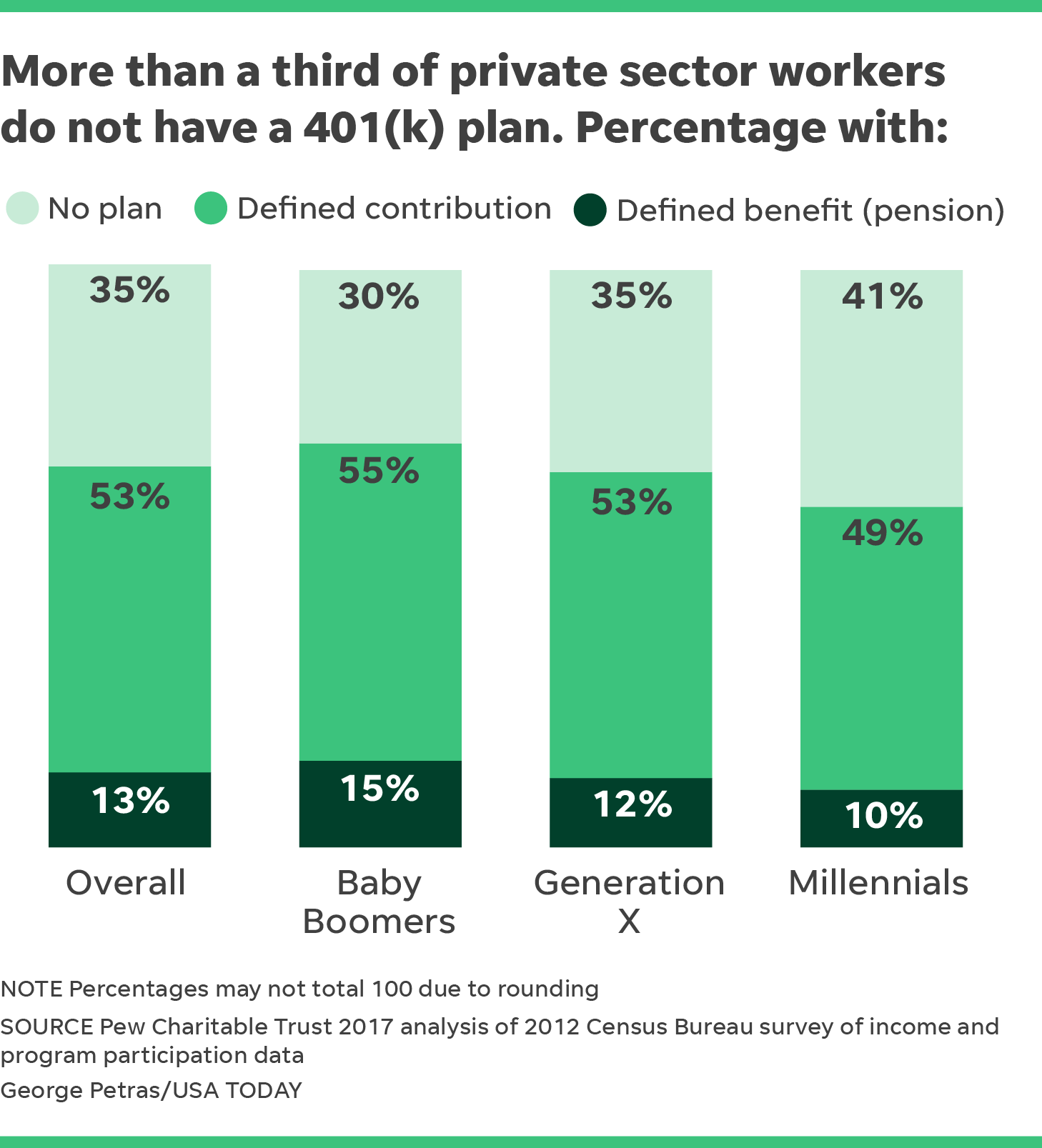

The median number of years that workers stay with an employer is 4.1 years, according to the Bureau of Labor Statistics. The XpertHR report shows that 28% of employers require a waiting period of more than four years.

Despite the potential for a long crediting schedule, it’s still worth contributing at least enough to get your company match if you can afford to, experts say.

“Even if you don’t think you’re going to stay at a particular company long enough to get the match, it’s still worth contributing at least enough to earn it,” said Kathryn Hauer, a certified financial planner with Wilson David Investment Advisors in Aiken, South Carolina.

“Financial planners continually beat the ‘save-for-retirement’ drum, and the amount you need to put in a 401 to get the match is well below the amount you should save each year,” Hauer said.

Additionally, you never know what the future may hold career-wise, she said. In other words, you may end up staying at a company longer than you originally anticipated.

If you are able to contribute more than just enough to get the match, financial advisors generally recommend you do. The contribution limit for 2021 is $19,500, with workers age 50 and older allowed an extra $6,500 as a “catch-up” contribution for a total of $26,000.

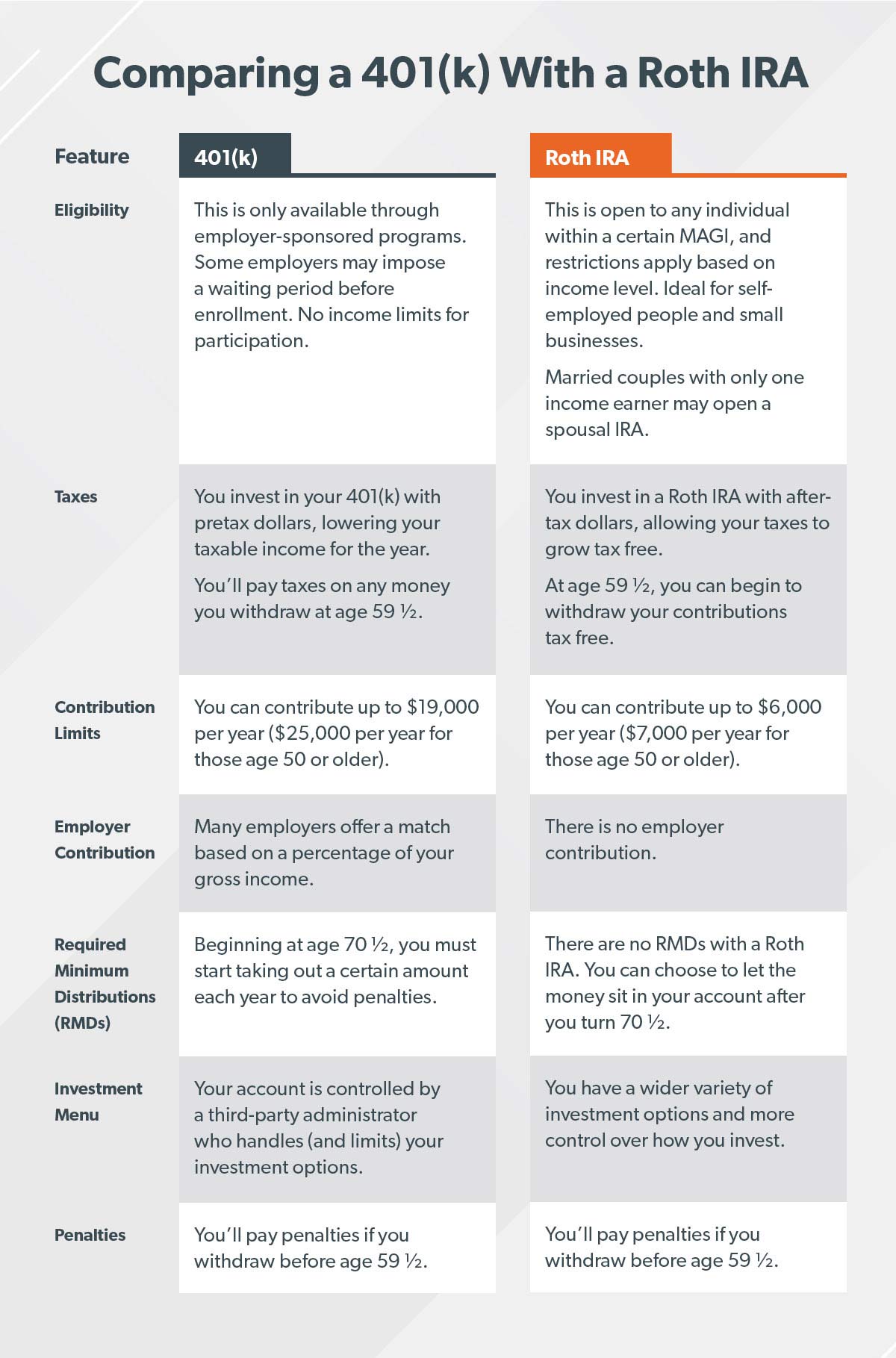

Matching Contributions For A Roth 401

If you choose to save money in a Roth 401, matching contributions must be allocated to a separate traditional 401 account. This is because IRS rules require you to pay regular income tax on employer contributions when they are withdrawnâand Roth 401 withdrawals arenât taxed in all but a few cases.

Remember, with a traditional 401 account, your contributions are made pre-tax, and you pay regular income tax on withdrawals. And with a Roth 401 account, your contributions are made using after-tax dollars, and qualified withdrawals are generally tax free.

Don’t Miss: How To Get My 401k Money Without Quitting

Oppose The Temptation To Tap Your 401

While you’re contributing assets to your 401 account without fail, there will be times when the market flags and you see the worth of your ventures consistently decrease. You might confront the desire to pull out cash from the market during slumps, it’s fundamental that you oppose the enticement.

Particularly for youthful financial backers, it’s essential to remind individuals to stick with it in any event, when the market is unstable. Individuals who are opportunistic and have willpower are potential to brave market swings.

Why Do Employers Match 401

401 employer matches are one of the best job benefits available for employees. But these matches are entirely optional for companies. Even if they offer a 401 program, they have no obligation to contribute any amount whatsoever to their employees accounts.

So why do employers match 401 contributions for their employees?

For one, a 401 matching program is a powerful way to incentivize employees to come work at an organization.

Competitive 401 employer matches can also drive employee retention. And employee retention can help employers build a more resilient organization.

Thats because those organizations can rely on the talent they have. They can also safely invest in developing employees into leaders since the people they develop are more likely to stay.

You May Like: How Do You Roll A 401k Into An Ira

How Does A 401k Match Work

A 401k match is a way employers can encourage employees to participate in a retirement plan. When you choose to put money in a 401k that offers a matching contribution, the company will put in money alongside what you put in. How does the 401k match work at your company? It depends. Your employer doesnt have to offer a match at all. For those that do, the approach and generosity will vary just like your other employee benefits.

How Does Employer 401 Matching Work

An employer 401 contribution match is one of the best perks going. An employer match is literally free money and with our good friend compound returns coming in clutch, it can make a serious difference in how much money youll have when you retire. Its kind of like being given magic beans without having to sell the cow.

Even better: This is no fairy tale. In fact, employer matches are pretty common. More than three-quarters of employers with fewer than 1,000 401 plan participants offer a match and that percentage only goes up the bigger the company and the plan.

If your employer offers a 401 match, heres what you need to know.

Recommended Reading: How Do You Get Money From 401k

How Does A 401 Work Once You Reach Retirement

If you’re retired and have reached the minimum age required by your plan, then you’re free to withdraw from your account penalty-free. The exact process will depend on the company that manages your 401, but you are free to sell investments and withdraw money in retirement as you please. Withdrawals from ordinary 401 plans will be taxed at your income tax rate. Roth 401 withdrawals are tax-free.

Always Contribute Enough To Get The Full Match

If your employer offers matching 401 contributions, make sure you contribute enough to qualify for the full match. If you donât, youâre basically losing out on free money. Talk to an HR representative or a plan administrator to find out how much you need to withhold from each paycheck to get the full match.

Read Also: How Much Should I Put In 401k

My Wife And I Are In Our Mid 40s Save 15% A Year And Have A 401 Balance Of More Than Half A Million Dollars Are We On The Right Track Toward Retirement

The fact that youâre saving at good clip and that you already have a sizeable amount tucked away in retirement savings about half way through your career suggests that youâre likely on pace toward a secure retirement, or at least not too far off.

But itâs always smart to check now and then to get a better handle on where you really stand. After all, the last thing you want is to blithely assume everythingâs going swimmingly only to find out when youâre ready to retire that youâre not nearly as prepared as you thought.

That said, keep in mind that no assessment can give you complete assurance that youâll be able to retire on schedule and live the post-career lifestyle you envision. There are too many variables, uncertainties and potential disruptions along the road to retirement for such certainty. But the idea is to come away with a decent sense of whether youâre on the right path and, if not, change what youâre doing so you can tilt the odds more in your favor.

So, for example, if you earn $50,000 a year, plan to maintain your current lifestyle in retirement and expect to stop working at 65, Fidelity estimates you should have about six times your salary, or about $300,000, saved in retirement accounts by age 45.

Can Employees Enroll In A 401 Employer Match Plan As Soon As They Are Hired

Employers are able to define their own specifications regarding when employees are eligible for 401 enrollment. Some companies choose to allow for registration immediately, while others require a certain amount of time to pass, such as the probation period, six months of employment and so on. Employers should make these regulations clear during the hiring process, so employees arent surprised if they need to wait.

Read Also: How To Calculate Employee 401k Match

How Does A 401 Employer Match Work And What Are Its Rules

Once you sign up for a companys 401 plan as an employer, youll get to decide how much money you want to contribute from every paycheck before tax. Then, your employer will deduct this amount from your paycheck before income and payroll taxes are calculated.

For example, if you make $1,875 pre-tax and decide to deduct 4%, youll be putting $75 into your 401 account monthly. The remaining $1,800 will be taxed.

Finally, the employer will automatically contribute the amount they agreed to, depending on their matching policies. They may match a percentage of your own contribution or provide a dollar amount.

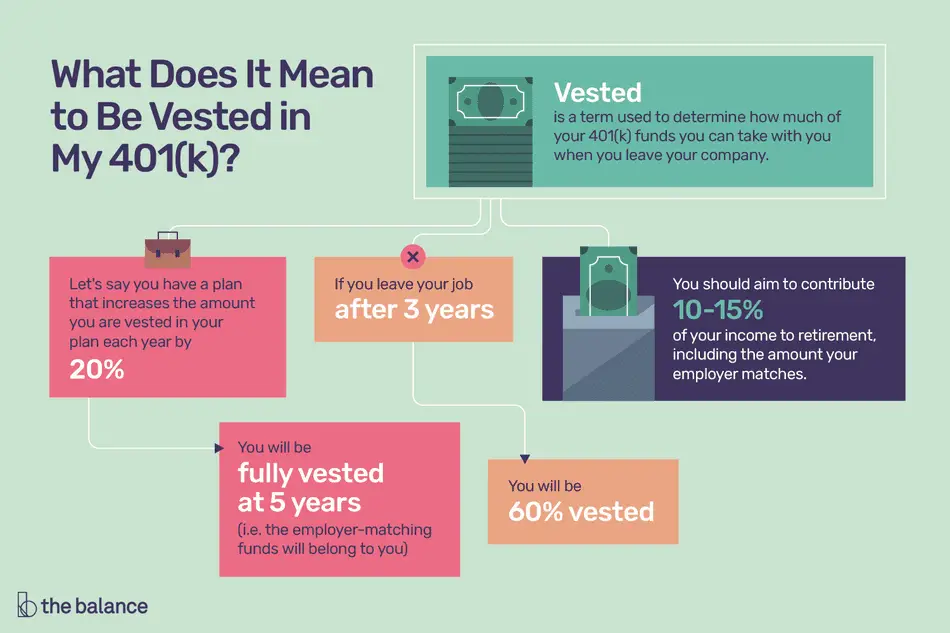

The 401 employer match rules limit when and why you can take a distribution from your 401. A distribution is the technical term for when money is withdrawn from a retirement account. If you decide to withdraw from your 401 account early, you may be subject to penalties.

The IRS considers it an early withdrawal if you take money out before you reach age 59 ½. Youll have to pay an additional income tax of 10% if you do this.

Most organizations also use a vesting schedule. This means that the money they match to your contributions doesnt belong to you until after a certain period of time. Instead, theyll invest this money separately from your own contributions.

Companies do this to incentivize you to stay with them long-term.

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our reporters and editors focus on the points consumers care about most how to save for retirement, understanding the types of accounts, how to choose investments and more so you can feel confident when planning for your future.

Don’t Miss: When Can You Take Out Your 401k

How Does A 401k Benefit An Employer

Recruit and Retain. In todays workforce, its becoming the norm to expect certain benefits such as retirement and healthcare. From an employers perspective, offering a 401k can give you that extra edge to stand out amongst your competitors. Attractive benefits are now a must.

Incentivize Performance. Employers also have the ability to use retirement perks as incentives. Many organizations tie their contributions to specific goals, and when employees meet these benchmarks they are rewarded by increases in their 401k contribution. Depending on how you choose to structure your benefits program, they can be used to incentivize performance, which ultimately helps the company succeed.

Tax Perks. 401k plans also help the employer come tax season. Matched contributions and administrative work associated with the benefits plan are tax-deductible. Lower your tax burden with a company-wide 401k program.

These three perks are highly beneficial from a production and financial standpoint. Not to mention, a retirement program lets your staff know that you value their financial future. Showing you care can do wonders for company culture.

How Do 401 Matches Work

Every 401 plan is different, so youll have to check your employers plan for the details on exactly how yours works. But there are two common types of matches:

Partial matching

Your employer will match part of the money you put in, up to a certain amount. The most common partial match provided by employers is 50% of what you put in, up to 6% of your salary. In other words, your employer matches half of whatever you contribute but no more than 3% of your salary total. To get the maximum amount of match, you have to put in 6%. If you put in more, say 8%, they still only put in 3%, because thats their max.

Heads-up that you might see this written in a lot of different ways. 50 cents on the dollar up to 6%, 50% on the first 6%, 3% on 6% you get the picture. All various ways to describe a partial match.

Dollar-for-dollar matching

With a dollar-for-dollar match , your employer puts in the same amount of money you do again up to a certain amount. An example might be dollar-for-dollar up to 4% of your salary. In this case, if you put in 4%, they put in 4% if you put in 2%, they put in 2%. If you put in 6%, they still only put in 4%, because thats their max.

Recommended Reading: How To Get Money From 401k After Retirement

Making Sense Of Any Of This

As with most things, its a little complicated. The bottom line is that a 401k match is free money so, for most people, its a no-brainer to take advantage of it.

Every situation is different, though, so if youre still not sure, chatting with both your employer and a trusted financial coach can help you make sense of how to best maximize the profitability of your specific 401k plan.

Jessica Reinhart

What Is 401 Employer Matching

401 employer matching is the process by which an employer contributes to an employees retirement account based on the employees contributions. Employers tend to set their 401 contribution limits based on the employees annual salary. In other words, an employers contribution rate may be at most a certain percentage of the employees salary. For example, an employer may be willing to match 50% of an employees contribution, up to 6% of their annual salary. So, if the employee contributed 6% to their 401 plan, the employer would contribute an additional 3% to the employees retirement savings.

Rarely, some employers instead set a contribution limit of a predetermined dollar amount thats unrelated to the employees annual salary.

Key takeaway: 401 employer matching is when an employer also contributes to an employees retirement account.

Also Check: How To Check My Walmart 401k

What Is A Good 401 Match

First, any match is better than no match and fortunately, according to 2020 data from Vanguard, about 86% of employers offer some kind of 401 match program. A typical match is about 3-4% of your salary, though some employers might match as low as 1% or as high as 9% .

Furthermore, 401 matches might be structured in a variety of different ways. Dollar-for-dollar is the easiest to understand, but some companies also offer a lower per-dollar percentage up to a higher percentage of your overall pay say 50% on the dollar up to 8% of your salary, as opposed to 100% on the dollar up to 4% of your salary. This is sometimes known as stretching the match, and is meant to encourage employees to save more.

Begin Making 401 Contributions Immediately

A few businesses have a holding up period after you start some work before they start matching your 401 contributions. Try not to trust that the matching contributions will kick in begin contributing when you start your new position.

On the off chance that you’re threatened by the investment choices, make the most of the plans target-date reserves. “By far most managers have their default investments set up as a target-date fund which is attached to your age and retirement year. You can place your money in there, and it’s a kind of do-it-for-me choice where it’s assigned across values proper for your age.

Recommended Reading: Can I Rollover A 401k To A 403b

Employer Contributions To 401 Plans How Do They Work

In general, 401 plans depend primarily on money put into them by the workers themselves. You can choose to defer a portion of your wages to the plan, up to certain limits.

In return, you receive an immediate tax deduction plus tax-free investment growth, though you will ultimately have to pay taxes on the money when you withdraw it from the plan in retirement.