Oops You Change Your Mind

Imagine retiring at 37 after 15 years of work after undergrad. You spend the next 3 years traveling the world, living a leisure lifestyle and experiencing new things.

At age 40, you realize the reason why travel and play is so fun is because of work! You have the urge to get back into the game, but whos going to risk hiring a 40 year old with a 3 year employment gap?

The employer will suspect you are rusty, and that you may just bolt after a year. As a result, the employer simply chooses to hire someone with no gap in their employment, or someone else from another firm.

Ways To Use Retirement Money Early

As you approach retirement, you may find that youre in a comfy spot and want to retire early. But how can you enjoy an early retirement before you can access 401s and IRAs penalty-free at 59½? The best way is to have savings invested in a taxable account. If you dont, there are other ways to enjoy an early retirementas long as youre confident your financial situation allows for it! Take a look at some different ways to access your retirement money early without triggering a 10% early withdrawal penalty. Well cover:

- The Rule of 55

Planning Out The Timing Of Your Withdrawals

The timing of your early withdrawals is important, says Dave Lowell, certified financial planner and founder of Up Your Money Game.

If you were employed for most of the year and had a relatively high income, then it makes sense to not withdraw money under the rule of 55 in that calendar year, since it will add to your total income for the year and possibly result in you moving to a higher marginal tax bracket, Lowell says.

The better strategy in that scenario may be to use other savings or take withdrawals from after-tax investments until the next calendar rolls around. This may result in your taxable income being much lower.

Read Also: What Should I Do With My Old Company 401k

Build An Emergency Fund

This should be the foundation of your financial plan and experts recommend having about six months worth of expenses saved. You can park this money in a high-yield savings account to earn more interest than you would in a traditional checking account. An emergency fund should help you manage most of lifes curveballs.

What Early Retirement Means: Financial Independence

Now, dont get me wrong. There are certainly people who want to retire early in order to never work another day in their lives.

But, aside from these people, many seek early retirement not to quit working altogether but to achieve a place of financial independence. They want to be debt-free with an emergency fund of three to six months expenses set aside. They want a substantial retirement account, with a well-diversified portfolio of stocks, bonds, commodities, and even real estate. And they want to be independent of their personal income.

That last part is important. Many of those who seek early retirement want to be so financially independent they could quit their job with little financial repercussions. Likewise, many seek independence in order to quit their job and find a career that gives them more satisfaction, albeit at a lower rate of pay.

In fact, if you were to ask an early retiree why they retired so early, they would probably respond with something like, to write that novel Ive always wanted to write. Or to start my travel blog. Or to finally whittle chairs like my grandfather. Youll rarely hear idleness from those who are serious about early retirement.

Don’t Miss: How Much Can I Invest In 401k And Roth Ira

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our reporters and editors focus on the points consumers care about most how to save for retirement, understanding the types of accounts, how to choose investments and more so you can feel confident when planning for your future.

Youve Saved Diligently In Your 401 And You Wouldnt Mind Tapping Into It But Youre Not Age 59 Yet So You Could Have To Pay The Irs A 10% Penalty On Your Withdrawal There Are Exceptions To That Rule Though Here Are 10 Of Them

Retirement is something each of us must plan for. Not surprisingly, you want to make sure youll have enough income to last throughout your lifetime. Theoretically, if you plan well, you could even retire early. Perhaps youve sold your business for a profit, maximized your retirement account contributions, invested in non-qualified accounts, and own multiple rental properties.

In such a perfect scenario, you could take a blended distribution from various accounts and investments, allowing your money to continue to grow in tax-sensitive ways. On the other hand, taking distributions from your retirement accounts before age 59½ could cause you to owe the IRS a 10% early distribution penalty. However, there are a few conditions in which the government will waive that 10% early retirement penalty.

Before I continue, Id like to make one thing clear. The purpose of this article is to inform you of ways you might be able to avoid the 10% income tax penalty. If you take money from your qualified retirement accounts early, you will still pay ordinary income taxes on that money. You cannot avoid that.

With that out of the way, lets take a look at some of the ways you might be able to avoid the early retirement penalty.

You May Like: How To Move 401k To Cash

Retire Now Claim Later

You can always take early retirement and still wait until later to begin your Social Security benefits. That is a particularly important strategy for married couples who want to make sure the surviving spouse gets a larger benefit later in life.

The highest monthly benefit between you and your spouse is what will become the survivor benefit amount when one of you passesat that point, you’ll only get that higher benefit amount, not both amounts.

For the purpose of maximizing your future survivor benefit, you may want to plan for the higher earner between the two of you to delay the start of benefits to age 70 if possible. The lower earner, however, may want to start their benefits at an earlier age.

Debt Relief Without Closing My 401k

Before borrowing money from your retirement account, consider other options like nonprofit credit counseling or a home equity loan. You may be able to access a nonprofit debt management plan where your payments are consolidated, without having to take out a new loan. A credit counselor can review your income and expenses and see if you qualify for debt consolidation without taking out a new loan.

8 MINUTE READ

Don’t Miss: How Long Does A 401k Rollover Take

Is It A Good Idea To Use The Rule Of 55

Just because you can take distributions from your 401 or 403 early doesn’t mean you should. Depending on your financial situation, it might be better to let your money continue to grow. Holding off withdrawals could help you better position yourself for a financially sound future. If you’re tempted to withdraw retirement funds before you’re eligible, instead consider finding another job, drawing from your savings or using other sources of income until you need to tap into your retirement savings.

If you decide to begin withdrawing funds from your 401 early, the long-term value of your portfolio will likely decrease. It’s essential that you time your withdrawals carefully and take into account how much they would cost you in taxes. To create a strategy that makes sense in your situation, consider working with a financial advisor or a retirement planner.

Pension Benefits Can Lower Earnings

Some pension plans offer a larger initial monthly benefit when you take early retirement the pension benefit then automatically goes down when you become eligible to draw on Social Security. If you are not aware of this, you may think you will get your full pension benefit plus Social Security.

Not all pensions work this way, so attend all classes or seminars offered by your employer to make sure you fully understand your pension and health benefits prior to taking early retirement. Ask plenty of questions, and set up a one-on-one appointment with a benefits advisor or HR person if you can.

In addition, if you worked in education or for the state or a government entity, be aware when you do begin your Social Security benefits that they may be less than what your statement shows due to something called the Windfall Elimination Provision and/or the Government Pension Offset.

For example, suppose your neighbor Lois worked as a teacher for 43 years, and in retirement she expects to get her pension plus $1,300 a month in Social Security. She will be shocked when she learns her Social Security will be less than $300 a month due to the government pension offset that applies if you get a pension for years of work where you were not covered under the Social Security system.

Read Also: How To Take Out A Loan Against 401k

Roll Money Into An Ira

If you are not satisfied with the 401 investment options, you can rollover the money into an IRA since the latter has more investment options and offers greater control. You can reallocate your portfolio of investments to help you grow your investments further in years to come.

If you have a string of old 401s when you retire, you should consolidate them into an IRA for better management of your retirement savings. Also, you can reduce the administration fees of your retirement money, and even qualify for discounts on sales charges.

Traditional Ira Vs Roth Ira

Like traditional 401 distributions, withdrawals from a traditional IRA are subject to your normal income tax rate in the year when you take the distribution.

Withdrawals from Roth IRAs, on the other hand, are completely tax free if they are taken after you reach age 59½ and see out a five-year holding period. However, if you decide to roll over the assets in a traditional 401 to a Roth IRA, you will owe income tax on the full amount of the rolloverwith Roth IRAs, you pay taxes up front.

Traditional IRAs are subject to the same RMD regulations as 401s and other employer-sponsored retirement plans. However, there is no RMD requirement for a Roth IRA, which can be a significant advantage during retirement.

Recommended Reading: Is Fidelity Good For 401k

Roth Ira Conversion Ladder

Another way to access your retirement fund is through the Roth IRA conversion. You can build a Roth IRA ladder and withdraw without having to pay the 10% penalty.

Just repeat this every year until youre 59 ½.

The drawback here is you have to wait 5 years before you can take out the first chunk of money without penalty. The 5 years wait only applies to Roth IRA conversion. If you contribute to your Roth IRA outside of a conversion, then you can withdraw that contribution anytime without paying the 10% penalty.

Retire Earlier With Real Estate

Real estate is my favorite way to build wealth and increase your chances of retiring earlier. Real estate is less volatile than stocks, provides utility, and generates higher income.

The combination of rising rents and rising capital values is a very powerful combination over time. By the time I was 30, I had bought two properties in San Francisco and one property in Lake Tahoe. The income from these properties helped give me the confidence to leave work in 2012 at age 34.

In 2016, I started diversifying into heartland real estate to take advantage of lower valuations and higher cap rates. I did so by investing $810,000 with real estate crowdfunding platforms. With interest rates down, the value of cash flow is up. Further, the pandemic has made working from home more common.

Take a look at my two favorite real estate crowdfunding platforms. Both are free to sign up and explore.

Fundrise: A way for accredited and non-accredited investors to diversify into real estate through private eFunds. Fundrise has been around since 2012 and has consistently generated steady returns, no matter what the stock market is doing. For most people, investing in a diversified eREIT is the easiest way to gain low-volatility exposure.

Recommended Reading: How Is 401k Paid Out

You Sacrifice The Power Of Compounding Interest

Time is your friend when you are saving for retirement, but not when you are spending. If you sock away $250 a month $3,000 a year from age 25 to age 55, you’ll have about $237,000 when you retire, assuming you make no withdrawals and earn an average 6 percent annually on your investments. Seemingly not a bad return on your $90,000 in contributions.

But let’s say you work 10 more years and retire at 65. In that scenario, you’ll have about $464,000, nearly double. Why? The extra decade’s worth of contributions helps, but that only adds up to $30,000. The real growth comes from another 10 years worth of interest earned not only on all the principal you contributed but also the interest earned on the interest that has compounded for four decades.

No : Ira Withdrawal For Disability

Unfortunately, many of my clients have had to take early distributions from their IRAs due to disability. If you become disabled, you may be eligible for Social Security Disability Insurance and/or Supplemental Security Income benefits, but most SSDI recipients receive between $800 and $1,800 per month. The average monthly benefit for 2021 is only $1,277. Anything is better than nothing, but if youre a business owner, youre probably used to taking home significantly more than that.

Therefore, if you become disabled AND you have a physician who signs off on the severity of your condition, you could take money out of your IRA, penalty-free, to supplement your SSDI income. While I hope you never have to use this option, at least you know its a possibility.

Recommended Reading: When Can You Access 401k

Disadvantages Of Closing Your 401k

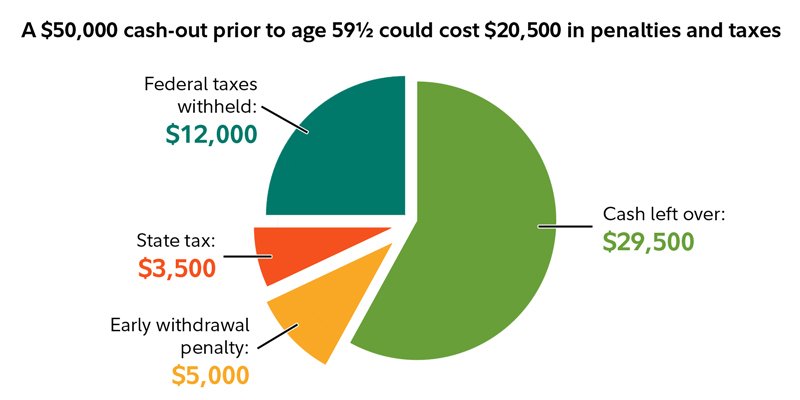

Whether you should cash out your 401k before turning 59 ½ is another story. The biggest disadvantage is the penalty the IRS applies on early withdrawals.

First, you must pay an immediate 10% penalty on the amount withdrawn. Later, you must include the amount withdrawn as income when you file taxes. Even further down the road, there is severe damage on the long-term earning potential of your 401k account.

So, lets say at age 40, you have $50,000 in your 401k and decide you want to cash out $25,000 of it. For starters, the 10% early withdrawal penalty of $2,500 means you only get $22,500.

Later, the $25,000 is added to your taxable income for that year. If you were single and making $75,000, you would be in the 22% tax bracket. Add $25,000 to that and now youre being taxed on $100,000 income, which means youre in the 24% tax bracket. That means youre paying an extra $6,000 in taxes.

So, youre net for early withdrawal is just $16,500. In other words, it cost you $8,500 to withdraw $25,000.

Beyond that, you reduced the earning potential of your 401k account by $25,000. Measured over 25 years, the cost to your bottom line would be around $100,000. That is an even bigger disadvantage.

Hardship Distributions From 401k Plan

If you are younger than 59 ½, youre going to have to demonstrate that you have an approved financial hardship to get money from your 401k account. And thats only if your employers retirement plan allows it. They are not required to offer hardship distributions, so the first step is to ask the Human Resources department if this is even possible.

If it is, the employer can choose which of the following IRS approved categories it will allow to qualify for hardship distribution:

- Certain medical expenses

- Certain expenses for repairs to a principal residence

The only other way to get access to your funds is to leave your employer.

Also Check: Should I Roll My 401k Into An Ira

Consider Your Personal Circumstances

There are many factors you should consider when deciding when to start receiving your CPP retirement pension. These include your health, your financial situation, and your plans for retirement.

For example, if youre healthy, expect to live a long life, or have access to other sources of income, you may choose to start receiving your CPP retirement pension later. This will result in a larger monthly pension, which could help protect you from outliving your savings.

However, if youd prefer to work less, or you want the money now to pay off debts or to fund your retirement plans, you may choose to start receiving your pension before age 65. This will result in a smaller monthly payment which can help meet immediate needs, especially if you have little or no other income.

The Canadian Retirement Income Calculator can also help you better understand your future financial security.

Beneficiaries And 401s Explained

The federal law governing 401 retirement plans is designed to encourage people to use their retirement savings for retirement when they are likely to need financial savings the most.

Under a traditional 401 plan, you may not make penalty-free withdrawals from your plan until you are age 59 and a half. You do not have to take withdrawals at that time, but you can. You must begin withdrawing funds from your 401 every year by the time you reach age 72. This is referred to as your required minimum distribution .

When you pass away, either before or after retirement, the funds in your 401 account will be transferred to whomever you name as the beneficiary of your plan benefits.

» MORE: Create one for free with Cake.

You May Like: How To Transfer 401k Accounts