Pros And Cons: 401 Vs Ira

401 Pros |

|

|---|---|

|

|

|

|

Look For Contact Information

If you don’t know how to contact your former employer perhaps the company no longer exists or it was acquired or merged with another company see if you have any old 401 statements. These should have contact information to help put you in touch with the plan administrator.

If you don’t have an old 401 statement handy or yours doesn’t tell you what you need to know, visit the U.S. Department of Labor website and look up your employer. There you should find your old retirement account’s tax return, known as Form 5500. That will most likely have contact information for your 401’s plan administrator.

Suggested Next Steps For You

If you are not able to max out your 401k contributions, then the best strategy may be to contribute the minimum amount required to take advantage of your employers contributions.

Here are some steps you can take now, and for free, to help you manage and evaluate your 401k:

The content contained in this blog post is intended for general informational purposes only and is not meant to constitute legal, tax, accounting or investment advice. You should consult a qualified legal or tax professional regarding your specific situation. Keep in mind that investing involves risk. The value of your investment will fluctuate over time and you may gain or lose money.

You May Like: How Do You Rollover Your 401k To A New Employer

How Can I Find Out My 401k Balance

Over $5.3 trillion is held in 401 plans as of September 2017, according to the Investment Company Institute. If you’re using a 401 to help you save for retirement, it’s important to know how much you have in your plan so you can determine if your savings are in line with the amount you’ll need to fund your golden years. If you don’t receive paper statements with your 401 balance, there are other ways you can check how much you’ve saved.

Contributing To A 401 Plan

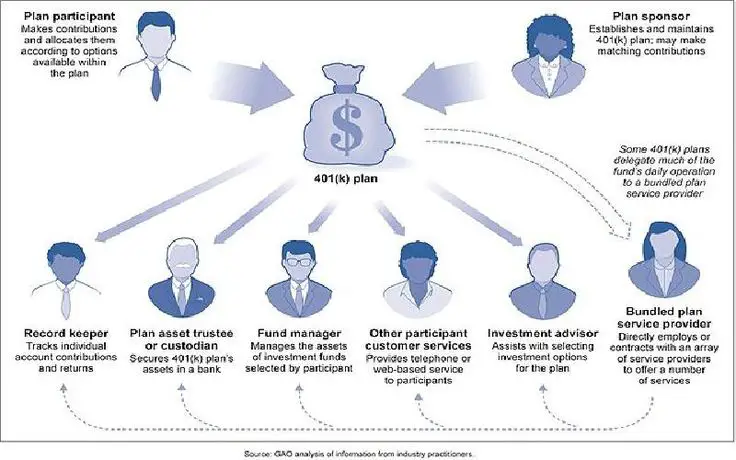

A 401 is a defined contribution plan. The employee and employer can make contributions to the account up to the dollar limits set by the Internal Revenue Service .

A defined contribution plan is an alternative to the traditional pension, known in IRS lingo as a defined-benefit plan. With a pension, the employer is committed to providing a specific amount of money to the employee for life during retirement.

In recent decades, 401 plans have become more common, and traditional pensions have become rare as employers shifted the responsibility and risk of saving for retirement to their employees.

Employees also are responsible for choosing the specific investments within their 401 accounts from a selection their employer offers. Those offerings typically include an assortment of stock and bond mutual funds and target-date funds designed to reduce the risk of investment losses as the employee approaches retirement.

They may also include guaranteed investment contracts issued by insurance companies and sometimes the employer’s own stock.

Also Check: How Much Can I Loan From My 401k

What Is A 401 Plan And How Does It Work

A 401 Plan is a retirement savings vehicle that allows employees to have a portion of each paycheck directly paid into a long-term investment account. The employer may contribute some money as well.

There are immediate tax advantages for the employee if the account is a traditional 401 and tax advantages after retiring if it is a Roth 401.

In either case, the money earned in the account will not be taxed until it is withdrawn during retirement if it is a traditional 401. If it is a Roth 401, no taxes will be due when the money is withdrawn.

But Why Would I Max Out My Roth Ira Before My 401k If Its So Good

Theres a lot of nerdy debate in the personal finance sphere about this very question, but our position is based on taxes and policy.

Assuming your career goes well, youll be in a higher tax bracket when you retire, meaning that youd have to pay more taxes with a 401k. Also, tax rates will likely increase in the future.

The Ladder of Personal Finance is pretty handy when considering what to prioritize when it comes to your investments, but it is just a tool. For more about the Ladder of Personal Finance and how to make it work for you, check out THIS video where I explain it.

PRO TIP: The video is less than three minutes long. It is worth your time.

Also Check: How Can I Get Money From My 401k

What Reasons Can You Withdraw From 401k Without Penalty

Here are some ways to get a free-kick off your IRA or 401

- Unpaid medical bills.

- If you are indebted to the IRS.

- They are buying houses for the first time.

- The cost of higher education.

- For financial purposes.

Is there a penalty for withdrawing from 401k in 2021?

The first 10% withdrawal penalty is back in 2021. The proceeds from the take are calculated as the tax revenue for the 2021 year.

How Long Does It Take To Get Money Out Of Your 401k

How long does it take to remove 401 after retiring? Depending on who manages your 401 account , it may take between three and ten working days for you to receive a check after deducting 401 .

Can I just withdraw money from my 401k?

Yes, you always have the right to deduct some or all of your contributions and their salaries, but it is not always black and white. All deductions you take will be subject to a tax deduction, and you may be liable for tax deduction as well.

How long does it take to get 401k withdrawal direct deposit?

The 401 credit system can be anywhere from the day if you do it online for a few weeks if done by hand. Once completed, it may take two to three days for the direct deposit to reach your account.

Don’t Miss: Can I Use My 401k To Buy A Second Home

Ways Of Finding My Old 401ks Including Using Ssn

If youâve ever left a job and wondered âWhere is my 401?â, youâre not alone. Locating 401âs is complicated. Thus, billions of dollars are left behind each year. Beagle can help track down your money.

Contributing to an employer-sponsored 401 plan is a great way to build wealth for retirement especially if youâre receiving a match from your company. The problem is they are tied to an individual employer. We forget about them, leave that company, and one day we realize âOh yeah! Where is my 401?â

A 401 can be in a few different places. Most commonly it could be with your previous employers, an IRA they transferred your funds to after you left, or mailed to the address they had on file.

Believe it or not, Americans unknowingly abandoned $100 billion worth of unclaimed 401 accounts. According to a US Labor Department study, the average worker will have had about 12 different jobs before they turn 40. So itâs easy to see how we can lose track of so much 401 money.

To find your old 401s, you can contact your former employers, locate an old 401 statement, search unclaimed asset database in different states, query 401 providers using your social security number or better yet, get some help to find your 401 accounts from companies like Beagle.

Cut Off Date For Making Contributions To 401

Using a 401 plan to save for retirement allows you to put your savings on autopilot with automatic payroll deductions. In addition, you receive tax breaks for your contributions, and the earnings arent taxed until you take distributions from the account. However, to make sure youre on track for the retirement of your dreams, you need to keep tabs on your 401 balance from time to time. In addition to knowing your 401 balance, its also important for you to know how much of your account has vested, especially if youre considering changing jobs in the near future.

Don’t Miss: How Do I Access My 401k Account

What To Do When You Find An Old 401

Once youve reconnected with your old 401, its time to decide what to do with it:

- Leave it with your old employer. If you contributed at least $5,000 to your old 401, you might consider leaving it where it is. But this may only be worthwhile if the account has competitive fees or offers access to unique investments. Otherwise, itll be yet another account to keep track of come retirement, and you may be better off rolling it over.

- New 401 rollover. Has your new employer offered you a 401? Consider consolidating your retirement funds by rolling your old retirement account into a new 401.

- IRA rollover. If you dont have a new 401 to move your old retirement funds into, consider rolling over into an individual retirement account. That way, your funds retain their tax-advantaged status.

- Cash it out. Consider this a last resort because cashing out a 401 ahead of schedule can result in major penalties.

- If youre older than 59 ½, you can access funds without penalty.

- If youre under 59 ½, withdrawals are subject to a 10% tax penalty and other fees.

Why You Should Roll Over Your Old 401 Accounts

Once you find forgotten retirement funds, you can make it easier to keep track of your money by simply rolling over your old 401 accounts into an IRA at a brokerage you already have an account with. This way you can manage your nest egg easier since all of your money is in one place.

“It’s beneficial to consolidate your accounts to reduce oversight obligations,” Cavazos says. “Having all of your funds consolidated in one account allows you to keep track of your balance and account performance.”

If you already have an existing IRA, you can roll your 401 balance into that account. Otherwise, it’s easy to open a new IRA at the big-name brokers like Charles Schwab, Fidelity, Vanguard, Betterment or E*TRADE. Rolling over your old 401 plan into an IRA gives you more control over how you invest your retirement funds since you won’t be limited to just the funds that were offered by your former employer. These large brokerages give you thousands of investment options, including mutual funds, index funds and individual stocks.

Read Also: How Much Should I Put In My 401k Per Paycheck

What You Can Do Next

To keep track of your retirement accounts, you first must know where they all are. Once you gather all your old accounts in one place and make sure they are properly balanced, its about sticking to the same investment principlesensuring your money is in diversified, low-cost fundsthat you would follow for your current company retirement plan.

For Compliance Use Only:1020356-00003-00

How To Locate A 401 From A Previous Job

If youre trying to locate an old 401 plan from a previous job, youre not alone. Not by a long shot. Roughly $850 million in plan assets owned by 33,000 employees are orphaned each year, held by a financial institution without an employer to oversee the plan . Thats a lot of money being left on the tableroughly two percent of all 401 plan assets.

The good news is that the Department of Labor has established rules for protecting money put into a 401, so the money isnt necessarily lostjust waiting for someone to claim it. However, that doesnt mean your old 401 account will always be easy to track down. It may take some digging, but there are a variety of ways you can find it.

Recommended Reading: Can I Roll My Roth 401k Into A Roth Ira

Traditional 401 Vs Roth 401

When 401 plans became available in 1978, companies and their employees had just one choice: the traditional 401. Then, in 2006, Roth 401s arrived. Roths are named for former U.S. Senator William Roth of Delaware, the primary sponsor of the 1997 legislation that made the Roth IRA possible.

While Roth 401s were a little slow to catch on, many employers now offer them. So the first decision employees often have to make is between Roth and traditional.

As a general rule, employees who expect to be in a lower after they retire might want to opt for a traditional 401 and take advantage of the immediate tax break.

On the other hand, employees who expect to be in a higher bracket after retiring might opt for the Roth so that they can avoid taxes on their savings later. Also importantespecially if the Roth has years to growis that there is no tax on withdrawals, which means that all the money the contributions earn over decades of being in the account is tax-free.

As a practical matter, the Roth reduces your immediate spending power more than a traditional 401 plan. That matters if your budget is tight.

Since no one can predict what tax rates will be decades from now, neither type of 401 is a sure thing. For that reason, many financial advisors suggest that people hedge their bets, putting some of their money into each.

Use An Outside Company Like Beagle

If your search in the above databases doesnât provide any results, utilizing an outside company to find your old 401s and do the difficult work of consolidating them is a great option.

Beagle is the first company of its kind that will do the difficult work for you. We will track down your old 401s and find any hidden fees in your current 401 plan.

Then, they will provide you with options on how best to rollover your 401s into one convenient, low-cost investment option.

This is a great option for anyone who is not sure where to start or even where to begin looking.

Also Check: How Much Will 401k Pay Per Month

Is The 401k Match Coming Back

We first discussed the 401K match, something a lot of companies had done away with temporarily. Mike shared that despite the loss of the match, the savings rate for 401K participant had not dropped. People are still putting money into their 401Ks. We discussed a recent study concerning the return of the 401K, and although Mike agreed with the optimism of the results , he found the study to be limited by the small amount of participants.

Can I Decide For Myself Whats In My Retirement Plan

Depends on the account. In a 401 for example, the choices of investments are typically determined by the plan sponsoror, in other words, the employer or group that sets up the retirement account. In an IRA, you get to decide the company, which purchases an IRA and the specific fund to invest in. You typically have options to delegate the ongoing management of those assets to a separate investment manager in both of those accounts, too.

So yes, you can decide for yourself what direction to go. That said, you could find it overwhelming to pick various stocks or bonds and what percentage to allocate to each for your retirement account.

You May Like: How Much Can I Put In My 401k Per Year

Don’t Leave Your 401 Behind Here’s How To Reclaim Your Hard

Switching jobs pulls your mind in several directions at once, and it’s easy for your old 401 to get lost in the shuffle. But you can’t afford to forget about it for good. Building a nest egg to sustain you for decades is tough, so you can’t afford to leave any old retirement accounts behind. If you’ve lost track of your old 401, take these steps to find it and put that money to good use.

What Happens To My 401k If I Change Jobs

You have a couple of options, but the one most would recommend is a 401k rollover. A 401k rollover is when you transfer your funds from your employer to an individual retirement account or to a 401k plan with your new employer. A much less popular option is to cash out your 401k, but this comes with massive penalties income tax, and an additional 10% withholding fee.

Don’t Miss: When Should I Start My 401k