How Much Income Should I Have In Retirement

According to a Federal Reserve report on the Economic Well-Being of people, only 36% of working individuals claim to have their retirement savings on track. It, therefore, means that about 64% are worried as they are falling behind.

Most experts agree that retirement income should be no less than 80% of one’s pre-retirement salary. So, if your pre-retirement income is $100,000 a year, if you trust the experts, you’ll need $80,000 a year to have a comfortable retirement. I say you can retire when you have more than enough income to cover your expenses in retirement. Your situation will likely sit somewhere in between. Admittedly, you may have expenses before you retire that you wouldn’t have in retirement.

For example, consider your mortgage. Will it get paid off by retirement? What about health insurance premiums? And, do you expect to be traveling more in retirement? Also, don’t forget any pensions so social security income you might receive. A retirement calculator can also help you with figuring out how much you need to retire.

Impact Of Inflation On The Cost Of Goods And Services

When saving for retirement, keep in mind that goods and services will cost more in the future. You can predict how much more goods and services may cost by looking at rates of inflation in past years.

Figure 1: How much a $100 item increases in cost over time because of inflation

| Year | |

|---|---|

| 2016 | $129.92 |

Bank of Canada Inflation Calculator. The average rate of inflation in Canada between the year 2000 and 2014 was 2.00%.

Set Your Retirement Goals

How much you need to save depends on how you want to spend your retirement. Think about:

- your travel plans

- your age when you retire

- if you’ll work after you retire

- if you’ll have children or grandchildren to support

- where you want to live

- whether youll have debt to pay, such as a mortgage or a loan

Recommended Reading: How Can I Find My 401k

How Much Savings Will You Need To Retire

Now let’s determine how much savings you’ll need to retire. After you’ve figured out how much income you’ll need to generate from your savings, the next step is to calculate how large your retirement nest egg needs to be in order to be able to produce this much income in perpetuity.

A retirement calculator is one option, or you can use the “4% rule.” While the 4% rule admittedly has its flaws, it’s a good starting point for determining a safe annual withdrawal amount.

The 4% rule says that, in your first year of retirement, you can withdraw 4% of your retirement savings. So, if you have $1 million saved, you would take $40,000 out during your first retired year either in a lump sum or as a series of payments. In subsequent years of retirement, you would adjust this amount upward to keep up with cost-of-living increases.

The idea is that, if you follow this rule, you shouldn’t have to worry about running out of money in retirement. Specifically, the 4% rule is designed to make sure your money has a high probability of lasting for a minimum of 30 years.

To calculate a retirement savings target based on the 4% rule, you use the following formula:

Retirement savings target = Monthly income required x 25

Continuing our example, we saw in the previous section that our couple would need $4,000 per month from their savings. So, in this case, our couple should aim for $1.2 million in retirement savings to provide $48,000 per year in sustainable retirement income.

How Much Do You Need To Retire In Your 50s

Early retirement is possible but not a last minute decision. It has to be planned in order to be achieved and in many cases sacrifices have to be made.

So how do you achieve Freedom 55? If you go back to the TFSA table above, there are 3 factors helping you reach the $1 million mark.

In the case of a TFSA, assuming you contribute the maximum, you only have control over the rate of return in way. For other accounts, you also control the contributions but in general, you will need time to reach your goals.

When working towards Freedom 55, you need to realized you have less working years to save and more years to live from your portfolio. It means you need to save more in your 30s and 40s than someone willing to retire at 65.

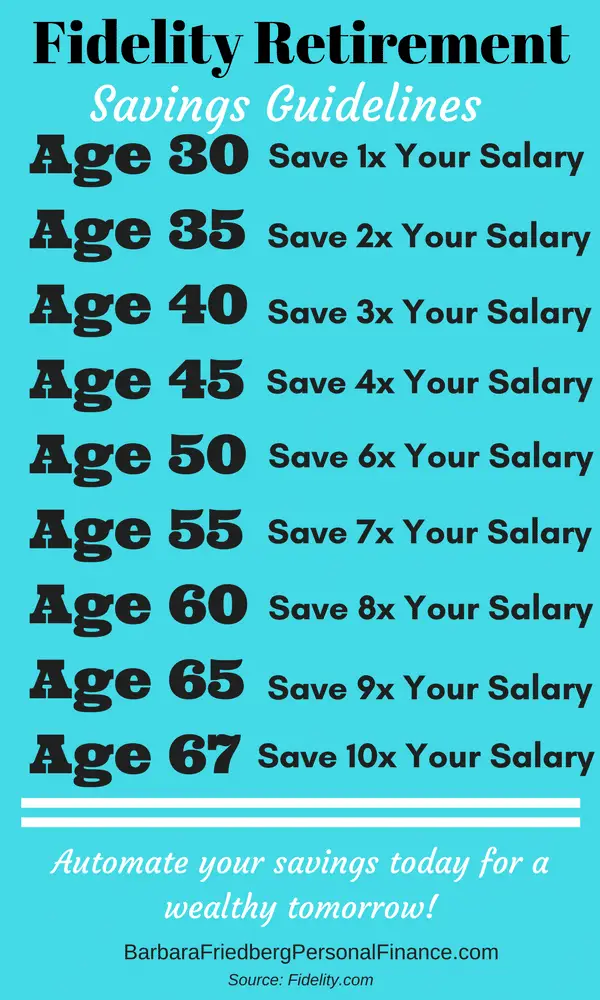

There are a few simple rules that can help give you an idea instead of trying to assess your life expectency and future cost of living.

Recommended Reading: How Much Can You Borrow From 401k

It’s Not About Money It’s About Income

One important point when it comes to determining your retirement “number” is that it isn’t about deciding on a certain amount of savings. For example, the most common retirement goal among Americans is a $1 million nest egg. But this is faulty logic.

The most important factor in determining how much you need to retire is whether you’ll have enough money to create the income you need to support your desired quality of life after you retire. Will a $1 million savings balance allow you to create enough income forever? Maybe, but maybe not. That’s what we’re going to determine in the next few sections.

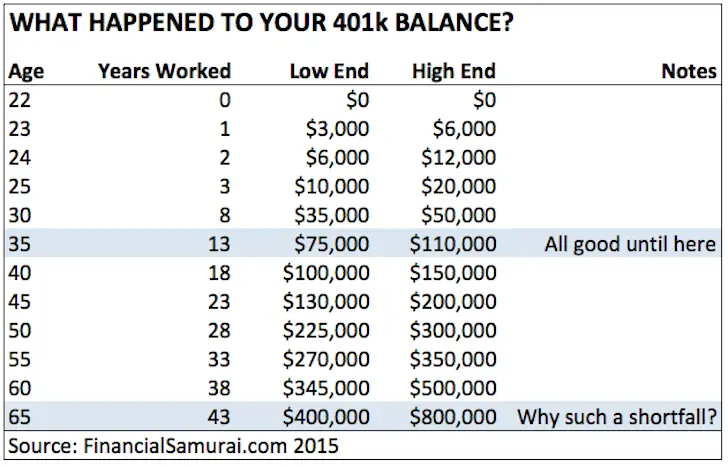

Where Do You Stand So Far

As shown below, only 26% of people in their 60s have over $500,000 set aside for retirement. You can see the average retirement savings ranges at different ages, but everybodys situation is unique.

Average Retirement Savings at Age 65

| Avg. | |

|---|---|

| 517,085 | 289,736 |

Reminder: The median is the middle of all answers from biggest to smallest. Data source: Hou .

Lets assume you want to retire on $500k of assets in your IRA, 401, and taxable accounts. You want to spend roughly $52,000 per year. Your Social Security benefits amount to $24,000 per year, and you have an additional pension of $6,000 per year.

Subtotal: You have $30,000 of income per year, and you need an additional $22,000.

Also Check: How Do I Change My 401k Contribution Fidelity

What Additional Income Will You Receive In Retirement

One of the downsides to the 4% rule is that it doesn’t take any sources of income into consideration other than investment returns. But there’s a good chance that you’ll have additional streams of income in retirement that can reduce how much you need to save.

First and foremost, you’ll want to consider your Social Security income. In December 2019, the average monthly Social Security benefit was $1,503. That’s $18,000 per year that the average person doesn’t need to pull from their retirement savings pot. To estimate your own Social Security income, you can use the Social Security Administration’s calculator.

Do you own a rental property? If so, you’ll want to take your rental income into account as you’re thinking through your retirement savings needs. And if you plan to do some part-time work after you retire from your primary career, that could significantly reduce how much you need to save as well.

Let’s say you plan to spend $65,000 per year in retirement. Using the 4% rule, you’d need to save $1,625,000 before you retire. But what if you know you’ll bring in $15,000 per year in additional income? That means your retirement investments only need to provide $50,000 of income per year instead of $65,000. And your retirement savings number would drop to $1,250,000 that’s a $425,000 difference!

Follow These Steps To Find Out

How much money do you need to comfortably retire? $1 million? $2 million? More?

The most common rule of thumb is that the average person will need approximately 80% of their pre-retirement income to sustain the same lifestyle after they retire. However, there are several factors to consider, and not all of this income will need to come from your savings. With that in mind, here’s a guide to help calculate how much money you will need to retire.

Don’t Miss: How To Transfer 401k From Old Job

Do I Need $1 Million To Retire In Canada

In some cities, you do if you want to maintain a certain lifestyle. Its plain and simple that retiring in Toronto and Vancouver will be easier if you to have a $1 million portfolio or equivalent in pension plan.

Given that everyone has different expenses and expectations for life in retirement, to get an accurate picture you will need to budget your annual spending. Personally, I think its harder to budget the annual spending than putting a plan to reach $1 million.

The plan for a $1 million portfolio can be as simple as seeing the numbers grow through simple math. Here is how you can do it with your TFSA account. Imagine when you have two TFSA accounts how fast you can make it.

| wdt_ID | |

|---|---|

| $96,937 | $58,818 |

The amount of money you need in retirement depends on when you want to retire. Moreover, it depends on what you want to do once you are retired .

To answer the question of whether or not you need $1 million to retire in Canada is not simple but until you are getting closed to retirement, you should work towards the $1 million. In your 20s and 30s, aim high for $1 million or more but as you enter your 40s and 50s, your life should be more stable that you can more easily budget what you need.

How Much Will You Need In Retirement

The sum youll need to retire is a highly personal question but needs careful consideration.

I believe retirement is a financial number versus a retirement age. Assess how much you need in your retirement account to live at least 20 years in retirement without having to go back to work to pay your bills, says Shaquana Watson-Harkness, personal finance coach and founder of Dollars Makes Cents, an online debt management and investing training course.

Rita-Soledad Fernández Paulino, a NextAdvisor contributor and creator of Wealth Para Todos, told us how she calculates her financial independence number using Trinity Studys 4% rule. According to the 4% rule, you can estimate how much money youll need to live on during retirement using this quick calculation:

Annual Expenses x 25 = Nest Egg .

For example, if your annual expenses are $40,000, multiply that by 25 for a total of $1M the amount youd need to retire, based on the 4% rule above.

If youre already freezing up thinking about million-dollar sums, remember youre not solely responsible for saving up this much on your own. The market, through compound interest, will do most of the heavy lifting for you, especially if you invest early and let your portfolio grow for decades.

Thats why starting early is so important.

Also Check: How Do I Know If I Have A 401k

How To Retire On $500k

posted on

By Justin Pritchard, CFP® in Montrose, CO

Sometimes retirement advice relies on round numbers and rules of thumb. For example, you might hear that you need $2 million to retire. But the amount you need depends on things like your monthly spending and any sources of retirement income. Most people never reach $1 million in savings, so it may be helpful to see how it looks to retire on $500k.

Ultimately, anybody approaching retirement faces a choice: Do you work longer so you can continue saving, or can you retire comfortably with less?

If You Start At Age 2:

With a 4% rate of return: $843.24 per month

- Annual salary needed if you save 10% of your income: $101,189

- Annual salary needed if you save 15% of your income: $67,459

With a 6% rate of return: $499.64 per month

- Annual salary needed if you save 10% of your income: $59,957

- Annual salary needed if you save 15% of your income: $39,971

With an 8% rate of return: $284.55 per month

- Annual salary needed if you save 10% of your income: $34,146

- Annual salary needed if you save 15% of your income: $22,764

Also Check: How To See How Much Is In My 401k

How Much Income Do You Need In Retirement

Planning for how much income you need in retirement is one of the most difficult things to do. Its difficult because we have to make some goals, predictions, and assumptions about the future. The further you are from retirement, the more difficult this process is because changes occur so quickly and frequently in our lives. In our adult lives, so many things can impact our financial future changing jobs, paying off debt, unexpected expenses, bonuses, inheritances, moving to different cities, marriage, children, houses, economy, etc.

Related article: Three steps to a retirement plan

Whether you are planning to retire in one year or twenty years, one of the first questions you will need to answer is how much income do you need for retirement. There are a few different strategies when trying to figure this out.

How Much Should You Save For Retirement

How much do you need to have saved up before you retire? The answer to that question used to be pretty straightforward. With $1 million in savings, at a 5% interest rate, you could be reasonably assured of having $50,000 in annual income by investing in long-term bonds and simply living off the income. If you saved $2 million, you could expect to have a six-figure yearly income without having to dip into principal.

Unfortunately, interest rates have been on a steady decline for roughly three decades now. Back in 1980, nominal Treasury bill rates were approximately 15%, but as of June 2021, a 30-year Treasury is yielding 1.91%. Lower bond yields have made the investing equation in retirement more difficult. It was only exacerbated by the , which complicated how individuals save enough to live off in retirement.

Read Also: Can You Use Your 401k To Start A Business

How To Calculate Retirement Savings

In addition to using the above methods to determine what you should have saved and by what age, online calculators can be a useful tool to help you reach your retirement savings goals. For example, they can help you understand how changing savings and withdrawal rates can impact your retirement nest egg. Though there are many online retirement savings calculators to choose from, some are much better than others. The T. Rowe Price Retirement Income Calculator and MaxiFi ESPlanner are two worth trying.

Factors That Affect The Amount You Need To Retire

The sooner you start saving to retire, the more comfortable life you’ll have. Therefore, knowing the amount you should save for retirement in advance gives you the edge. Sure, you might be saying, That’s easier said than done. I say, to achieve what you need to retire depends on various factors. They include:

Your Spending Habits

I couldn’t blame anyone for thinking that retiring is about how much money they get in retirement. But, the best financial plans emphasize controlling expenses. Income is secondary.

Expenses can get split into two categories: Needs and Wants. Needs are things that you need to live. For example, mortgage payments, insurance payments, and food are all examples of needs expenses. On the other hand, shopping, subscriptions , and travel are all examples of wants.

How much you need to retire depends on how much you intend to spend in retirement. If you can retire without any expenses, then you can retire today. Of course, that’s probably not the case. Perhaps you want to travel or save for your grandchildren’s education. Regardless, these expenses need to get planned and budgeted in advance.

Your Savings Habits

Age

Read Also: Is It Worth Rolling Over A 401k

Retirement Rule Of Thumb: 4% Rule

There are different ways to determine how much money you need to save to get the retirement income you want. One easy-to-use formula is to divide your desired annual retirement income by 4%, which is known as the 4% rule.

To generate the $80,000 cited above, for example, you would need a nest egg at retirement of about $2 million . This strategy assumes a 5% return on investments , no additional retirement income , and a lifestyle similar to the one you would be living at the time you retire.

Keep in mind that your life expectancy plays an important role in determining if the 4% rule rate will be sustainable. In general, the 4% rule assumes that you will live for about another 30 years in retirement. Retirees who live longer need their portfolios to last longer, and medical costs and other expenses can increase as you age.

The 4% rule does not work unless you stick to it year in and year out. Straying one year to splurge on a big purchase can have major consequences because this reduces the principal, which directly impacts the compound interest that a retiree depends on to sustain their income.

Retirement Calculator How Much Money I Need To Retire

With the few rules of thumb outlined, you can easily create a formula.

- TGA = Target Retirement Age

- PI = Pension Income

Portfolio Value = * PI)

See some example in the table. Those with a pension plan dont really see total value of their pension but rather the income they would receive and as such, remove the income from the total.

In the examples, no pension income is considered.

| Retirement Age |

|---|

Also Check: How Much Will My 401k Be Worth In 20 Years