Retirement Plan Buys Stock In New C

The funds from your retirement will buy stock in the new C-corp. The business issues shares that the new retirement plan, along with any potential outside investors, will purchase. You do not need to issue 100% of your business shares in the initial round of funding in case you wish to raise money by issuing shares in the future. Your ROBS provider can walk you through that process should you choose to pursue that strategy.

There Are Other Alternatives To Consider

Fortunately, if youre looking to start a new business, there are other financing options that you can choose from. One of the most common options is a small business loan, but you could also apply for SBA loans, cash advances, or a line of credit, just to name a few examples. Instead of using your 401k, try to pursue one of these options instead, so that you can have business financing while also protecting your retirement fund.

Get Cash For Your Own Business

If you want to use your Solo 401k to invest in startups, why not fuel the growth of your own new business? Yes, you can use your retirement account to fund a startup that you launch yourself. However, there are rules to follow.

You cannot invest your retirement funds directly into a business you own. Thats because you are a disqualified person to your Solo 401k plan. Using your retirement funds to invest directly in your business would be a prohibited transaction, and can carry a tax of up to 115%!

The way to compliantly use your retirement funds to invest in your business is through a participant loan. You can take a tax-free loan of up to 50% of your 401k account value, maxing out at $50,000. The loan does not count as new income, as long as you pay it back within 5 years. Any interest earned on the participant loan goes right back into your Solo 401k plan!

Don’t Miss: Is There A Fee To Rollover 401k To Ira

Robs To Start A Small Business

A ROBS plan is a withdrawal from a 401 that is transferred into a businesss new retirement account. This withdrawal should be more than $50,000, and it is not subject to penalties or income taxes. Many entrepreneurs consider this option as an alternative to going into debt through traditional business loans. A ROBS requires more convoluted steps than a 401 loan.

What Are The Steps To Complete A Robs

Removing money from a retirement account requires careful consideration of the costs and a frank assessment of the risksbeyond those inherent in any new business venture. The bottom line is that startups need cash. Tapping your retirement savings is one way to get it.

Don’t Miss: How Does Taking Money Out Of 401k Work

Understanding The Rules For 401 Withdrawal After 59 1/2

-

Waives the 10% early withdrawal penalty

-

Allows retirees to forgo taking Required Minimum Distributions from a 401 in 2020.

A 401 is a type of investment account thats sponsored by employers. It lets employees contribute a portion of their salary before the IRS withholds funds for taxes, which allows interest to accumulate faster to increase the employees retirement funds. Now, if you have a 401, you could pay a penalty if you cash out your investment account before you turn 59 ½. Heres some more information about the rules you need to follow to maximize your 401 benefits after you turn 59 ½.

What Is A Robs & How Does It Work

A rollover for business startups is a way for prospective business owners to use retirement funds to pay for the startup and initial operating costs of a new business without taking out a business loan. A ROBS can also be used to purchase or invest in an existing business or franchise. A C corporation , which allows for shareholders, is established and a new 401 plan is set up.

The prospective business owners retirement funds are used to purchase stock in the new company, with the proceeds from the sale of stock used to fund the new or purchased business. This option is preferred to borrowing against an existing 401 or IRA because of the interest and penalties that would be assessed and the short-term nature of many 401 and IRA loans.

You May Like: Can I Sign Up For 401k Anytime

Making A Hardship Withdrawal

Depending on the terms of your plan, however, you may be eligible to take early distributions from your 401 without incurring a penalty, as long as you meet certain criteria. This type of penalty-free withdrawal is called a hardship distribution, and it requires that you have an immediate and heavy financial burden that you otherwise couldn’t afford to pay.

The practical necessity of the expense is taken into account, as are your other assets, such as savings or investment account balances and cash-value insurance policies, as well as the possible availability of other financing sources.

What qualifies as “hardship”? Certainly not discretionary expenses like buying a new boat or getting a nose job. Instead, think along the lines of the following:

- Essential medical expenses for treatment and care

- Home-buying expenses for a principal residence

- Up to 12 months worth of educational tuition and fees

- Expenses to prevent being foreclosed on or evicted

- Burial or funeral expenses

- Certain expenses to repair casualty losses to a principal residence

The home-buying expenses part is a bit of a gray area. But generally, it qualifies if the money is for a down payment or for closing costs.

Can You Invest In Real Estate Through Your 401k

If you have a 401k plan through your employer, the answer is probably no — at least not directly. I have yet to find an employer-sponsored retirement plan that allows participants to buy investment properties or participate in crowdfunded real estate investments.

The only possibility of even putting money to work in real estate indirectly in an employer-sponsored 401k would be if there’s a real estate investment fund on the plan’s menu of investment options. For example, the Vanguard Real Estate Index Fund might be one of the funds offered by your plan.

You May Like: How To Find 401k From An Old Employer

Early Money: Take Advantage Of The Age 55 Rule

If you retireor lose your jobwhen you are age 55 but not yet 59½, you can avoid the 10% early withdrawal penalty for taking money out of your 401. However, this only applies to the 401 from the employer you just left. Money that is still in an earlier employer’s plan is not eligible for this exceptionnor is money in an individual retirement account .

If your account is between $1,000 and $5,000, your company is required to roll the funds into an IRA if it forces you out of the plan.

How Much Money Can You Use

One of the major differences between a 401 loan and a ROBS is the amount of money you can use. With a 401 loan, $50,000 is the maximum you can borrow. With a ROBS, on the other hand, $50,000 is the minimum you have to take out of your retirement account. Therefore, your choice between these two 401 business financing options will largely depend on the amount of money that you have in your retirement account and the percentage that youre willing to put toward your business.

Read Also: How Do I Know If I Have A 401k

How To Start Making Money Using Your 401k

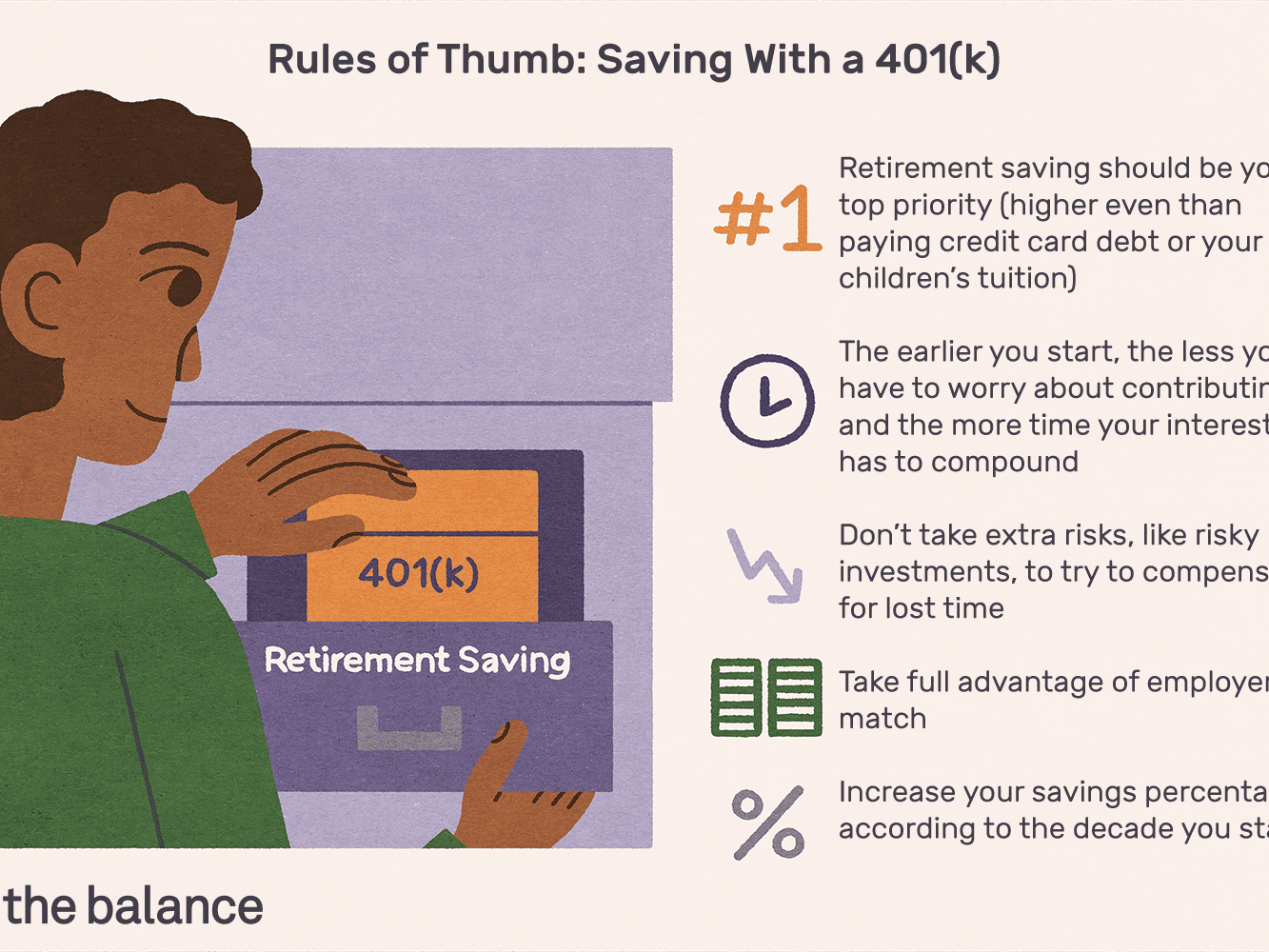

15 ways to make more money in your 401 Save as early in your working life as you can. Save more. Take advantage of the Roth variations of your 401 and IRA, especially in your early working years when you may not be in a high tax bracket. Whatever else you do, be sure that your contributions to your retirement plan are enough to get the full benefit of your companys matching funds.

The Millionacres Bottom Line

To sum it up, you can’t purchase real estate directly with funds in an employer-sponsored 401k plan if you’re still an active participant in the plan. However, if you have money in a former employer’s 401k plan or are self-employed, there are some good options that can allow you to put your retirement savings to work in investment properties and other types of real estate investments.

Also Check: How To Invest In A 401k For Dummies

What’s The Cost Of A Robs

ROBS providers charge a one-time, upfront fee and an ongoing administration fee. The one-time fee, which typically comes to around $5,000, covers C-corp and retirement plan setup and issuing the stock certificates. The ongoing administration fee, which is approximately $100 to $150 per month, ensures that youre in compliance with any rules around retirement plan administration. If you use a professional service to help you set up a ROBS, youll then pay any associated fees for their assistance throughout the process.

How To Use Your 401 To Start A Business

If you plan on using a 401 to start a business, youll want to first consider the risk involved with utilizing your retirement savings for business financing. If you do decide this is the right option for you, you have three options for 401 business financing. If youre eligible, you can either use a 401 business loan, you can use rollovers as business startups , or you can take a distribution from your retirement account.

We dont have to tell you that financing your business is one of the biggest challenges of entrepreneurship, whether youre just starting out or looking to grow or buy an existing company. Although business loans work for many entrepreneurs, you might not like the idea of taking on debt, especially if you have funds of your own that you can bring to the business. In this case, however, the problem is that most people have personal savings tied up in investments or retirement accounts like 401s and individual retirement accounts .

If you have one of these retirement accounts, you might then be wondering how to use your 401 to start a business. Fortunately, there are ways to take cash out of a retirement account and invest the money in your business, though there is substantial risk involved.

Don’t Miss: How To Get Your 401k Without Penalty

Robs Vs Retirement Plan Loans

All of this being said, however, one of the biggest and most important differences between a retirement plan loan and a ROBS is that a ROBS isnt a loan. The appeal of a ROBS, then, is that by using one you wont have any debt to pay backânot to yourself and not to a third party.

However, just as is the case with 401 loans, using a ROBS poses the risk of losing retirement funds. If you roll over money into your business and the business doesnt do well, you could lose your retirement savings. Plus, since theres no ceiling on the amount of money you can use with a ROBS, that actually creates greater risk. If your business doesnt do well, you could potentially lose all of your retirement savings, not just a subset.

Moreover, there are other disadvantages that are unique to a ROBS: Setting up a C-corp and a new retirement plan isnt simple, you need to comply with numerous legal rules to avoid hefty tax penalties, and theres a slightly elevated risk of an IRS audit when you do a ROBS.

Not Filing Form 5500 Or Form 1120

Many ROBS sponsors did not understand that a qualified plan is a separate entity with its own set of requirements. Promoters incorrectly advised some sponsors they did not have an annual return filing requirement because of a special exception in the Form 5500-EZ instructions for one-participant plans. The exception applies when plan assets are less than a specified dollar amount and the plan covers only an individual, or an individual and his or her spouse, who wholly own a trade or business. In a ROBS arrangement, however, the plan, through its company stock investments, rather than the individual, owns the trade or business. Therefore, this filing exception does not apply to a ROBS plan, and the annual Form 5500 is still required.

You May Like: How Do You Withdraw Money From A 401k

Robs Compliance & Audits

ROBS plans are held to compliance standards with the IRS and the United States Department of Labor, and ROBS plans may be audited. Those plans not in compliance with government regulations could face tax penalties and fines.

While the risk of an audit is rather low, an audit by the government will check for the following:

- That the retirement plan was set up correctly: Also, that your business is set up in the correct corporate structure .

- All annual filings have been completed and submitted: Among these is IRS Form 5500.

- You meet all employee requirements: This means you are an employee of the organization, providing eligible employees access to the companys retirement plan, and all necessary plan documents are provided to your employees.

Using a ROBS provider will provide you the needed support in ensuring you are meeting compliance requirements.

Is Your 401 Protected If Your Employer Goes Out Of Business

If you invest in your company’s 401 plan, you know that your pre-tax savings comes out of your paycheck each period and is invested in one or more investment vehicles, usually mutual funds. But you may wonder if your employer ever sees any of that money, other than any contribution it may provide. Very simply, your employer is not legally allowed to hold your 401 money. Under federal law, all 401 money must be held in a trust or in an insurance contract that’s separate from your employer’s assets. Therefore, neither your employer nor any of your employer’s creditors can grab that 401 money.

That said, there are certain circumstances in which you may not receive all the funds you expected if your employer goes out of business.

Recommended Reading: How To Cash Out Nationwide 401k

What Are Robs And How Can You Use Them To Fund Your Business

Starting a business requires cash. The problem is that few entrepreneurs have a ready supply handy.

If you’re looking to fund your new venture, you have several options. Yes, you can borrow from the bank or find investors, but you’ll be starting your business in debt. But did you know you may be sitting on a pile of cash, which can allow you to start your business cash-rich and debt-free? If you have money in a qualified retirement plan, you are and can with a process known as ROBS .

What Are ROBS?

With a ROBS plan, you withdraw money from your 401 or other tax-advantaged retirement fund to finance your new business venture. Normally, if you withdraw money from one of these accounts before the age of 59 1/2, you’ll pay both income taxes and an early withdrawal penalty. In the example below, your $200k retirement plan, once subjected to penalties and taxes, leaves you with $120k to use for your new business.

ROBS is a particular program election that allows you to use these funds without the income tax or withdrawal penalty. That means, the entire $200k is available to use. You can use ROBS to start a new business or to purchase an existing business. The money from your qualified retirement plan is not a loan, so you don’t begin your business in debt.

However, you should be aware of both the pros and cons of using a ROBS before you make your choice.

The Pros and Cons of Using ROBS

How ROBS Funding Works