How Much Can You Contribute To A 401

The most you can contribute to a 401 is $19,500 for 2021 . Employer contributions are on top of that limit. These limits are set by the IRS and subject to adjustment each year.

That limit dictates how much you can contribute, but it doesnt tell you how much you should contribute. To figure that out, consider the following.

Updates To Income Limits For Roth Ira Contributions

If youre already contributing to an employer-sponsored plan, like a 401, you can also contribute to a traditional IRA. But there are restrictions on what you can deduct from your taxes, based on your income. For 2021, those income ranges increased . Depending how much money you make, you may be able to deduct more of your IRA contributions from your taxes.

While traditional IRAs arent subject to income limits, Roth IRAs are. That limit increased for 2021.

| Account | |||

|---|---|---|---|

| Helps you invest for retirement with pre-tax deposits. | Income limitNone | Tax deduction limitsYou may take full, partial, or no deduction based on your income level and retirement plan. | |

| Roth IRA | Funded with after-tax dollars, but your eventual qualified withdrawals may be tax-free. | Income limit | Tax deduction limitsNot deductible |

For more information about IRA tax deduction limits, check out the IRS parameters for those who are covered or arent covered by a retirement plan at work.

Contribution Limits Vs 2020

- For 2021, the contribution limit for employees who participate in a 401 plan is $19,500, the same as 2020.

- Employees aged 50 or older can take advantage of catch-up contributions. In 2020, the IRS raised the limit on catch-up contributions by $500 to $6,500 from $6,000. This, too, is unchanged in 2021.

- Workers over the age of 50 can set aside a total of $26,000 in their 401 in 2021, unchanged from 2020.

These limits apply to other retirement plans, such as 403 plans for employees of public schools and nonprofit organizations, as well as the federal government’s Thrift Savings Plan .

There is an upper limit to the amount you can contribute to retirement plans of all types. For those age 49 and under, the limit is $58,000 in 2021, up from $57,000 in 2020. For those 50 and older, the limit is $64,500, up from $63,500 in 2020. You can’t contribute more than your earned income that year.

Join today and get instant access to discounts, programs, services, and the information you need to benefit every area of your life.

You May Like: How To Rollover Fidelity 401k To Vanguard

How Much Should You Save For Retirement

We recommend investing 15% of your gross income into retirement savings accounts like a 401 and IRA. We also suggest investing in four types of mutual fundsgrowth and income, growth, aggressive growth, and internationalinside of those retirement accounts.

And listen, we know youre eager to start saving money for your retirement future . . . but if you are still getting out of debt or need to get a solid emergency fund in place, now is not the time to save for retirement. Your income is your number one wealth-building tool, and you wont be able to take full advantage of it if its tied up in credit card or student loan payments.

So lets say youre out of debt with a fully funded emergency fund and you have an annual salary of $75,000. That means you should set a goal to save $11,250 each year for retirement. But where do you start? Lets walk through it step-by-step.

The Contribution Limits Also Apply To Roth 401 Contributions

Contribution limits for Roth 401 contributions are the same as they are for traditional 401 contributions. That means you can contribute up to $19,500 per year to either a regular 401 plan, or a Roth 401 plan.

More likely, you will want to contribute to both, in which case youll have to allocate how much of the $19,500 limit will go into each part of your 401.

Not coincidentally, the 401 limits are virtually the same as the limits for both the 403 plan and the Thrift Savings Plan .

In addition, any employer matching contributions to the plans are not included in the employee contribution limits listed above.

Your employer can contribute a matching contribution that exceeds the $19,500 regular contribution limit, or even the combined $26,000 limit if you are age 50 or older. It is always a good idea to figure out whether a Roth 401k vs Roth IRA is best for you.

Also Check: How Do I Invest In My 401k

Think About Your Legacy In Retirement

You either plan to spend all your money before you die or you plan to create a perpetual giving machine after you die . There is no right or wrong retirement philosophy to choose from.

However, if you plan to do good after death, then you will be more motivated to max out your 401 and build as many passive income streams as possible. This way, you can ensure your legacy lasts long after you are gone.

Personally, I would like to leave enough money for two charities that will given them money from my estate for 100 years after Im gone! Wanting to leave a legacy is partly why Ive been writing on Financial Samurai since 2009 as well.

Take advantage of the maximum 401k contribution limit every year. You wont regret your contributions 10 years from now.

Build Wealth Through Real Estate

In addition to investing in stocks and bonds through your 401k, I recommend diversifying into real estate as well. Real estate is a core asset class that has proven to build long-term wealth for Americans. Its important to own a tangible asset that provides utility and a steady stream of income.

Given interest rates have come way down, the value of rental income has gone way up. The reason why is because it now takes a lot more capital to generate the same amount of risk-adjusted income. Inflation is picking up steam, which further boosts the value of real estate.

With real estate, you can earn a steady stream of passive to semi-passive income well before age 59.5, which is when you can withdraw from a 401k penalty-free.

Also Check: What Happens When You Roll Over 401k To Ira

What Is A Good 401 Contribution

Your ideal 401 contribution depends on several factors. If your employer offers a match, your first priority should be to contribute enough to get the full match. From there, you may want to max out a tax-free retirement account such as a Roth IRA before you finish maxing out your 401. If you’re able to do all three of these, it can help you get the most out of your investments.

How Do You Calculate Your Retirement Income From A 401

While savings accounts pay almost nothing today at most banks, 401 plans give you many more options. You can invest your 401 balance in a selection of mutual funds offered by your specific plan. If you are investing at the market average, using the S& P 500 as a benchmark, the market returns around 7% per year over time.

Depending on the investment options you choose and market conditions, your return may be more or less than the average, but it is the best measure when projecting 401 income in the future. Calculating income from a 401 requires projecting your future 401 balance including your current balance, planned savings, and your expected investment performance. Also remember to subtract any fees you expect to pay.

Next, you have a few options to calculate your return. Some investment experts suggest using the 4% rule to estimate your ability to withdraw without ever running out of funds. Multiply your ending balance by 4% to conservatively estimate your annual withdrawals in retirement.

You May Like: How To Recover 401k From Old Job

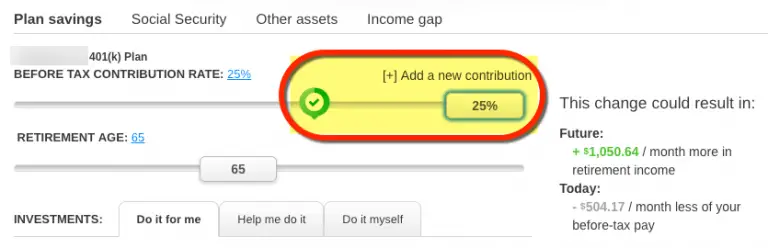

How Much You Should Contribute With The New Contribution Limits

The IRS determines whether or not to increase its contribution limits based on an annual basis. Sometimes changes in the Consumer Price Index have been very small, like on the order of 2% per year. Congress prefers to increase contributions in increments of at least $500, which they did this year.

With the ability to increase your contributions by $500 in 2020, you may be wondering if you should. My answer is a resounding yes.

If you divide that amount into monthly contributions, youre making only slightly smaller payments which will benefit you in the long run. Continuing to max out your 401k at this level is an ideal strategy,

Total 401 Employer And Employee Annual Contribution Limits

| 2020 | ||

|---|---|---|

|

Total with Catch-Up Contributions for those 50 or Older |

$63,500 |

$64,500 |

Vanguard data from 2018 show that among 401 plans the firm administered, 95% of employers provided matching or non-matching contributions to their employees. Approximately 85% of employers provided a 401 match to their employees. Approximately 10% of employers provided non-matching 401 contributions, with no requirement that employees also contribute.

While the annual limits for individual contributions are cumulative across 401 plans, employer contribution limits are per plan. If you were to participate in multiple 401 plans in one calendar year , each of your employers could max out their contributions.

You May Like: How To Collect My 401k Money

How We Approach Editorial Content

Maintaining independence and editorial freedom is essential to our mission of empowering investor success. We provide a platform for our authors to report on investments fairly, accurately, and from the investors point of view. We also respect individual opinionsthey represent the unvarnished thinking of our people and exacting analysis of our research processes. Our authors can publish views that we may or may not agree with, but they show their work, distinguish facts from opinions, and make sure their analysis is clear and in no way misleading or deceptive.

To further protect the integrity of our editorial content, we keep a strict separation between our sales teams and authors to remove any pressure or influence on our analyses and research.

Read our editorial policy to learn more about our process.

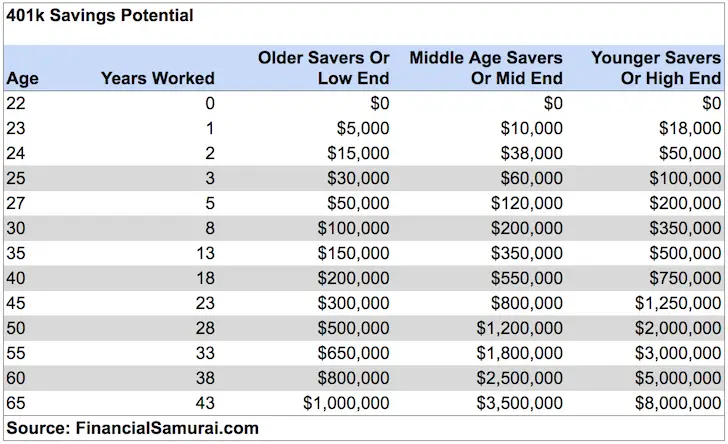

Breaking It Down: Where Do You Fit In

There are many reasons you might think this chart seems totally reasonable, or, conversely, totally unreasonable. And thats understandable. Life presents us all with different challenges. We have unexpected medical expenses, decide to go back to school, or have kids and want to pay their college tuitions. These are all perfectly valid excuses as to why you might be falling behind where this chart says you should, or could, be.

Based on this chart, you would think that most Americans should be retiring as multi-millionaires at age 65. This probably seems way off-base, and in reality, it is most people retire with very little in the way of savings and investments. The point is that this chart shows what is possible if you are disciplined and strategic about your 401k savings.

If you are on the younger end of the ages shown on the chart, you may be daunted at the prospect of contributing $8,000 per year to your 401k, not to mention $19,500. Where you live, what your first-year salary is, or what loans you may be paying can make it difficult for this contribution to seem realistic. Its crucial, however, to recognize the importance of saving as much as you can for retirement as early as you can.

So, lets determine, based on the two scenarios in the potential savings chart, whether these figures would be sufficient to support your lifestyle for the rest of your retirement.The average life expectancy for men is around 84 years old, and 86.5 years old for women.

Recommended Reading: How To Know If You Have A 401k

Calculate A Budget Based On A Reduced Gross Income Equal To The Maximum 401 Contribution Limit

Nobody really sits down and writes out their expenses. Were either afraid or lazy for some reason, yet we can spend hours doing research on our next big screen TV or laptop.

But for your own sake, take your current income, subtract $19,500, and multiply it by one minus your effective tax rate to calculate your disposable income e.g. $100,000 $19,500 = $81,500 X = $61,125 after taxes and 401k max.

Divide the annual income by 12 to get a monthly disposable income figure and work your budget from there. The bigger the buffer you can have from spending all your disposable income, the better. Making your contributions automatic will make savings so much easier.

Related: I Could Have Been A 401k Millionaire By 40

The 401 Contribution Limit Increased By $500 For 2020 Plus Workers 50 And Older Can Also Save An Extra Amount For Retirement

One of the best and most tax-friendly ways to build a nest egg for retirement is by contributing to an employer-sponsored 401 account. If your employer offers this benefit, jump in as soon as you can, because it’s never too early to start saving for retirement.

> > For more 2020 tax changes, see Tax Changes and Key Amounts for the 2020 Tax Year.< <

Read Also: Can You Roll A 401k Into A Roth

How We Use Your Personal Data

How we use your information depends on the product and service that you use and your relationship with us. We may use it to:

- Verify your identity, personalize the content you receive, or create and administer your account.

- Provide specific products and services to you, such as portfolio management or data aggregation.

- Develop and improve features of our offerings.

To learn more about how we handle and protect your data, visit our privacy center.

But Why Would I Max Out My Roth Ira Before My 401k If Its So Good

Theres a lot of nerdy debate in the personal finance sphere about this very question, but our position is based on taxes and policy.

Assuming your career goes well, youll be in a higher tax bracket when you retire, meaning that youd have to pay more taxes with a 401k. Also, tax rates will likely increase in the future.

The Ladder of Personal Finance is pretty handy when considering what to prioritize when it comes to your investments, but it is just a tool. For more about the Ladder of Personal Finance and how to make it work for you, check out THIS video where I explain it.

PRO TIP: The video is less than three minutes long. It is worth your time.

Also Check: How Much In 401k To Retire

Choosing Investments Within A Plan

Generally, 401 plans offer several options in which to invest contributions. Such options generally include mutual funds that may invest in stocks for growth, bonds for income, or money market investments for protection of principal. This flexibility may help lower investment risk by diversifying a portfolio amongst different types of classes, manager styles, investment styles, and economic sectors.

Employers Have A Higher Contribution Ceiling

The employers 401 maximum contribution limit is much more liberal. Altogether, the most that can be contributed to your 401 plan between both you and your employer is $58,000 in 2021, up from $57,000 in 2020. That means an employer can potentially contribute much more than you do to your plan, though this is not the norm.

The salary cap for determining employer and employee contributions for all tax-qualified plans is $290,000. Even at that level, the employer would have to contribute a hefty amount to reach the $58,000 limit.

Don’t Miss: What Is An Ira Account Vs 401k

See Also: 10 Ways The Secure Act Will Impact Your Retirement Savings

A traditional 401 is an employer-based retirement savings account that you fund through payroll deductions before taxes have been taken out. Those contributions lower your taxable income and help cut your tax bill. For example, if your monthly income is $5,000 and you contribute $1,000 of that to your 401, only $4,000 of your paycheck will be subject to tax. While the money is in your account, it is sheltered from taxes as it grows.

The money can usually be invested in a variety of stock funds and bond funds. The average 401 plan offers 19 funds, and typically nearly half of plan assets are invested in U.S. stock funds and target-date funds, the latter of which can change their asset allocation to become more conservative over time. s for more on where to invest your retirement savings.)

Many employers also match their employees’ contributions up to a certain percentage of salary. Some companies even contribute to workers’ accounts regardless of whether the employees contribute their own money. On average, companies contributed 5.2% of an employee’s pay to the employee’s 401 account, according to the Plan Sponsor Council of America.

Contributions In Excess Of 2020 Limits

Evaluating your estimated contributions for the year ahead and analyzing your contributions at the end of a calendar year can be very important. If you find that you have contributions in excess of the 2020 limits, the IRS requires notification by March 1, 2021, and excess deferrals should be returned to you by April 15, 2021.

Read Also: How To Make 401k Grow Faster

Company Matching Aka Free Money

Because many companies offer their employees a dollar-to-dollar match on 401 contributions up to a certain amount, many employees choose to max out their 401 contributions for the year first, then contribute to another retirement account, such as an IRA. At a minimum, you should aim to contribute enough to take full advantage of your employer match, if they offer one, says Jason DallAcqua, a CFP and president of Crest Wealth Advisors LLC. .