Compare Your Options For Cash Withdrawals And Loans

Following are overviews of your options for making withdrawals or receiving loans from each plan type. For details, see Eligibility and Procedures for Cash Withdrawals and Loans.

| Cash Withdrawals | ||

|---|---|---|

| Not Available | ||

| Former Employee | Employee contributions and earnings at any age, university contributions and earnings at age 55 or older | Not Available |

|

At age 59½ or older hardship disability |

At any age |

| Current Employee | At age 59½ or older one-time withdrawal if account is less than $5,000 when specific conditions are met. See below for details. | At any age |

|---|---|---|

| Fidelity 457 only |

You Might Have Other Options

If youre still employed at the company that sponsors your 401, you might be able to borrow up to 50% of your balance instead of cashing it out. Although your money wont grow while the loan is outstanding, you wont pay taxes on the amount you borrow, and any interest you pay goes right back into your account. Just be aware that youll have to repay the loan within five years or immediately if you leave your employer. Otherwise, the outstanding funds will be treated like an early withdrawal.

John Csiszar contributed to the reporting for this article.

Our in-house research team and on-site financial experts work together to create content thats accurate, impartial, and up to date. We fact-check every single statistic, quote and fact using trusted primary resources to make sure the information we provide is correct. You can learn more about GOBankingRates processes and standards in our editorial policy.

When A Problem Occurs

The vast majority of 401 plans operate fairly, efficiently and in a manner that satisfies everyone involved. But problems can arise. The Department of Labor lists signs that might alert you to potential problems with your plan including:

- consistently late or irregular account statements

- late or irregular investment of your contributions

- inaccurate account balance

Also Check: How To Withdraw My 401k

Withdrawing From A Roth 401k

Most 401k plans involve pre-tax contributions, but some allow for Roth contributions, meaning those made after taxes already have been paid.

The benefit of making a Roth contribution to your 401k plan is that you already have paid the taxes and, when you withdraw the money, there is no tax on the amount gained as long as you meet these two provisions:

- You withdraw the money at least five years after your first contribution to the Roth account

- You are older than 59 ½ or you became disabled or the money goes to someone who is the beneficiary after your death

Taking A 401k Loan Might Not Be Such A Good Idea

A 401K is supposed to help you have money in retirement. When you temporarily take money out of the plan, it inhibits its ability to compound with interest or stock market growth. You may end up with less money in retirement than if you had left the money in your 401K. In addition, if you terminate your employment, youll owe a 10% penalty and income taxes on the balance unless you can pay the loan back right away. 401K loans may also have fees and the payment terms are often very inflexible. Finally, taking a 401K loan may be a sign of broader financial distress.

Also Check: When Can You Take Out 401k Without Penalty

Withdrawing When You Retire

After you reach the age of 59 1/2, you may begin taking withdrawals from your 401. If you leave your job in the calendar year when you turn 55 or later, you can also begin taking penalty-free withdrawals from the 401 you had with that current company. If you are a public safety worker, this rule takes effect at the age of 50.

Once you reach 72, you are actually obligated to begin making required minimum distributions or RMDs.

What Is A Required Minimum Distribution

The government imposes penalties for making early withdrawals from retirement accounts. After a certain age, however, youre required to take some money out every year. A mandatory 401k withdrawal is called a required minimum distribution.

In general, 401k withdrawal rules from the IRS require you to start withdrawing money from your 401k by April 1 of the year following the year that you turn 70.5, and your age and account value determine the amount you must withdraw. If youre 70.5 or older and still working, you might be able to delay taking RMDs if your plan is sponsored by the company for which youre still working. Known as the still working exception, you can apply if you:

Recommended Reading: What’s My 401k Balance

What If You Cant Meet Your Employer Match

If you arent yet in a position to contribute enough to meet your employers match, and thus not enough to reach the desired 15% savings rate, aim to boost your retirement contributions by 1% to 2% each year. If you opt in to do so, some companies will automatically raise your contribution rate annually, so its worth making sure you are signed up for what is called an auto-escalation feature.

Ivory Johnson, a CFP and founder of Delancey Wealth Management, recommends increasing your contribution rate as you get pay raises until you max out the limit. There is a limit to how much you can contribute annually to your 401. In 2021, the standard annual contribution limit is $19,500 for 401 plans. And those over age 50 can use catch-up contributions to add an extra $6,500 in their 401 account. Employer contributions dont count towards those specific limits.

Lynch reminds retirement savers to be strategic with the magic number they would like to contribute to their 401 before automatically trying to max it out, however.

Situations can arise where you may need to prioritize your cash savings in your emergency fund or save for a different reason, such as for a down payment on property or a vehicle, she adds. $19,500 isnt a small chunk of change.

Keep in mind that although you dont pay income taxes on the money you set aside in a 401, youll have to pay taxes later on when you eventually withdraw the funds in your nonworking years.

Does 401k Get Taxed When Withdrawn

Traditional 401 exemptions are taxed at the current personal income tax rate. Roth 401 withdrawals are generally tax-free if the account is five years old and the account holder is 59½ years or older.

Examples of liabilities and assetsWhat is asset vs liability? In banking, an asset is anything on which you earn interest, and a liability is anything on which you owe interest. For the banks themselves, assets are loans, portfolios of securities on which they receive interest.How to calculate liabilities?Calculating Liabilities: A Step-by-Step Guide for Small Businesses. Make a list of your obligations. To calculate liability,

Also Check: How To Know If You Have A 401k

Borrowing Money From My 401k

It may seem like an easy way to get out of debt to borrow from your retirement accounts for DIY debt consolidation, but you can only borrow $50,000 or half the vested balance in your account, if its less than $50,000. You wont face a tax penalty for doing so, like you would with an out-right withdrawal, but youll still have to pay the money back.

And unlike a home equity loan where payments can be drawn out over a 10-to-30-year period, most 401k loans need to be paid back on a shorter time table like five years. This can take a huge chunk out of your paycheck, causing you even further financial distress. Borrowing money from your 401k also limits the ability of your invested dollars to grow.

Paying off some of your debt with a 401k loan could help improve your debt-to-income ratio, a calculation lenders make to determine how much debt you can handle. If youre almost able to qualify for a consolidation or home equity loan, but your DTI ratio is too high, a small loan from your retirement account, amortized over 5 years at a low interest rate may make the difference.

Requesting A Loan From Your 401

If you do not meet the criteria for a hardship distribution, you may still be able to borrow from your 401 before retirement, if your employer allows it. The specific terms of these loans vary among plans. However, the IRS provides some basic guidelines for loans that won’t trigger the additional 10% tax on early distributions.

Whether you can take a hardship withdrawal or a loan from your 401 is not actually up to the IRS, but to your employerthe plan sponsorand the plan administrator the plan provisions they’ve established must allow these actions and set terms for them.

For example, a loan from your traditional or Roth 401 cannot exceed the lesser of 50% of your vested account balance or $50,000. Although you may take multiple loans at different times, the $50,000 limit applies to the combined total of all outstanding loan balances.

Don’t Miss: Can I Borrow From My Solo 401k

Required Minimum Distribution Method

This will result in an annual payment to the recipient. The account balance is divided by the life expectancy factor of the recipient to arrive at the annual amount. The amount is recalculated each year based on the new account balance, but the life table used in the original calculation is used for the duration of the payments.

A Means Of Avoiding High

You may consider finding quick financial relief by putting expenses on a credit card or taking out a loan. Know that both of these options require you to pay back the amount with interest, which could make the amount you owe much greater than you originally needed . Alternatively, withdrawing from retirement accounts in a disaster situation gives you a cushion of three years to pay the amount back, interest-free.

Read Also: How Can I Find My 401k

What To Know Before Cashing Out Your 401k

Things to Know Before Using a 401k 6 Things to Know Before Using a 401k 1. Age Requirements and Fines 2. Early Withdrawal Exemption 3. Taxes 4. Time to Get Money 5. Retirement at Risk 6. Renewal of insurance options Consider the implications of depositing your security deposit.

Compound interest accountsWhat kind of accounts earn compound interest? Compound interest can be earned on savings and retirement accounts.What are the best compound interest investments?Monthly investments in ETFs. One of the most popular and statistically proven methods of generating high returns is investing in long-term ETFs.fixed. R

How To Cash Out On A 401k Plan

Have you ever wondered if you could access the money in a 401 plan to use for other purposes before you actually retire? It is possible, but there are limitations to accessing money in any tax-qualified plan.

You see, some of the money in these plans, is really the governments money because you havent paid the taxes yet. Thus, the government wants to have a say in how you can get to the money.

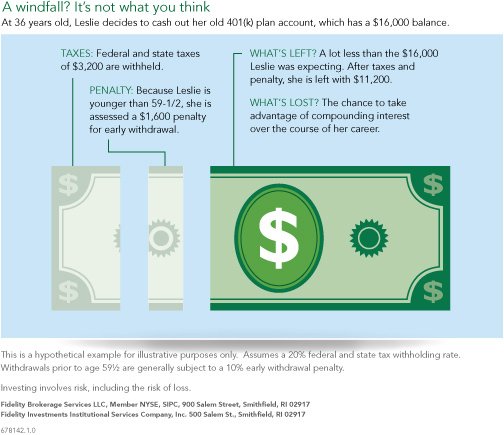

Many financial advisors discourage a 401 early withdrawal because of:

- the penalties and

- the fact that you may be spending your retirement savings prematurely

Whenever you consider an early withdrawal from a 401 plan, youll want to know the cost associated, to make sure this is still a good option.

Be sure to consider your reasons carefully and clearly, rather than making a spur-of-the-moment decision. Its worth thinking twice before losing money, even if you expect to save or make more money by taking a short-term loss.

And if you think you may need money you are contributing to a 401 today, sooner than retirement, it may be a good idea to keep that money in a place that will be more accessible rather than trying to get it out of the 401 later.

OUTLINE:

Recommended Reading: Where To Put My 401k

See If You Qualify For An Exception To The 10% Tax Penalty

Generally, the IRS will waive it if any of these situations apply to you:

-

You choose to receive substantially equal periodic payments. Basically, you agree to take a series of equal payments from your account. They begin after you stop working, continue for life and generally have to stay the same for at least five years or until you hit 59½ . A lot of rules apply to this option, so be sure to check with a qualified financial advisor first.

-

You leave your job. This works only if it happens in the year you turn 55 or later .

-

You have to divvy up a 401 in a divorce. If the courts qualified domestic relations order in your divorce requires cashing out a 401 to split with your ex, the withdrawal to do that might be penalty-free.

Other exceptions might get you out of the 10% penalty if you’re cashing out a 401 or making a 401 early withdrawal:

-

You become or are disabled.

-

You rolled the account over to another retirement plan .

-

Payments were made to your beneficiary or estate after you died.

-

You gave birth to a child or adopted a child during the year .

-

The money paid an IRS levy.

-

You were a victim of a disaster for which the IRS granted relief.

-

You overcontributed or were auto-enrolled in a 401 and want out .

-

You were a military reservist called to active duty.

Why Does Slavic401k Reimburse All Revenue Paid By The Funds

Also Check: How To Open A Solo 401k

Don’t Miss: Can An Llc Have A Solo 401k

Is There A Way To Get The Funds Out Of My 401k Early Without Paying A Penalty

Option A: Rollover to an IRA And Withdraw – You can rollover your 401K to an IRA but that will not give you early, penalty-free access to your retirement funds. It simply transfers the funds from your employers retirement account to a personal retirement account that also has early withdrawal restrictions. If you rollover your 401K to an IRA, no taxes are withheld . Rollover transactions are reported on Form 1099-R. You can rollover by having one institution pass the funds to another or you can actually withdraw the funds and move them yourself to a new institution within 60 days. If you choose this latter option, there will be mandatory withholding of 20%, so it is easier to do a direct institution to institution transfer. There may be an option to withdraw the funds early for specific reasons – IRAs are another type of retirement vehicle and have slightly different early withdrawal rules than 401Ks. If you rollover your 401K to an IRA, you may be able to withdraw money early penalty free for the following reasons: first time home purchase, tuition and educational expenses, disability, medical expenses, and health insurance

Early Withdrawal Age Rules Only Apply To The Assets In The 401 Plan Maintained By Your Former Employer

Assets in an IRA have their own rules regarding a penalty-free early withdrawal. In a similar vein, assets that youve rolled over from your 401 to an IRA will generally no longer be eligible for penalty-free early withdrawals unless you qualify for a different exemption . If theres a possibility you may need to tap into the savings in your 401, you may want to hold off on rolling those assets over to an IRA until you turn 59 ½.

Read Also: How Do Companies Match 401k

Hardship Distributions From 401k Plan

If you are younger than 59 ½, youre going to have to demonstrate that you have an approved financial hardship to get money from your 401k account. And thats only if your employers retirement plan allows it. They are not required to offer hardship distributions, so the first step is to ask the Human Resources department if this is even possible.

If it is, the employer can choose which of the following IRS approved categories it will allow to qualify for hardship distribution:

- Certain medical expenses

- Certain expenses for repairs to a principal residence

The only other way to get access to your funds is to leave your employer.

Consider All Of Your Financial Options

When you need cash in a crunch, ideally you have options: using money saved, dipping into emergency savings, getting a loan, or possibly as a last resort withdrawing money saved for retirement. Consider the relief available if you’ve been impacted by a FEMA declared disaster , and talk to your plan sponsor and/or retirement services provider before taking any next steps.

Don’t Miss: What’s The Maximum Contribution To A 401k

Substantial Equal Periodic Payments Section 72

If youre no longer employed, there may also be an option to set up a series of substantial equal periodic payments according to section 72 which would allow you to start withdrawals from a 401 over a period of 5 years or until age 59 ½, whichever is longer.

These periodic payments must be calculated according to one of three IRS-approved methods: fixed amortization, fixed annuitization, or required minimum distribution.

There are more conditions and moving parts to this type of arrangement, and you cant change your mind later if you decide you dont want to make a withdrawal in one of the appropriate years.

This option should be used with caution because if something goes wrong, then the withdrawals you did take become subject to the 10% penalty + interest.