Vesting And Employer 401 Contributions

Some 401 plans include a vesting schedule for employer contributions. With vesting, you must wait for a period of time before taking ownership of the 401 contributions made by your employer.

Note that most 401 plans let you start contributing to your account as soon as you join the company. Contributions that you make to your 401 account are always considered fully vestedthey are always 100% owned by you. Extended vesting periods only cover employer contributions.

According to Vanguard, 40% of 401 participants were in plans with immediate vesting of employer matching contributions. Smaller plans, meaning plans with fewer participants, used longer vesting schedules, with employees only becoming fully vested after five or six years.

If you have a 401 and your employer matches your contributions, be sure to ask about the vesting schedule. If your plan has a vesting schedule, you dont own your employers contributions to your 401 until you are fully vested. If you take a new job before that point, you could lose some or even all of your employers 401 contributions.

Can You Negotiate 401k Match

When you negotiate a job offer, youre not just haggling over the number on your paycheck. The benefits and perks that come with your salary can make a big difference in terms of how much money you keep in your bank account each month. The same goes for dental, vision, 401 match, and other employee benefits.

What Are 401 Matching Contributions

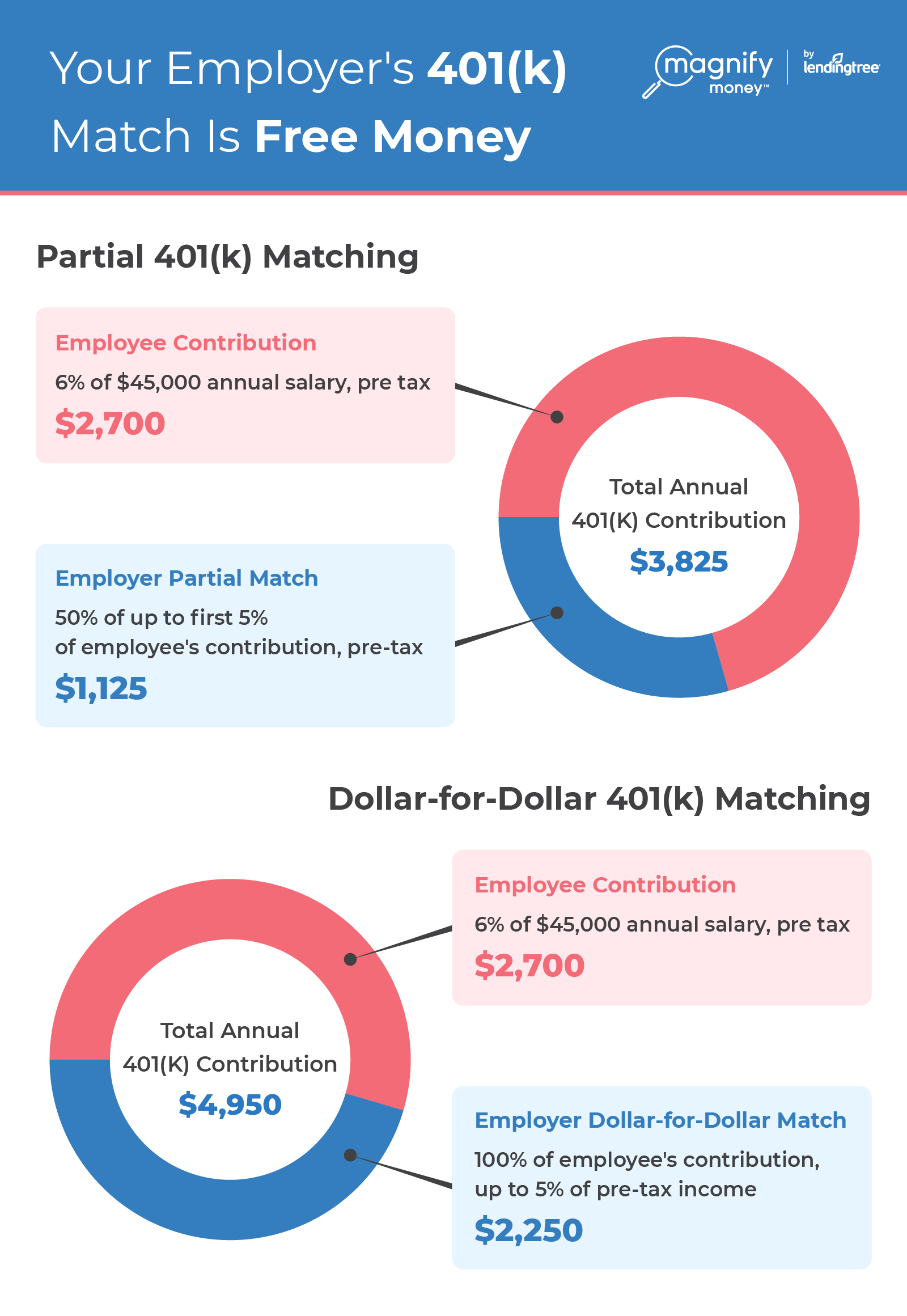

If your employer offers 401 matching contributions, that means they deposit money in your 401 account to match the contributions you make, up to a certain threshold. Depending on the terms of the 401 plan, an employer may choose to match your contributions dollar-for-dollar, or they may offer a partial match. Some employers may also make non-matching 401 contributions.

Matching contributions arent required by law, so not all employers offer them as part of their 401 plans. But according to Katie Taylor, vice president of thought leadership at Fidelity Investments, a 401 match can be a core employee benefit that helps an organization retain talent and build strong teams.

About 85% of the employers we work with offer some sort of matching contribution, said Taylor. The average employer contribution dollar amount into 401s in 2019 was $4,100, which equates to a little bit more than $1,000 per quarter.

Some 401 plans vest employer contributions over the course of several years. This means you must remain at the company for a set period of time before you fully take ownership of your employers matching contributions. Employers use vesting to incentivize employees to remain at the company. When you complete the schedule, you are said to be fully vested.

You May Like: Can You Borrow Money Against Your 401k

Whats This Whole Employer Match Vesting Thing

A lot of employers use a vesting schedule for their 401 matches. Its a way to help them hedge their bets on you as an employee by reducing the amount of money theyd lose if you were to leave the company. Its also meant to give you a shiny incentive to stay.

A vesting schedule determines how much of your employers matching contributions you actually own, based on how long youve worked there. For example, if your employer contributions vest gradually over four years, then 25% of your employer contributions belongs to you after youve been there one year, 50% belongs to you after two years, 75% belongs to you after three years, and theyre all yours once you hit your fourth work anniversary.

Theres another type of vesting schedule, called cliff vesting. This ones more of an all-or-nothing scenario. With a four-year cliff, 0% of the contributions are yours until you hit your fourth workiversary, then 100% of them are all yours, all at once.

All the contributions made after your vesting schedule ends are usually fully vested right away. Oh, and dont worry: 100% of the money you put in yourself is always fully vested.

Average 401k Match 2017

The average 401 match in 2017 was 4.5% of eligible employee compensation. A 2017 Vanguard Study titled âHow America Savesâ reported an increase in the average contributions to 4.7% up from 3.9% in 2015 and 3% during the financial crisis of 2007/08.

After the financial crisis, most companies reduced or suspended their 401 match when their earnings dropped. As revenue stabilized, employers increased their match to retain and attract the best talents, especially in competitive sectors. Most companies also introduced automatic enrollment for new hires as an inducement for employees to save for retirement.

Read Also: Can You Contribute To 401k And Roth Ira

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our reporters and editors focus on the points consumers care about most how to save for retirement, understanding the types of accounts, how to choose investments and more so you can feel confident when planning for your future.

How Much Can An Employer Contribute To A 401k In 2019

Every year, retirement plan contribution limits can change to account for inflation. In 2019, employer contribution maximums rose by $500 to $19,000 per employee. However, for those 50+, the catch-up contribution limit is the same, holding steady at $6,000.

If youre wondering about the employer and employee contribution limits, it increased $1,000 in 2019 to $56,000. However, if youre considered a highly compensated employee your minimum compensation increased to $125,000 this year.

Don’t Miss: How Do You Rollover Your 401k To A New Employer

What Is The Standard 401k Employer Contribution

Short answer There is no standard 401k employer contribution as companies can decide for themselves how much they will add to an employees plan. That said, market trends are emerging, and the data below can give you a sneak peek into how your contributions compare with those of your competitors. The Low Down on Contribution

No account yet? Register

Short answer

There is no standard 401k employer contribution as companies can decide for themselves how much they will add to an employees plan. That said, market trends are emerging, and the data below can give you a sneak peek into how your contributions compare with those of your competitors.

Why Do Employers Match 401s Anyways

401s and other defined contribution plans are more cost-effective for the employer than managing a traditional pension plan funded entirely by the company, and are also preferred by most private-sector employees.

While an employer match is not required by the IRS, this company match can be a selling point for recruiting employees particularly if competing firms are offering a generous 401 matching plan.

Employers also get tax benefits for contributing to 401 accounts employer matches can be deducted on their federal corporate income tax returns, and theyre often exempt from payroll taxes and state taxes as well.

Recommended Reading: How Much Money Should I Put In My 401k

Vesting On 401k Matching

Similar to other benefits at work, your employer wants to encourage you to stay. Some employers use the 401k to encourage retention by using a concept called vesting. Vesting on 401k matching means that you must stay at the company for a set period of time for the money to be yours if you decide to leave. Some 401ks dont have vesting requirements so its not an issue. For 401ks that do have vesting on 401k matching, the approach varies. For example, the 401k could have a graded scale that means for every year you stay more of the 401k is yours to keep no matter what. This eventually reaches 100%. Others decide to use a cliff vesting approach. In this approach, after you reach a number of years of service, 100% becomes yours to keep all at once. Keep in mind vesting can only apply to money your employer puts in, if at all. Money you put in is always yours to keep.

Example of one company’s approach to vesting

How We Approach Editorial Content

Maintaining independence and editorial freedom is essential to our mission of empowering investor success. We provide a platform for our authors to report on investments fairly, accurately, and from the investors point of view. We also respect individual opinionsthey represent the unvarnished thinking of our people and exacting analysis of our research processes. Our authors can publish views that we may or may not agree with, but they show their work, distinguish facts from opinions, and make sure their analysis is clear and in no way misleading or deceptive.

To further protect the integrity of our editorial content, we keep a strict separation between our sales teams and authors to remove any pressure or influence on our analyses and research.

Read our editorial policy to learn more about our process.

Don’t Miss: How Do I Get My 401k

Crank Up The Investments Available

- Contribute more Put a higher percentage of your income into your existing retirement plan. Since it lowers your taxable income, it may be cheaper than you think.

- Try other tax-deferred options Consider opening an individual retirement account if youve reached the maximum contribution level in your employer-sponsored plan.

- Consider getting taxed up front Money placed in a Roth IRA is taxed now, but qualified Roth earnings are never taxed. This can save you more money in the long run.

Timing Payments For Maximum Effect

Many employers match their contribution schedule to their employees contribution schedules. In other words, any pay period during which you make a tax-deferred contribution, your employer does, too. However, every employer is slightly different, and the plan manager in your company can help everyone optimize their contribution plans to maximize the employer match program.

Read Also: How To Withdraw Money From My Fidelity 401k

Negotiate Your Total Compensation With Levelsfyi

When applying for a job with Amazon, you need to consider Amazon’s 401k match and other company benefits. Even small differences in compensation can translate into significant differences in financial goals over the years.

The good news is you can use the salary negotiation service from Levels.fyi to negotiate the best mix of benefits and total compensation for your long-term wealth. Book your one-on-one consultation with our negotiation specialists today.

Get updates on salary trends, career tips, and more.

Understand The Value Of An Employer Match

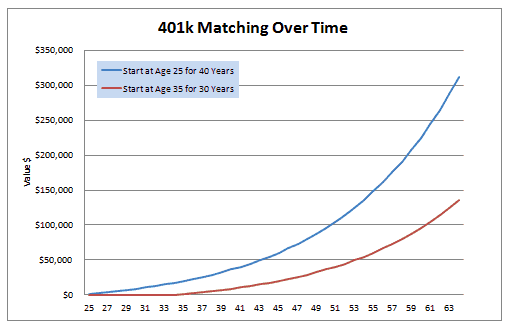

A 401 or similar employer-sponsored retirement plan can be a powerful resource for building a secure retirementand an employer match can add a substantial amount to your nest egg. Let’s assume you are 30 years old, make $40,000 and contribute 3 percent of your salary$1,200to your 401. And, for the sake of this example, let’s assume you continue to make the same salary and the same contribution each year until you are 65. After 35 years, you will have contributed $42,000 to your 401.

Now let’s assume you get a match from your employer. One of the most common matches is a dollar-for-dollar match up to 3 percent of the employee’s salary. Taking full advantage of the match literally doubles your savings, even assuming no increase in the value of your investments: Instead of having set aside $42,000 by the time you retire, you will have set aside $84,000, with $42,000 in free contributions. Look at it this way: it’s a no-cost way for you to increase your contributions by 100 percent.

In reality though, the impact will be even bigger than that. That’s because when you invest money its value compounds. Check out The Time Is Now: The True Value of Time for Young Investors to learn how taking full advantage of a match early in your career can add up.

Don’t Miss: What Is The Difference Between A Pension And A 401k

What If I Have A Roth 401

If you have a Roth 401, you pay income taxes on your contributions now, rather than when you take that money out during your retirement. But your employer isnt likely to pay the taxes on matching contributions , so if you have a Roth, their matching contributions usually go into a separate, traditional 401. Youll pay the taxes on the traditional when you withdraw the money.

Tips On Saving For Retirement

- If navigating 401 rules and other retirement topics sounds complicated, a financial advisor can help guide you. Finding the right financial advisor that fits your needs doesnt have to be hard. SmartAssets free tool matches you with financial advisors in your area in 5 minutes. If youre ready to be matched with local advisors that will help you achieve your financial goals, get started now.

- To branch out a bit more in your retirement savings, you can open an IRA. An IRA, or individual retirement account, isnt sponsored by your employer. You have to open and fund it entirely yourself, but the upside is that you have more investment options. Of course, you can get an advisor to manage your accounts for you, as well.

Read Also: How Do You Take Money Out Of 401k

How Does A 401k Benefit An Employer

Recruit and Retain. In todays workforce, its becoming the norm to expect certain benefits such as retirement and healthcare. From an employers perspective, offering a 401k can give you that extra edge to stand out amongst your competitors. Attractive benefits are now a must.

Incentivize Performance. Employers also have the ability to use retirement perks as incentives. Many organizations tie their contributions to specific goals, and when employees meet these benchmarks they are rewarded by increases in their 401k contribution. Depending on how you choose to structure your benefits program, they can be used to incentivize performance, which ultimately helps the company succeed.

Tax Perks. 401k plans also help the employer come tax season. Matched contributions and administrative work associated with the benefits plan are tax-deductible. Lower your tax burden with a company-wide 401k program.

These three perks are highly beneficial from a production and financial standpoint. Not to mention, a retirement program lets your staff know that you value their financial future. Showing you care can do wonders for company culture.

Getting The Most From Your Employer 401 Match

Getting the most from your 401 plan is one of the best things you can do when planning your retirement. That’s because your employer may match the money you put into your account. If you work at a place that offers a 401 match benefit, when you put money from your paycheck into your 401, your employer puts money into the account, too.

If your company offers a match, you may have gotten a notice about it when you started your job. You can ask the 401 plan manager at work whether a 401 match is offered if you haven’t already heard about it. Companies want employees to contribute to their 401, so they match the funds as a way to spur on workers to save for their futures.

Think of matching funds as free money you receive from your job after you make pre-tax contributions to your 401 plan from your paycheck. If you fail to put money into your 401, you give up the chance to receive your employer’s matching amount.

Recommended Reading: Where Can I Get A 401k Plan

What Is An Employer 401 Match

A 401 is an employer-sponsored, tax-advantaged retirement account. Employers can both host employee contributions and make contributions to these accounts. Employer match programs allow employers to make contributions to an employees plan based on factors such as the employees salary and the employees contributions.

Many employers match a portion of the employees own contributions up to a certain dollar amount or percentage, and this is a powerful incentive for small companies wanting to attract and retain good employees. However, employer matching contributions are optional and at the discretion of an employer. That said, the majority of employers do provide some type of match . The average employer match is 4.7% of an employees salary.

Once employers set the rules for a match program, employees have guidelines about when and how they can access the plan. These matches form part of an employees total compensation package, along with access to a 401 account program and other benefits. It is advisable that employees should consider a potential employers contribution plan when evaluating a job offer. In fact, 88% of workers say a 401 is a must-have when theyre looking for a new job.

Nice Jobcongratulations On Taking Advantage Of Your Company’s Employer Match To See How Your Money Is Going To Grow Over Time Try Out Our Compounding Calculator

This calculator is intended as an educational tool only. John Hancock will not be liable for any damages arising from the use or misuse of this calculator or from any errors or omission in the same.

Employer match is not available for all plans. See your Summary Plan Description for availability and information about your employer’s vesting schedule.

John Hancock Retirement Plan Services ⢠200 Berkeley Street ⢠Boston, MA 02116

NOT FDIC INSURED. MAY LOSE VALUE. NOT BANK GUARANTEED

Don’t Miss: How To Get My 401k Early

Annual Limits For An Employers 401 Match

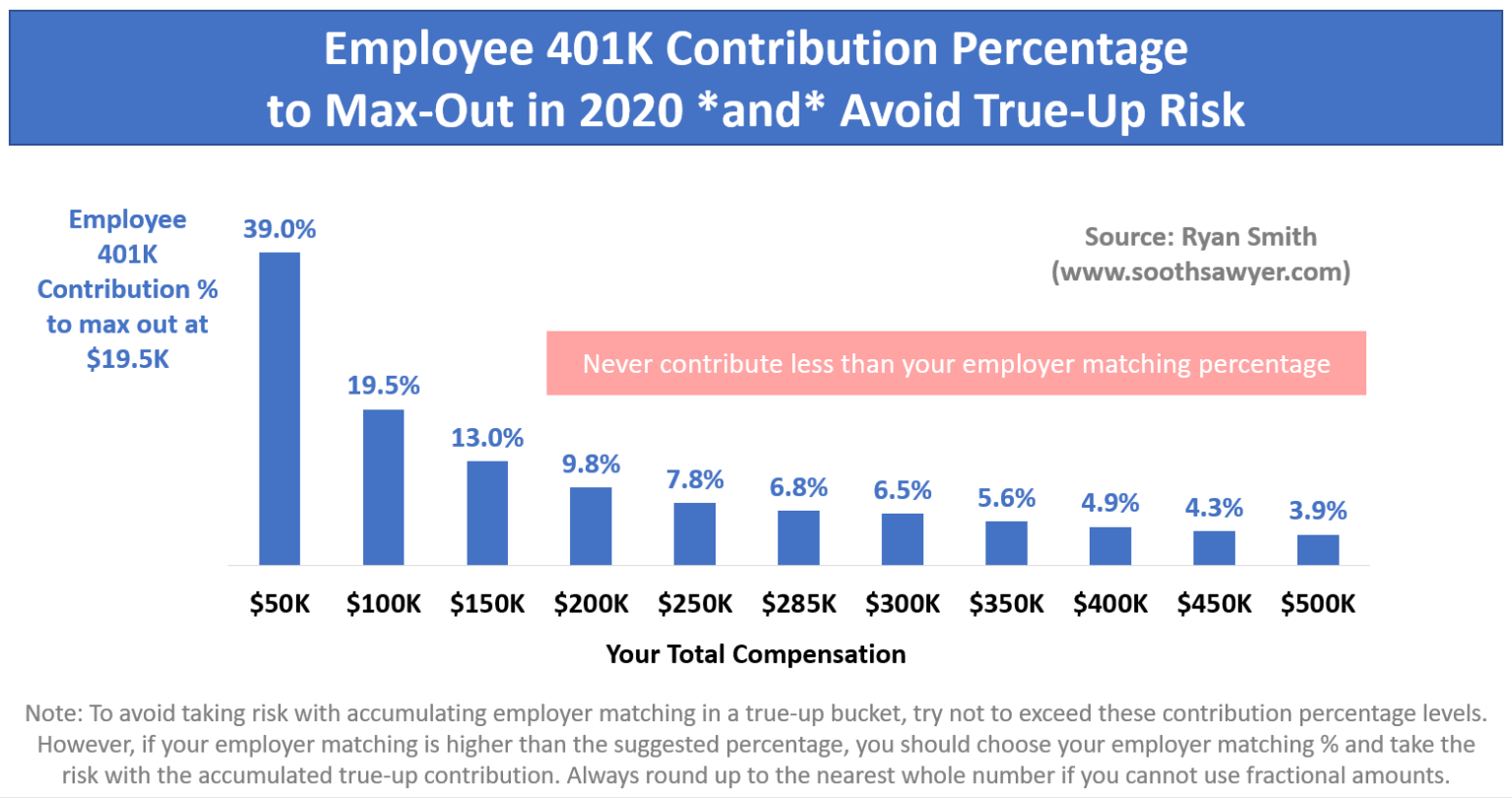

The 2020 and 2021 annual limit on employee elective deferralsthe maximum you can contribute to your 401 from your own salaryis $19,500. The 2020 annual limit for all 401 contributions, including an employers 401 match and your elective deferrals, is 100% of your annual compensation or $57,000, whichever is less. In 2021, this total rises to the lower of $58,000 or 100% of your compensation.

Considering that surveys suggest many Americans dont have enough money saved for retirement, meeting or exceeding the amount needed to gain your employers full 401 matching contribution should be a key plank in your retirement savings strategy.

Taking into account the power of compounding and a 6% annual rate of return, contributing enough to receive the full employer match could possibly be the difference between retiring at 60 versus 65, said Young.

Use Fidelitys 401 match calculator to find out how matching contributions can impact your retirement savings.