What Are Required Minimum Distributions

Required Minimum Distributions generally are minimum amounts that a retirement plan account owner must withdraw annually starting with the year that he or she reaches 72 , if later, the year in which he or she retires. However, if the retirement plan account is an IRA or the account owner is a 5% owner of the business sponsoring the retirement plan, the RMDs must begin once the account holder is age 72 , regardless of whether he or she is retired.

Retirement plan participants and IRA owners, including owners of SEP IRAs and SIMPLE IRAs, are responsible for taking the correct amount of RMDs on time every year from their accounts, and they face stiff penalties for failure to take RMDs.

Calculating The Required Minimum Distribution

The required minimum distribution for any year is the account balance as of the end of the immediately preceding calendar year divided by a distribution period from the IRSs Uniform Lifetime Table. A separate table is used if the sole beneficiary is the owners spouse who is ten or more years younger than the owner. In this regard, the following materials will be useful to you in determining required distribution amounts and payout periods:

- worksheets to calculate the required amount

- tables to calculate the RMD during the participant or IRA owners life:

- Uniform Lifetime Table -for all unmarried IRA owners calculating their own withdrawals, married owners whose spouses arent more than 10 years younger, and married owners whose spouses arent the sole beneficiaries of their IRAs

- Table I is used for beneficiaries who are not the spouse of the IRA owner

- Table II is used for owners whose spouses are more than 10 years younger and are the IRAs sole beneficiaries

Inherited IRAs – if your IRA or retirement plan account was inherited from the original owner, see “required minimum distributions after the account owner dies,” below.

What Is A Withdrawal Buckets Strategy

With the buckets strategy, you withdraw assets from three buckets, or separate types of accounts holding your assets.

Under this strategy, the first bucket holds some percentage of your savings in cash: often three-to-five years of living expenses. The second holds mostly fixed income securities. The third bucket contains your remaining investments in equities. As you use the cash from the first bucket, you replenish it with earnings from the second and third buckets.

Potential advantages: This approach allows your savings to continue to grow over time. Through constant review of your funding, you also benefit from a sense of control over your assets.

Potential disadvantages: This approach is more time-consuming.

Also Check: Can You Have Your Own 401k

What Happens If I Stop Contributing To My 401k

If you are considering stopping contributions to a 401k, you would be better served to merely suspend those contributions. A short-term suspension will slow the performance of your retirement fund, but it wont keep it from growing. It also will lessen the temptation to simply withdraw all the funds and wipe out retirement savings in the process.

You May Need To Take Money Out Of A 401 Here’s What You Need To Know

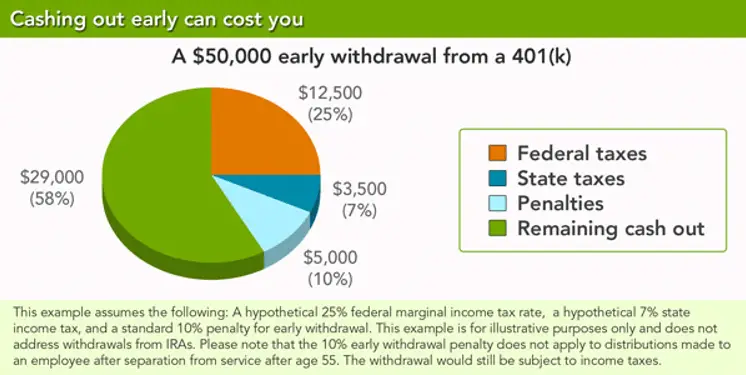

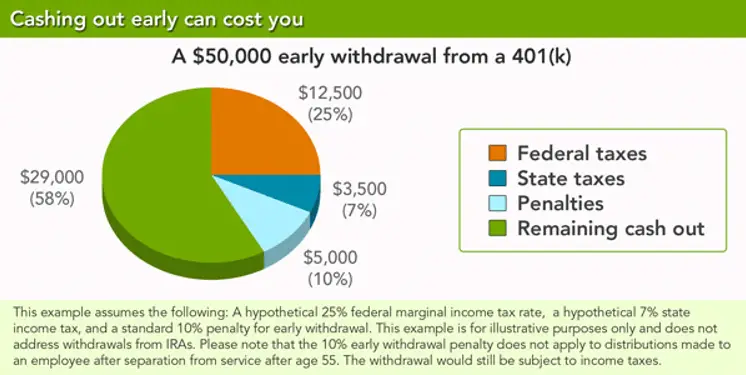

401s are incentivized plans to help Americans save for retirement. The government provides tax breaks to encourage you to contribute, but it also enforces certain rules to discourage you from taking distributions before retirement. In some cases, breaking those rules and taking distributions early can cost you a 10% penalty in addition to the ordinary income taxes you’ll owe on withdrawn funds.

Let’s look at all the approved ways you can take money out of a 401 and look into the penalties you’ll incur if your early distributions don’t fall within one of those exceptions.

Read Also: How To Pull 401k Early

How Is The Amount Of The Required Minimum Distribution Calculated

Generally, a RMD is calculated for each account by dividing the prior December 31 balance of that IRA or retirement plan account by a life expectancy factor that IRS publishes in Tables in Publication 590-B, Distributions from Individual Retirement Arrangements . Choose the life expectancy table to use based on your situation.

- Joint and Last Survivor Table – use this if the sole beneficiary of the account is your spouse and your spouse is more than 10 years younger than you

- Uniform Lifetime Table – use this if your spouse is not your sole beneficiary or your spouse is not more than 10 years younger

- Single Life Expectancy Table – use this if you are a beneficiary of an account

See the worksheets to calculate required minimum distributions and the FAQ below for different rules that may apply to 403 plans.

How To Withdraw Money From Your 401

The 401 has become a staple of retirement planning in the U.S. Millions of Americans contribute to their 401 plans with the goal of having enough money to retire comfortably when the time comes. Whether youve reached retirement age or need to tap your 401 early to pay for an unexpected expense, there are various ways to withdraw money from your employer-sponsored retirement account. A financial advisor can steer you through these decisions and help you manage your retirement savings.

Read Also: Why Choose A Roth Ira Over A 401k

Continued Growth Vs Inflation

Remember that your retirement savings accounts don’t grind to a halt when you begin retirement. That money still has a chance to grow, even as you withdraw it from your 401 or other accounts after retirement to help pay for your living expenses. But the rate at which it will grow naturally declines as you make withdrawals because you’ll have less invested. Balancing the withdrawal rate with the growth rate is part of the science of investing for income.

You also need to take inflation into account. This increase in the cost of things we purchase typically comes out to about 2% to 3% a year, and it can significantly affect your retirement money’s purchasing power.

Our Take: When Can You Withdraw From Your 401k Or Ira Penalty

There are a number of ways you can withdraw from your 401k or IRA penalty-free. Still, we recommend not touching your retirement savings until you are actually retired. Compounding is a huge help when it comes to maximizing your retirement savings and extending the life of your portfolio. You lose out on that when you take early distributions. To see how much compounding can affect your 401k account balance, check out our article on the average 401k balance by age.

We understand that its always possible for unforeseen circumstances to arise before you reach retirement. Being aware of the exceptions allows you to make informed decisions and possibly avoid paying extra fees and taxes.

To take control of your finances, a good place to start is by stepping back, getting organized, and looking at your money holistically. Personal Capitals free financial dashboard will allow you to:

The content contained in this blog post is intended for general informational purposes only and is not meant to constitute legal, tax, accounting or investment advice. You should consult a qualified legal or tax professional regarding your specific situation. Keep in mind that investing involves risk. The value of your investment will fluctuate over time and you may gain or lose money.

Don’t Miss: Can I Roll A 401k Into A Roth Ira

Are You Still Working

You can access funds from an old 401 plan after you reach age 59 1/2 if you’re still working, but you may not have the same access to the funds at the company for which you currently work if you’ve changed jobs.

Check with your 401 plan administrator to find out whether your plan allows what’s referred to as an in-service distribution at age 59 1/2. Some 401 plans allow this, but others don’t.

When Do I Have To Start Making Withdrawals From My Ira

You cant keep your funds in a retirement account indefinitely. Generally, youre required to start taking withdrawals from your traditional IRA when you reach age 70 ½ . Roth IRAs, however, dont require withdrawals until the owner of the account dies.

The amount that youre required to withdraw is called a required minimum distribution . You can withdraw more than the RMD amount, but withdrawals from a Traditional IRA are included in your taxable income. If you fail to make withdrawals that meet the RMD standards, you may be subject to a 50% excise tax. Roth IRAs do not require RMDs. Your money grows tax-free, since contributions are made from after-tax dollars, and your withdrawals in retirement aren’t taxed.

Don’t Miss: What Companies Offer The Best 401k Match

Is It A Good Idea To Use The Rule Of 55

Just because you can take distributions from your 401 or 403 early doesn’t mean you should. Depending on your financial situation, it might be better to let your money continue to grow. Holding off withdrawals could help you better position yourself for a financially sound future. If you’re tempted to withdraw retirement funds before you’re eligible, instead consider finding another job, drawing from your savings or using other sources of income until you need to tap into your retirement savings.

If you decide to begin withdrawing funds from your 401 early, the long-term value of your portfolio will likely decrease. It’s essential that you time your withdrawals carefully and take into account how much they would cost you in taxes. To create a strategy that makes sense in your situation, consider working with a financial advisor or a retirement planner.

Penalty Exceptions For Retirement

There will be some actions when you can make an early withdrawal from your TSP account. It is used to prevent a penalty for early withdrawal. If you become total or permanent disabilities, you dont take loans on your withdrawal. You can also use your TSP fund to pay the medical debt, which is more than 7.5 percent of your annual income. If you divorce, you can use the money from your TSP account to adjust a divorce appointment. All early withdrawals will prevent a penalty, but you still pay income tax.

If you withdraw money from TSP due to other reasons, you will get the charge off early withdrawal penalty. It is adding extra cost up to 10 per cent for all withdrawals. Furthermore, you will get frozen from the TSP program for 6 months in which you can invest. It is bad news because you can invest in gold while having a TSP account. The gold investment is promising for retirement because the gold price is always rising.

Also Check: How To Find Out If You Have A 401k Account

Rrsp Withholding Tax On Multiple Withdrawals

If you withdraw multiple smaller amounts in a short period of time to avoid the higher withholding tax, your financial institution could still deduct the amount of withholding tax that would apply on the total amount. For example, if you want to withdraw $8000 but you split it into 4 monthly withdrawals of $2000 to avoid the 20% tax withholding, your financial institution could still withhold 20% on the last withdrawal if they notice the pattern.

Breaking It Down: Where Do You Fit In

There are many reasons you might think this chart seems totally reasonable, or, conversely, totally unreasonable. And thats understandable. Life presents us all with different challenges. We have unexpected medical expenses, decide to go back to school, or have kids and want to pay their college tuitions. These are all perfectly valid excuses as to why you might be falling behind where this chart says you should, or could, be.

Based on this chart, you would think that most Americans should be retiring as multi-millionaires at age 65. This probably seems way off-base, and in reality, it is most people retire with very little in the way of savings and investments. The point is that this chart shows what is possible if you are disciplined and strategic about your 401k savings.

If you are on the younger end of the ages shown on the chart, you may be daunted at the prospect of contributing $8,000 per year to your 401k, not to mention $19,500. Where you live, what your first-year salary is, or what loans you may be paying can make it difficult for this contribution to seem realistic. Its crucial, however, to recognize the importance of saving as much as you can for retirement as early as you can.

So, lets determine, based on the two scenarios in the potential savings chart, whether these figures would be sufficient to support your lifestyle for the rest of your retirement.The average life expectancy for men is around 84 years old, and 86.5 years old for women.

Recommended Reading: How To Calculate Employer Contribution To 401k

What Is The Tax On 401 Withdrawls After 65

Putting money aside in a 401 during your working years is one of the most effective ways to accumulate wealth for your retirement years. But accumulating that money is only half of the battle. The other half is devising a strategy that allows you to meet your daily living expenses while minimizing your taxes. Understanding how 401 withdrawals impact your taxes makes devising such a strategy a lot easier.

What Types Of Retirement Plans Require Minimum Distributions

The RMD rules apply to all employer sponsored retirement plans, including

profit-sharing plans, 401 plans, 403 plans, and 457 plans. The RMD rules also apply to traditional IRAs and IRA-based plans such as SEPs, SARSEPs, and SIMPLE IRAs.

The RMD rules also apply to Roth 401 accounts. However, the RMD rules do not apply to Roth IRAs while the owner is alive.

Read Also: Is It Worth Rolling Over A 401k

Taxes If You Withdraw The Money Early

For traditional 401s, there are three big consequences of an early withdrawal or cashing out before age 59½:

Taxes will be withheld. The IRS generally requires automatic withholding of 20% of a 401 early withdrawal for taxes. So if you withdraw the $10,000 in your 401 at age 40, you may get only about $8,000.

The IRS will penalize you. If you withdraw money from your 401 before youre 59½, the IRS usually assesses a 10% penalty when you file your tax return. That could mean giving the government another $1,000 of that $10,000 withdrawal.

You may have less money for later, especially if the market is down when you start making withdrawals. That could have long-term consequences.

There are a lot of exceptions. This article has more details, but in a nutshell, you might be able to escape the IRSs 10% penalty for early withdrawals from a traditional 401 if you:

-

Receive the payout over time.

-

Qualify for a hardship distribution with the plan administrator.

-

Leave your job and are over a certain age.

-

Are getting divorced.

-

Give birth to a child or adopt a child.

-

Are or become disabled.

-

Put the money in another retirement account.

-

Use the money to pay an IRS levy.

-

Use the money to pay certain medical expenses.

-

Were a disaster victim.

-

Were in the military.

-

Die.

You can withdraw money from a Roth 401 early if youve held the account for at least five years and need the money due to disability or death.

How Contributions Affect Rmds

When you calculate an employee’s RMD, consider any contributions that you make for that employee. For defined contribution plans, calculate the RMD for an employee by dividing his or her prior December 31 account balance by a life expectancy factor in the applicable table in Appendix B of Pub. 590-B. A defined benefit plan generally must make RMDs by distributing the participant’s entire interest as calculated by the plan’s formula in periodic annuity payments for:

- the participant’s life,

Read Also: How To Take Out A Loan Against 401k

What Happens If You Fail To Take Out Money When Required

If you don’t take money out of your retirement account when required, the penalties are harsh. You’ll owe a 50% excise tax on the amount you should have withdrawn. If you were required to take out $5,000 and failed to do so, this would mean you’d lose $2,500 to the IRS. You definitely don’t want that to happen, as this would mean giving up a huge chunk of your retirement funds for nothing.

The History Of The 401

The first 401 retirement plan was founded in the 1970s by employees of the Kodak corporation. You remember them: the guys who made all of those old-style cameras and film?

So, in the early 1970s, according to Wikipedia, a group of high-earning Kodak employees went to Congress. They wanted Congress to pass a law stating they could invest part of their salary into the stock market and have that money be exempt from income taxes.

This law eventually morphed into what we now know as the 401. Todays 401 is used by individuals all over the world as a way to save for retirement.

Recommended Reading: Is Spouse Entitled To 401k In Divorce In Ny

What Is Rrsp Withholding Tax

RRSP withholding tax is a tax that’s withheld when you make a withdrawal from your RRSP. The money withheld by your financial institution is passed to the CRA. The rate of RRSP tax varies depending on the amount you withdraw and the province you live in. This tax is also called RRSP Withdrawal tax.

For British Columbia, Alberta, Saskatchewan, Ontario, New Brunswick, Nova Scotia, Nunavut, Newfoundland and Labrador, Prince Edward Island, Yukon and Northwest Territories the following tax rates apply:

| Amount of withdrawal |

|---|

| $15,000+ | 15% |

Residents of Québec also pay provincial sales tax of 16% in addition to the federal withholding tax. If you are a non-resident of Canada, you will pay 25% tax withholding regardless of the size of the withdrawal. The withholding tax is generally not enough to cover all taxes owing on the withdrawal, depending on your other sources of income.