K Savings Potential By Age

The following chart depicts 401k savings potential by age, based on several assumptions. So this is how much you could have saved. These numbers can seem high to many people, especially if you are older and started your retirement savings when the contribution limit was much lower. It can still be used as a guide for your target total retirement savings amounts, including your IRA, Roth IRA, and after-tax savings. While its designed for one person, it can also be used as a guide for a married couple if one spouse decides to no longer work.

The assumptions we used for this chart include:

| AGE | |

|---|---|

| $827,000.00 | $6,610,084.46 |

*Generally, financial planners say the expected rate of return for a 401k is between 8% and 10%.

So, how do you stack up? Are you on the high end? The low end? Do you think these numbers are realistic?

A Roth Option Isn’t Guaranteed

These days, a growing number of 401s are including a Roth savings option, which allows you to enjoy tax-free gains in your account and tax-free withdrawals during retirement. But not all 401 plans have a Roth version, and so you may get stuck saving in a manner that doesn’t fully work to your benefit in terms of taxes.

With an IRA, on the other hand, putting your money in a Roth savings plan is an option one way or another. If you earn too much money to contribute to a Roth IRA directly — there are income limits that change from year to year — you can always fund a traditional IRA and then convert it to a Roth afterward.

Many savers do quite well for themselves housing their retirement cash in a 401. But don’t assume that a 401 is the best savings tool for you. There are plenty of drawbacks associated with 401s, and if you’re not particularly happy with yours, then there’s no sense sticking with it.

What you should do in that case is contribute just enough money to your 401 to snag your full employer match, if one is offered, but then put the rest of your savings into an IRA. Doing so could help you invest more appropriately, avoid high fees, and enjoy the perks of a Roth saving option.

How The Flexibility Of A Roth Ira Works In Your Favor

While your 401 plan might not have a lot of mutual funds to pick from, you can choose any of the thousands of existing mutual funds for your Roth IRA. How do you know which funds are right for your portfolio? Work with an investing pro you trust to help you weigh the pros and cons of different fund options.

With thousands of funds to choose from, you can select good growth stock mutual funds to build what the investing experts call a well-diversified portfolio to grow your retirement nest egg.

That might sound like boring investment lingo, but aside from increasing the amount you invest for retirement, spreading out your investments by selecting a balanced mix of mutual funds is probably the best thing you can do with your retirement savings. A Roth IRA gives you the freedom to choose a balanced mix of mutual funds for retirement: 25% growth, 25% aggressive growth, 25% growth and income, and 25% international.

Recommended Reading: How Do I Transfer My 401k To A Roth Ira

How Rate Of Return Affects How Much You Can Withdraw

You’ll also want to spend some time studying historical rates of return so you can understand how the rate on your investments will affect how much you can withdraw in retirement. You might get 20 years of great returns, or you might hit an economic period where interest rates are low and stock returns are in the single digits.

You can hedge against poor returns when you use your retirement withdrawal plan to match investments with the point in time when you’ll need to use them. For example, if it makes more sense to take income out of your IRA early on, you’ll want the amounts that you’ll need in the next five years to be placed in safe investments.

On the other hand, that money has a longer time to work for you and can be invested more aggressively if your withdrawal plan shows that it’s best for you to delay IRA withdrawals until age 72.

How Much Will Your 401 Be Worth

We all have ideas for how wed like to spend our retirement. Whether you hope to travel the world, buy an RV, or just spend more time with your family, the choices you make today will dictate the options available to you when you retire.

Fortunately, you dont have to fly blind. Use Ubiquitys 401 calculator to get a clear picture of how your savings will stack up when you retire and how much you should be saving now to realize your goals.

Also Check: How To Take Out 401k Money For House

Depend On Nobody But Yourself

Contribute the maximum pre-tax income you can to your 401k for as long as you work. This is the absolute MINIMUM you can do to by on the right 401k savings by age path. Below is a chart that shows the maximum 401k contributions in 2021 by employee and employer.

After you contribut a maximum to your 401k every year, try and contribute at least 20% of your after-tax income after 401k contribution to your savings or retirement portfolio accounts.

This way, you will have potentially DOUBLE the amount in total retirement saving if your household income is $100,000 or more. If your household income is closer to $50,000, you should still see a nice 30% boost to your retirement savings if you consistently save 20% of your after tax income.

Treat your 401k just like Social Security and write it off completely from your mind. Do not expect either accounts to be there for you when you retire. Its just like how you should never expect the government to ever help you when youre in need.

Just imagine 30 years from now, the government deciding to raise penalty free 401k withdrawal to age 75 from 59.5? Unfortunately, you need the money at age 60. Because you withdraw, the government imposes a 30% penalty on top of the taxes you have to pay. Dont think it cant happen. Expect it to happen!

How You Want To Live In Retirement

In other words, do you expect your expenses to go down when you retire? We call that a below average lifestyle. Or will you spend as much as you do now? That’s average. If you expect your expenses will be more than they are now, that’s above average.

Let’s look at some hypothetical investors who are planning to retire at 67. Joe is planning to downsize and live frugally in retirement, so he expects his expenses to be lower. His savings factor might be closer to 8x than 10x. Elizabeth is planning to retire at age 67 and her goal is to maintain her lifestyle in retirement, so her savings factor is 10x. Sean sees retirement as an opportunity to travel extensively, so it may make sense for him to save more and plan for a higher level of retirement spending. His savings factor is 12x at age 67.

Also Check: Can You Convert Your 401k To A Roth Ira

Compare Your Current Spending With Expected Retirement Spending

Look at how much you spend now. Then, figure out how those expenses will change when you’re retired.

For example, you wont need to spend money on getting to work, but you might decide to spend more on hobbies or on travel.

You may save money by taking advantage of seniors discounts.

Low-fee bank accounts for seniors

Many financial institutions offer low-fee bank accounts for seniors. They usually offer these accounts to people 60 years old and older. Speak to somebody at your financial institution to find out if they have accounts for seniors.

Seniors who have a low income can get special no-cost bank accounts. Find out if you’re eligible to get a no-cost bank account.

Discounts on goods and services

Many businesses offer discounts to seniors on a wide range of goods and services including:

- groceries or household supplies

Always ask about seniors discounts. It could save you money.

How Much Do Couples Need

Back to the original question: Just how much does a couple need to retire? In general, you will need roughly 70% to 90% of your pre-retirement income to continue your standard of living in retirement.

As a couple, the good news is that, along with having to plan for the expenses of two people, you can plan on having two people’s income and savings. This can help bolster your spending power..

Don’t Miss: When Leaving A Company What To Do With 401k

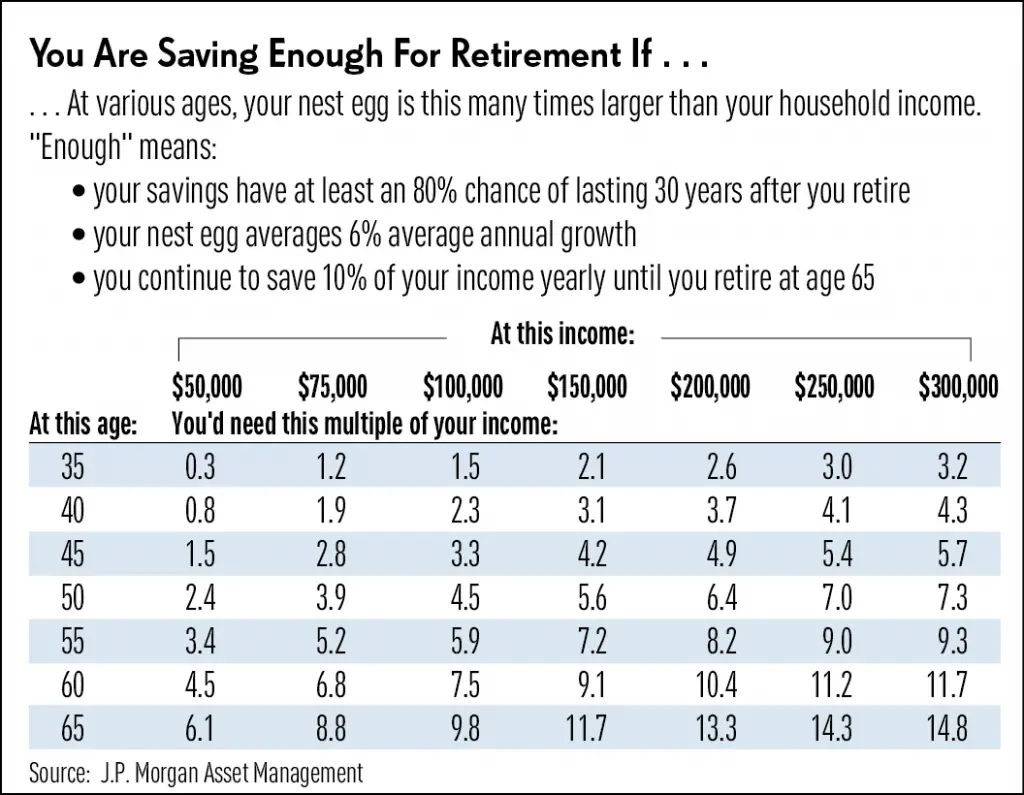

How Much Savings Will You Need To Retire

Now let’s determine how much savings you’ll need to retire. After you’ve figured out how much income you’ll need to generate from your savings, the next step is to calculate how large your retirement nest egg needs to be in order to be able to produce this much income in perpetuity.

A retirement calculator is one option, or you can use the “4% rule.” While the 4% rule admittedly has its flaws, it’s a good starting point for determining a safe annual withdrawal amount.

The 4% rule says that, in your first year of retirement, you can withdraw 4% of your retirement savings. So, if you have $1 million saved, you would take $40,000 out during your first retired year either in a lump sum or as a series of payments. In subsequent years of retirement, you would adjust this amount upward to keep up with cost-of-living increases.

The idea is that, if you follow this rule, you shouldn’t have to worry about running out of money in retirement. Specifically, the 4% rule is designed to make sure your money has a high probability of lasting for a minimum of 30 years.

To calculate a retirement savings target based on the 4% rule, you use the following formula:

Retirement savings target = Monthly income required x 25

Continuing our example, we saw in the previous section that our couple would need $4,000 per month from their savings. So, in this case, our couple should aim for $1.2 million in retirement savings to provide $48,000 per year in sustainable retirement income.

Your 401 Savings And Your Desired Retirement Lifestyle

How you want to live out your golden years is another huge factor in what your 401 savings will need to look like. Thats because retirement has evolved over time to become a more active time of life. Its now viewed as a new beginning to our lives rather than a beginning of our end. That shift in mindset has driven the need for additional sources of retirement income.

The Employee Benefit Research Institute study on the Expenditure Patterns of Older Americans shows that as we age our expenses decline. Using age 65 as a benchmark, the study found that household expenses drop by 19% by age of 75 and 34% by age 85. The study also found that people over the age of 50 spend 40-45% of their budget on their home and home-related items. The bottom line is that by the time we retire our expenses are down between 20% and 40%. This is why expert opinions differ on how much of our pre-retirement income we need. Guidelines generally vary from 60% to 80%.

If you have a household income of $100,000 when you retire and you use the 80% income benchmark as your goal, you will need $80,000 a year to maintain your lifestyle. Assuming your 401 savings grow at 8%, you should expect to have up to $80,000 a year in interest income so you can avoid having to touch your principal as much as possible.

Also Check: How To Collect My 401k Money

Offer From The Motley Fool

The $16,728 Social Security bonus most retirees completely overlook: If you’re like most Americans, you’re a few years behind on your retirement savings. But a handful of little-known “Social Security secrets” could help ensure a boost in your retirement income. For example: one easy trick could pay you as much as $16,728 more… each year! Once you learn how to maximize your Social Security benefits, we think you could retire confidently with the peace of mind we’re all after. Simply click here to discover how to learn more about these strategies.

The Motley Fool has a disclosure policy.

The Motley Fool is a USA TODAY content partner offering financial news, analysis and commentary designed to help people take control of their financial lives. Its content is produced independently of USA TODAY.

Company Matching Aka Free Money

Because many companies offer their employees a dollar-to-dollar match on 401 contributions up to a certain amount, many employees choose to max out their 401 contributions for the year first, then contribute to another retirement account, such as an IRA. At a minimum, you should aim to contribute enough to take full advantage of your employer match, if they offer one, says Jason DallAcqua, a CFP and president of Crest Wealth Advisors LLC. .

Read Also: Can I Contribute To Traditional Ira And 401k

Tips For Getting Retirement Ready

- If youre unsure of what your retirement plans should look like, a financial advisor can help you get things in order. Luckily finding a financial advisor doesnt have to be hard. SmartAssets free matching tool can pair you with up to three advisors in your area. Get started now.

- Dont forget about Social Security. Youll get a check from the government each month, which can help you get to your desired retirement income level. Find out how much youll get with our free Social Security calculator.

How Much Should I Have Saved In My 401k By Age

Updated: by Financial Samurai

Are you looking for a 401k savings guide? This post will go through how much I think you should have in your 401k by age in order to have a comfortable retirement.

The 401k is one of the most woefully light retirement instruments ever invented. The maximum amount you can contribute is $19,500 for 2021. A 401k is part of your three-legged retirement stool. The other two legs include your after-tax investment accounts and your side hustles.

Although the 401k pales in comparison to a nicely funded pension, even more disappointing than the 401k is the IRA. With the IRA retirement plan, you can only contribute $6,000 in pre-tax dollars. Further, you can only contribute if you make under $76,000 a year as an individual and $125,000 as a married couple. What about the rest of us?

Meanwhile, you have to make less than $140,000 a year as a single person or $208,000 as a married couple for the privilege of contributing the maximum $6,000 in after- tax dollars to a Roth IRA. I do not recommend doing this before maxing out your 401k.

Give me a pension that pays 70% of my last years salary for the rest of my life over a 401k or IRA any time! At least with the 401k, anybody can contribute.

Recommended Reading: How To Avoid Penalty On 401k Withdrawal

Is It Too Late To Start Saving

In a perfect world, youd start saving in your early 20s. However, personal finances come with their ups and downs, so putting money aside for your 401k is often not a priority or not a possibility. If this is you, consider that its never too late to start saving for retirement. While many people aim to retire early, life doesnt stop at 65, and its better to save late than not save at all.

Is Your 401 Enough For Retirement

7 Minute Read | September 27, 2021

We talk to people every day who are trying to build a strong financial future. And one of the best pieces of advice we can give is this: Your workplace 401 is the foundation of a solid retirement plan,

Is that the most exciting investing tip out there? Not really. But do you know what is exciting? Becoming a millionaire! According to our National Study of Millionaires, eight out of 10 millionaires said their 401 was their main wealth-building tool. Theres a reason for that!

Heres why a traditional 401 is a great place to start your retirement savings:

- If your employer matches your contributions , you get an instant 100% return on part of the money you invest in your 401. Thats free money. Take it!

- Tax-deferred growth means your money grows faster.

- Pre-tax contributions lower your taxable income, which makes it easier to invest more.

- You can invest up to $19,500 per year . If youre 50 or older, the contribution limit increases to $26,000 per year to help you catch up.1

Thats why you usually need more than just a traditional 401 if you want a secure retirement. So, what else should you invest in?

Don’t Miss: Can I Manage My Own 401k

Early Money: Take Advantage Of The Age 55 Rule

If you retireor lose your jobwhen you are age 55 but not yet 59½, you can avoid the 10% early withdrawal penalty for taking money out of your 401. However, this only applies to the 401 from the employer you just left. Money that is still in an earlier employer’s plan is not eligible for this exceptionnor is money in an individual retirement account .

If your account is between $1,000 and $5,000, your company is required to roll the funds into an IRA if it forces you out of the plan.