Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

You Typically Have Five Years To Repay The Loan

A 401 loan generally must be repaid within five years of borrowing the money from your account.

However, the CARES Act temporarily extends your repayment time if you’re borrowing due to COVID-19. For loans outstanding after March 27, 2020, with payments due between March 27 and the end of 2020, you’ll have six years to repay what you owe.

That extra year can make repayment more affordable, although it means your money will be out of the stock market for longer, so your loan could be costlier in the end due to the lost potential for investment gains.

Report The Rollover On Your Taxes

In a direct rollover, you shouldnt owe any additional taxes, but you need to report the transaction on your taxes. If you roll over a 401k to an IRA, you should expect a 1099-R form from your 401k plan provider. This is the form youll use to report a direct rollover to the IRS. Fidelity will also send you a 5498 form if your rollover was a direct one. Simply add that information to your tax return at the end of the year.

More on 401k Investments:

Read Also: Is There A Max Contribution To 401k

Eligibility For A Hardship Withdrawal

The Internal Revenue Service ‘s immediate and heavy financial need stipulation for a hardship withdrawal applies not only to the employee’s situation. Such a withdrawal can also be made to accommodate the need of a spouse, dependent, or beneficiary.

Immediate and heavy expenses include the following:

- Certain medical expenses

- Home-buying expenses for a principal residence

- Up to 12 months worth of tuition and fees

- Expenses to prevent being foreclosed on or evicted

- Burial or funeral expenses

- Certain expenses to repair casualty losses to a principal residence

You wont qualify for a hardship withdrawal if you have other assets that you could draw on to meet the need or insurance that will cover the need. However, you needn’t necessarily have taken a loan from your plan before you can file for a hardship withdrawal. That requirement was eliminated in the reforms, which were part of the Bipartisan Budget Act passed in 2018.

The $2-trillion coronavirus emergency stimulus bill signed into law on March 27, 2020, allows those affected by the coronavirus situation a hardship distribution to $100,000 without the 10% penalty those younger than 59½ normally owe account owners have three years to pay the tax owed on withdrawals, instead of owing it in the current year.

How Can A 401 Loan Default

Because most loan payments are generally required to be paid back with deductions from your paycheck the default rate on 401 loans is relatively low. However, the single biggest cause of loan defaults is the loss of ones job. Once separated from employment , your employer can no longer just debit your paycheck to ensure timely payments and the full balance of the loan must be repaid promptly to avoid the loan going into default.

Less commonly, loan payments are not required to be paid back via deductions from your paycheck and you become fully responsible for ensuring timely payments. Of course, laying the responsibility of making timely payments on the loan recipient opens up the door to loan defaults. Falling behind on payments can cause a loan to default.

Don’t Miss: Is An Ira Better Than 401k

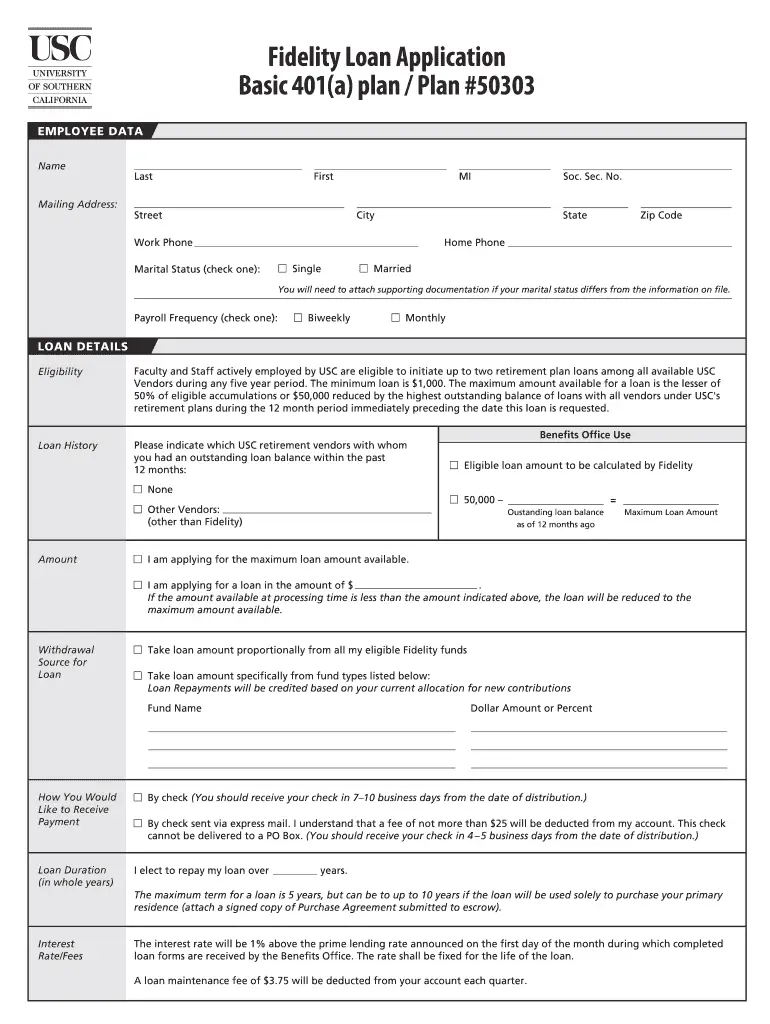

Prior Outstanding Loan Balance

The participants highest outstanding loan balance during the twelve-month-period ending on the day before the date a new loan is issued must be taken into account. That amount is applied to reduce the overall cap of $50,000, so it primarily comes into play only when a participant is seeking a fairly sizeable loan. This is true even if the previous loan has been paid in full.

However, that does not mean we can ignore it in the case of smaller loans. Weve seen a number of situations in which a participant has taken out a $50,000 loan to meet a short-term need and repaid it just a few months later. If that same participant then requests another loan less than 12 months later, he or she would not be able to take it even if it is a small amount. Why? Because the overall limit of $50,000 is reduced by the highest balance the participant had in the trailing twelve months, which in this case, is also $50,000.

Retirement Savings Withdrawals Vs Loans

Category: Benefits Strategy

At some point, you may find yourself needing extra cash because of financial hardship or a life change such as a down payment on a home. You may have considered using your retirement savings for this purpose, but this decision shouldnt be taken lightly. Two ways to get money from defined contribution plans before reaching retirement age include loans and withdrawals.

There are key differences between these two options, some of which could have major financial consequences or penalties. Knowing the difference can help you make the wisest choice for your financial situation. Your choice will affect future savings goals. Keep in mind that your specific retirement plan will have rules for withdrawals and loans. Discuss these options with your provider before making a decision.

Recommended Reading: How To Avoid Penalty On 401k Withdrawal

Decide Whats Best For You

The first step is deciding if you want to roll over your 401k and, if so, what sort of account you want to move your nest egg to.

You have five basic options for what to do with your old Fidelity 401k account: leave it with Fidelity, roll it over into the 401k account of a new employer, roll it over into a traditional IRA, roll it over into a Roth IRA or cash it out.

Leaving your account in place is one of the simplest options, but keeping track of your finances across multiple retirement accounts might prove to be difficult. Whats more, youll no longer be able to make contributions or, in most cases, take out a 401k loan.

Moving it to a new 401k will consolidate your accounts, but the new company might charge higher fees or not have the same investment options. And, if your new employer doesnt offer a 401k, this wont be possible.

Rolling your 401k over into an IRA doesnt require your new employer to have a 401k plan, but an IRA wont necessarily offer the same protections under federal law as a 401k. Some states, however, offer certain creditor protection for IRAs.

Finally, you can opt to cash out your account. Unless you have a critical need for cash, you should avoid doing so since this could result in consequences that vary depending on your age and tax situation.

If You Are Under 59 1/2

Making a withdrawal from your Fidelity 401k prior to age 60 should always be a last resort. Not only will you pay tax penalties in many cases, but youre also robbing yourself of the tremendous benefits of compound interest. This is why its so important to maintain an emergency fund to cover any short-term money needs without costing yourself extra by making a 401k early withdrawal.

However, life has a way of throwing you curveballs that might leave you with few to no other options. If you really are in a financial emergency, you can make a withdrawal in essentially the same way as a normal withdrawal. The form is filled out differently, but you can find it on Fidelitys website and request a single check or multiple scheduled payments.

If you jump the gun, though, and start making withdrawals prior to the age of 59 1/2, youve essentially broken your pact with the government to invest that money toward retirement. As such, youll pay tax penalties that can greatly reduce your nest egg before it gets to you. A 401k early withdrawal means a tax penalty of 10 percent on your withdrawal, which is on top of the normal income tax assessed on the money. If youre already earning a normal salary, your early withdrawal could easily push you into a higher tax bracket and still come with that additional penalty, making it a very pricey withdrawal.

Know: The Best Roth IRA Accounts

Also Check: What Happens When You Roll Over 401k To Ira

Traditional Rollover Sep And Simple Iras

If you are considering a withdrawal from one of these types of IRAs before age 59½, it will be considered an early distribution by the IRS.

In many cases, you’ll have to pay federal and state taxes. There may also be a 10% penalty unless you are using the money for exceptions such as a first-time home purchase, birth or adoption expense , qualified education expense, death or disability, health insurance , and some medical expenses. A 25% penalty may apply if you take a distribution within the first 2 years of opening a SIMPLE IRA.

If any of these situations apply to you, then you may need to fill out specific IRS forms. Always consult your tax advisor about your specific situation.

Early Withdrawals Less Attractive Than Loan

One alternative to a 401 loan is a hardship distribution as part of an early withdrawal, but that comes with all kinds of taxes and penalties. If you withdraw the funds before retirement age youll typically be hit with income taxes on any gains and may be assessed a 10 percent bonus penalty, depending on the nature of the hardship.

You can also claim a hardship distribution with an early withdrawal.

The IRS defines a hardship distribution as an immediate and heavy financial need of the employee, adding that the amount must be necessary to satisfy the financial need. This type of early withdrawal doesnt require you to pay it back, nor does it come with any penalties.

A hardship distribution through an early withdrawal covers a few different circumstances, including:

- Certain medical expenses

- Some costs for buying a principal home

- Tuition, fees and education expenses

- Costs to prevent getting evicted or foreclosed

- Funeral or burial expenses

- Emergency home repairs for uninsured casualty losses

Hardships can be relative, and yours may not qualify you for an early withdrawal.

This type of withdrawal doesnt require you to pay it back. But its a good idea to avoid an early withdrawal, if at all possible, because of the serious negative effects on your retirement funds. Here are a few ways to sidestep those hefty levies and keep your retirement on track.

Recommended Reading: How Can You Take Out Your 401k

Who Is Eligible For A Withdrawal

Reasons might include hardship , or this option may be made available for employees who are over a specified age such as 55 or 59 ½.

While a large percentage of plans offer in-service withdrawals, the rules can be complex as to which portions of your account balance are eligible. For example, this might be limited to employer matching contributions and employer contributions to a profit-sharing account connected to the plan.

Where allowed, in-service withdrawals might be a good option if the investment choices in your companys plan are sub-par or the plan is a high cost one.

An option, if allowed, might be to roll funds allowed under the in-service withdrawal option to an IRA account where you have a wider range of investment choices.

Many brokerages can help you roll over your 401 into an IRA.

If you decide an in-service withdrawal is something you want to explore, be sure to consult with your plan administrator to be sure you understand all of the rules and restrictions involved. You should also consult with your financial advisor or tax professional if you use one.

How To Withdraw From A Fidelity 401k

The Fidelity suite of products offer a wide range of services that help individuals do everything from saving for retirement to investing extra money to trade on the stock market. Fidelity manages employer-sponsored 401 plans and offers its own self-employed and small business 401 plans. Customers with a Fidelity 401 can withdraw money from the account, but they should be aware of the tax implications of early withdrawal.

Read Also: How To Set Up 401k In Quickbooks

Can I Take Money Out Of My Fidelity 401k

For a withdrawal from your Employer-Sponsored Retirement Plan Single Withdrawal Request

Keeping this in view, can I take money out of my Fidelity retirement account?

No, as long as your Roth account has been open for at least five years, starting at age 59½, you can begin taking money out of your retirement accounts without penalty. No, starting at age 59½, you can begin taking money out of your retirement accounts without penalty. Fidelity does not provide legal or tax advice.

Beside above, can you take money out of your 401k? In general, when you make a withdrawal from your 401K before you reach age 59 ½, the Internal Revenue Service may charge you a 10% early withdrawal penalty. You‘ll also pay taxes on any amounts you cash out because these funds come directly from your pre-tax income.

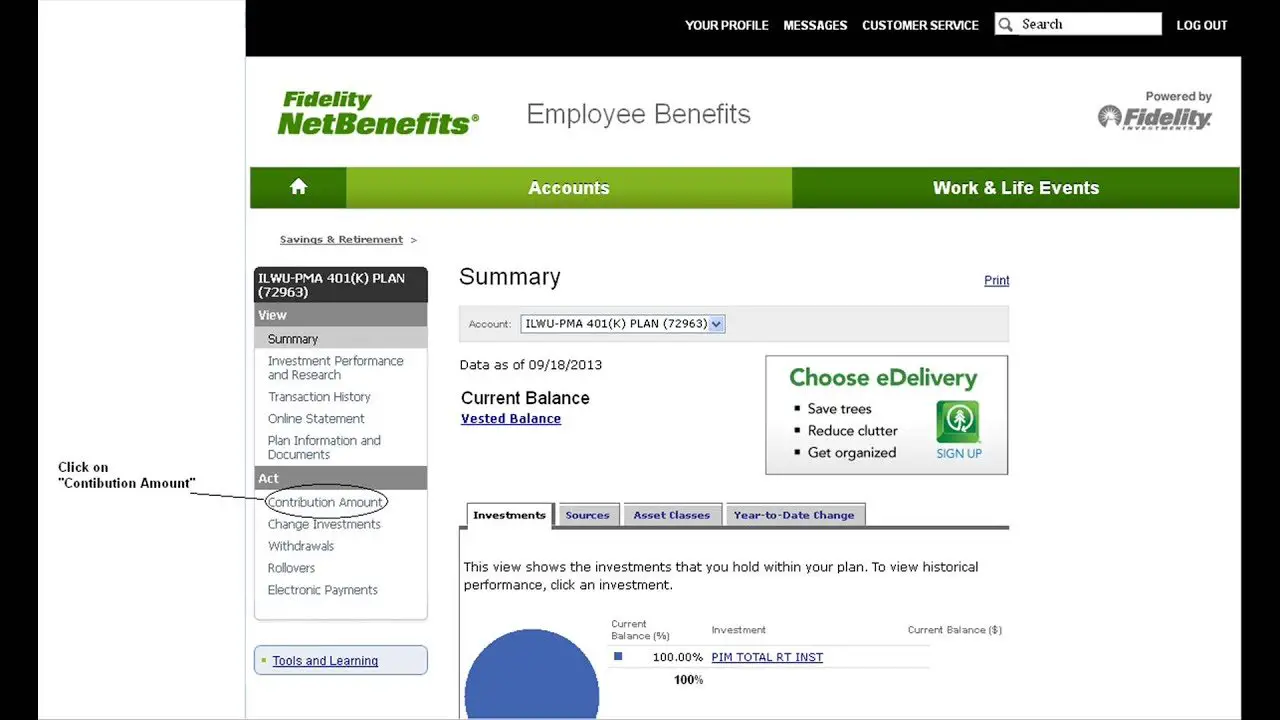

People also ask, how do I withdraw money from my Fidelity 401k?

Your 401k is your money, and making a withdrawal is as simple as contacting Fidelity to let them know you want it. The easiest way is to simply visit Fidelity’s website and request a check there. However, you can also reach out via phone if you prefer: Call 800-343-3543 with any questions about the process.

Can I borrow from my Fidelity 401k?

Most workplace retirement plans let you borrow up to $50,000 or 50% of your vested account balance, which- ever is less. Most also have a loan minimum of $1,000.

You May Like Also

Alternatives To Tapping Your 401

If you must tap into retirement savings, it’s better to look at your other accounts firstspecifically IRAsespecially if you’re buying a first home .

Unlike 401s, IRAs have special provisions for first-time homebuyerspeople who haven’t owned a primary residence in the last two years, according to the IRS.

First, look to take a distribution from your IRAif you have one. You may be able to withdraw IRA contributions without penalty due to a qualified financial hardship. You can also withdraw up to $10,000 of earnings tax-free if the money is used for a first-time home purchase. As a first-time homebuyer, you can take a $10,000 distribution without owing the 10% tax penalty, although that $10,000 would be added to your federal and state income taxes. If you take a distribution larger than $10,000, a 10% penalty would be applied to the additional distribution amount. It also would be added to your income taxes.

Read Also: How To Make A Loan From 401k

Pay On Your Extra Pay Periods

Maybe you have not thought about it before, but if you get paid weekly, you usually get four paychecks a month, and you will receive five paychecks every year for four months.

If you get paid biweekly, you typically bring home two paychecks a month. These extra paychecks are fun to spend on petty things, but they are perfect for paying down your loan debt. Remember the more you settle towards your loan, the faster you will get it paid off.

What Happens If You Leave Your Job

When you take out a loan from a 401, you may have no intention of leaving your current employer. But if you receive a better job offer, or are laid off or otherwise leave, you could be required to pay the loan back in full or face some serious tax consequences.

Employees who leave their jobs with an outstanding 401 loan have until the tax-return-filing due date for that tax year, including any extensions, to repay the outstanding balance of the loan, or to roll it over into another eligible retirement account. That means if you left your job in January 2020, you would have until April 15, 2021 when your 2020 federal tax return is due to roll over or repay the loan amount. Prior to the Tax Cuts and Jobs Act of 2017, the deadline was 60 days.

If you cant repay the loan, your employer will treat the remaining unpaid balance as a distribution and issue Form 1099-R to the IRS. That amount is typically considered taxable income and may be subject to a 10% penalty on the amount of the distribution for early withdrawal if youre younger than 59½ or dont otherwise qualify for an exemption.

Unfortunately, this worst-case scenario isnt rare. A 2014 study from the Pension Research Council at the Wharton School of the University of Pennsylvania found that 86% of workers in the sample who left their jobs with a loan outstanding eventually defaulted on the loan.

You May Like: How Do I Start My Own 401k

Placing Real Estate Investment Question:

That is good news, and it sounds like the Fidelity brokerage account set up up process went smoothly and now you can start placing investments in alternative investments such as real estate. You can either place the investments by writing a check or by filling out the Fidelity outgoing wire directive, which we can fill out for you. for more information regarding investing in real estate.