Two Ways To Use A 401 To Buy A House

Taking a 401 distribution

The first method you can use to borrow money from a 401k for a down payment is to withdraw money or take a distribution without intending to pay it back. Unfortunately, this method of using retirement funds to buy a house can have some expensive tax consequences.

While withdrawing from a 401 is always considered a taxable event, depending on your age, theres a good chance that youll be taxed on the same money twice. To start, all 401 distributions are taxed as ordinary income. However, if youre under the age of 59 ½, your withdrawal will be considered an early distribution and youll have to pay an additional 10% early withdrawal tax.

Using a 401 loan

Instead of withdrawing from a 401 for a house, it might be a better idea to use a 401 loan for your home purchase. As the name suggests, you have to pay back a 401 home loan eventually, but as long as you follow the rules, the money you borrow is not taxable. That fact alone can make it a more affordable option than taking a 401 withdrawal for a home purchase.

First, you have to pay attention to how much you can borrow. While not all 401 plans allow for loans, if yours does, youre allowed to borrow up to 50% of your vested account balance or a maximum of $50,000, whichever is less.

Can A Loan Be Taken From An Ira

Loans are not permitted from IRAs or from IRA-based plans such as SEPs, SARSEPs and SIMPLE IRA plans. Loans are only possible from qualified plans that satisfy the requirements of 401, from annuity plans that satisfy the requirements of 403 or 403, and from governmental plans. Reg. Section 1.72-1, Q& A-2)

Go Around The Downpayment Barrier

If you want to buy your first home but have not yet been able to, chances are its the downpayment requirement thats stopping you.

According to the National Association of REALTORS®, the lack of downpayment savings is the biggest barrier to homeownership for many buyers.

It can be a challenge saving money when youre paying monthly rent. Fortunately, there are ways to speed up the process by borrowing some or all of the required money down.

Fortunately, many loan programs today require a small downpayment, or none at all, making it even easier to raise necessary funds. Low-downpayment programs include the zero-down USDA loan and 3.5 percent down FHA mortgage.

When you still come up short, financing a downpayment can be a real option.

Recommended Reading: Can I Rollover 401k To Ira While Still Employed

Better Real Estate Agents At A Better Rate

Enter your zip code to see if Clever has a partner agent in your area.

If you don’t love your Clever partner agent, you can request to meet with another, or shake hands and go a different direction. We offer this because we’re confident you’re going to love working with a Clever Partner Agent.

Contact Us

Should You Use A Roth Ira To Buy A Home

For the most part, experts say that using a Roth IRA to buy a home isnt the best strategyunless youre already saving a lot for retirement in another account and youre opening a Roth account specifically to save up for a home down payment.

But even if you keep contributing to another retirement account, taking money out of a Roth to buy a home incurs opportunity cost, Roberge says. While a home can be considered an investment, the overall returns on a primary residence arent likely to beat market returns, says Roberge.

You should be especially careful if you didnt set up your Roth IRA specifically for a home purchase.

If youre using the Roth because thats the only source of funding you have to make the purchase, that might be a red flag, Roberge says. If youre stretching yourself financially to buy a house, then buying might not be the best idea.

Read Also: How Can I Invest My 401k

Can I Take Out A 401 Loan To Buy A House

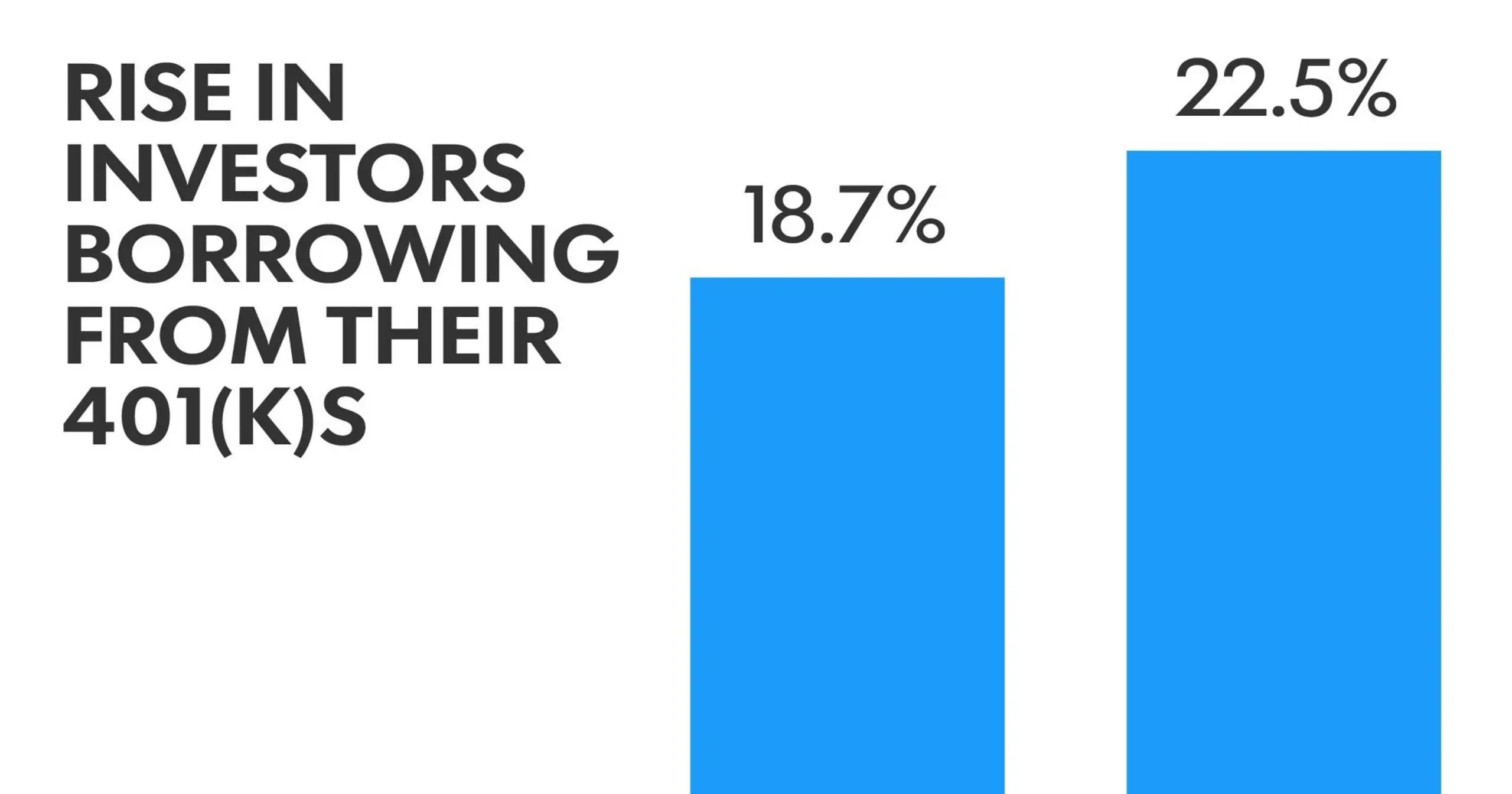

While not all 401 plans allow you to take out a loan from your account, a good many do. Vanguard reported that in 2018, 78% of its 401 plans allowed participants to borrow from their retirement accounts.

Check with your plan sponsor to see whats allowed. If your retirement plan allows you to take a loan from your 401, you may be able to use that money for a home down payment or closing costs.

One important distinction to note: You cant borrow money from an IRA.

Here are some things to consider before you take out a 401 home loan.

When A 401 Loan Makes Sense

When you mustfind the cash for a serious short-term liquidity need, a loan from your 401 plan probably is one of the first places you should look. Let’s define short-term as being roughly a year or less. Let’s define “serious liquidity need” as a serious one-time demand for funds or a lump-sum cash payment.

Kathryn B. Hauer, MBA, CFP®, a financial planner with Wilson David Investment Advisors and author of Financial Advice for Blue Collar America put it this way: “Lets face it, in the real world, sometimes people need money. Borrowing from your 401 can be financially smarter than taking out a cripplingly high-interest title loan, pawn, or payday loanor even a more reasonable personal loan. It will cost you less in the long run.”

Why is your 401 an attractive source for short-term loans? Because it can be the quickest, simplest, lowest-cost way to get the cash you need. Receiving a loan from your 401 is not a taxable event unless the loan limits and repayment rules are violated, and it has no impact on your .

Assuming you pay back a short-term loan on schedule, it usually will have little effect on your retirement savings progress. In fact, in some cases, it can even have a positive impact. Let’s dig a little deeper to explain why.

Read Also: What Is A Pension Vs 401k

When You Are In Serious Financial Need

Sometimes, it makes sense to take a 401 loan when you are in a temporary period of financial need and have to cover expenses until you return to a more secure situation, Golladay says.

“Picture a scenario in which one spouse is let go from their job and the family is having trouble making ends meet on one income,” Golladay says. “The employed spouse might borrow from his or her 401 to cover the gap, and then pay that loan back promptly once the other spouse finds a new job.”

If it’s a specific need you are trying to finance, such as permanent disability or medical bill coverage, 401 plans typically offer withdrawal waivers where the additional 10% tax you’d typically be charged on the withdrawal is waived.

“There are different exceptions that qualify for a 10% early withdrawal waiver,” Marshall says. “I recommend finding out if you qualify for the waiver and using funds out of the proper account to fund your need.”

Should You Borrow From Retirement To Buy A Home

Buying a home is one of the most expensive purchases youll ever make. Its so expensive that over 90% of buyers actually take out a mortgage and finance their home. They cant afford to pay cash.

Getting a mortgage is pretty normal actually. There are some unique cases where buyers are super frugal and save for several years to buy a home in cash. Or they may live in a lower cost of living area that makes it more possible.

The rest of us are stuck with trying our luck with a mortgage lender. Plus, coming up with a decent down payment.

A good rule of thumb is to put at least 20% down on your home but even that can be a huge sum of money depending on the home youre trying to buy.

If the home you want costs $250,000, youd have to put $50,000 down to honor the 20% rule. Whether youre aiming to put 20% down or not, coming up with your down payment money may be stressful.

One option some people take is borrowing from their retirement savings to buy their home.

Also Check: Should I Roll My 401k Into An Annuity

Why Use A Roth Ira To Buy A Home

Technically speaking, you can withdraw savings from almost any tax-advantaged retirement account to fund a first-time home down payment. IRS early withdrawal rules let you take out up to $10,000 of investment earnings penalty-free to fund the purchase of your first home. And the IRS considers you a first-time home buyer so long as you havent owned a home for the last two years.

But early withdrawals from accounts like your traditional 401 or individual retirement account still raise your tax bill. While youre off the hook for the 10% early withdrawal penalty, youll still owe income tax on everything you withdraw. Thats because your original contributions were tax free.

Withdrawals from a Roth IRA, on the other hand, are tax and penalty free as long as youve had the account open for at least five years. But just because you can withdraw from your Roth IRA to finance your first home purchase doesnt mean you should.

Pulling money out of your Roth IRA could mean missing out on investment growth, says Eric Roberge, CEO and lead advisor of Beyond Your Hammock, a a fee-only financial planning firm. However, it might make sense, depending on your situation.

If you no longer need your Roth IRA money for retirement, then you may be able to tap the account to generate the cash needed for the purchase, Roberge says.

How To Borrow From Your 401k Account

To borrow from your 401k loan to finance a down payment, youll need to talk to your employers benefits office or HR department, or with your 401k plan provider. You can also consult your plan document to find out if your plan permits borrowing from your 401k to purchase a home.

Youll want to find out how much youre able to borrow, the interest youll have to pay, and the repayment period. Additionally, ask about repayment options, such as whether your employer will deduct the monthly payment from your paycheck or if they will allow you to make 401k contributions while you pay back the loan.

Read Also: Can I Open A 401k Without An Employer

Can You Use Your 401 To Buy A House

Retirement accounts are just that: money thats being set aside for you to use in your golden years. And if you’ve been carefully saving, you might be wondering if its OK to tap those funds to use for something right now, like a home purchase, given that its an investment in its own right.

One of the most common type of retirement plans is the 401, which is often offered by companies to their workers. It provides an easy way to earmark some of your salary for retirement savings, along with the tax benefits that a 401 brings. Youll be setting aside money without paying taxes right now and then will pay the taxes when you withdraw it, which ideally will be when you re in a lower tax bracket than you are in now. In many cases, companies also match up to part of your personal savings, which is another reason that 401 accounts are so popular, since thats essentially free money.

But those funds have been set aside specifically for your retirement savings, which means that if your plan allows you to withdraw it earlier, youll pay a penalty, along with the taxes you owe given your current tax bracket. Theres usually the potential to borrow from it, though, which may be a better option.

So, while you can use your 401 for first time home purchase in most cases the question is whether you should.

What Are The Borrowing Limits For A 401

In general, you can only borrow up to 50% of your vested account balance or $50,000, whichever is less. Some plans may offer an exception if your balance is less than $10,000 you may be allowed to withdraw the entire amount. With a withdrawal, there are no limits on the amount, assuming your plan allows you to do so.

You May Like: How Do I Stop My 401k

If Im Considering A 401 Loan What Information Should I Get From My Plan Provider

If youre considering taking a loan from your 401, ask your plan administrator for the following information:

- Whether or not loans are/are not permitted

- The minimum dollar amount required to obtain a loan

- The maximum number of loans permitted by the plan

- The maximum dollar amount permitted

- The term of repayment

- Any interest rate information

- Any required security for the loan

- How repayment may be made

- Any spousal consent requirements

Downsides Of Borrowing Against Your 401 To Fund Your Home Purchase

Unfortunately, while the benefits of a 401 loan may make it sound attractive, there are considerable downsides to consider as well.

- You’ll be putting your retirement at risk: The money you take out of your 401 won’t be invested and growing for retirement. Chances are good the return on investment you would have received by leaving your money invested would have been higher than the return on investment from the interest you pay yourself .

- You’ll have less money in your budget. You have to repay the 401 loan, which means that you’re committing part of your future paychecks towards it. You won’t have access to this money for other things, such as the expenses of homeownership.

- You’ll have to repay the loan quickly. Generally, you have only five years to repay your 401 loan. This could mean making very large monthly payments if you borrow a lot.

- You could end up owing penalties if you can’t pay back the loan: If you aren’t able to repay the loan, it will be treated as a withdrawal. You’ll have to pay ordinary income taxes on it, and will also be subject to a 10% penalty associated with early withdrawals if you weren’t 59 ½ or older when you took the money out.

- You could accelerate repayment if you leave your job: If you are fired or quit, you will have to pay back the entire loan amount by the due date for filing taxes that year — including any extensions. This could mean you have to repay your loan very quickly or face penalties.

Recommended Reading: How To Open A Solo 401k

What Are The Differences In The Loan Rules For Amounts Borrowed By Participants After Hurricanes Harvey Irma And Maria

For participants affected by Hurricanes Harvey, Irma, or Maria, the maximum amount that can be borrowed from August 23, 2017 , September 4, 2017 , or September 16, 2017 , through December 31, 2018, from a plan is generally increased to the lesser of $100,000 or 100% of the participants account balance. In addition, repayments due from affected individuals may be suspended by the plan for one year.

Other Roth Ira Early Withdrawal Rules

A home purchase isnt the only way you can withdraw from a Roth IRA tax and penalty free. Other exceptions to early withdrawal penalties include:

Total and permanent disability. If you meet the requirements to be considered permanently disabled, you can arrange to take an early IRA distribution without paying a penalty.

Unreimbursed medical expenses. If you have unreimbursed medical expenses that amount to more than 7.5% of your adjusted gross income, you can withdraw money from your Roth IRA to meet those obligations.

Unemployment. If youre unemployed but youre making medical insurance premium payments, you can withdraw money early from your Roth IRA without penalty.

Education. IRA withdrawal rules allow you to take money penalty-free for qualified higher education expenses.

Substantially equal payments. Its possible to arrange for substantially equal payments from your Roth IRA and avoid a penalty. But you should check with a tax professional before attempting this complex withdrawal technique, says Levine.

Remember youre able to withdraw your contributions tax and penalty free at all times. With Roth IRAs, your contributions are taken out first when you request to make withdrawal, Levine says. Just make sure you keep track so you dont dip into your earnings, he says.

You May Like: How Do I Get My 401k

Got $1000 The 10 Top Investments Wed Make Right Now

Our team of analysts agrees. These 10 real estate plays are the best ways to invest in real estate right now. By signing up to be a member of Real Estate Winners, youâll get access to our 10 best ideas and new investment ideas every month. Find out how you can get started with Real Estate Winners by .

Should I Make A 401 Withdrawal Instead

Withdrawing money from your 401 before retirement, as opposed to borrowing from it, is usually a bad financial move. Not only will you be taking the money that youve invested for your golden years leaving you with less for retirement you may be hit with an early-withdrawal penalty.

Unless youre 59½ or qualify for another exception, youll have to pay tax on the amount you withdraw plus a 10% penalty. Though that penalty may be waived on up to $10,000 withdrawn from a traditional, SIMPLE or Roth IRA if you use the money to buy, build or rebuild your first home.

If youre experiencing financial hardship, your plan may offer the option of a hardship withdrawal. Youll still need to pay tax on the withdrawal amount, and you may also need to pay the 10% penalty. But the amount you take for a hardship withdrawal cant be paid back to your retirement plan like a 401 loan can.

Recommended Reading: What Is An Ira Account Vs 401k