Making A Fidelity 401k Withdrawal

Your 401k is your money, and making a withdrawal is as simple as contacting Fidelity to let them know you want it. The easiest way is to simply visit Fidelitys website and request a check there. However, you can also reach out via phone if you prefer: Call 800-343-3543 with any questions about the process.

From there, you can download the appropriate withdrawal request form and then mail it to the address listed on the form. Fidelity will have your check for you in five to seven business days after receiving your request. There are no fees for requesting a check, but if you liquidate any holdings, there could be commissions or mutual fund fees associated with that.

Borrowing From Your 401k: What You Need to Know

Using Life Insurance For Sustainable Wealth

Many people like to fund whole life insurance during their career instead of maxing out 401 contributions. High cash values in life insurance can be valuable when opportunities arise where 401 funds are off-limit.

For example, my brothers run a metal fabrication business and recently had an opportunity to buy a machine shop for only $50,000 on a special liquidation deal. This equipment would have run close to $250,000 if they had to buy it piecemeal at used prices.

They were able to get a policy loan against their whole life insurance policies and take advantage of this deal quickly.

Some people like to fund whole life insurance with money from a 401, so they have a permanent death benefit and accessible cash values going into their golden years.

If they need more money during retirement 10-15+ years later, they can withdraw more than they paid for the policy or roll a policy to an annuity to create guaranteed passive income for the rest of their life. A high percentage of this income is usually tax-free.

Owning life insurance can also help with estate planning needs or as a volatility buffer where a policy owner can take a loan or withdrawal to cover lifestyle expenses in times when volatile market investments are down. This can allow time for the market to recover instead of further drawing down assets in an invested account.

How Covid Retirement Plan Withdrawals Affect Your Taxes

Though you dont have to pay the 10% penalty on these withdrawals, youll still owe taxes on the money you withdraw. To make things a bit easier, though, the CARES Act allows you to spread the income over three different tax years.

For example, if you borrowed $30,000, you can apply $10,000 to your 2020 taxable income, $10,000 in 2021 and the last $10,000 in 2022. You must take at least one-third of the money in each year, though. You can also opt to take more in any year, including up to all of the money if you so choose.

If, in a later year, youve made back the money you withdrew, that is allowed. Youll have to file an amended return for any years with withdrawal money to get a refund. Again, the same rules apply for IRAs and 401s.

Don’t Miss: How To Avoid Penalty On 401k Withdrawal

Penalties For Cashing Out Your 401 Early

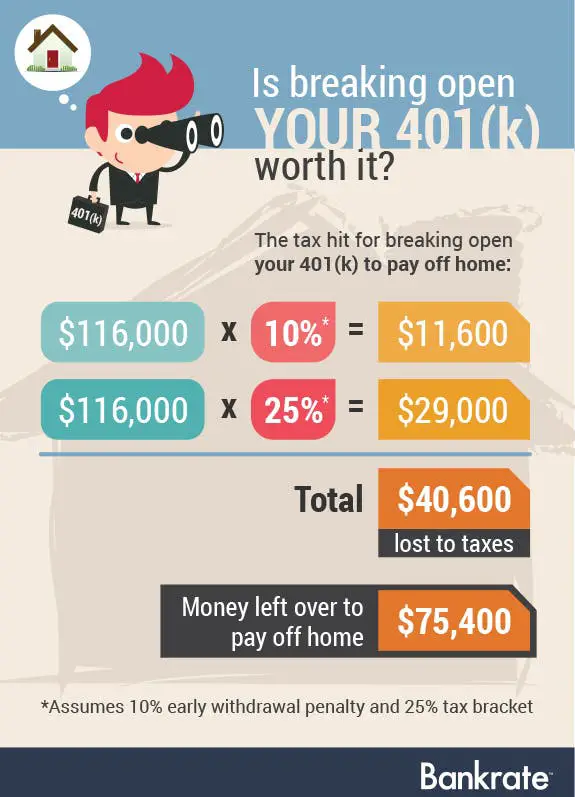

Of course, the biggest consequence comes from the penalties youll pay. You already know youll likely have to pay taxes on your cash out. But if you take out the money before you reach 59.5 years of age, the IRS will charge a 10 percent early withdrawal penalty. The money will also be included with your gross income for the year and taxed at the rate that applies to your tax bracket. You could find that withdrawing the funds moves you into a higher tax bracket.

One way around this is to qualify for a 401 hardship withdrawal, which can exempt you from early withdrawal penalties. The following events can qualify you for a hardship exemption, depending on the rules laid out by your plan:

- Medical expenses

Weighing Pros And Cons

Before you determine whether to borrow from your 401 account, consider the following advantages and drawbacks to this decision.

On the plus side:

- You usually dont have to explain why you need the money or how you intend to spend it.

- You may qualify for a lower interest rate than you would at a bank or other lender, especially if you have a low credit score.

- The interest you repay is paid back into your account.

- Since youre borrowing rather than withdrawing money, no income tax or potential early withdrawal penalty is due.

On the negative side:

- The money you withdraw will not grow if it isnt invested.

- Repayments are made with after-tax dollars that will be taxed again when you eventually withdraw them from your account.

- The fees you pay to arrange the loan may be higher than on a conventional loan, depending on the way they are calculated.

- The interest is never deductible even if you use the money to buy or renovate your home.

CAUTION: Perhaps the biggest risk you run is leaving your job while you have an outstanding loan balance. If thats the case, youll probably have to repay the entire balance within 90 days of your departure. If you dont repay, youre in default, and the remaining loan balance is considered a withdrawal. Income taxes are due on the full amount. And if youre younger than 59½, you may owe the 10 percent early withdrawal penalty as well. If this should happen, you could find your retirement savings substantially drained.

You May Like: How To Make 401k Grow Faster

Reasons To Proceed With Caution

Experts suggest moving slowly with any withdrawal. Here are three things to consider.

Hardship withdrawals are still subject to income taxes. Since your savings went into your retirement plan on a pretax basis, you’ll be paying income taxes on the contributions and earnings withdrawn.

“You get a three-year period to pay the taxes to Uncle Sam,” said Paul Porretta, partner at Pepper Hamilton LLP in New York.

Plan ahead to cover the tax bill and spread it over that period of time, perhaps out of your cash flow.

Know your 401 plan’s rules. Be aware that a workplace retirement plan may allow hardship distributions from participants’ savings, but it isn’t required to do so.

You’ll need to talk to your human resources department or your plan administrator before you proceed.

“A 401 plan or a 403 plan, even if it allows for hardship withdrawals, can require that the employee exhaust other sources of money before taking a withdrawal,” said Porretta.

How To Take Money Out Of Your 401

There are many different ways to take money out of a 401, including:

- Withdrawing money when you retire: These are withdrawals made after age 59 1/2.

- Making an early withdrawal: These are withdrawals made prior to age 59 1/2. You may be subject to a 10% penalty unless your situation qualifies as an exception.

- Making a hardship withdrawal: These are early withdrawals made because of immediate financial need. You may be still be penalized for them.

- Taking out a 401 loan: You can borrow against your 401 and will not incur penalties as long as you repay the loan on schedule.

- Rolling over a 401: If you leave your job, you can move your 401 into another 401 or IRA without penalty as long as the funds are moved over within 60 days of your distribution.

- Taking a coronavirus-related withdrawal: There are special rules in place in 2020 allowing a penalty-free withdrawal of up to $100,000 if you’re experiencing hardships related to the coronavirus.

Also Check: How To Take Out 401k Money For House

Ira Rollover Bridge Loan

There is one final way to borrow from your 401k or IRA on a short-term basis. You can roll it over into a different IRA. You are allowed to do this once in a 12-month period. When you roll an account over, the money is not due into the new retirement account for 60 days. During that period, you can do whatever you want with the cash. However, if its not safely deposited in an IRA when time is up, the IRS will consider it an early distribution. You will be subject to penalties in the full amount. This is a risky move and is not generally recommended. However, if you want an interest-free bridge loan and are sure you can pay it back, its an option.

Better Options For Emergency Cash Than An Early 401 Withdrawal

We know it can be a struggle when suddenly you need emergency cash for medical expenses, student loans, or crushing consumer debt. The extreme impact of coronavirus on public health and the economy has only compounded some of the more routine challenges of consumer cash flow.

We get it. The money squeeze can be quick and traumatic, especially in a more volatile economy.

Thats why information about an early 401 withdrawal is among the most frequently searched items on principal.com. Understandably so, in a world keen on saddling us with debt.

But the sad reality is that if you do it, you could be missing out on crucial long-term growth, says Stanley Poorman, an advice and planning manager for Principal® Advised Services who helps clients on household money matters.

In short, he says, Youre harming your ability to reach retirement. More on that in a minute. First, lets cover your alternatives.

Recommended Reading: Can You Roll A Traditional 401k Into A Roth Ira

Youre Our First Priorityevery Time

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Substantially Equal Period Payments

Substantially Equal Period Payments might be a good option if you need to withdraw money for a long term need. These payments must last a minimum of 5 years or until you reach the normal 401k withdrawal age of 59 1/2, whichever is shorter. For this reason, this is not a good option if you have a short term need like a sudden unexpected expense. You cannot withdraw funds under this method if you still work for the employer through which you have the 401. To calculate the amount of these payments, the IRS recognizes three acceptable methods.

Don’t Miss: How Do I Transfer 401k To New Employer

Borrowing Money From My 401k

It may seem like an easy way to get out of debt to borrow from your retirement accounts for DIY debt consolidation, but you can only borrow $50,000 or half the vested balance in your account, if its less than $50,000. You wont face a tax penalty for doing so, like you would with an out-right withdrawal, but youll still have to pay the money back.

And unlike a home equity loan where payments can be drawn out over a 10-to-30-year period, most 401k loans need to be paid back on a shorter time table like five years. This can take a huge chunk out of your paycheck, causing you even further financial distress. Borrowing money from your 401k also limits the ability of your invested dollars to grow.

Paying off some of your debt with a 401k loan could help improve your debt-to-income ratio, a calculation lenders make to determine how much debt you can handle. If youre almost able to qualify for a consolidation or home equity loan, but your DTI ratio is too high, a small loan from your retirement account, amortized over 5 years at a low interest rate may make the difference.

Withdrawing From A Roth 401k

Most 401k plans involve pre-tax contributions, but some allow for Roth contributions, meaning those made after taxes already have been paid.

The benefit of making a Roth contribution to your 401k plan is that you already have paid the taxes and, when you withdraw the money, there is no tax on the amount gained as long as you meet these two provisions:

- You withdraw the money at least five years after your first contribution to the Roth account

- You are older than 59 ½ or you became disabled or the money goes to someone who is the beneficiary after your death

Recommended Reading: How Do I Stop My 401k

Purchasing Your First Home

You can use money from your 401 to buy a house. But you will pay a 10% penalty.

You can take money from your IRA without a penalty. You do not have to be a first-time home buyer, but you cannot buy another house if youve owned a home in the last two years. You can take more than one withdrawal for a home, but there is a $10,000 limit over a lifetime.

Other Options If You Need Cash

If you are experiencing financial hurdles because of the recent coronavirus outbreak, Ellis recommends exhausting other resources before tapping into your retirement plan balance.

First, consider using any emergency savings you may have. “We recommend our clients keep three to six months’ worth of living expenses in cash for emergencies, which this would definitely fall under,” Ellis says.

If you own a home, you could look into getting a home equity line of credit since housing values have been on the rise and interest rates are low. “You may have the ability to utilize the equity in your home at a low carrying cost,” Ellis says.

If you need cash and don’t have any emergency savings or home equity on hand, consider applying for a personal loan from your bank, which is generally used to consolidate debt or make a big purchase. The average interest rate for a two-year personal loan was about 10.2% in November 2019, according to the latest data from the Federal Reserve.

Keep in mind that the rate depends on both your credit and on the length of the loan, as shorter loans tend to have lower APRs. If you have bad credit, you may be facing an interest rate of up to 36%.

If those options don’t work, you could also tap into a Roth IRA if you have one. With these accounts, you can withdraw any money you’ve invested at any time, without taxes or penalties. But again, remember there’s an opportunity cost to using that money.

Also Check: Is There A Maximum You Can Contribute To A 401k

It Doesnt Matter Why Your Employment Ended

It doesnt matter whether you were fired, quit or were laid off. As long as you are no longer employed by the company maintaining the plan, and your employment was terminated during or after the year you turned 55, you will qualify for penalty-free early withdrawals from that 401.

Additionally, you dont even need to be retired to avoid paying taxes or penalties. If you have a 401 with Company ABC and quit at age 57, youll be able to access those savings without penaltyeven if you immediately take a job with Company XYZ.

When Should You Make A 401 Early Withdrawal

Considering the 10% penalty, financial planners often advise taking an early withdrawal from your 401 as a last resort. Since penalty-free withdrawals are available for a number of financial hardships and situations, plan participants who take an early withdrawal with a penalty are often in serious financial straits.

Ive seen people take withdrawals for a number of reasons, Stiger says. Everything from a childs tuition to a spouses burial expenses the hope is that distributions are used for larger, more unexpected expenses like medical emergencies, keeping a home out of foreclosure or eviction, and in a down period, putting food on the table.

Ultimately, taking an early withdrawal can make sense if you are able to take advantage of a penalty-free exception, use the Rule of 55 or the SEPP exemption, or take advantage of a topical change in rules, such as the Covid-related changes offered in 2020 as part of the CARES Act.

It might make sense to exhaust other options firstcheck out these 10 ways to get cash nowbefore turning to your tax-deferred retirement account for an early withdrawal. And remember: Contributions to a Roth IRA can always be withdrawn without penalty if youre truly in a bind.

Don’t Miss: What Is An Ira Account Vs 401k

No More Creditor Protection

Once youve squared away how long it takes to cash out your 401, its time to think about consequences. The first is the loss of protection against creditors. If youre cashing out because creditors may come knocking, this is something you need to consider. Employer-sponsored 401 plans are often protected against creditors, bankruptcy proceedings, and civil lawsuits. Once youve cashed the funds out, theyll be subject to action along with your other assets.

But before you assume this could be a problem, check to make sure your plan isnt vulnerable for other reasons. If youre in the process of divorcing or are already divorced, the other party could be able to snag a portion of the funds under a qualified domestic relations order. Funds in a 401 can also be seized to pay tax debts and federal penalties.

Plan for a better future

Get an affordable, professionally prepared retirement plan today.