How Do You Calculate Your Retirement Income From A 401

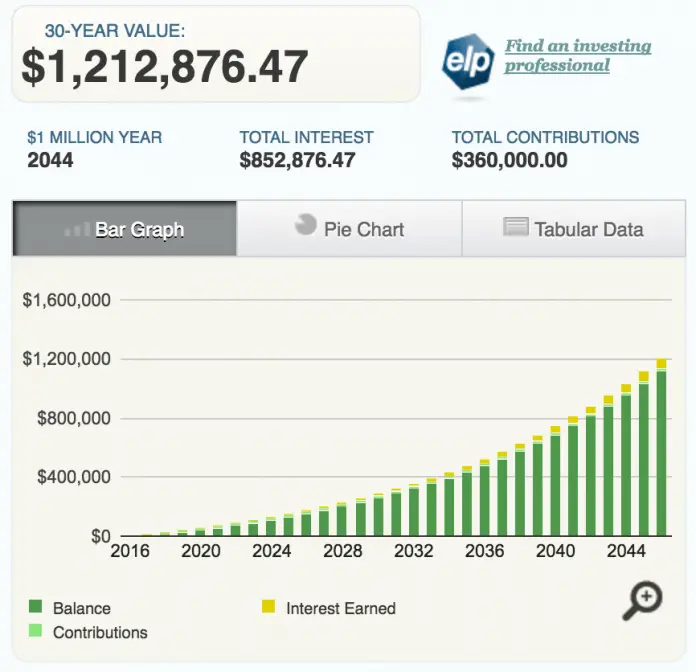

While savings accounts pay almost nothing today at most banks, 401 plans give you many more options. You can invest your 401 balance in a selection of mutual funds offered by your specific plan. If you are investing at the market average, using the S& P 500 as a benchmark, the market returns around 7% per year over time.

Depending on the investment options you choose and market conditions, your return may be more or less than the average, but it is the best measure when projecting 401 income in the future. Calculating income from a 401 requires projecting your future 401 balance including your current balance, planned savings, and your expected investment performance. Also remember to subtract any fees you expect to pay.

Next, you have a few options to calculate your return. Some investment experts suggest using the 4% rule to estimate your ability to withdraw without ever running out of funds. Multiply your ending balance by 4% to conservatively estimate your annual withdrawals in retirement.

What Is A 401

A 401 is a retirement plan offered by some employers. These plans allow you to contribute directly from your paycheck, so theyre an easy and effective way to save and invest for retirement. There are two main types of 401s:

-

A traditional 401: This is the most common type of 401. Your contributions are made pre-tax, and they and your investment earnings grow tax-deferred. Youll be taxed on distributions in retirement.

-

A Roth 401: About half of employers who offer a 401 offer this variation. Your contributions are made after taxes, but distributions in retirement are not taxed as income. That means your investment earnings grow federally tax-free.

What Kind Of Investments Are In A 401

401s often offer a small, curated selection of mutual funds. Thats a good thing and a bad thing: On the plus side, you may have access to lower-cost versions of those specific funds, especially at very large companies that qualify for reduced pricing.

The negative is that even with discounted costs, that small selection narrows your investment options, and some of the funds offered may still have higher expense ratios than what youd pay if you could shop among a longer list of options. That can make it harder to build a low-cost, diversified portfolio.

Some plans also charge administrative fees on top of fund expenses, which can add up. If your 401 is expensive, contribute enough to earn your matching dollars, and then direct any additional retirement savings contributions for the year into an IRA.

Also Check: How Can You Take Out Your 401k

Plan To Replace About 80% Of Income

When you stop working, aim to replace about 80% of pre-retirement earnings from all income sources combined, such as 401s and IRAs, Social Security, and pensions.

You can anticipate spending less, because youll no longer be paying payroll taxes or making 401 contributions. You may also spend less on things like gas and clothing, because youre no longer working. The actual amount youll need in order to replace your working income depends on how frugal or luxurious you want your retirement to be.

A 401 Is A Defined Contribution Plan

Unlike a defined benefit plan , also known as a pension plan, which is based on formulas for determining retirement withdrawals, defined contribution plans allow their participants to choose from a variety of investment options. DCPs, 401s in particular, have been gaining in popularity as compared to DBPs. Today, the 401 defined contribution pension plan is the most popular private-market retirement plan. The shift in the choice between DBPs and DCP can be attributed to a number of reasons, one of which is the projected length of time a person is likely to stay with a company. In the past, it was more common for a person to stay with a company for several decades, which made DBPs ideal since deriving the most value out of a DBP required a person to stay with their company for 25 years or more. However, this is no longer the case today, as the workforce turnover rate is much higher. DCPs are highly mobile in comparison to DBPs, and their values do not drop when a person switches companies. When an employee with a 401 plan changes employers, they generally have the option to:

Don’t Miss: How Do You Take Money Out Of 401k

Other Benefits Of A 401

Even for employers who do not offer any matching program, every employer with a 401 plan is responsible for administering the plan. That may seem like its no big deal, but it actually saves quite a bit of trouble for the employees. As an employee in a 401 plan, you dont have to worry about the complicated rules and regulations that need to be followed, or about making arrangements with the funds in which you invest your moneyyour employer takes care of all of that for you. Thats quite a bit of saved paperwork.

At the same time, employees who participate in a 401 maintain control over their money. While employers provide a list of possible investment choices, most commonly different sorts of mutual funds, employees have quite a bit of freedom to decide their own strategy. Whether you are willing to take on a little more risk with your investments, or if you would rather play it safe, theres probably an option for you.

See How Much You Can Save By Starting Now

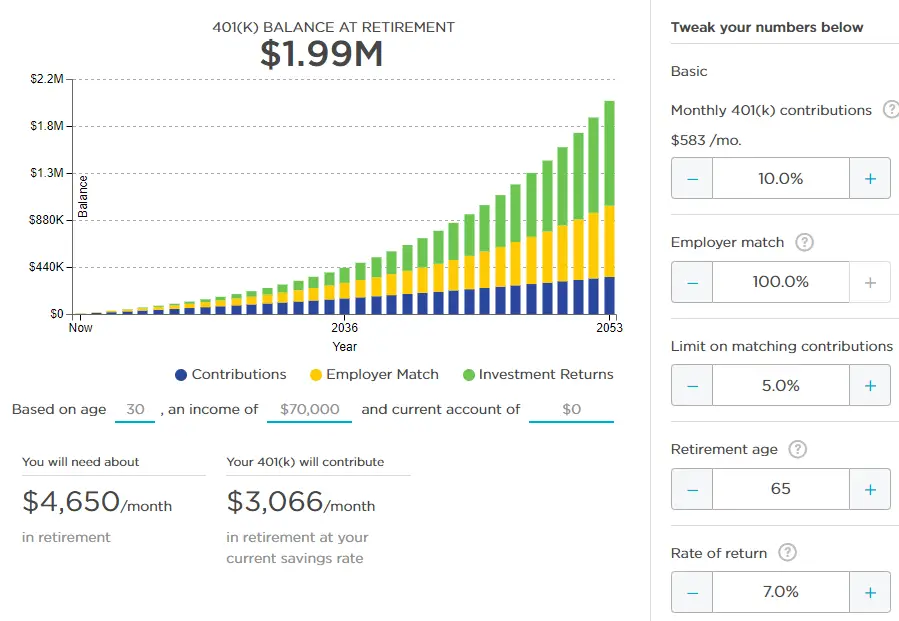

Contributing to a 401 can generate a large immediate rate of return on your investment. Let’s see how investing 10% of a $1,250 biweekly paycheck could affect your assets.

In other words, contributing 10% of your salary to a 401 would generate a whopping 140% immediate rate of return.

You can see the effect of contributing to a pre-tax account such as a 401 in the pie charts below.

Also Check: Can I Buy Individual Stocks In My 401k

What Is A 401k

A 401k is an employer-sponsored savings plan that allows workers to set aside a portion of their paycheck for retirement. Named after a section of the Internal Revenue Code, 401k plans are an easy way to save for the future because the money is automatically deducted from your paycheck. Many retirees count on Social Security to cover their living expenses after the working years, but these benefits are often not enough to sustain seniors without an additional income. If your employer offers a 401k plan, this may be an excellent way to start saving for retirement and lighten the burden of doing it alone.

Transparency Is Our Policy Learn How It Impacts Everything We Do

Transparency is how we protect the integrity of our work and keep empowering investors to achieve their goals and dreams. And we have unwavering standards for how we keep that integrity intact, from our research and data to our policies on content and your personal data.

Wed like to share more about how we work and what drives our day-to-day business.

Recommended Reading: Can A Sole Proprietor Have A 401k

How We Make Money

We sell different types of products and services to both investment professionals and individual investors. These products and services are usually sold through license agreements or subscriptions. Our investment management business generates asset-based fees, which are calculated as a percentage of assets under management. We also sell both admissions and sponsorship packages for our investment conferences and advertising on our websites and newsletters.

Taxable Investment Portfolio Is Key

The only thing you can count on is after-tax money youve invested or saved. This is why after maxing out your 401k, its good to open up an after-tax brokerage account. Consistently contribute a percentage of your paycheck each mont into your taxable investment portfolio.

Your goal should be to then build as many passive income streams as possible. The more passive income streams and active income streams you have, the more financially free you will be.

Challenge yourself to raise your after-tax and 401k contribution savings percent to possibly 50%. It wont be easy. But if you practice raising your savings rate by 1% a month until it hurts, youll find it easier than you think.

A straightforward way to maximum savings is to make your 401k maximum contribution automatic. Save every other paycheck for the rest of your working life.

Max out your 401k and save over 50% of your after-tax income for at least 10 years in a row. If you do, you will be financially free to do whatever you want!

Read Also: How To View Your 401k

Financial Samurai 401k Savings By Age Guide

From the results, we can see that even after 38 years of consistent saving, youll only have around $1,000,000 to $5,000,000 in your 401k in a realistic cycle of bull and bear markets. In other words, I believe everybody should become 401k millionaires by 60.

If youre just starting your 401 savings journey, you could get lucky and achieve the high end column with consistent 8%+ annual growth and company profit sharing after 38 years. After all, the maximum 401 contributions will be much higher over the next 38 years than the previous 38 years.

But its most likely that most people reading this article should follow the middle-to-low end columns as a 401 savings guide. The median age in America is roughly 36. Meanwhile, the median age of a Financial Samurai reader is closer to 38.

Saving For Retirement: Where Are You Now

Whether you plan to live lavishly or frugally, youll need to have a certain amount of money saved by the time you retire. Think of this figure as a mountain summit, reachable by several different paths. If youve done everything right so far, that summit is still in plain view youve followed the most direct and least difficult path, and all you need to do is continue on in the same direction. If, however, your savings arent where they should be, its as if youve wandered in the wrong directionyoull need to recalibrate and start climbing in order to reach the summit.

To determine your current financial coordinates, you need to answer three questions:

- How much have I saved thus far?

- How many years until I retire?

- Whats my annual income ?

The answers to those questions will determine how much work you have to do to reach that mountaintop. If youve saved plenty and youre still young, greatyoure well on your way. If youve saved nothing and your sixties are just around the corner, not so much. Lets check out some examples using our retirement calculator to see how this works in reality.

Also Check: How Do I Invest In My 401k

Is Your 401k Savings On Track

Have you met your mark? If you arent there yet, dont panic. These are just rules of thumb. That means they only give you a rough estimate of what you should ideally have by the time you hit these ages. They do not take into account your individual income and experiences or other investments you might have in play.

In reality, theres no one hard answer to how much you should have in your 401k and anyone who tells you otherwise is either lying to you or just doesnt know much about finance. We could pull up a bunch of figures and show you how much someone in their 20s or 30s is saving but that would be a complete waste of time for two reasons:

1. Its impossible to compare two investors fairly. Everyone has their own unique savings situation. Thats why itd just be dumb to compare the Ph.D. student saddled with thousands in student loan debt with the trust fund baby who just snagged a cushy six-figure corporate gig the first month out of college. Theyre both going to save very differently, so its not worth comparing.

2. Most people arent financially prepared for retirement. The American Institute of CPAs recently released a study that found that nearly half of all Americans arent sure if theyll be able to afford retirement. Thats even scarier when you consider the fact that many people underestimate how much theyll need for a comfortable retirement.

How Much Should I Put Into My 401 Out Of Each Paycheck

Aiming to put at least 15% of each paycheck into your 401 as long as you can still comfortably afford your living expenses is an excellent start on your way to saving for retirement. It’s suggested that if you can’t meet this amount, aim for the minimum amount to where your employer will match your 401 investment.

Read Also: Is A 401k A Defined Benefit Plan

Start Earning More For A Better Financial Future

The answer to How much should I have in my 401k? is an important one but its not the only way to ensure your financial future.

We are going to let you in on a little secret. It is one that has helped thousands of people live their Rich Life:

Theres a limit to how much you can save, but theres no limit to how much money you can earn.

Bonus:

Many people dont understand this and because of that, theyre content with contributing very little to their retirement accounts. When they actually retire, theyre surprised when their nest egg is a lot smaller than they thought and they have to get a job as a Walmart greeter to pay for their condo.

If you realize that your earning potential is LIMITLESS, you can truly get started working toward living a Rich Life today.

We recommend three ways to start earning more money:

1. Negotiate a salary raise. 99% of people are content with not asking for a salary raise. So if you are willing to negotiate, that puts you in the 1% and showcases to your boss that youre a Top Performer willing to work hard for more money.

2. Start a side hustle. One of my favorite money-making tactics is starting your own side hustle. We all have skills. Why not leverage those skills to start earning more money in your free time?

We want to help you get started on one of these tactics today: Starting a side hustle.

Thats why we want to offer you my Ultimate Guide to Making Money.

Stuff like:

UGH.

When To Start Saving For A 401k

Not everyone gets the opportunity to invest in their 401k early on. As soon as it becomes available, consider taking advantage of this benefit. As of 2017, individuals under 49 could legally contribute $18,500 per year. Those 50 years or older, can save an additional $6,000 for a total annual $401k contribution of $24,500.

Many 20-something-year-olds have student debt, changed jobs a handful of times, have not started saving, or are not in a job where a 401k plan is offered. In this case, well look at the amount you should have saved starting at age 30.

A good rule of thumb is to add on one year of salary saved for every five years of age for example, at age 30 youd want to have saved one year of salary, at age 35, two years, at age 40, three years, and so on. Use these guidelines along with your post-retirement budget to gauge if you are on track for a comfortable retirement.

Read Also: How To Invest In A 401k Plan

How To Use The Contribution Calculator

This calculator is designed to show you how you could potentially increase the value of your retirement plan account by increasing the amount that you contribute from each paycheck. The Growth Chart and Estimated Future Account Totals box will update each time you select the “Calculate” or “Recalculate” button.

Pre-filled amountsBased on our records, the following information may be pre-filled:

Salary

- Pay period. If the information is not available, the default pay period is weekly.

Contribution

- Your contribution rate. Note that we will use 8% as a default value if your contribution rate is not available or if your contribution is a dollar amount rather than a percentage.

Investment

- Years invested

- Your initial balance

You may change any of these values.

Using the calculator

In the following boxes, you’ll need to enter:

Salary

- Your expected annual pay increases, if any.

- How frequently you are paid by your employer.

Contribution

- The amount of your current contribution rate .

- The proposed new amount of your contribution rate. Be sure to verify the maximum contribution rate allowable under your plan. Also, pre-tax contributions are subject to the annual IRS dollar limit.

Pre-tax Contribution Limits 401, 403 and 457 plans |

|

|---|---|

| 2020 | |

| After 2020 | May be indexed annually in $500 increments |

Employer Match

Investment

- The length of time that you anticipate you will invest this money.

- The amount of your current account balance.

- Your hypothetical assumed annual rate of return.

How We Use Your Personal Data

How we use your information depends on the product and service that you use and your relationship with us. We may use it to:

- Verify your identity, personalize the content you receive, or create and administer your account.

- Provide specific products and services to you, such as portfolio management or data aggregation.

- Develop and improve features of our offerings.

To learn more about how we handle and protect your data, visit our privacy center.

Recommended Reading: Can I Use My 401k To Buy Stocks

Is It Too Late To Start Saving

In a perfect world, youd start saving in your early 20s. However, personal finances come with their ups and downs, so putting money aside for your 401k is often not a priority or not a possibility. If this is you, consider that its never too late to start saving for retirement. While many people aim to retire early, life doesnt stop at 65, and its better to save late than not save at all.