Sysco 401 Plan Enhancement

When you need to take a loan or withdrawal from your 401 plan, it can take days or even weeks to access your funds due to waiting periods. In an effort to support our associates impacted by coronavirus, weâve partnered with Fidelity to make Electronic Funds Transfer and eCertified Hardships available, so you can access your funds quickly.

Electronic Funds Transfer â Starting today, we have eliminated the 10-day waiting period for EFTs. Now, when a participant enters their banking information in NetBenefits, they no longer have a 10-day waiting period to receive funds. EFTs are immediately available for any loans or withdrawals that are $50,000 or less. In addition to eliminating wait times, this will also reduce cost to the participant.

eCertified Hardships â If you need to make a hardship withdrawal, you may be able to initiate a withdrawal in as little at 48 hours through eCertification. You can speak with a representative or initiate a qualifying hardship withdrawal anytime on NetBenefits.

To learn more about accessing your retirement funds for coronavirus-related relief, call Fidelity at 1-800-635-4015 or visit the Fidelity website. Review the rest of the content on this page to learn more about the Sysco 401 Plan.

Ignoring Or Forgetting Old Plans

If you’ve switched jobs frequently in your career, you may be ignoring or have entirely forgotten an old 401 plan.

Rolling over old 401 balances usually can’t be done in a fully digital fashion it can be a tedious process of phone calls and some paperwork. Still, it’s a small inconvenience that’s well worth the benefits you’ll reap. Your 401 plans should be monitored frequently accounts need re-balancing, your progress and performance should be tracked, and you should stay abreast of fees.

Experts recommend you have no more than two to three retirement accounts at any time. To the extent possible, consolidate them into a rollover IRA, and only keep old 401 plans active if they offer excellent investment options and low fees that you can’t enjoy in an IRA.

Your 401 is one of the most precious sources of financial security you’re likely to enjoy, so treat it kindly. If you contribute diligently, choose low-cost funds and respect the integrity of your savings, it’ll be there to cushion you for many comfortable years in retirement.

The Number Of Workplace Retirement Accounts With $1 Million Or More Hit An All

Despite surging covid cases and climbing inflation, Americans retirement account balances continue to rise to record levels. Others, though, are fighting to pay rent unable even to think about investing for the future.

Lets look at the haves who are saving for retirement in workplace plans.

Fidelity Investments just released its quarterly analysis of more than 30 million 401 and 403 retirement accounts. Average retirement account balances maintainedan upward trend for the third straight quarter.

Workers who continue to contribute to their plans, even as the pandemic produced some heart-clutching moments in the stock market, were rewarded with significant increases in their account balances, according to Fidelity, the largest administrator of workplace retirement accounts.

In fact, as the pandemic caused people to lose their jobs, 38 percent of 401 savers increased their savings rate. And this wasnt just among older workers, who you might expect would contribute more as they get closer to retirement.

People are really seeing the benefit of long-term investing, said Jessica Macdonald, vice president for thought leadership at Fidelity.

Macdonald said 85 percent of the growth in account balances came from stock market performance.

Also Check: How To Switch 401k To Ira

Are You Investing Enough For Retirement

Periodically, you may decide to invest more for retirement. This can be easily done using the following steps:

Need Help Call Fidelity

Most questions related to your Nazarene 403 Retirement Savings Plan account can be answered by phoning a Fidelity retirement services specialist at 866-NAZARENE . If you still have questions after doing this, phone Pensions and Benefits USA at 888-888-4656.

Also, Fidelity has a broad array of valuable tools, such as calculators and informational videos to assist in managing your financial life. We encourage you to explore their many resources.

Unless otherwise noted, transaction requests confirmed after the close of the market, normally 4 p.m. Eastern time, or on weekends or holidays, will receive the next available closing prices.

The investment options available through the plan reserve the right to modify or withdraw the exchange privilege.

Recommended Reading: How Do I Open A 401k Account

Fidelity Funds Are Renowned For Their Managers’ Stock

Fidelity celebrates good stock picking. The firm holds a contest every year for its portfolio managers: They get 60 seconds to pitch one idea, and the best pitch wins a dinner for four. The best performer after 12 months also wins dinner.

Maybe that’s why many of the best Fidelity funds stand up so well in our annual review of the most widely held 401 funds.

Here, we zero in on Fidelity products that rank among the 100 most popular funds held in 401 plans, and rate the actively managed funds Buy, Hold or Sell. A total of 22 Fidelity funds made the list, but seven are index funds, which we don’t examine closely because the decision to buy shares in one generally hinges on whether you seek exposure to a certain part of the market.

Actively managed funds are different, however. That’s why we look at the seven actively managed Fidelity funds in the top-100 401 list. We also review seven Fidelity Freedom target-date funds as a group as they all rank among the most popular 401 funds. And we took a look at Fidelity Freedom Index 2030 it has landed on the top-100 roster for the first time, and while it’s index-based, active decisions are made on asset allocation.

This story is meant to help savers make good choices among the funds available in their 401 plan. It is written with that perspective in mind. Look for our reviews of other big fund firms in the 401 world, which currently include Vanguard, and will soon include American Funds and T. Rowe Price.

Potential Strategies For After

Making after-tax contributions allows you to invest more money with the potential for tax-deferred growth. That’s a powerful benefit on its ownbut that’s not the end of the story. You could then go a step further and convert your after-tax contributions to a Roth account. There are a couple of different ways to accomplish that, including rolling over your balances to an IRA or doing an in-plan conversion if it’s offered by your employer along with a Roth option.

When you convert after-tax balances to Roth, no taxes would be due on the conversion of your contributions. But, converting the earnings associated with those contributions to the Roth option in your workplace savings plan or a Roth IRA would be a taxable event. So you may want to roll those earnings to a traditional IRA instead. That strategy is covered more below.

Earnings in a Roth account grow and may potentially be distributed tax-free as long as certain conditions are met. So no taxes would be due on withdrawalsas long as they take place after age 59½ and the 5-year aging requirement has been met.

Not all employers offer a Roth option in their retirement planor they may not offer the option to do an in-plan conversion. If your employer does not offer a Roth option or the in-plan Roth conversion feature, you can still roll over your after-tax contributions to a Roth IRA. Here are the 3 strategies. The options available to you will depend on your situation.

Also Check: How Many Loans Can I Take From My 401k

If You Are 59 1/2 Or Older

Once you are six months away from your 60th birthday, you can begin making withdrawals from your Fidelity 401k without having to worry about any additional tax penalties. Your 401k is now money thats there for you to start preparing for the next stage of your life as you put the finishing touches on your career and prepare to start drawing Social Security benefits.

However, that doesnt mean you dont have to worry at all about taxes. Money withdrawn from your 401k is taxable income, so you should be careful to consider just how much you need to withdraw in any given tax year to ensure youre not hitting a higher tax bracket and seeing more of your hard-earned money lost to taxes. If you have a Roth IRA or Roth 401k, though, you can make tax-free withdrawals from those, so you can balance withdrawals to minimize the tax impact.

Your Fidelity 401k comes with the option to schedule regular withdrawals so that you can do the paperwork for your withdrawal once and then set up a recurring payment. With structured, regular withdrawals, you can set up a budget that will limit your withdrawals to what you need, and youll be able to have checks showing up on a set schedule.

Learn: The Best 401k Companies

Sysco 401 Plan Provision

The Sysco 401 plan has a special provision for disaster-related relief that gives you access to your retirement funds.

This provision:

- Provides flexibility for loans from specific retirement plans for coronavirus-related relief.

- Waives the 10% early withdrawal penalty for distributions up to $100,000 from qualified retirement accounts for coronavirus-related purposes.Note: Income attributable to disaster-related distributions would be subject to tax over three years. Within those three years, you may recontribute funds to an eligible retirement plan without regard to that yearâs contribution cap.

A coronavirus-related distribution is a distribution made to an individual:

Recommended Reading: Why Cant I Take Money Out Of My 401k

Be Sure To Consider All Your Options

Making after-tax contributions and then converting to Roth may seem complicated, but the long-term benefits can make it worthwhile. But bear in mind: there can be benefits to keeping your money in the workplace savings plan. Balances in your workplace retirement account may be available for loans, if your plan allows them, while balances in an IRA are not. On the other hand, IRAs have certain advantages as well. For instance, you may be able to get a broader range of investment choices. So it’s a good idea to check with your financial advisor and tax advisor before choosing a strategy.

Master The Employer Match

Are you missing out on your employer match because you’re not contributing enough? A recent study from personal finance website MagnifyMoney shows that roughly 20% of Americans are failing to receive their full 401 employer match by not contributing enough.

With the average employer match now reaching an all-time high of 4.7% of a worker’s salary, according to Fidelity Investments, that could result in a cost of tens of thousands of dollars over the typical worker’s career and much more, when compound interest is considered.

Remember, a match is free money you’re leaving on the table if you don’t take advantage of it. By not contributing enough to secure the match, your overall compensation is lower. Think of it as giving yourself an unintentional pay cut. Cut back on whatever you need to in order to contribute enough to get that full match. You’re opting for lower total compensation, otherwise.

Recommended Reading: How Can I Invest My 401k

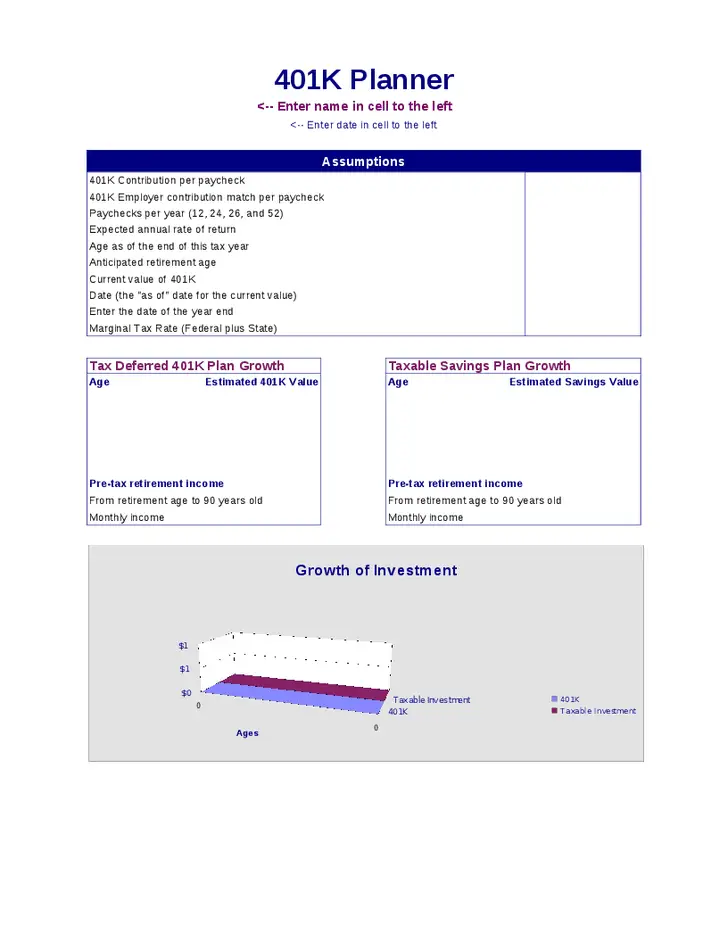

Take Home Pay Calculator

To see how your pre-tax contribution might affect your take home pay, enter the following information, then click on the Calculate button. For additional information, see How are these numbers calculated?

Is your bi-weekly pre-tax contribution to your retirement plan account.

Is an estimation of how much your bi-weekly take home pay will be reduced by.

You are solely responsible for the accuracy of any data you enter into this calculator and the calculations are based on the information you have entered. The simplified tax calculations also do not take into account any other pre-tax deferrals, such as your reimbursement accounts for health plan or dental insurance, or other payroll taxes, such as FICA.

Your circumstances are unique therefore, you need to assess your own situation and consult an investment professional if you feel you need more personal advice. Also, you should remember that the results you receive from this calculator do not account for tax effects of any kind. Therefore, the dollar amount of your actual plan contribution may be less than the estimate provided by the calculator. In addition, your circumstances will probably change over time, so review your financial strategy periodically to be sure it continues to fit your situation. All examples are hypothetical and are intended for illustrative purposes only.

Is Now A Good Time To Rebalance My 401k

At a minimum, you should rebalance your portfolio at least once a year, preferably on about the same date, Carey advises. You could also choose to do so on a more periodic basis, such as quarterly. An investor who rebalances quarterly would sell bonds and buy stocks to get back to a 60/40 portfolio mix.

Recommended Reading: What Happens To My 401k If I Switch Jobs

Fidelity Average 401 Account Balances Hit Another High

Fidelity Investments quarterly analysis of more than 30 million IRA, 401, and 403 retirement accounts finds that average retirement account balances increased to record levels for the third consecutive quarter, with long-term retirement savers seeing significant gains.

While many Americans are still addressing challenges posed by the pandemic, the firms second quarter 2021 analysis reveals positive results across retirement account balances, contributions and savings behaviors, as well as positive investor sentiment, with workers reporting reduced levels of stress and anxiety.

According to the findings, the average 401 balance increased to $129,300 in the second quarter, which was a 4% increase from the first quarter and up 24% from a year ago. The average 403 account balance increased to a record $113,300, an increase of 6% from last quarter and 24% higher than in the second quarter of 2020. Similarly, the average IRA balance was $134,900, a 4% increase from last quarter and a 21% increase from second quarter of 2020.

Average Retirement Account Balances

|

$91,100 |

$56,300 |

Those individuals taking a long-term approach to retirement savings continue to see gains. The overall average balance for individuals who have been in their 401 plan continuously for 10 years crossed the $400,000 threshold for the first time, reaching $402,700 in the second quarter.

Contribution Rates Increase

Positive Savings Behavior

Don’t Let Plan Costs Derail Your Profits

Are your 401 fees too high? Recent data show that the average person pays about 0.45% on their balance annually in plan administration fees and costs. And as the average 401 balance now exceeds $103,000, the costs and fees associated with retirement plans become an even more significant consideration. Even a fraction of a percent more in fees can eat away at your investments and mean thousands less in retirement.

Speak with your plan administrator or human resources department to understand your plan and investment selection fees. Choose quality mutual funds or exchange-traded funds with low fees. The average equity mutual fund fee in 2018 was 0.55% and for bond funds, it was 0.48%, according to the Investment Company Institute. Index mutual funds should be even lower. The average fee for a target date fund the popular 401 option that uses a variety of individual mutual funds matched to your risk profile and expected retirement age was 0.40% in 2018.

If you’re considering switching employers, consider the difference in fees between your existing plan and new one. You might do better by keeping your existing 401 with your old employer if it offers significantly lower-fee choices.

Read Also: What Is The 401k Retirement Plan

How Do You Take A Withdrawal Or Loan From Your Fidelity 401

If you’ve explored all the alternatives and decided that taking money from your retirement savings is the best option, you’ll need to submit a request for a 401 loan or withdrawal. If your retirement plan is with Fidelity, log in to NetBenefits®Log In Required to review your balances, available loan amounts, and withdrawal options. We can help guide you through the process online.

Schedule A Meeting With A Representative

If you need help navigating your TIAA account, you can meet with our University TIAA representative. To schedule an upcoming appointment, call 1 842-2825. To view upcoming dates of when the representative will be on campus, please view our Events Page. You can also meet with a TIAA representative at their Grand Rapids office in Bridgewater Place. To sign up for an appointment, visit the TIAA website.

If you need more information about your Fidelity account, feel free to consult our University Fidelity Representative.

You May Like: Can I Sign Up For 401k Anytime

Investing In You And Your Future

After one year of service American will provide you with an employer contribution to your 401 account. The amount contributed will depend on your workgroup.

Team members with prior service or who transfer to American from one of its wholly owned subsidiaries will have their prior service at the subsidiary credited towards the one-year eligibility requirement and toward the service requirement for vesting full ownership of your 401 account balance.

American will contribute 16% of your eligible compensation to your 401 account up to the IRS limits. Participation is automatic, and you will be eligible for this nonelective company contribution* after completing one year of service.

If you do not have an investment election on file, your nonelective company contributions will be made to the Target Date Fund closest to the year you will turn age 65.

You are always 100% vested in your contributions, the nonelective company contributions and any associated earnings.

*A nonelective company contribution is a contribution to your 401 account that the company makes regardless of whether you are making your own contributions.

Flight Attendants receive a nonelective company contribution*, plus you are eligible to receive matching company contributions based on your eligible compensation. You become eligible to receive the following employer contributions after completing one year of service:

TWU-designated team members

IAM-designated team members