Rollover Your 401 Into An M1 Ira

1. Open an M1 IRA account.

2. Contact your current 401 administrator

Tell them that you would like to initiate a rollover.

If you dont know who your administrator is, you can check your last statement or reach out to your former employer.

Helpful tips:

- Have your current administrator make the check payable to Apex Clearing.

- The check should include your name and M1 IRA account number in the memo line.

- Your M1 IRA account number is foundin the account information drop down menu

- If the account number is not on the check, please include a slip of paper with your M1 IRA account number written on it.

3. Have the rollover check sent to:

Apex Clearing c/o BPO

350 North St. Paul Street #1300

Dallas, TX 75201

If the 401 administrator sends your distribution check to you directly, then you will need to send the check to Apex Clearing Corporation at the address above.

If the check is made out to you, please make sure to endorse the check. After the check is sent, please allow 20 days before contacting M1.

Consider Mobile Check Deposit

If you’re already a Vanguard client and you’re registered for online access, remember that you can use our mobile check deposit option offered through the Vanguard app. It’s faster than mailing a check!

When you’re logged on and using the app, just tap the Mobile check option under the main menu and then follow the instructions. Learn more about mobile check deposit

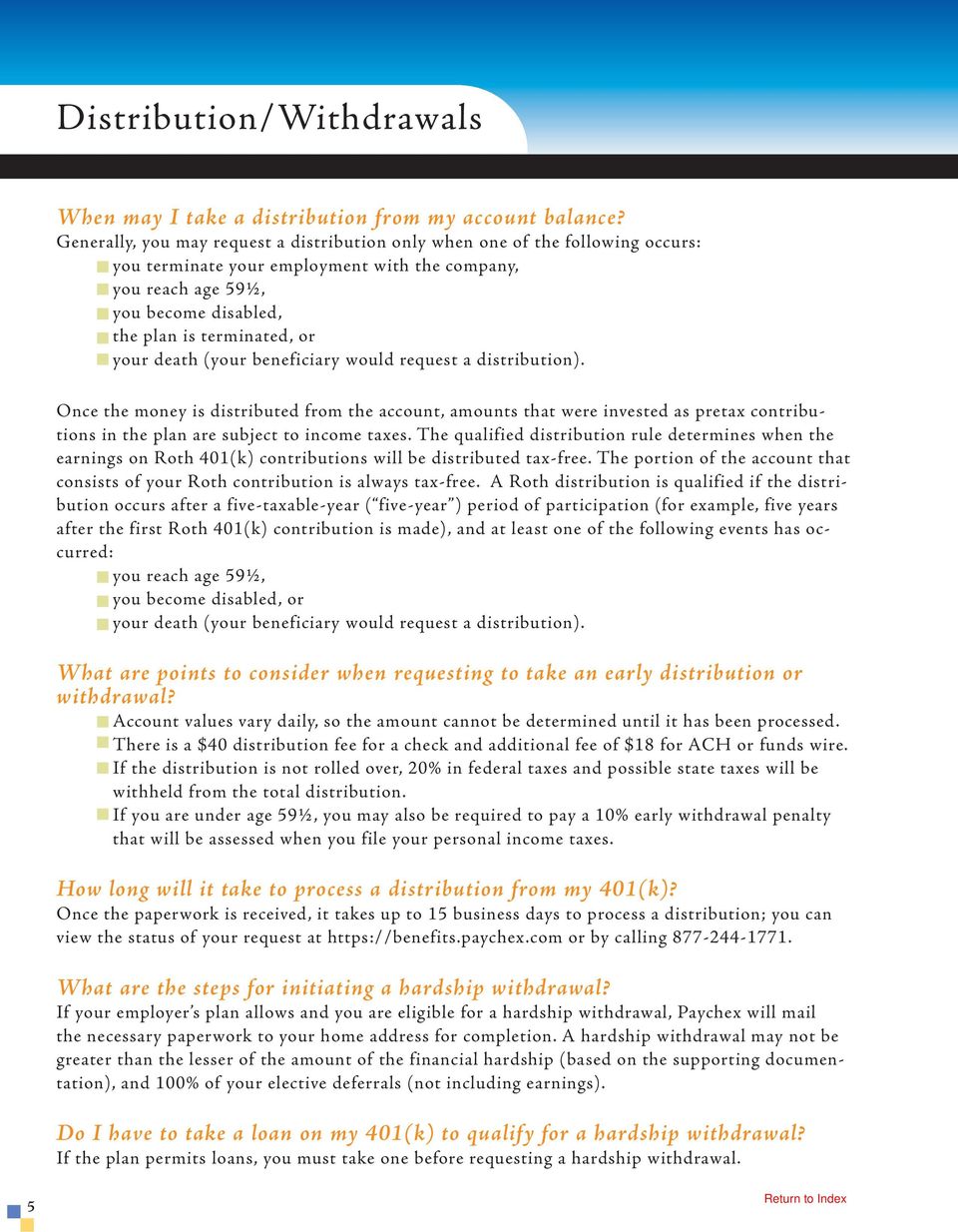

Are There Exceptions To The 10% Early Withdrawal Penalty

If you’re under 59½ when you cash out of your plan, you may also be subject to a 10% early withdrawal penalty. Certain exceptions include:

- If youre 55 or older when you leave your job.

- Distributions due to death, disability and certain medical expenses.

- You take the distribution as part of substantially equal payments over your lifetime.

Ask your financial professional for more information about these and other exceptions.

Read Also: Should I Open A 401k

If I Make Contributions To My Rollover Ira Can I Still Roll The Ira Into An Employer Plan

You may be able to transfer your IRA balance into your new plan if the new plan accepts rollovers from IRAs. Before rolling your money into a new plan, you should compare the plans investment options and withdrawal rules with those of your IRA. You may give up some flexibility or face stricter requirements if you make the move.

If you rolled after-tax deferrals from an employers plan into a traditional IRA, you may not subsequently roll those after-tax deferrals to another employers retirement plan.

Start With Your Old 401k

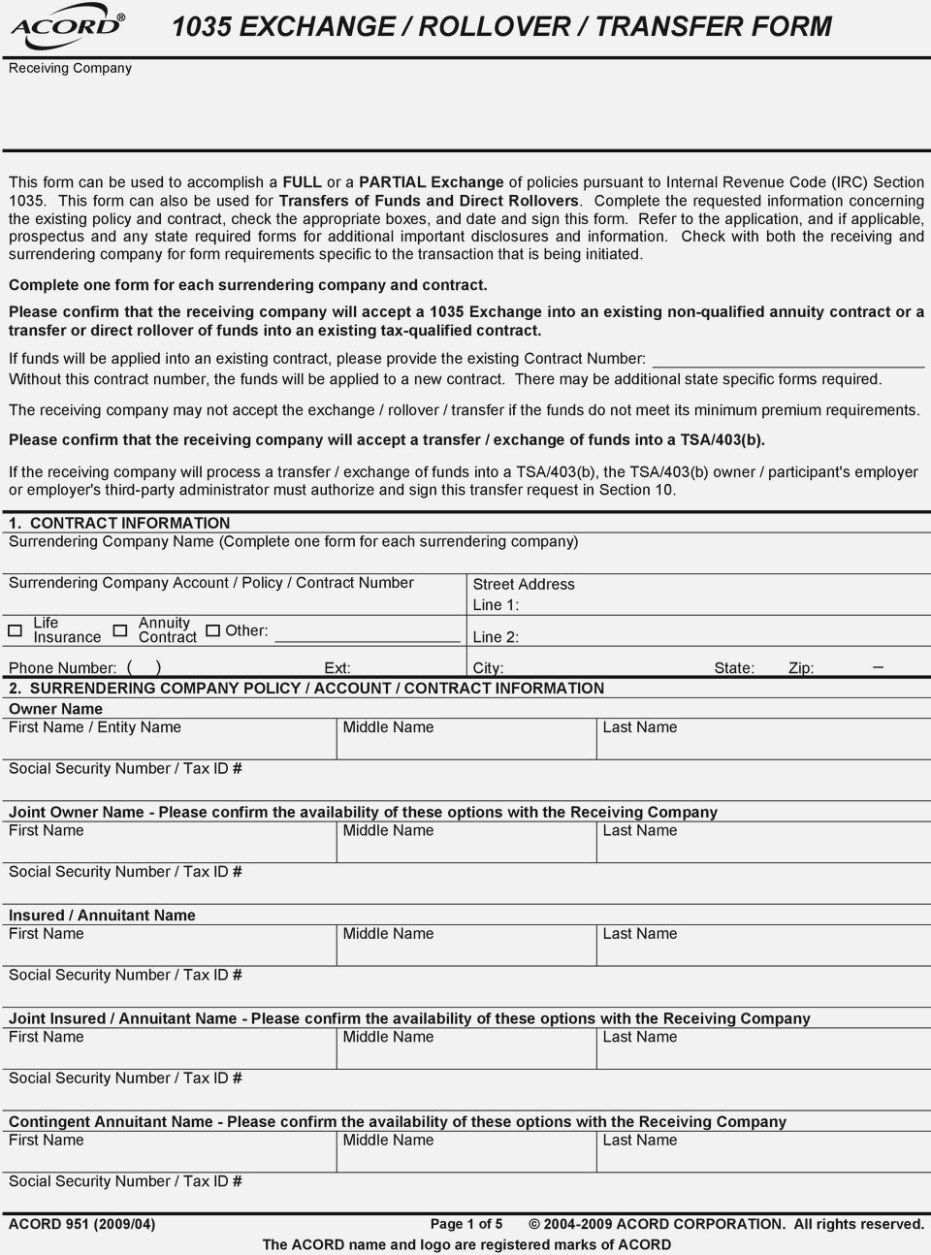

When you want to do a 401K rollover, start with your old employer and the company that managed your 401K with your old employer . We start here as each 401K plan has its own rules and processes. Some have an online process, some require you to send an email to the plan provider, and some require signed forms from different parties in the process.

If you have an online portal that you used to see your 401K account information, find the contact information for somebody at the provider to reach out to and tell them you want to begin a rollover. Even emailing the general email inbox at the custodian typically works as these companies are very familiar and comfortable with their clients performing a rollover. If you are unsure about an online portal or dont have your account information, reach out to an HR representative at your old employer and tell them you want to do a 401K rollover and they will help you get started.

At this point, you are mostly in information-gathering mode. When you talk to an HR representative or 401K custodian, tell them you want to do a rollover and ask the following:

-

What is their process for completing a rollover?

-

What forms and signatures do they require?

-

What will you need from your old employer and from your current employer?

-

How quickly can they complete the rollover?

In some cases, you will be required to fill out a paper form and fax it to your old employer for signatures.

Also Check: What Is The Difference Between A Pension And A 401k

What Is A Rollover Ira

A rollover IRA is an individual retirement account often used by those who have changed jobs or retired. A rollover IRA allows individuals to move their employer-sponsored retirement accounts without incurring tax penalties and remain invested tax-deferred. Consolidating multiple employer-sponsored retirement accounts can make it easier to monitor your retirement savings.

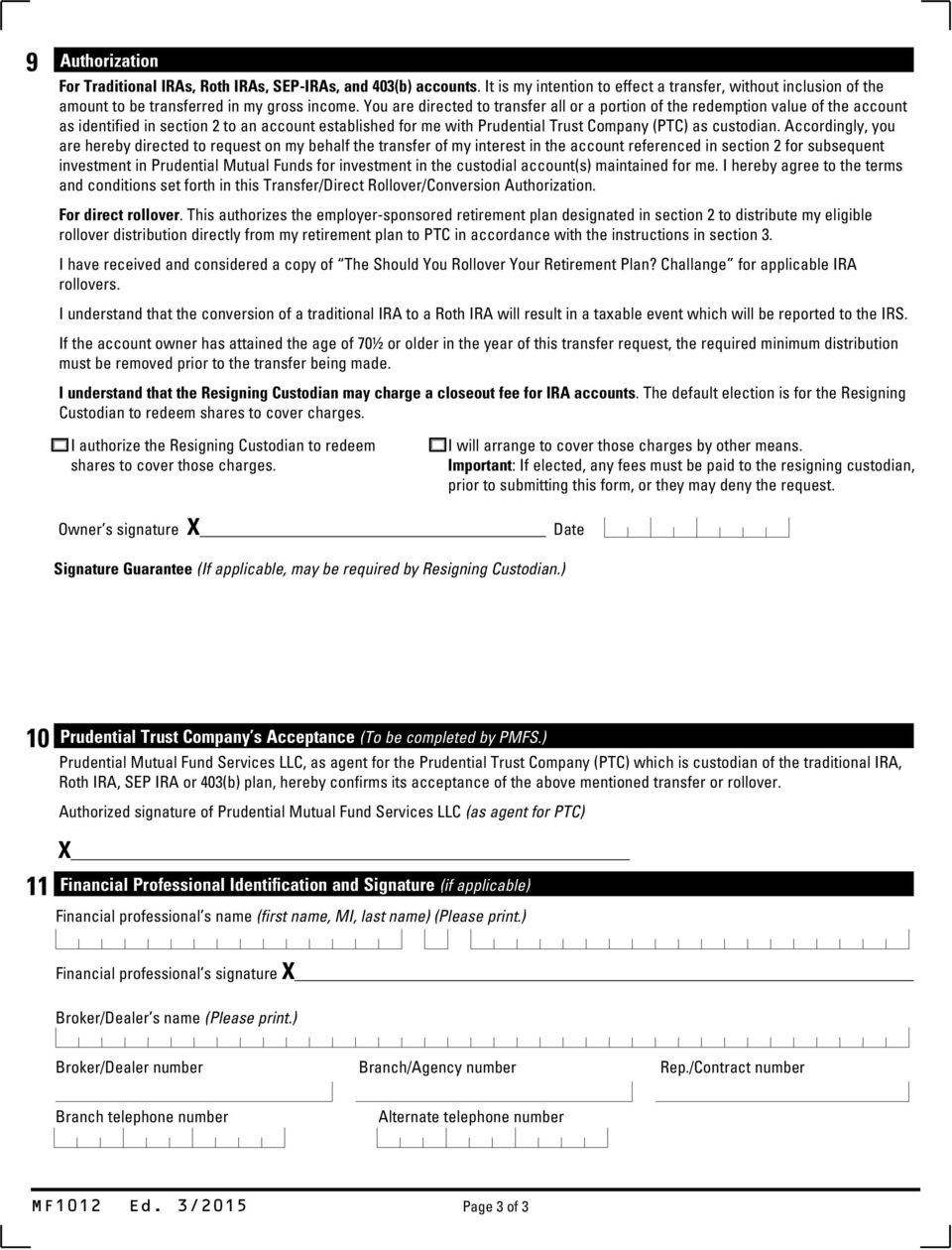

*Note: If you have an existing rollover or traditional IRA at Prudential, you can roll your assets into that account.

Short Of Cash Be Cautious

It may be tempting to pull money out of your 401 to cover a financial gap. Or, when you are considering rolling money over from a 401 to an IRA, you may wish to roll over only a portion of your retirement savings and take the rest in cash. But do you know the true cost? Use our 401 Early Withdrawal Costs Calculator first.

Investment and Insurance Products are:

- Not Insured by the FDIC or Any Federal Government Agency

- Not a Deposit or Other Obligation of, or Guaranteed by, the Bank or Any Bank Affiliate

- Subject to Investment Risks, Including Possible Loss of the Principal Amount Invested

Investment products and services are offered through Wells Fargo Advisors. Wells Fargo Advisors is a trade name used by Wells Fargo Clearing Services, LLC and Wells Fargo Advisors Financial Network, LLC, Members SIPC, separate registered broker-dealers and non-bank affiliates of Wells Fargo & Company.

WellsTrade® and Intuitive Investor® accounts are offered through WFCS.

Retirement Professionals are registered representatives of and offer brokerage products through Wells Fargo Clearing Services, LLC . Discussions with Retirement Professionals may lead to a referral to affiliates including Wells Fargo Bank, N.A. WFCS and its associates may receive a financial or other benefit for this referral. Wells Fargo Bank, N.A. is a banking affiliate of Wells Fargo & Company.

You May Like: How Do I Use My 401k To Start A Business

Cashing Out: The Last Resort

Avoid this option except in true emergencies. First, you will be taxed on the money. In addition, if you’re no longer going to be working, you need to be 55 to avoid paying an additional 10% penalty. If you’re still working, you must wait to access the money without penalty until age 59½.

Most advisors say that if you must use the money, withdraw only what you need until you can find another income stream. Move the rest to an IRA or similar tax-advantaged retirement plan.

Rolling 401 Assets Into An Ira

When you retire or leave your job for any reason, you have the right to roll over your 401 assets to an IRA. You have a number of direct rollover options:

Rolling your traditional 401 to a traditional IRA. You can roll your traditional 401 assets into a new or existing traditional IRA. To initiate the rollover, you complete the forms required by both the IRA provider you choose and your 401 plan administrator. The money is moved directly, either electronically or by check. No taxes are due on the assets you move, and any new earnings accumulate tax deferred.

Rolling your Roth 401 to a Roth IRA. You can roll your Roth 401 assets into a new or existing Roth IRA with a custodian of your choice. You complete the forms required by the IRA provider and your 401 plan administrator, and the money is moved directly either electronically or by check. No taxes are due when the money is moved and any new earnings accumulate tax deferred. Earnings are eligible for tax-free withdrawal once the IRA has been open at least five years and you are at least 59½.

Rolling your traditional 401 to a Roth IRA. If your traditional 401 plan permits direct rollovers to a Roth IRA, you can roll over assets in your traditional 401 to a new or existing Roth IRA. Keep in mind youll have to pay taxes on the rollover amount you convert.

Also Check: How To Pull From 401k

Is There Any Portion Of A Distribution Thats Tax

Yes, if the distribution includes after-tax contributions or Roth contributions. Non-Roth after-tax contributions can be distributed tax-free, but earnings are taxable. Qualified distributions from Roth 401 or Roth 403 accounts are tax-free. However, the earnings portion of nonqualified Roth distributions is taxable.

What Is A 401 Rollover

A 401 rollover is the technical term for transferring the money in an old 401 account to another retirement account. Most people who roll over end up transferring their 401 savings into a new or existing IRA .

Let Capitalize handle your 401 rollover for you, for free! Weve made it our mission to make the 401-to-IRA rollover process easy for everyone. Learn more

You May Like: How Do You Take Money Out Of 401k

Transfer To A Retirement Plan Account With Principal

Simplify your retirement planning with one website, one statement and one dedicated team. If you’re joining a company that offers a retirement plan, your savings stay invested and you can continue to make ongoing contributions to help you save for your future.

Log in to your account or call us at 800-547-7754 and our retirement specialists can help you get the process started.

Do I Have To Leave My Job To Withdraw My Retirement Plan Money

Not necessarily, although thats what most plans require. If your employer terminates your retirement plan, or if you become disabled, you may be given an opportunity to take a distribution. Also, some retirement plans permit you to draw on your retirement plan money after a fixed number of years or upon reaching a certain age, such as 59½ or the plans designated retirement age.

Read Also: How Much Money Do I Have In My 401k

Rolling The Assets Into An Ira Or Roth Ira

Moving your funds to an IRA is the route financial experts advise in most instances. “Now you’re in charge and you have more investment flexibility,” said Smith. Try not to go it alone, he advises. “Once you roll the money over, it’s you making the decisions, but getting a financial professional should be the first step.”

Your first decision: whether to open a traditional IRA or a Roth.

Traditional IRA. The main benefit of a traditional IRA is that your investment is tax-deductible now you put pre-tax money into an IRA, and those contributions are not part of your taxable income. If you have a traditional 401, those contributions were also made pre-tax and the transfer is simple. The main disadvantage is that you have to pay taxes on the money and its earnings later, when you withdraw them. You are also required to take an annual minimum distribution starting at age 70½, whether if you’re still working or not.

Roth IRA. Contributions to a Roth IRA are made with post-tax income money you have already paid taxes on. For that reason, when you withdraw it later neither what you contributed nor what it earned is taxable you will pay no taxes on your withdrawals. Investing in a Roth means you think the tax rates will go up later, said Rain. “If you think taxes will increase before you retire, you can pay now and let the money sit. When you need it, it is tax-free,” said Rain.

How To Roll Over An Empower 401

If you have a 401 at Empower Retirement from a previous job, there are a few options for you to consider when doing a rollover. Depending on your plan, the process for Empower can be done over the phone or by filling out a form, and a check will either be mailed to your new account provider or sent directly to you to deposit into the new account.

You May Like: How To Grow 401k Fast

If I Roll My Account Into An American Funds Ira What Sales Charges Or Account Fees Will I Have To Pay

It depends. Generally, an amount already invested in American Funds can be rolled over into an American Funds IRA without paying any up-front sales charges. Any amount held in investments other than American Funds is subject to applicable sales charges.

A one-time $10 setup fee will be deducted from your account when you open an American Funds IRA. There is also an annual custodian fee .

Move Money To New Employer’s 401

Although there’s no penalty for keeping your plan with your old employer, you do lose some perks. Money left in the former companys plan cannot be used as the basis for loans. More importantly, investors may easily lose track of investments left in previous plans. I have counseled employees who have two, three, or even four 401 accounts accumulated at jobs going back 20 years or longer, Ford said. These folks have little or no idea how well their investments are doing.

For accounts between $1,000 and $5,000, your company is required to roll the money into an IRA on your behalf if it forces you out of the plan.

If you have at least $5,000 in your account, most companies allow you to roll it over. But accounts of less than $5,000 can be rolled out of the plan by the company if a former employee does not respond to a notification letter within 30 days.

For amounts under $1,000, federal regulations now allow companies to send you a check, triggering federal taxes and state taxes if applicable, and a 10% early withdrawal penalty if you are under age 59½. In either scenario, taxes and a potential penalty can be avoided if you roll over the funds into another retirement plan within 60 days.

Also Check: How To Start My Own 401k

How We Can Help

If you have a 401 and are exploring what options make the most sense for you, we invite you to meet with one of our financial advisors to discuss your situation. He or she will take the time to explain the options available to you, answer any questions you may have and together you can determine what’s best for you.

Option : Transfer The Money From Your Old 401 Plan Into Your New Employers Plan

Moving your old 401 into your new employers qualified retirement plan is also an option when you change jobs. The new plan may have lower fees or investment options that better support your financial goals. Rolling over your old 401 into your new companys plan can also make it easier to track your retirement savings, since youll have everything in one place. Its worthwhile to talk with an Ameriprise advisor who will compare the investments and features of both plans.

Some things to think about if youre considering rolling over a 401 into a new employers plan:

Don’t Miss: When Can You Take Out 401k

How Long Does A 401k Rollover Take

While weve heard stories of 401K rollovers taking weeks, it can as quick as a few days. Here is an illustrative timeline of how that would work.

The ideal 401K rollover timeline: you can complete the rollover in as little as 4 days from start to finish.

When you are ready to get started on the 401K rollover process, were here to help. The rest of this guide walks through that process step-by-step. We assume you plan to open an IRA, but have included instructions for rolling into your new employers 401K as well. Before you jump in, be prepared with this checklist of information you will need:

-

Contact info for HR

-

Contact info for old 401K provider

-

401K account number

-

IRA account number

Contact Fidelity And Ask For A Direct Rollover

Reach out to a Fidelity representative about beginning your rollover. The company has a set procedure to follow for rollovers.

Be very sure, though, to emphasize that you want a direct rollover, meaning youre moving the funds directly from one retirement account to another. No taxes will be withheld from the transfer amount, according to the IRS.

Beware: 11 Things You Should Never Do With Your 401k

Also Check: How Do You Roll A 401k Into An Ira

Changing Jobs The Ins And Outs Of A 401 Rollover

Thomas J Catalano is a CFP and Registered Investment Adviser with the state of South Carolina, where he launched his own financial advisory firm in 2018. Thomas’ experience gives him expertise in a variety of areas including investments, retirement, insurance, and financial planning.

If you’ve decided to leave your current job for another, you will need to decide what to do with the money that you have invested in your current company’s 401 plan. Options typically include leaving it where it is, rolling it over to a new employer’s plan, or opting for an IRA rollover.

If you are about to change jobs, here’s what you need to know about rolling over your funds into a new employer’s 401 plan and the ins and outs of other options.

Can I Transfer The American Funds Shares Held In My Retirement Plan Account Into An Ira

It depends on your retirement plan. Check your plans SPD to see when youre allowed to take a distribution. If you qualify to take a distribution , you can request a direct rollover to an IRA.

Rollovers from retirement plans to IRAs are tax-reportable, however, direct rollovers are not taxable if completed as direct rollovers.

To determine if you may continue to hold your American Fund shares in the same share class, speak with your financial professional or you may call us at .

Don’t Miss: How Can You Take Out Your 401k