Should You Roll Over Your 401

To start, its worth knowing that you dont have to make a 401-to-IRA rollover, even if you do leave your job. You have the option of leaving the money youve invested in the plan at your old company. You cant keep contributing to it, but it will stay invested and if your investments go up, youll continue to see your account grow. This is called an orphan account.

Do you like the way your money is invested currently? If so, you may want to consider keeping your money in the existing plan. If you currently arent working but anticipate taking a new job soon, you could leave your money at your old plan temporarily and put it into your new companys plan once you have access to it.

For those who dont think theyll end up in another 401 plan but still want to save more for retirement, it might make sense to do a 401-to-IRA rollover. Remember, even though you still have your account at your old companys 401, you wont have the ability to make more contributions.

Will Taxes Be Withheld From My Distribution

- IRAs: An IRA distribution paid to you is subject to 10% withholding unless you elect out of withholding or choose to have a different amount withheld. You can avoid withholding taxes if you choose to do a trustee-to-trustee transfer to another IRA.

- Retirement plans: A retirement plan distribution paid to you is subject to mandatory withholding of 20%, even if you intend to roll it over later. Withholding does not apply if you roll over the amount directly to another retirement plan or to an IRA. A distribution sent to you in the form of a check payable to the receiving plan or IRA is not subject to withholding.

How Do I Complete A Rollover

Recommended Reading: How To Take Out 401k Money For House

You Get More Investment Options

In a 401 plan, your mutual fund investment options can be limited, points out Dominique Henderson, CFP, founder of DJH Capital Management.

Often you have between six and 24 fund choices in a 401, Henderson says. With an IRA, you can choose individual stocks as well as fundsand even use alternative investments. Alternative investments can include everything from real estate to bitcoin.

If you move your retirement funds into an IRA, you get a very broad menu of investment choices and more control over how your money is invested.

Roll It Over To An Ira

This option makes sense if you want to roll over your 401 and you want to avoid a taxable event. If you have an existing IRA, you may be able to consolidate all of your IRAs in one place. And an IRA gives you many investment options, including low-cost mutual funds and ETFs.

There are plenty of mutual fund companies and brokerages that offer no-load mutual funds and commission-free ETFs, says Greg McBride, CFA, Bankrate chief financial analyst.

You also want to just make sure that youre satisfying any account minimums so that you dont get dinged for an account maintenance fee for having a low balance, McBride says. Index funds will have the lowest expense ratios. So theres a way that you can really cut out a lot of the unnecessary fees.

Check with your IRA institution first to ensure that it will accept the kind of rollover that you would like to make.

The letter of the law says it is OK . But in practice, your 401 plan may not allow it,says Michael Landsberg, CPA/PFS, member of the American Institute of CPAs Personal Financial Planning Executive Committee.

You May Like: How Long Does A 401k Rollover Take

How To Reduce The Tax Hit

Now, if you contributed more than the maximum deductible amount to your 401, you’ve got some post-tax money in there. You may be able to avoid some immediate taxes by allocating the after-tax funds in your retirement plan to a Roth IRA and the pre-tax funds to a traditional IRA.

Alternatively, you can choose to split up your retirement money into two accounts, one a traditional IRA and the other a Roth IRA. That will reduce the immediate tax impact.

This is going to take some numbers-crunching. You should see a competent tax accountant or tax attorney to determine exactly how the alternatives will affect your tax bill for the year.

However, consider the long-term benefit: When you retire and withdraw the money from the Roth IRA, you will not owe taxes. There is another reason to think long term, which is the five-year rule explained later.

Saving Tips For Retirement

- Need help planning for retirement? Talk with a financial advisor about your goals. SmartAssets financial advisor tool can match you with up to three local financial advisors, and you can choose the one who is best for you. If youre ready, get started now.

- Take advantage of any 401 match that your employer offers. Be sure to contribute enough to your 401 to qualify for the matching funds. See if youre on track to save enough for retirement by using SmartAssets 401 calculator.

Also Check: How To Grow 401k Fast

Do I Have To Pay Taxes When Rolling Over A 401

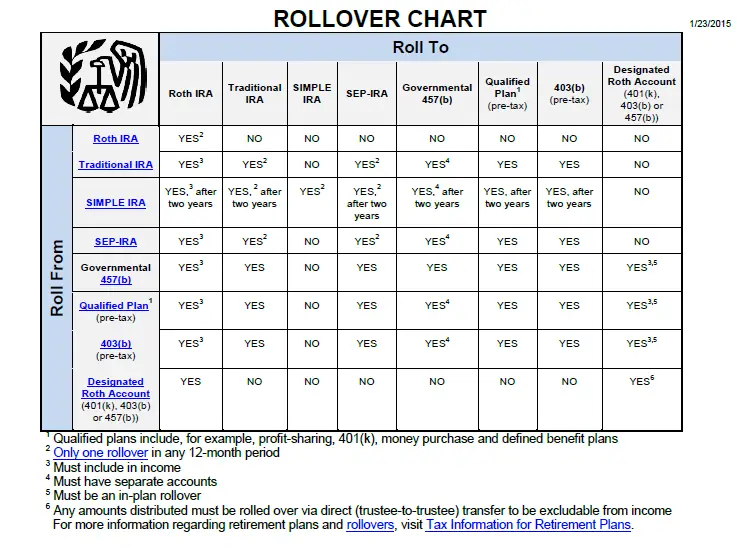

Whether you owe taxes on a rollover depends on whether youre changing account types . Generally, if you move a traditional 401 account to a Roth IRA, you could create a tax liability. Here are a few scenarios:

- If youre rolling over money from a traditional 401 to another traditional 401 or traditional IRA, you wont create a tax liability.

- If youre rolling over a Roth 401 to another Roth 401 or Roth IRA, you wont create a tax liability.

- However, if youre rolling a traditional 401 into a Roth IRA, you could create a tax liability.

Its also important to know that if you have a Roth 401 that has any employer matching funds in it, those matching funds are categorized as a traditional 401 contribution. So if you transfer a Roth 401 with matching funds into an IRA, youll need to create two IRA accounts a traditional IRA and a Roth IRA to avoid any tax issues during the rollover.

Of course, youll still need to abide by the 60-day rule on rollovers. That is, you have 60 days from the date you receive a retirement plan distribution to roll it over into another plan, according to the IRS. Taxes generally arent withheld from the transfer amount, and this may be processed with a check made payable to your new qualified plan or IRA account.

Sign up for Bankrates myMoney today to track your finances in one place.

Can I Roll Over A Portion Of My 401

There a few limited circumstances where a partial 401 rollover makes sense.

There are a few different investment options for retirement that most of you are using, such as traditional IRAs, Roth IRAs, and employer-sponsored 401 retirement plans.

These retirement plans allow you to squirrel away pre-tax money. When you take it out after you retire, the money is taxed at your current tax bracket rate, which will be presumably lower than your tax bracket while working .

Not all your retirement savings have to be in the same place and there are certainly tax benefits to mixing your retirement accounts across a mix of pre-tax and post-tax options.

Lots of people ask what they should do with an old 401 when they change jobs. Some people leave the 401 with the previous employer while others choose to move the old 401 to the new employer.

But what if you only want to rollover a portion of the money? Can you do that? Lets find out.

You May Like: How To Find Lost 401k

The Drawbacks Of Rolling Over An Ira To A 401

There are some reasons investors may hesitate to roll over IRA funds into a 401.

- Higher management fees. 401 plans tend to have higher management fees, which usually include both investment and administrative fees. In some cases, additional consulting fees for financial advisor services may also be tied to a 401 plan. Many investors may not even know the fees theyâre being charged, but will have little to no choice since the employer chose the plan. With an IRA, investors can choose any brokerage or robo-advisor they want.

- Fewer investment options. Most employer 401 plans have a limited number of investments from which to choose. Target-date funds are common and come with preselected asset allocations based on when an investor expects to retire. 401 account holders usually canât invest in stocks, and ETFs and mutual funds are likely to be limited. â

- Fewer penalty-free early withdrawals. 401s and IRAs both provide several exceptions for early withdrawal penalties. In some cases, investors can avoid the 10% penalty on withdrawals for things like unreimbursed medical expenses , court-ordered alimony, or child support. With an IRA, investors get access to two additional exceptions: qualified higher education expenses and buying a home the first time .

Can You Transfer A 401 To An Ira While Youre Still Employed

Home » IRA » Can You Transfer a 401 to an IRA While Youre Still Employed?

Thousands of Americans wonder the same thing: Can I transfer my 401 to an IRA if Im still with my current employer? Yes, theres a good chance you can.

While most people think about transferring their 401 after they leave a job, its actually something you might be able to do while youre still in that joband doing so could offer some attractive asset options. Learn when it makes sense to roll some of your 401 into an IRA while still employed, along with the advantages.

Recommended Reading: Can Anyone Open A 401k

Can I Keep The Same Funds I Have In My Retirement Plan

This depends on your plan. First, you’ll want to reach out to your provider to determine if moving the assets over “in-kind” or “as is” could be an option for you.

If it is an option, then you’ll want to contact us at 877-662-7447 . One of our rollover specialists can help determine if we can hold your current investments here at Vanguard.

If it isn’t an option, don’t worrywe can still help you choose new investments once your assets have arrived here at Vanguard.

Reasons You May Want To Roll Over Now

- Diversification. Investment options in your 401 can be limited and are selected by the plan sponsor. Rolling your funds over into an IRA can often broaden your choice of investments. More choices can mean more diversification in your retirement portfolio and the opportunity to invest in a wider range of asset classes including individual stocks and bonds, managed accounts, REITs and annuities.

- Beneficiary flexibility. With some IRAs, you may be able to name multiple and contingent beneficiaries or name a trust as the beneficiary. Other IRAs may allow you to impose restrictions on beneficiaries. These options aren’t usually available with 401s. But, keep in mind, not all IRA custodians have the same rules about beneficiaries so be sure to check carefully.

- Ownership control. You are the owner and have access rights with an IRA. The assets in your IRA are also not subject to blackout periods. With a 401 plan, the qualified plan trustee owns the assets and assets may be subject to blackout periods in which account access is limited.

- Distribution options. If your IRA is set up as a Roth IRA, there is not a set age when the owner is required to take minimum distributions. With 401 plans and traditional IRAs, the owner will have to take required minimum distributions by April 1 of the year after they turn age 72.

Recommended Reading: Why Cant I Take Money Out Of My 401k

What Are The Tax Implications Of An Ira Rollover

401 and 403 contributions are pre-tax contributions, which means that if you begin to accept distributions from these accounts in retirement, you will have to pay taxes on them. However, until that time comes, you do not have to pay taxes, which means that the rollover can be tax-free if you roll the funds into a new tax-deferred account . However, if the rollover process involves accepting a check from the institution managing your 401, the IRS will withhold taxes ranging between 10-20 percent, depending on the type of account you are rolling over from. You must also cash the check within 60 days, otherwise, the IRS will treat the rollover as a taxable distribution, such as the ones you take in retirement.

What Are The Advantages Of Rolling Over A 401 To An Ira

Doing a 401 rollover to an IRA offers perks that can include more diverse investment selections than a typical 401 plan, perhaps cheaper investments and lower account fees. It’s also a way to keep your retirement funds organized and ensure you have easy access to them. And while some 401 plans pass account management fees along to the employees, many IRAs charge no account fees.

In summary, it’s a good way to save money, stay organized and make your money work harder.

Recommended Reading: Can You Withdraw Your 401k If You Quit Your Job

You May Be Charged Lower Fees

In 2016, a comprehensive study of annual fees by Employee Fiduciary found that the average 401 participant paid 2.2% of their balance as administrative and fund fees. While some plans had combined fund and administrative fees as low as 0.2%, others charged as much as 5%.

Check with your old 401 provider to see what fees you may owe them annually. By comparing fees, you can figure out if you would save money with an IRA rollover.

While youll probably never be able to escape fund expense ratios, you can minimize or completely eliminate most administrative fees by moving from a 401 to an IRA. An IRA may also afford you better access to more low-cost funds, like index funds.

> > > Get Your Free Gold Investor Kit Here

An individual retirement account is one of several types of IRAs. This type of IRA allows you to invest in bonds, stocks, and other assets, instead of having to invest in mutual funds and other products. A good gold IRA has a lower cost of investment than a standard or Roth IRA which invests solely in bonds, stocks, and mutual funds. However, there are differences between a standard and a hedge against inflationary climate.

There are several types of IRAs that an individual can open for investing. The most common IRA types include a standard IRA, a hedge against inflation, and a gold IRA. If you want to have the most flexibility with your investments, then you should invest in a standard IRA. To learn more about these different IRAs, as well as the pros and cons, we have looked at some of the more popular options.

Don’t Miss: Can An Llc Have A Solo 401k

Roth 401 To Roth Ira Conversions

The rollover process is straightforward if you have a Roth 401 and you’re rolling it over into a Roth IRA. The transferred funds have the same tax basis, composed of after-tax dollars. This is not, to use IRS parlance, a taxable event.

If your 401 is a Roth 401, you can roll it over directly into a Roth IRA without intermediate steps or tax implications. You should check how to handle any employer matching contributions because those will be in a companion regular 401 account and taxes may be due on them. You can establish a Roth IRA for your 401 funds or roll them over into an existing Roth.

K Rollover To An Ira Why You Should Think Twice About It

Written byAdamonOctober 29, 20182018-10-29.UpdatedFebruary 11, 2021.

When I was 26 I left my first job. It had a 401k that I had been contributing to since I started. Being the responsible investor I was at the time, I immediately decided to rollover that 401k into an IRA at my bank Bank of America at the time. The total amount of the account wasnt anything huge maybe $20,000 or so. This seemingly innocent action ended up costing me thousands of dollars in taxes over the next decade. Let me explain how.

Read Also: What Is The Tax Rate On 401k Withdrawals

When Should You Rollover A 401k

If youre thinking how long do i have to rollover my 401k from a previous employer? well, rest easy theres no time limit. As long as your 401k exists youll be able to leave your funds there.

As mentioned above, there may be reasons why it makes sense to move it over . If youre leaving or have left your job you dont need to worry about immediately moving it somewhere else.

You will need to make sure you can continue to access the account after leaving your job though. You should continue to have access to your funds, your dashboard and all the same tools you had previously.