You Put Your Retirement Savings At Risk

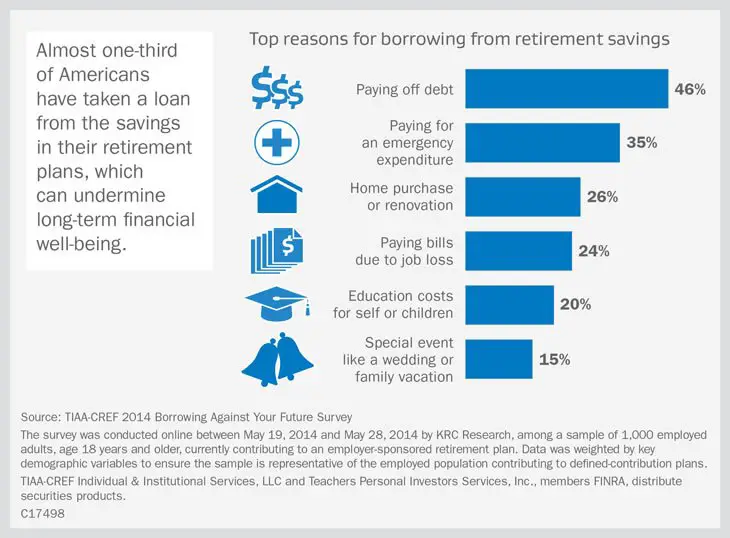

There are many reasons folks end up taking out a 401 loan, from covering the cost of an emergency to wiping out credit card debt. According to the Ramsey Solutions 2021 Q1 State of Personal Finance study, more than half of those who borrowed money from a 401 in the past year said they did so to cover basic necessities.

But heres the deal: Your 401 is for retirement, not for emergencies, getting rid of debt or going on vacation. When you turn to your 401 for help now, youre putting your retirement future at risk.

Borrowing as little as $10,000 from your 401 when youre 25 years old, for example, could set your retirement back several years and cost you hundreds of thousands of dollars in your nest egg down the linemaybe more.

In fact, a whopping 7 out of 10 people who borrowed money from their account in the past year because of COVID-19 said they regretted that decision.4On top of that, more than half of Americans now feel they are behind on their retirement goals.5

Retirement Plans Faqs Regarding Loans

Information on this page may be affected by coronavirus relief for retirement plans and IRAs.

These frequently asked questions and answers provide general information and should not be cited as any type of legal authority. They provide the user with information responsive to general inquiries. Because these answers do not apply to every situation, yours may require additional research.

How To Prevent Needing A 401 Loan

Sandy Blair, director of retirement readiness at CalSTRS, says the best way to resist using a retirement account is to build emergency savings.

To build emergency savings, Blair offers these three tips:

For those who might think emergency funds are too hard to build, as compared with the convenience of using a 401 loan, Blair has an easy anecdote to resist the temptation:

Think of it as an insurance policy on your financial future.

Recommended Reading: Can I Transfer Part Of My 401k To An Ira

Talk With A Financial Advisor

Still have questions about your 401 and what a 401 loan would mean for your financial future? The best thing you can do is talk to a qualified financial advisor you can trust.

Our SmartVestor program can connect you with a financial advisor you can turn to for sound advice. That way, you dont have to make these huge financial decisions on your own.

About the author

Ramsey Solutions

Ramsey Solutions has been committed to helping people regain control of their money, build wealth, grow their leadership skills, and enhance their lives through personal development since 1992. Millions of people have used our financial advice through 22 books published by Ramsey Press, as well as two syndicated radio shows and 10 podcasts, which have over 17 million weekly listeners.

Can 401k Hardship Withdrawal Denied

A 401 plan may deny your 401 loan request for several reasons. Your 401 loan could be rejected because you are retired, your job is being scrapped in a restructuring process, or if you have exceeded the loan limit. If your 401 loan was refused, you should find out why it was refused.

Can you be denied a 401k withdrawal?

Your company may also refuse to give you your 401 before retirement if you need it. The IRS imposes penalties for early withdrawal of money in a 401 account. A company may refuse to give you your 401 if it goes against their resume description.

Can my hardship withdrawal be denied?

Once you reach retirement age, you can start withdrawing funds from your 401 without penalties. At this time, your employer or fund manager may not refuse to give you the money in your fund, either as a flat-rate distribution or as equal periodic payments.

Is it hard to get a hardship withdrawal from 401k?

Hardship Basics A hardship retreat is not like a plan loan. The retreat can be hard to get, and expensive if you get it. Remember, your 401k is meant to provide retirement income. It should be a last resort source of cash for spending before then.

Read Also: How To Find Out If You Have A 401k Account

Borrowing From An Old 401

If you are no longer working for the company where your 401 plan resides, you may not take out a new 401 loan unless your plan specifically allows for it. You may transfer the balance from a former employer to your new 401 plan, and if your current employer plan allows for loans, then you can borrow from there. If you transfer your old 401 to an IRA, you cannot borrow from the IRA. It is best to know all the rules before you cash out or transfer an old 401 plan.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Recommended Reading: What Happens To My 401k After I Quit

Can I Take A Loan From My 401k If I Am Unemployed

Workers 55 and older can access 401 funds without penalty if they are laid off, fired, or quit. Unemployed individuals can receive substantially equal periodic payments from a 401. These payments are distributed over a minimum of five years or until the individual reaches age 59½, whichever is greater.

How Does A 401k Loan Work

When you take a 401 loan, you specify the investment account from which you want to borrow money. Those investments are liquidated for the duration of the loan.

You lose any positive earnings that would have been produced by those investments for the period of the loan. The upside is that you also avoid any investment losses on this money.

You May Like: Should I Transfer 401k To Roth Ira

Why Do People Get 401 Loans

As long as a plan allows it, participants generally can borrow from their 401 for any reason. Some plans may only allow loans for specific reasons, so be sure to check your plans rules before trying to borrow.

Since youre borrowing your own money, and no credit check is involved, it may be easier to get approved for a 401 loan as long as you meet the plans requirements for borrowing. In some cases, a requirement may be getting approval from your spouse , because your spouse may be entitled to half of your retirement assets if you divorce.

Here are some potential uses for a 401 loan.

- Paying household bills and expenses

- Funding a down payment on a house

- Paying off high-interest debt

- Paying back taxes, or money owed to the IRS

- Funding necessary home repairs

- Paying education expenses

But that doesnt mean 401 loans are always a good idea. In fact, there are some major risks that come with borrowing from your retirement savings. Here are two.

Repaying The 401 Loan

You should make payments at least quarterly, but commonly, this interval is manageable as you’ll repay your loan through payroll deductions. The longest repayment term allowed is five years, though there are exceptions. Some 401 plans do not allow you to contribute to the plan for a certain period after you take out a loan.

If you lose your job while you have an outstanding 401 loan, you may need to repay the balance in full or risk having it be categorized as an early distribution, which can result in both taxes owed and a penalty from the IRS.

You May Like: Where Can I Get 401k Plan

Can I Close My 401k And Take The Money

Cashing Out Your 401k While Still Employed When you resign or are fired, you can withdraw the money to your account, but again, there are penalties for doing so that you should consider. You will be subject to 10% early withdrawal penalty and the money will be taxed as regular income.

How much will I get if I withdraw my 401k?

Traditional 401 : You get 100% of the balance, minus state and federal taxes. Roth 401 : You get 100% of your balance, without taxation. Payout before age 59.5: You will be subject to a 10% penalty on top of all taxes owed.

What happens if I close my 401k early?

If you withdraw money from your 401 account before age 59 1/2, you must pay a 10% early withdrawal penalty, in addition to income tax, on the distribution. For someone in the 24% tax bracket, a $ 5,000 early 401 withdrawal costs $ 1,700 in taxes and penalties.

What reasons can you withdraw from 401k without penalty?

Here are the ways to take impunity withdrawal from your IRA or 401

- Unreimbursed medical bills.

An Example Of A 401 Loan

Suppose you have $5,000 in and $50,000 in a 401 plan. You borrow $5,000 and agree to pay off the debt within five years at an annual percentage rate of 4.25%. At the end of the five years, after having made payments of $92.65 a month, you will have replenished your account and paid yourself $558.83 in interest.

If you were to take the same amount of time to pay off the $5,000 of credit card debt, which had an annual percentage rate of 14.25%, using money left over after meeting your other expenses, you would have paid the card issuer $2,019.47 in interest after having made monthly payments of $116.99.

You May Like: Is 401k The Best Way To Save For Retirement

Loans Are Tied To Your Company

If you leave your job, youre still required to pay the balance of any 401 loans.

If you don’t repay, and you sever ties with your existing company for whatever reason, the IRS will deem the loan a distribution, and you will be taxed in that tax year, says Allan Katz, certified financial planner at Comprehensive Wealth Management Group in Staten Island, New York. And if youre younger than 59½, youll incur a 10% early withdrawal penalty.

You could be left in a deeper financial hole than the one caused by your credit card debt.

About 86% of people who leave their job with an outstanding 401 loan default on it, according to the National Bureau of Economic Research, compared with 10% of all 401 loan borrowers.

What Is The Penalty For Hardship Withdrawal From 401k

You will pay taxes on the amount you withdraw in the form of a hardship deduction. In addition to the regular income tax, you will probably pay a 10% penalty. 1 You can avoid the 10% penalty if you meet one of a few exceptions: you are disabled.

Is the early withdrawal penalty for 2021 waived? Although the initial provision for impunity 401k retreat expired at the end of 2020, the Consolidated Appropriations Act, 2021, provided a similar retreat exemption, allowing eligible individuals to take a qualified disaster distribution of up to $ 100,000 without the 10 % To be subject to penalty. that would be

You May Like: How To Find A Deceased Person’s 401k

What Are The Exceptions To The Penalty For An Early Withdrawal From My 401 K

There are some exceptions to the age 59½ minimum. The IRS offers impunity without special circumstances related to death, disability, medical expenses, childcare, spouse support and military active duty, said Bryan Stiger, CFP, a financial advisor at Betterments 401 .

What reasons can you withdraw from 401k without penalty?

Here are the ways to take impunity withdrawal from your IRA or 401

- Unreimbursed medical bills.

- If you owe the IRS.

- First time house beetle.

- For income purposes.

What are the exceptions to the 10% early withdrawal penalty?

Up to $ 10,000 from an IRA early retirement used for a first home for a parent, grandparent, yourself, a spouse to buy, build or rebuild, or you or your spouses child or grandchild can receive up to 10% Punishment will be released. You must meet the IRS definition of a first time home buyer.

Which of the following is not an exception to the 10 early withdrawal penalty for an IRA?

The following distributions are not subject to the 10% penalty tax: Death of IRA owner. Distributions to your designated beneficiaries after your death. Most non-spouse beneficiaries must liquidate the hereditary accounts within 10 years.

How Much Will I Get If I Cash Out My 401k

Traditional 401 : You get 100% of the balance, minus state and federal taxes. Roth 401 : You get 100% of your balance, without taxation. Payout before age 59.5: You will be subject to a 10% penalty on top of all taxes owed.

How much tax do I pay on 401k withdrawal? There is a mandatory maintenance of 20% of a 401 deduction to cover federal income tax, whether you ultimately owe 20% of your income or not. Rolling over the portion of your 401 you want to withdraw into an IRA is a way to gain access to the funds without being subject to this 20% mandatory withdrawal.

Recommended Reading: When Can I Draw From My 401k Without Penalty

Next Steps To Consider

This information is intended to be educational and is not tailored to the investment needs of any specific investor.

Fidelity does not provide legal or tax advice. The information herein is general in nature and should not be considered legal or tax advice. Consult an attorney or tax professional regarding your specific situation.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917

Consider Other Options First

An effective debt consolidation plan should allow you to pay off your credit cards within five years.

If you cant pay off the consolidated debt within five years, or if your total debt equals more than half your income, you might have too much debt to consolidate. Your best option is to consult an attorney or credit counselor about debt relief options, including debt management or bankruptcy.

Chapter 13 bankruptcy and debt management plans require five years of payments at most. After that, your remaining consumer debt is wiped out. Chapter 7 bankruptcy discharges consumer debt immediately.

Unlike consumer debt, a 401 loan isnt forgiven in bankruptcy. If you cant repay, the loan is considered a withdrawal, and youll owe the IRS income taxes and a penalty on the money youve already spent trying to pay down credit cards.

Better consolidation options for smaller debt loads include a:

-

0% balance transfer card: If you have good or excellent credit, look into a balance transfer credit card with an introductory no-interest period. These typically range from six months to two years. This is usually the cheapest option for those who qualify.

-

Personal loan: Interest rates on debt consolidation loans are lower for most borrowers than rates on regular credit cards. Your rate depends on your credit history and income.

Recommended Reading: Can I Contribute To Traditional Ira And 401k

The True Cost Of A 401 Loan

Any money you borrow from your retirement fund misses both market gains and the magic of compound interest.

Just imagine taking out a five-year 401 loan during this current bull market at 30 or 35 years old it could severely impact your future nest egg, says Malik Lee, a certified financial planner at Henssler Financial in Kennesaw, Georgia.

According to Vanguards 401 loan calculator, borrowing $10,000 from a 401 plan over five years means forgoing a $1,989 investment return and ending the five years with a balance that’s $666 lower.

But the cost to your retirement account doesnt end there. If you have 30 years until retirement, that missing $666 could have grown to $5,407, according to NerdWallets compound interest calculator .

Moreover, many people reduce their 401 contributions while making payments on a loan from the plan. In fact, some plans prohibit contributions when a loan is outstanding. This further damages retirement plans.

The New Rules Of Borrowing Money From Your 401 And Better Options To Consider

The COVID-19 pandemic has caused millions of people to lose their jobs or temporarily stop earning an income. The halt in cash flow means you or any of your friends and relatives cant afford basic necessities, like making home payments and buying food.

If there were no global pandemic, experts would be singing in unison to avoid borrowing money from your 401 or 403. But desperation and hardship are very real for millions of Americans. If youve emptied your emergency fund and your checking and savings accounts are exhausted, taking a 401 loan to cover current costs may be your next best alternative.

Heres what you need to know about 401 loans and taking out money from your retirement accounts before you retire.

Read Also: How To Take My Money Out Of 401k

Hardship Withdrawal Vs 401 Loan: An Overview

Is it ever OK to borrow from your 401 plan, either as a 401 loan or a hardship withdrawal? After all, your plan is a powerful retirement savings tool and should be carefully handled. Indeed, data from Fidelity shows that the average account balance has climbed to $112,300, as of February 2020.

The recently enacted CARES Act lets you make a penalty-free COVID-19 related withdrawal or take out a loan from your 401 in 2020 with special repayment provisions and tax treatment.

The primary advantage of saving in a 401 is the ability to enjoy tax-deferred growth on your investments. When youre setting aside cash for the long term, a hands-off approach is usually best. Nevertheless, there are some scenarios in which taking money out of your 401 can make sense.

Before you pull the trigger, though, its important to understand the financial implications of tapping your retirement plan early. There are two basic avenues for taking some money out before reaching retirement age.