New & Outstanding Disaster Loans:

- Loan payment dates that are due between the disaster event date and ending 180 days after the disaster period may be delayed.

- Loan repayments may be delayed for one year , with the loans term extended by the period of the delay.

- Loan balances will continue to accrue interest during this delayed timeframe.

- The max 5-year loan term is disregarded for outstanding loans deferring payment for 1 year.

A Deeper Dive On The 401 Loan Option

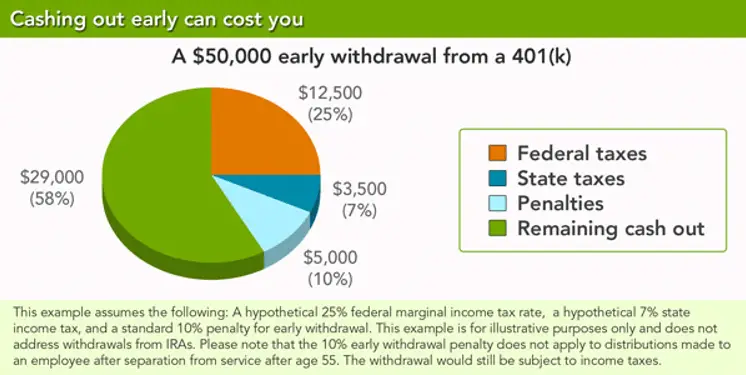

A loan is more strategic than a withdrawal, which torpedoes your savings altogether. With a full cash-out, instantly you lose a big chunk, paying a 10% penalty to the IRS if you leave the plan under age 55 plus another 20% for federal taxes. For instance, with a $50,000 withdrawal, you may keep just $32,500 and pay $17,500 in state and federal taxes. And the leftover sum you receive, if you happen to be in a higher tax bracket, may nudge you into paying even more taxes for that additional annual income.

Another adjustment in 2020 for workers affected by COVID-19: If your plan allows or through your IRA, you can withdraw up to $100,000 without the 10% penalty even if youre younger than 59½. The standard 20% federal tax withholding does not apply, but 10% withholding will unless you decide otherwise. You also can spread your income tax payments on the withdrawal over three years.

We understand emergencies can leave people with limited choices. Just remember that even the less extreme option of a 401 loan may paint your future self into a corner. The most severe impact of a 401 loan or withdrawal isnt the immediate penalties but how it interrupts the power of compound interest to grow your retirement savings.

At the very least, dont start stacking loans . Some employer retirement plans allow as many as three.

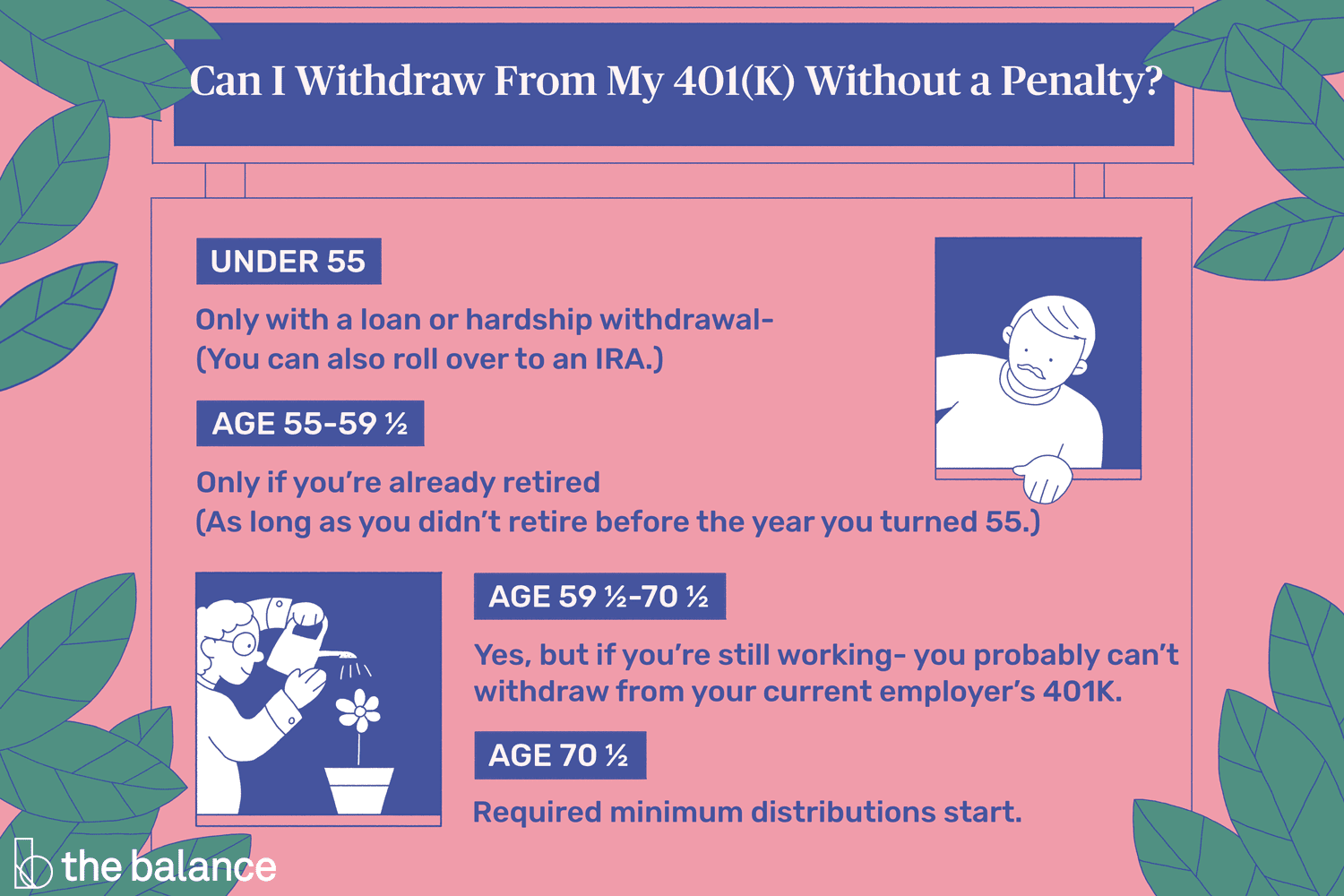

What Reasons Can You Withdraw From 401k Without Penalty

Qualifying medical expenses: If your expenses exceed a certain percentage of your adjusted gross income, you can withdraw funds penalty -free to cover them. Qualified domestic relations order: If a court orders you to give 401 funds to a spouse or dependent, you can withdraw the money penalty -free.

Recommended Reading: Can You Invest In 401k And Roth Ira

Is Borrowing From 401k A Good Idea

Key Takeaways. When done for the right reasons, taking a short-term 401 loan and paying it back on schedule isnt necessarily a bad idea. Reasons to borrow from your 401 include speed and convenience, repayment flexibility, cost advantage, and potential benefits to your retirement savings in a down market.

Should You Take A Distribution From Your 401 Or Ira

Like the CARES Act, the Consolidated Appropriations Act allows you to withdraw funds from both a 401 and an IRA, as long as the amount is up to $100,000 across all accounts. If you are deciding whether to take a distribution from either your IRA or a 401, think about factors such as each of the account’s typical rules around penalties and taxes. F

Also Check: How Do Companies Match 401k

When Can You Withdraw From Your 401

Were here to help! First and foremost, SoFi Learn strives to be a beneficial resource to you as you navigate your financial journey.Read moreWe develop content that covers a variety of financial topics. Sometimes, that content may include information about products, features, or services that SoFi does not provide.We aim to break down complicated concepts, loop you in on the latest trends, and keep you up-to-date on the stuff you can use to help get your money right.Read less

If youre the kind of take-charge retirement planner whos diligently contributing to a 401 fund, receiving matching contributions from your employer, and watching your savings start to stack, you might find yourself wondering When can I withdraw from my 401 account?

The answer depends on a number of factors including your age, whether youre still working or already retired, if you qualify for a hardship withdrawal, whether it makes sense to take out a 401 loan, or rollover your 401 into another account.

Are You Still Working

You can access funds from an old 401 plan after you reach age 59 1/2 if you’re still working, but you may not have the same access to the funds at the company for which you currently work if you’ve changed jobs.

Check with your 401 plan administrator to find out whether your plan allows what’s referred to as an in-service distribution at age 59 1/2. Some 401 plans allow this, but others don’t.

Read Also: How Much To Invest In 401k To Be A Millionaire

Loan Or 401 Withdrawal

While similar, a 401 loan and 401 withdrawal aren’t interchangeable and have a few key differences. While you can use either to access up to $100,000 of your retirement funds penalty- and tax-free as part of the Consolidated Appropriations Act, they each have their own rules.

As part of a 401 withdrawal:

- Repayment isn’t required.

- There’s no withdrawal penalty.

- Distribution will be taxed as income, but you can pay it back within three years and claim a refund.

As part of a 401 loan:

- You must repay the loan within a specified time frame .

- The loan amount isn’t taxed initially, and there’s no penalty. If you can’t pay it back within the specified time frame, the outstanding balance is taxed and you’ll also be assessed a 10 percent early withdrawal penalty, if you are under age 59 1/2.

- If you leave your job, you have until mid-October of the following year to offset the outstanding loan amount. Otherwise, you could owe 401 early withdrawal taxes and penalties.

Work with your plan sponsor to learn more about the pros and cons of a 401 withdrawal vs. 401 loan.

What Type Of Situation Qualifies As A Hardship

The following limited number of situations rise to the level of hardship, as defined by Congress:

- Unreimbursed medical expenses for you, your spouse or dependents

- Payments necessary to prevent eviction from your home or foreclosure on a mortgage of principal residence.

- Funeral or burial expenses for a parent, spouse, child or other dependent

- Purchase of a principal residence or to pay for certain expenses for the repair of damage to a principal residence

- Payment of college tuition and related educational costs for the next 12 months for you, your spouse, dependents or non-dependent children

Your plan may or may not limit withdrawals to the employee contributions only. Some plans exclude income earned and or employer matching contributions from being part of a hardship withdrawal.

In addition, IRS rules state that you can only withdraw what you need to cover your hardship situation, though the total amount requested may include any amounts necessary to pay federal, state or local income taxes or penalties reasonably anticipated to result from the distribution.

A 401 plan even if it allows for hardship withdrawals can require that the employee exhaust all other financial resources, including the availability of 401 loans, before permitting a hardship withdrawal, says Paul Porretta, a compensation and benefits attorney at Troutman Pepper in New York.

Don’t Miss: Should I Transfer My 401k To A Roth Ira

How To Boost Your Retirement Savings

DON’T know where to start? Here are some tips on how to get going.

- Understand where you start: Before you consider your plans for tomorrow, you’ll need to understand where you stand today. Look into your current pension savings and research when youll be eligible for social security benefits, if at all.

- Take advantage of a 401k: The 401k plans are tax-effective accounts put you in a better place financially for your retirement. If you save, your employer may too.

- Take advantage of online planning tools: Financial provider Western & Southern Financial Group and comparison site Bankrate have tools that give you an idea of what your retirement income will be based on how much you’re saving.

- Find out if your workplace offers advice: Some employers offer sessions with financial advisers to help you plan for your future retirement.

With a Roth, employees make contributions with post-tax income but can make withdrawals tax-free.

Most employees can currently put in $19,500 a year of their own money in a 401k account, excluding employer contributions.

However, workers who are older than 50-years-old are eligible for an extra catch-up contribution of $6,500 in 2020 and 2021.

Cashing Out Your 401k While Still Employed

The first thing to know about cashing out a 401k account while still employed is that you cant do it, not if you are still employed at the company that sponsors the 401k.

You can take out a loan against it, but you cant simply withdraw the money.

If you resign or get fired, you can withdraw the money in your account, but again, there are penalties for doing so that should cause you to reconsider. You will be subject to 10% early withdrawal penalty and the money will be taxed as regular income. Also, your employer must withhold 20% of the amount you cash out for tax purposes.

There are some exceptions to the rule that eliminate penalties, but they are very specific:

- You are over 55

- You are permanently disabled

- The money is needed for medical expenses that exceed 10% of your adjusted gross income

- You intend to cash out via a series of substantially equal payments over the rest of your life

- You are a qualified military reservist called to active duty

Recommended Reading: Can You Have Your Own 401k

Tips For Planning Your Retirement

- Switching from saving for retirement to spending your nest egg is a tough transition. A financial advisor can help you figure out which accounts to draw down first, when to start taking Social Security and more. Finding a qualified financial advisor doesnt have to be hard. SmartAssets free tool matches you with up to three financial advisors in your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- If the idea of a protected stream of income that you cant outlive sounds good, you may want to look into buying an annuity. These insurance products are pretty complex though, and theres a wide variety and selection. In other words, youll want to do your homework. You can start by reading up on the pros and cons.

Circumstances When You Can Withdraw From A 401k If You Have An Outstanding Loan

Each 401 plan has different rules on 401 loans and 401 withdrawals. If your employerâs 401 plan allows employees to tap into their retirement money, you may be required to provide some proof to document that you are in an urgent financial need to get approved. The approval process is rigorous since allowing frivolous withdrawals puts the 401 plan at risk of losing its tax-favored status.

Some of the circumstances when you could withdraw money from your 401 plan if you have an unpaid loan include:

Roll Over 401 If You Have an Outstanding Loan

If you terminate employment with an outstanding 401 loan, you can rollover the money to an IRA or new employerâs 401. As long as the loan repayment was in good standing, the employer will rollover your retirement money net of the outstanding 401 loan. You will have until the tax due date to pay off the 401 loan balance.

For example, assume that you have a $50,000 vested 401 balance, including an outstanding 401 loan of $15,000. If you quit your job and request the plan sponsor to rollover the retirement savings to your new IRA, the plan sponsor will reduce the vested 401 balance by the $15,000 outstanding loan, and disburse the remaining $35,000 to your IRA. You will then have until the tax due date to come up with the $15,000 outstanding loan, after which you can rollover the $15,000 401 balance to your IRA.

Cash out 401 with an Outstanding Loan

Take a Second loan with an Outstanding Balance

Tags

Also Check: How Does Taking Money Out Of 401k Work

The 401 Withdrawal Rules For People Between 55 And 59

Most of the time, anyone who withdraws from their 401 before they reach 59 ½ will have to pay a 10% penalty as well as their regular income tax. However, you can withdraw your savings without a penalty at age 55 in some circumstances. You cannot be a current employee of the company that runs the 401, and you must have left that employer during or after the calendar year in which you turned 55. Many people call this the Rule of 55.

If youre between 55 and 59 ½ years old and you are considering a 401k withdrawal from an old employer, you should keep a few things in mind. For starters, doesnt matter why your employment stopped. Whether you quit, you were fired, or you were laid off, you can qualify for a penalty-free withdrawal. However, you need to meet the age requirement and your employment must end in the calendar year you turn 55 or later.

These rules for early 401 withdrawal only apply to assets in 401 plans maintained by former employers. The rules dont apply if youre still working for your employer. For example, an employee of Washington and Sons usually wont be able to make a penalty-free withdrawal before they turn 59 ½. However, the same employee can make a withdrawal from a former employers 401 account and avoid the penalty when he or she turns 55.

Withdrawals Before Age 59 1/2

Any withdrawal made from your 401 will be treated as taxable income and subject to income taxes in the year in which you made it, before or after retirement. But you’ll also be subject to a 10% early distribution penalty if you’re younger than age 59 1/2 at the time you take the withdrawal.

These taxes and penalties can add up and can nearly cut the value of your original withdrawal in half in some cases.

You can avoid these taxes and the penalty with a trustee-to-trustee transfer. This involves rolling over some or all of your 401 assets into another qualified account. You might consider a 401 loan if you want to access your account’s assets because of financial hardship.

You can take a penalty-free withdrawal from your 401 before reaching age 59 1/2 for a few reasons, however:

- You pass away, and the account’s balance is withdrawn by your beneficiary.

- You become disabled.

- You begin “substantially equal periodic” withdrawals.

- Your withdrawal is the result of a Qualified Domestic Relations Order after a divorce.

- You’re at least 55 years old and have been laid off, fired, or quit your job, otherwise known as the “Rule of 55.”

Your distributions will still be taxed if you take the money for any of these reasons, but at least you’ll dodge the extra 10% penalty.

Read Also: How Much Will My 401k Grow If I Stop Contributing

The Rules For Accessing Your Money Are Determined By Your Employer’s Plan

Whether you can take regular withdrawals from your 401 plan when you retire depends on the rules for your employers plan. Two-thirds of large 401 plans allow retired participants to withdraw money in regularly scheduled installments — say, monthly or quarterly. About the same percentage of large plans allow retirees to take partial withdrawals whenever they want, according to the Plan Sponsor Council of America , a trade association for employer-sponsored retirement plans.

Other plans offer just two options: Leave the money in the plan without regular withdrawals, or take the entire amount in a lump sum. ‘s summary plan description, which lays out the rules, or call your company’s human resources office.) If those are your only choices, your best course is to roll your 401 into an IRA. That way, you won’t have to pay taxes on the money until you start taking withdrawals, and you can take money out whenever you need it or set up a regular schedule.

If your company’s 401 allows periodic withdrawals, ask about transaction fees, particularly if you plan to withdraw money frequently. About one-third of all 401 plans charge retired participants a transaction fee, averaging $52 per withdrawal, according to the PSCA.

You Can Only Withdraw From Your Current 401

Penalty-free early withdrawals are limited to funds held in your most recent companys 401 or 403 under the rule of 55.

Even if youre 55 or older, you cant reach back to old 401s and use that money, says Luber. Additionally, this rule doesnt apply to individual retirement accounts , so you need to leave your IRA alone if you want to avoid the penalty.

If youre actively planning how to retire early, Roger Whitney, certified financial planner and host of the Retirement Answer Man Show, suggests rolling retirement funds from old jobs and other retirement accounts into your current 401 before you leave. This way, you can get access to they money with the rule of 55.

Read Also: Can You Transfer Your 401k

Rules About 401 Loans

Another option open to employers is to allow 401 plan participants to borrow from their 401 accounts. You then repay the loan plus interest. Some plans recommend covering the interest by bumping up the pre-tax deferrals from your paycheck.

The good news about 401 loans is that they offer lower interest rates and dont require a credit check, unlike many other loans. The bad news is that if you leave your company voluntarily or involuntarily, the loan becomes due typically within 90 days, depending on your terms. If you cant repay the funds youve borrowed within that time frame, the IRS treats the money as income, taxes it as such and levies the 10% early withdrawal penalty.

While 401 loans that you repay on time dont come with the 10% IRS penalty, they do again- come with interest. Also, many companies wont allow you to contribute to your 401 while the loan is outstanding. Because of this, you lose the chance to contribute and take advantage of compound interest.