What Is A 401 How Does A 401 Work

A 401 is an employer-sponsored retirement savings plan that offers significant tax benefits while helping you plan for the future.

With a 401, an employee sets a percentage of their income to be automatically taken out of each paycheck and invested in their account. Participants can choose how to allocate their funds among the investment choices offered by the plan, which usually include a variety of mutual funds.

Also Check: What Happens To 401k When You Change Jobs

What Else Do Small Business Owners Need To Know About 401 Plans

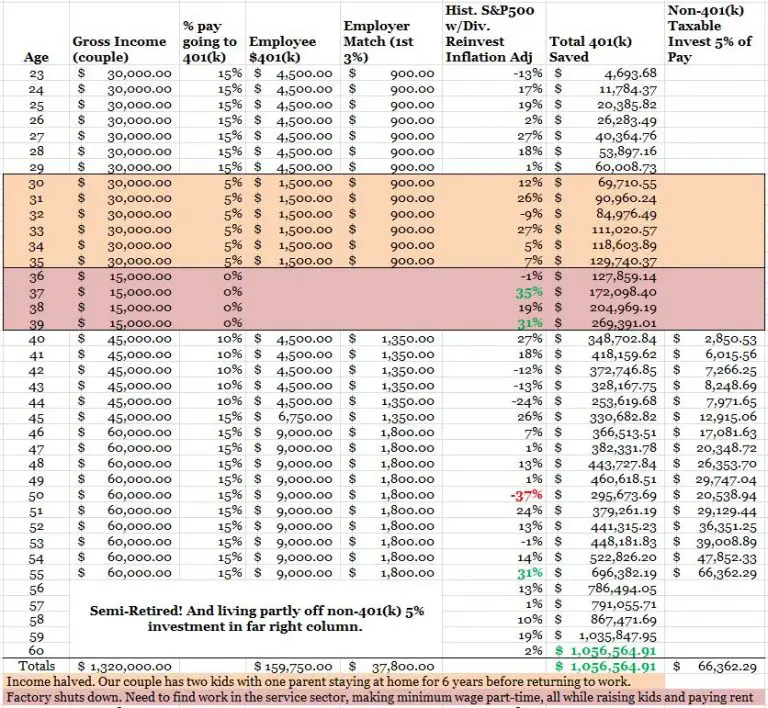

Small business owners who offer retirement savings plans may be able to take advantage of tax incentives. Matching employee contributions, for instance, is generally tax deductible as a business expense. For the first three years of the plan, employers may also be eligible for tax credits up to 50% of the start-up and administration costs or $5,000 , as well as a $500 automatic enrollment credit per year.

Making A Choice For Your 401

Maybe youve switched jobs to take on new challenges. Perhaps youre thinking about changing career paths for something more rewarding. Or maybe youre finally getting ready to retire.

We understand when your life changes, other things may change toolike your goals for retirement. Well help you consider your options for your 401 accounts from past jobs, so you can feel confident youre on track for the future you want.

You May Like: Can I Cash In My 401k

Find Your 401 With Your Social Security Number

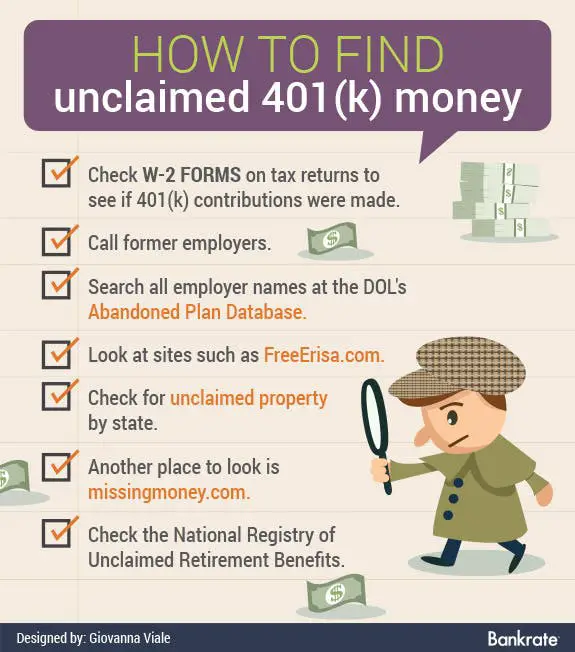

If the old plan administrator cannot tell you where your 401 funds went, there are several databases that can assist. You can use your Social Security number to find your lost 401 by popping it into some of the databases below.

National Registry of Unclaimed Retirement Benefits

The National Registry of Unclaimed Retirement Benefits works like a missed connections service where companies register with the site to help facilitate a reunion between ex-employees and their retirement money. Not every company is registered with this site, so if none of these searches yields results, move on to the next step.

Department of Labor’s abandoned plan database

Another good place to start is with the Department of Labors abandoned plan database. It’s provided by the Employee Benefits Security Administration. The tool helps you find out if you have a plan that’s terminated, or is in the process of being terminated. You can also figure out who is doing the terminating in case you need to contact them directly.

U.S. Pension Guaranty Corp. database of unclaimed pensions

If you were covered under a traditional pension plan that was disbanded, search the U.S. Pension Guaranty Corp. database of unclaimed pensions. You’ll need to provide your name, address, Social Security number, the employers name, and the dates you worked for the company, as well as your contact phone number.

FreeErisa

Search Unclaimed Property Databases

If a company terminates its retirement plan, it has more options on what its allowed to do with the unclaimed money, no matter what the account balance.

It might be rolled into an IRA set up on your behalf, deposited at a bank, or left with the states unclaimed property fund. Hit up missingmoney.com, run in part by the National Association of Unclaimed Property Administrators, to do a multistate search of state unclaimed property divisions.

Note that if a plan administrator cashed out and transferred your money to a bank account or the state, a portion of your savings may have been withheld to pay the IRS. Thats because this kind of transfer is considered a distribution and is subject to income taxes and penalties. Some 401 plan administrators withhold a portion of the balance to cover any potential taxes and send you and the IRS tax form 1099-R to report the income. Others dont, which could leave you with a surprise IRS IOU to pay.

You May Like: Can I Rollover Solo 401k To Ira

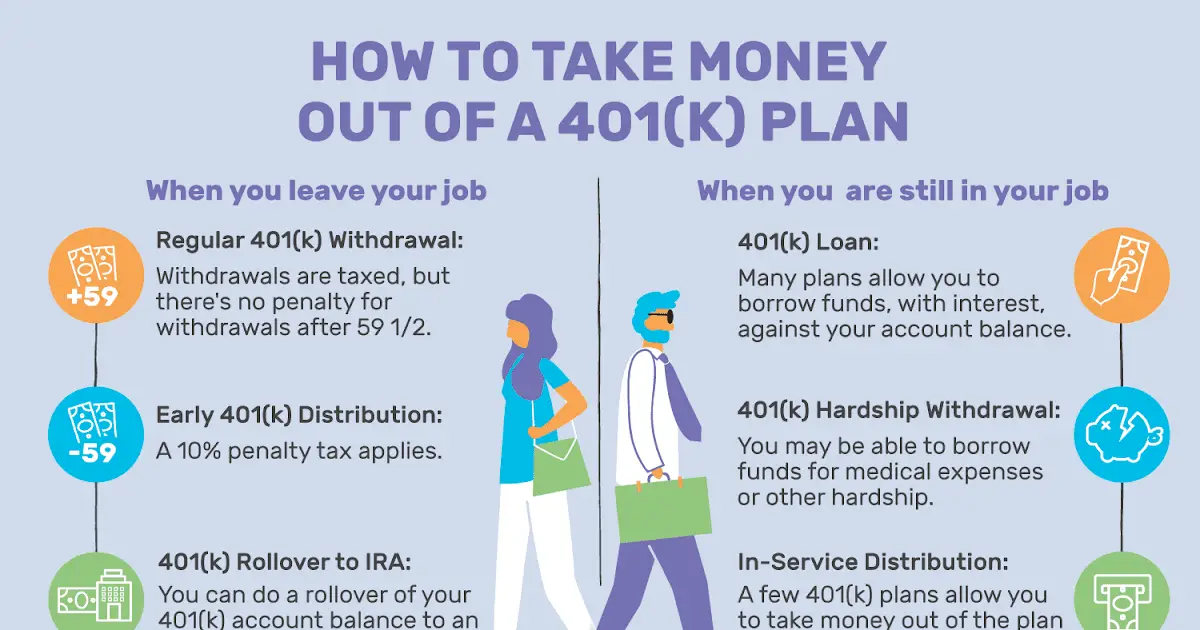

Roll Over The Old 401 Account Into An Ira

This will likely be the best option for most people because the IRA is attached to you instead of your employer, making it less likely that youll lose track of the account again. An IRA also comes with a much wider selection of investments than most 401 plans. Youll be able to choose from individual stocks as well as mutual funds, ETFs and more.

If you dont already have an IRA, youll need to set up an account before you roll over your 401. The process is fairly straightforward and you can open an IRA through most online brokers.

I Still Have A 401k From My Last Job What Do I Do About That

As you move ahead from job to job, dont make the mistake of leaving a trail of old savings accounts behind you. Put your hard-earned savings to work for you by looking at all the options. If youve left a job and a 401k, here are the options available to you for those funds.

- Leave your balance

- Rollover to new 401 plan.

- Rollover to an IRA.

Also Check: How To Find Lost 401k

How To Reclaim Your Retirement Plan With A Previous Employer

Millions of Americans accidentally or unknowingly leave money in retirement plans with previous employers. According to a study by the National Association of Unclaimed Property Administrators, Americans lost track of more than $7.7 billion in retirement savings in 2015.

If you’ve left a retirement plan with a previous employer, not to worry. Here are 6 tips you can follow to reclaim your money.

How Many Lost 401ks And Other Retirement Accounts Are Forgotten

Think lost and forgotten retirement accounts amount to chump change? Although no one keeps data on how much retirement money gets lost or forgotten, in an interview with Bloomberg, Terry Dunne of Millennium Trust Co., made an educated guess based on government and industry data that more than 900,000 workers lose track of 401k-style, defined-contribution plans each year.

That figure doesnt include pensions. According to the Pension Benefit Guaranty Corporation, an independent agency of the U.S. government tasked with protecting pension benefits in private-sector defined benefit plans, there are more than 38,000 people in the U.S. who havent claimed pension benefits they are owed. Those unclaimed pensions total over $300 million dollars, with one individual being owed almost $1 million dollars!

Could that money belong to you?

Dont Miss: How Do I Open A Roth 401k

You May Like: How To Use 401k For Home Purchase

How To Find An Old 401

Quick Answer

To find an old 401, there are three main places you should look. Start your search by looking through your documents, then try contacting your former employer and checking your states unclaimed property website.

In this article:

Millions of forgotten 401 retirement accounts are begging to be claimed. As of May 2021, an estimated 24.3 million 401s holding $1.35 trillion in assets had been left behind by people who changed jobs, according to financial services company Capitalize.

If you’ve lost track of an old 401, what do you do? Well, don’t panic. To find an old 401, start by searching your files, then contact your former employer’s HR department and check with your state’s unclaimed property agency.

Why You Should Roll Over Your Old 401 Accounts

Once you find forgotten retirement funds, you can make it easier to keep track of your money by simply rolling over your old 401 accounts into an IRA at a brokerage you already have an account with. This way you can manage your nest egg easier since all of your money is in one place.

“It’s beneficial to consolidate your accounts to reduce oversight obligations,” Cavazos says. “Having all of your funds consolidated in one account allows you to keep track of your balance and account performance.”

If you already have an existing IRA, you can roll your 401 balance into that account. Otherwise, it’s easy to open a new IRA at the big-name brokers like Charles Schwab, Fidelity, Vanguard, Betterment or E*TRADE. Rolling over your old 401 plan into an IRA gives you more control over how you invest your retirement funds since you won’t be limited to just the funds that were offered by your former employer. These large brokerages give you thousands of investment options, including mutual funds, index funds and individual stocks.

Read Also: How Do You Convert A 401k To A Roth Ira

Option : Move The Money To An Ira

If you’re not able to transfer the funds to your current 401 or you don’t want to, you can roll over the funds to an IRA instead. The process is the same as doing a rollover to a new 401, and you still have the choice between a direct or indirect rollover.

You’ll need to set up a new IRA with any broker if you don’t already have one. Make sure you choose an IRA that’s taxed the same way as your old 401 funds. Most 401s are tax-deferred, which means your contributions reduce your taxable income in the year you make them, but you pay taxes on your withdrawals in retirement. You want a traditional IRA in this case because the government taxes these funds the same way.

If you had a Roth 401, you want a Roth IRA. Both of these accounts give you tax-free withdrawals in retirement if you pay taxes on your contributions the year you make them.

In most cases, losing track of your old 401 doesn’t mean the money is gone for good. But finding it is only half the challenge. You must also decide where to keep those funds going forward so they’ll be most useful to you. Think the decision through carefully, then follow the steps above.

Too Complicated Get Some Help

If this process seems like a lot of work, youâre not alone. Locating your old 401 accounts and finding the proper place to transfer them to can get confusing.

Fortunately, Beagle can do all of the difficult work for you. The tasks of finding your accounts and facilitating their transfers are all done for you. Getting started is easy.

Recommended Reading: How Do I Transfer 401k To New Employer

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our reporters and editors focus on the points consumers care about most how to save for retirement, understanding the types of accounts, how to choose investments and more so you can feel confident when planning for your future.

Search Unclaimed Assets Databases

If your search is still coming up empty, your former employer has folded or was bought by another company, youâre not out of luck yet.

It may take a little more effort and research but there are many national databases that can help you track down your old 401 accounts:

- The Department of Laborâs Abandoned Plan database can help you identify what happened to your old plan and the contact information of the current administrator

- The National Registry of Unclaimed Retirement Benefits allows you to do a free search for any unclaimed retirement money using just your Social Security number

- FreeERISA is another free resource to search for any old account information that has been filed with the federal government

- The Securities and Exchange Commissionâs website or your stateâs Secretary of State can provide more information on your previous employer

You May Like: Can I Have My Own 401k

What Is A Defined Contribution Plan

A defined contribution plan is any retirement plan to which an employee or employer regularly contributes some amount. Often, the employee chooses to send a fixed percentage of monthly income to the account, and these contributions are automatically withdrawn, directly from her paycheck no effort required. The money that doesnt go to the employees take-home pay gradually accumulates, the balance earns interest from investments, and by the time retirement rolls around, its grown into a substantial nest egg for the retiree. Thats the idea.

In a defined contribution plan , there are no guarantees about the income youll receive in retirement. That doesnt mean such plans cant be just as effective, however, and employers often sweeten the deal by making contributions of their own, straight into your account.

How Can I Determine What Guidelines Affect Me

To fully understand the vesting policies of your company, speak with the human resources department. They should be able to explain your companys vesting policy and schedule. Being aware of this policy can help you to make the most of your retirement contributions and accounts.

It can also help you determine the right time to begin looking for a new job. For example, if you are only six months away from becoming fully vested in your retirement account, it may be worth waiting to switch jobs.

Read Also: Can You Use 401k To Refinance A House

What Is Employer Matching

With an employer match, a company matches what an individual employee contributes to their 401 up to a certain amount. Most companies that offer an employer match determine how much it contributes based on a percentage of what an employee contributes.

For instance, a company may contribute 50% of the first 6% that an employee contributes. So, if your annual salary is $60,000 and you choose to contribute 6% to your 401 each year, you will contribute $3,600 and your company will contribute 50% of that, or $1,800. You can choose to contribute more of your salary, but your companys match will be capped at $1,800.

Inaction Can Be Costly

If you have left money behind, it would behoove you to track it down. The average balance in forgotten accounts is $55,400. Over a lifetime, says Capitalize, failure to reclaim these assets could cost individuals as much as $700,000 in retirement savings, an estimate based on data from the U.S. Department of Labor, the Census Bureau, 401 record-keepers, IRAs and the Center for Retirement Research at Boston College.

Forgetting about old 401s, and how much money is in them, is very common, says Kashif Ahmed, a CFP at American Private Wealth in Bedford, Massachusetts. Recently, we uncovered one for a client that had more than triple what she thought it had. Youve worked for this money, so its important to locate it and keep building it, says Tess Zigo, a CFP at Emerge Wealth Strategies in Palm Harbor, Florida. I’ve seen many young folks believe it or not who have old accounts sitting in money market funds not earning a dime.

Recommended Reading: How To Roll Your 401k Into Another Job

What Happens To Money Left In An Old 401

If youve ever had a 401 account with an employer and lost track of it after youve left youre not alone.

We estimate that there are over 25 million orphaned 401 accounts just like yours. These are accounts tied to former employers that continue to have money in them, but are not actively being monitored or used.

At Capitalize, we help people find these old, orphaned 401 accounts and consolidate them into a new retirement account for free. This helps them better keep track of their retirement savings over time.

The money youve put away in a 401 account remains yours even after youve left that job. Most of the time its still at the same financial institution that managed it while you had it. This financial institution is known as a 401 provider. Its a company engaged by your former employer to hold and manage your 401 assets. You can see a full list of 401 providers here.

Some of the time, though, your money has been transferred to a new institution. That generally happens in one of three cases:

- Your former employer changes their 401 provider when this happens your 401 account will be transferred over to the new institution.

- Your former employer is acquired by another company when this happens your account usually gets transferred to the 401 provider used by the acquiring company.

- Your account balance was under $5,000 and was transferred to an IRA at a different institution this is known as a forced rollover and is allowed by some 401 plans.

Ways Of Finding My Old 401ks Including Using Ssn

If youâve ever left a job and wondered âWhere is my 401?â, youâre not alone. Locating 401âs is complicated. Thus, billions of dollars are left behind each year. Beagle can help track down your money.

Contributing to an employer-sponsored 401 plan is a great way to build wealth for retirement especially if youâre receiving a match from your company. The problem is they are tied to an individual employer. We forget about them, leave that company, and one day we realize âOh yeah! Where is my 401?â

A 401 can be in a few different places. Most commonly it could be with your previous employers, an IRA they transferred your funds to after you left, or mailed to the address they had on file.

Believe it or not, Americans unknowingly abandoned $100 billion worth of unclaimed 401 accounts. According to a US Labor Department study, the average worker will have had about 12 different jobs before they turn 40. So itâs easy to see how we can lose track of so much 401 money.

To find your old 401s, you can contact your former employers, locate an old 401 statement, search unclaimed asset database in different states, query 401 providers using your social security number or better yet, get some help to find your 401 accounts from companies like Beagle.

Recommended Reading: Can A Sole Proprietor Open A Solo 401k