How 401 Plans Work

Let’s review the basics. An employer-sponsored retirement plan such as a 401 can be a valuable tool in accumulating savings for the long-term. Each company that offers a 401 plan provides an opportunity for employees to contribute moneya percentage of their wageson a pretax basis , through paycheck deferrals. Often, employers provide a match on employee contributions, up to a certain percentage, creating an even greater incentive to save.

While they vary according to the company and the plan provider, each 401 offers a number of investment options to which individuals can allocate their contributionsusually, mutual funds and exchange-traded funds . Employees benefit not only from systematic savings and reinvestment, their investments’ tax-free growth, and employer matching contributions, but also from the economies-of-scale nature of 401 plans and the variety of their investment options.

Average 401 Return: What You Can Expect

Many retirement planners suggest the typical 401 portfolio generates an average annual return of 5% to 8% based on market conditions. But your 401 return depends on different factors like your contributions, investment selection and fees. This article will explain these points in-depth so you can aim for the best returns from your 401. We can also assist you in finding a financial advisor. This professional can help you create a personalized retirement planning strategy.

Why Employers Offer 401s

In 1978, when the law authorizing the creation of the 401 was passed, employers commonly attracted and retained talent by offering a secure retirement through a pension . The 401 created an entirely new system, with more flexibility for both employer and employee. One of the ways it did so was by giving employers the option to match employee contributions.

Matching is a very transparent process: for every dollar you put into your 401, your employer also puts in a dollar, up to a certain amount or percentage of your income. Theres no mystery here. If your employer promises to match all 401 contributions up to 5% of your income, and you contribute that amount every month, your employer will match you dollar for dollar, every month. Its a win-win situation. You are doubling your money, and your employer is building a happy workforce.

Read Also: When Do You Need A 401k Audit

Real Rate Of Return Vs Compound Annual Growth Rate

A closely related concept to the simple rate of return is the compound annual growth rate . The CAGR is the mean annual rate of return of an investment over a specified period of time longer than one year, which means the calculation must factor in growth over multiple periods.

To calculate compound annual growth rate, we divide the value of an investment at the end of the period in question by its value at the beginning of that period raise the result to the power of one divided by the number of holding periods, such as years and subtract one from the subsequent result.

What Is The Internal Rate Of Return

The IRR is the discount rate that can bring an investment’s NPV to zero. When the IRR has only one value, this criterion becomes more interesting when comparing the profitability of different investments.

In our example, the IRR of investment #1 is 48% and, for investment #2, the IRR is 80%. This means that in the case of investment #1, with an investment of $2,000 in 2013, the investment will yield an annual return of 48%. In the case of investment #2, with an investment of $1,000 in 2013, the yield will bring an annual return of 80%.

If no parameters are entered, Excel starts testing IRR values differently for the entered series of cash flows and stops as soon as a rate is selected that brings the NPV to zero. If Excel does not find any rate reducing the NPV to zero, it shows the error “#NUM.”

If the second parameter is not used and the investment has multiple IRR values, we will not notice because Excel will only display the first rate it finds that brings the NPV to zero.

In the image below, for investment #1, Excel does not find the NPV rate reduced to zero, so we have no IRR.

The image below also shows investment #2. If the second parameter is not used in the function, Excel will find an IRR of 10%. On the other hand, if the second parameter is used ), there are two IRRs rendered for this investment, which are 10% and 216%.

Recommended Reading: How Do I Open A 401k Account

Understanding A Rate Of Return

A rate of return can be applied to any investment vehicle, from real estate to bonds, stocks, and fine art. The RoR works with any asset provided the asset is purchased at one point in time and produces cash flow at some point in the future. Investments are assessed based, in part, on past rates of return, which can be compared against assets of the same type to determine which investments are the most attractive. Many investors like to pick a required rate of return before making an investment choice.

Tips On Maximizing Your Retirement Savings

- It can be difficult to put a light on what affects 401 returns. And you dont want to be left in the dark, especially when you reach retirement and need your savings the most. A financial advisor can help you understand retirement and all of its moving parts. SmartAssets free tool connects you with financial advisors in your area in five minutes. If youre ready to be matched with local advisors, get started now.

- 401s are not only reliable retirement savings vehicles, but they also offer plenty of tax breaks, including some you may not know about. To help, we published a report on the 401 tax rules you need to know to make the most out of your plan.

- You may find your companys 401 plan may not be the best option for you. And you may get better investment choices and tax breaks if you open an IRA or a Roth IRA. To help you decide, we published studies on the best IRAs and the best Roth IRAs.

Read Also: How Much Should I Put In 401k

What Is A 401

A 401 is a retirement plan offered by some employers. These plans allow you to contribute directly from your paycheck, so theyre an easy and effective way to save and invest for retirement. There are two main types of 401s:

-

A traditional 401: This is the most common type of 401. Your contributions are made pre-tax, and they and your investment earnings grow tax-deferred. Youll be taxed on distributions in retirement.

-

A Roth 401: About half of employers who offer a 401 offer this variation. Your contributions are made after taxes, but distributions in retirement are not taxed as income. That means your investment earnings grow federally tax-free.

What Rate Of Return Should I Expect On My 401

We hate to drag out that old, on-the-fence phrase, “it depends.” But it does. Your 401 plan‘s rate of return is directly correlated to the investment portfolio you create with your contributions, as well as the current market environment.

That being said, although each 401 plan is different, contributions accumulated within your plan, which are diversified among stock, bond, and cash investments, can provide an average annual return ranging from 3% to 8%, depending how you allocate your funds to each of those investment options.

Don’t Miss: When Can I Use My 401k

Example Of Annualized Rate Of Return

Let us revisit the example above and determine the annualized ROR. Recall that Adam purchased 10 shares at a per-unit price of $20, received $1 in dividends per share each year, and sold the shares at a price of $25 after two years. The annualized ROR would be as follows:

/ $200 )1/2 1 = 16.1895%

Therefore, Adam made an annualized return of 16.1895% on his investment.

What Kind Of Investments Are In A 401

401s often offer a small, curated selection of mutual funds. Thats a good thing and a bad thing: On the plus side, you may have access to lower-cost versions of those specific funds, especially at very large companies that qualify for reduced pricing.

The negative is that even with discounted costs, that small selection narrows your investment options, and some of the funds offered may still have higher expense ratios than what youd pay if you could shop among a longer list of options. That can make it harder to build a low-cost, diversified portfolio.

Some plans also charge administrative fees on top of fund expenses, which can add up. If your 401 is expensive, contribute enough to earn your matching dollars, and then direct any additional retirement savings contributions for the year into an IRA.

You May Like: How To Make More Money With My 401k

What Is The Average Rate Of Return On A 401

Were here to help! First and foremost, SoFi Learn strives to be a beneficial resource to you as you navigate your financial journey.Read moreWe develop content that covers a variety of financial topics. Sometimes, that content may include information about products, features, or services that SoFi does not provide.We aim to break down complicated concepts, loop you in on the latest trends, and keep you up-to-date on the stuff you can use to help get your money right.Read less

If your employer offers a 401 plan, you may have wondered if its really where you want to put a portion of your hard-earned money every month.

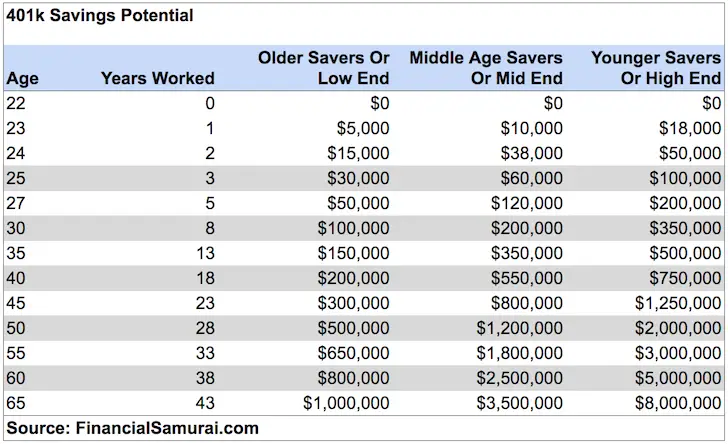

Youve likely been told that the earlier you start saving for retirement, the better off youll be. But how can you know that the average rate of return on your 401 investments will be the same or more than other available options?

The average rate of return on 401s from 2015 to 2020 was 9.5%, according to data from retirement and financial service provider, Mid Atlantic Capital Group.

Keep in mind, returns will vary depending on the individual investors portfolio, and 9.5% is a general benchmark.

Heres what you should know to help you make an informed decision.

What Is A Defined Contribution Plan

A defined contribution plan is any retirement plan to which an employee or employer regularly contributes some amount. Often, the employee chooses to send a fixed percentage of monthly income to the account, and these contributions are automatically withdrawn, directly from her paycheck – no effort required. The money that doesn’t go to the employee’s take-home pay gradually accumulates, the balance earns interest from investments, and by the time retirement rolls around, its grown into a substantial nest egg for the retiree. Thats the idea.

In a defined contribution plan , there are no guarantees about the income youll receive in retirement. That doesnt mean such plans cant be just as effective, however, and employers often sweeten the deal by making contributions of their own, straight into your account.

Also Check: Can You Convert Your 401k To A Roth Ira

Stock Rates Of Return

When you buy stock, you’re buying a small piece of ownership in a company. Shares of stock have prices that rise and fall in a marketplace depending on factors like the company’s quarterly earnings and external conditions like interest rates and the economy. Some companies pay a quarterly dividend to share their earnings with shareholders.

To calculate the rate of return for a dividend-paying stock you bought 3 years ago at $100, you subtract it from the current $175 value of the stock and add in the $25 in dividends you’ve earned over the 3-year period. That gives you:

$175 new stock value – $100 old stock value = $75 gain

$75 gain + $25 dividends = $100 total per-share gains

$100 per-share gain / $100 per-share cost X 100% = 100% rate of return per share

Keep in mind that people usually purchase stocks through their brokerage accounts or vehicles like an Individual Retirement Account or a 401 plan, which often charge fees that may alter the rate of return somewhat.

Can I Collect My Deceased Spouses Social Security And My Own At The Same Time

So far, we have talked about many social security estimator tools such as social security calculator by age. Now lets move on to another most frequently asked question.

Many individuals are asking Can I take the social security of my deceased wife and my own at the same time? Indeed, both a survivor benefit and your own pension benefit cannot simply be merged.

Don’t Miss: Where To Put My 401k

Compound Annual Growth Rate For The S& p 500

| 30-Year Period | |

|---|---|

| 11.29% | 7.52% |

I should note that these numbers are the compound annual growth rate which is a more accurate measure of market returns than a simple annualized average. For example, if you have an investment that goes up 100% one year and then slides 50% the next, youve made $0, yet the simple average return is stated as 25% . The CAGR would be 0% .

As you can see, inflation-adjusted average returns for the S& P 500 have been between 5% and 8% over a few selected 30-year periods. The bottom line is that using a rate of return of 6% or 7% is a good bet for your retirement planning. Ill use 6% because I like many of you I polled last week would rather be conservative and save more than be overly optimistic and wind up short in 30 years.

What Is An Investment Calculator For

An investment calculator is a simple way to estimate how your money will grow if you keep investing at the rate youre going right now.

But rememberan investment calculator doesnt replace professional advice! If you need help with your investments, we recommend working with an expert wholl help you understand what youre investing in. If thats your next step, we can help you connect with a pro near you.

Read Also: What Is A 403b Vs 401k

Do Not Use Arithmetic Rate Of Return

Using average annual rate of return or average annual arithmetic return will not be an accurate showing of your rate of return on your investments. It is a simple equation where you add up all of the returns for the time periods you are looking at, then divide by the number of time periods.

The average annual rate of return can be calculated as: / N.

For example, you invest $1,000 and in one year it grows to $1,500. Your return is $500. . The following year it drops back to $1,000 and you return is -$500.

The first years rate of return is 50% . The second years rate of return is -33.33% .

If you add them together and divide by two years, you get 8.5% as the average annual rate of return.

The average annual rate of return over the two years is positive and quite healthy at 8.5%. However the actual return is 0% because the money grew to $1,500 then shrank back to the starting investment amount of $1,000. We can also tell this is inaccurate because if you multiply $1,000 by 8.5% growth you would end up with $1,177.23 instead of $1,000.

Balancing Risk And Returns

Now, it’s time to return to that 5% to 8% range we quoted up top. It’s an average rate of return, based on the common moderately aggressive allocation among investors participating in 401 plans that consists of 60% equities and 40% debt/cash. A 60/40 portfolio allocation is designed to achieve long-term growth through stock holdings while mitigating volatility with bond and cash positions.

On the risk/reward spectrum, the 60/40 portfolio is about in the middle. For instance, if you invest in a more aggressive portfoliosay 70% equities, 25% debt, and only 5% cash you may expect higher, double-digit returns over time. However, the volatility within your account may also be much greater.

Conversely, if you went more conservative75% debt/fixed-income instruments, 15% equities, 10% cashyour portfolio would have a pretty smooth ride, but returns of only 2% to 3% .

Typically, an individual with a long time horizon takes on more risk within a portfolio than one who is near retirement. And it’s common, and prudent, for investors to gradually shift the assets within the portfolio as they get closer to retirement.

As a one-stop-shopping way to accomplish this metamorphosis, target-date funds have become a popular choice among 401 plan participants. These mutual funds allow investors to select a date near their projected retirement year, such as 2025 or 2050.

Also Check: What Happens To 401k Money When You Quit

What Are My 401 Plan Fees

The 401 plan is complex machine with plenty of moving parts, and fees could be hiding anywhere. But well explain what to look for and where to find them. For starters, you can look into your 401 plan summary annual report. This document depicts the plans total assets and expenses. Another crucial document is your fund prospectus. This one details the costs associated with managing the mutual fund or funds that youre invested in.

When reviewing these and other documents, these are some of the fees you should look out for.

Administrative Fees: These are fees associated with the overall management of your companys 401 plan. They can include expenses for recordkeeping, legal representation and services offered to employees such as educational seminars.

Expense Ratios: This represents the portion of a funds assets used to pay for overall management and ongoing operation of the fund. The expense ratio comes out of a funds total assets, so you and everyone invested in the same fund pay indirectly via investment returns. Your fund prospectus should detail the expense ratio.

12b-1 fees: If present, these fees are factored into the funds expense ratio. 12b-1 fees generally pay for marketing of the fund.

If all of these 401 fee designations sound a little difficult to wrap your head around, dont fret.