Roth Ira Eligibility And Contribution Limits

The total annual contribution limit for the Roth IRA is currently $6,000, with an additional catch-up contribution of up to $1,000 allowed for people 50 or older. That limit applies to both Roth and traditional IRA accounts if you have both, you can contribute a total of up to $6,000 .

At certain income levels, the Roth IRAs maximum annual contribution begins to phase down, and the ability to contribute to a Roth IRA is eliminated completely at a modified adjusted gross income of $208,000 for people who are married filing jointly in 2021 and at $214,000 for people who are married filing jointly in 2022. For single filers, the cutoff is $140,000 in 2021 and $144,000, in 2022. Our calculator identifies your maximum contribution for the year based on the age, income and the filing status you provide.

Understand The Rules For Contributing To A 401k And A Roth Ira

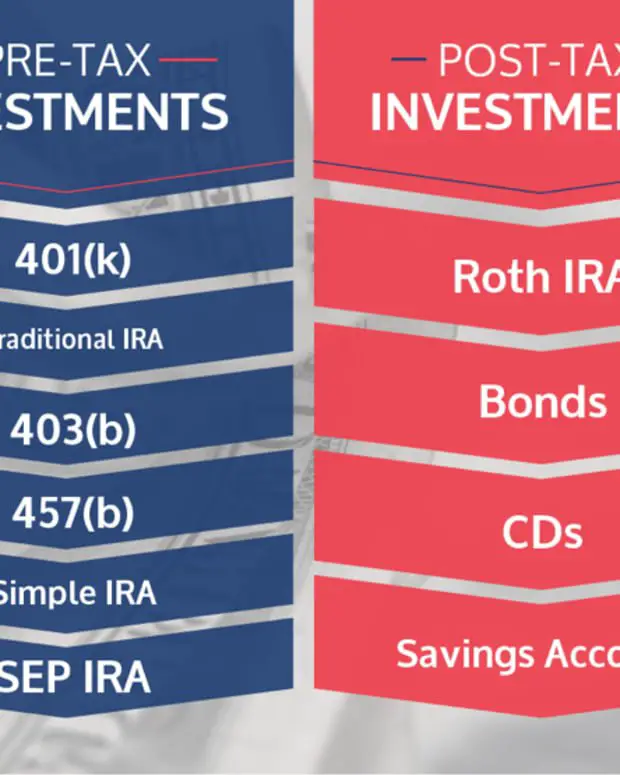

If your employer offers a 401 plan, there may still be room in your retirement savings for a Roth IRA. Yes, you can contribute to both a 401 and a Roth IRA, but there are certain limitations you’ll have to consider.

This article will go over how to determine your eligibility for a Roth IRA. You’ll also learn how much you can contribute to that Roth IRA, how to work around the eligibility restrictions, the flexibility of saving in a Roth IRA versus other individual retirement accounts, and the benefits of saving in both a 401 and a Roth IRA.

Talk With An Investment Pro About Your Roth 401

If you want to learn more about your Roth 401 or other investing options, find an investing pro in your area. A financial advisor can help you understand your investments and make confident decisions.

A do-it-yourself approach to investing is never a good idea. Even the pros work with a financial advisor! Your familys future is way too important to wing it.

Looking for a qualified investing pro? Try the SmartVestor program! Its a free way to find top-rated financial advisors near you. Start building a relationship with an investing pro who understands the financial journey youre on.

Recommended Reading: How To Transfer 401k Without Penalty

The Rules You Need To Knowplus A Pitfall You”ll Want To Avoid

Eric is currently a duly licensed Independent Insurance Broker licensed in Life, Health, Property, and Casualty insurance. He has worked more than 13 years in both public and private accounting jobs and more than four years licensed as an insurance producer. His background in tax accounting has served as a solid base supporting his current book of business.

Even if you participate in a 401 plan at work, you can still contribute to a Roth IRA and/or traditional IRA, as long as you meet the IRA’s eligibility requirements. You might not be able to take a tax deduction for your traditional IRA contributions if you also have a 401, but that will not affect the amount you are allowed to contributeup to $6,000, or $7,000 with a catch-up contribution for those 50 and over, for 2021.

It usually makes sense to contribute enough to your 401 account to get the maximum matching contribution from your employer. But after that, adding an IRA to your retirement mix can provide you with more investment options and possibly lower fees than your 401 charges. A Roth IRA will also give you a source of tax-free income in retirement.

Here are the rules you’ll need to know.

Should You Convert Your Traditional 401 To A Roth 401

The law now allows employees to convert funds from a traditional 401 plan to a Roth 401, if the plan allows it. About half of employers offer a Roth 401, according to 2017 data from Transamerica Center for Retirement Studies.

You’ll have to pay taxes in the year you convert, just as you would if you converted a traditional IRA to a Roth. Plus, a large conversion could bump you into a higher tax bracket. Note that unlike converting from a traditional IRA to a Roth, you can’t change your mind and undo a 401 conversion to a Roth.

Recommended Reading: Can An Llc Have A Solo 401k

Ira Benefits And Drawbacks

The investment choices for IRA accounts are vast. Unlike a 401 plan, where you’re likely to be limited to a single provider, you can buy stocks, bonds, mutual funds, ETFs, and other investments for your IRA at any provider you choose. That can make finding a low-cost, solid-performing option easy.

However, the amount of money you can contribute to an IRA is much lower than with 401s. For 2020 and 2021, the maximum allowable contribution to a traditional or Roth IRA is $6,000 a year, or $7,000 if you are age 50 or older. If you have both types of IRAs, the limit applies to all of your IRAs combined.

An added attraction of traditional IRAs is the potential tax-deductibility of your contributions. But, as discussed above, the deduction is only allowed if you meet the modified adjusted gross income requirements.

Your MAGI may also limit your contributions to a Roth IRA. In 2020, single filers have to make below $139,000, while married couples filing jointly must make less than $206,000 to be eligible for a Roth. These amounts rise for 2021 when single filers must make below $140,000, and married couples filing jointly must make less than $208,000 to be eligible for a Roth IRA .

Having earned income is a requirement for contributing to an IRA, but a spousal IRA lets a working spouse contribute to an IRA for their nonworking spouse, making it possible for the couple to double their retirement savings.

Roll Over Your Money To A New 401 Plan If This Option Is Available

If you’re starting a new job, moving your retirement savings to your new employer’s plan could be an option. A new 401 plan may offer benefits similar to those in your former employer’s plan. Depending on your circumstances, if you roll over your money from your old 401 to a new one, you’ll be able to keep your retirement savings all in one place. Doing this can make sense if you prefer your new plan’s features, costs, and investment options.

-

- Any earnings accrue tax-deferred.1

- You may be able to borrow against the new 401 account if plan loans are available.

- Under federal law, assets in a 401 are typically protected from claims by creditors.

- You may have access to investment choices, loans, distribution options, and other services and features in your new 401 that are not available in your former employer’s 401 or an IRA.

- The new 401 may have lower administrative and/or investment fees and expenses than your former employer’s 401 or an IRA.

- Required minimum distributions may be delayed beyond age 72 if you’re still working.

Don’t Miss: Can I Rollover My 401k To A Roth Ira

Leaving A Roth Ira Inheritance

Because there are no required minimum distributions with a Roth IRA during your lifetime, if you don’t need the money for living expenses, you can leave it all to your heirs.

Because youve prepaid the taxes on the Roth IRA, your beneficiaries wont be hit with a tax bill when they receive income from the account. This allows you to leave a stream of tax-free income to your children, grandchildren, or other heirs.

While non-spouse heirs must take required minimum distributions on inherited Roth IRAs, they wont be taxed on withdrawals as long as they comply with the RMD rules. Again, this differs from traditional IRAs, where RMDs are taxable for beneficiaries, just as they are for the original owners.

Vs Roth : Which One Is Better

11 Minute Read | September 27, 2021

If youve heard of a Roth 401, you may be wondering how different it really is from a traditional 401. We get it, 401s can be confusing! While these two types of 401 accounts have some similarities, they also have some pretty huge differences.

Access to a Roth option is becoming more and more common, so youre in the majority if you have this option at work. Just over the last five years, the number of plans offering a Roth 401 option has increased by 32%. As of 2021, about 3 out of 4 workplace retirement plans now offer a Roth optionwhich is great news for you!1

And guess what? Younger savers are starting to take advantage of this new option. Millennials are the most likely group to contribute to their Roth 401 at work.2

If you can contribute to a Roth and traditional 401 at work, which one should you choose? Lets dig into some of the differences between these options so you can make the best decision.

Don’t Miss: Can I Manage My Own 401k

Making Roth Ira Contributions

As mentioned, no matter how old you are, you can continue to contribute to your Roth IRA as long as youre earning incomewhether you receive a salary as a staff employee or 1099 income for contract work.

This provision makes Roth IRAs ideal for semi-retirees who keep working a few days a week at the old firm, or retirees who keep their hand in doing occasional consulting or freelance jobs.

Who Is Eligible For A Roth 401

If your employer offers it, youre eligible. Unlike a Roth IRA, a Roth 401 has no income limits. Thats a fantastic feature of the Roth option. No matter how much money you earn, you can contribute to a Roth 401.

If you dont have access to a Roth option at work, you can still take advantage of the Roth benefits by working with your investing pro to open a Roth IRA. Just keep in mind that income limits do apply when you contribute to a Roth IRA.

Don’t Miss: How Does A 401k Work When You Change Jobs

A Roth Option Isn’t Guaranteed

These days, a growing number of 401s are including a Roth savings option, which allows you to enjoy tax-free gains in your account and tax-free withdrawals during retirement. But not all 401 plans have a Roth version, and so you may get stuck saving in a manner that doesn’t fully work to your benefit in terms of taxes.

With an IRA, on the other hand, putting your money in a Roth savings plan is an option one way or another. If you earn too much money to contribute to a Roth IRA directly — there are income limits that change from year to year — you can always fund a traditional IRA and then convert it to a Roth afterward.

Many savers do quite well for themselves housing their retirement cash in a 401. But don’t assume that a 401 is the best savings tool for you. There are plenty of drawbacks associated with 401s, and if you’re not particularly happy with yours, then there’s no sense sticking with it.

What you should do in that case is contribute just enough money to your 401 to snag your full employer match, if one is offered, but then put the rest of your savings into an IRA. Doing so could help you invest more appropriately, avoid high fees, and enjoy the perks of a Roth saving option.

Youre Our First Priorityevery Time

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Also Check: Can I Open A 401k Without An Employer

The Boring Glory Of Index Funds

Your best bet is to buy something called an index fund and keep it forever. Index funds buy every stock or bond in a particular category or market. The advantage is that you know youll be capturing all of the returns available in, say, big American stocks or bonds in emerging markets.

And yes, buying index funds is boring: You usually wont see enormous day-to-day swings in prices the same way you may if you owned Apple stock. But those big swings come with powerful feelings of greed, fear and regret, and those feelings may cause you to buy or sell your investments at the worst possible time. So best to avoid the emotional tumult by touching your investments

Other Reasons To Use A Roth Ira

One of the biggest advantages of a Roth IRA over other retirement savings accounts is the ability to access contributions at any time. Thus a Roth IRA can be a good vehicle to save for preretirement goals if you otherwise wouldn’t contribute to an IRA.

Assuming you’re eligible for Roth IRA contributions, let’s say you deposit $9,000 over three years. You invest those contributions in low-cost mutual funds, and your balance grows to about $13,000 in six years. At that point you decide to buy a car. You can withdraw up to $9,000 from the account without explanation and without penalties. You can’t touch $4,000 in earnings unless you want to pay income taxes plus a 10% penalty.

There’s also a way to access your Roth IRA earnings early, without paying penalties or taxes. You can withdraw up to $10,000 in earnings if you use the money for a home purchase. These are the requirements:

- It’s been at least five years since your first Roth IRA contribution

- You and your spouse haven’t owned a primary home in the past two years

- You use the funds within 120 days of withdrawal

The $10,000 earnings withdrawal exception is a lifetime cap, so you can’t repeat this move in the future.

You May Like: How To Find Out If I Have An Old 401k

Get An Automated Micro

Small savings add up quickly.

A wave of micro-investing apps have allowed users to invest spare money in small amounts in selected exchange-traded funds , which are securities that track a basket of stocks, bonds, commodities, or indexes like the S& P 500 index, for instance. You can often select a ready-made portfolio depending on your risk tolerance and invest as little as $5 each day.

Take Acorns as an example: It automatically invests a small amount of your money daily, weekly, or monthly. One of Acorns interesting features is rounding up your purchases to the nearest full dollar amount and makes the change available for you to invest.

Lets say you used a credit card to buy a cup of coffee for $2.75. You can choose to invest the 25 cents on the app, or Acorns will invest the change for you if you elect automatic-roundup investments. Its free to open an Acorns account. The app charges $1 per month if your balance is under $5,000, or 0.25 percent per year if your balance is $5,000 or more.

Weve reviewed four micro-investing apps. Read more about their features here.

One thing to note: These apps target investors saving small amounts of cash, so you want to make sure the fees dont eat into your returns. As a reference, the average ETF fee is 0.24%, and the average for target-date funds is 0.71%, according to Morningstar. So, it really doesnt make much sense for you to pay $12 a year if you only invest $200 a year through Acorns the fee would be a sky-high 6%.

Invest In A Traditional Or Roth Ira

Yep, you may be able to put money into a traditional or Roth IRA even if you have a workplace 401. You can invest $6,000 a year . If you go with a traditional IRA, You might be able to deduct the full amount of the contributions if you or your spouse participated in a retirement plan at work. If thats the case, and you want to contribute to an IRA, you can opt for a Roth IRA instead.

A Roth IRA is funded with money thats already been taxed, so youre not limited by the contributions youve made in other funds. However, not everybody can go the Roth IRA route. If your modified adjusted gross income doesnt exceed IRS limits , you can contribute to a Roth IRA. Thats good for you, since that money grows tax-free and it wont be taxed when you take it out in retirement!

Don’t Miss: How Do Companies Match 401k

Ways To Invest Outside Of Your 401 In 2021

Editorial Note: The content of this article is based on the authors opinions and recommendations alone and is not intended to be a source of investment advice. It may not have not been reviewed, commissioned or otherwise endorsed by any of our network partners or the Investment company.

So youve got plans to max out your 401 and your emergency fund is cash-flush. What next?

You have plenty of options, many of which weve listed below. Wherever you put your money, remember that each type of investment comes with drawbacks. You should understand your risk tolerance and be comfortable with the potential pitfalls involved before getting started with a new investment. Asset diversification is a way to offset the potential risks do not put all your eggs in one basket. If you are looking to diversify your assets, here are 10 ways to invest outside a 401. Weve put them in order of how complicated it is to get started with these investment strategies.