Tips On Boosting Your Retirement Savings

- Your nest egg will likely grow the most in the stock market. But to mitigate the risk, youll want to diversify your investments. If youre not sure what the right allocation is for you, consult a financial advisor. SmartAssets free tool connects you with financial advisors in your area in five minutes. If youre ready to be matched with local advisors, get started now.

- Increase your 401 contributions as soon as you get a raise. Ideally, you should defer the whole raise until youve reached the contribution cap. But any amount is better than nothing. If you do it right away, you wont miss the added amount withheld from your paycheck.

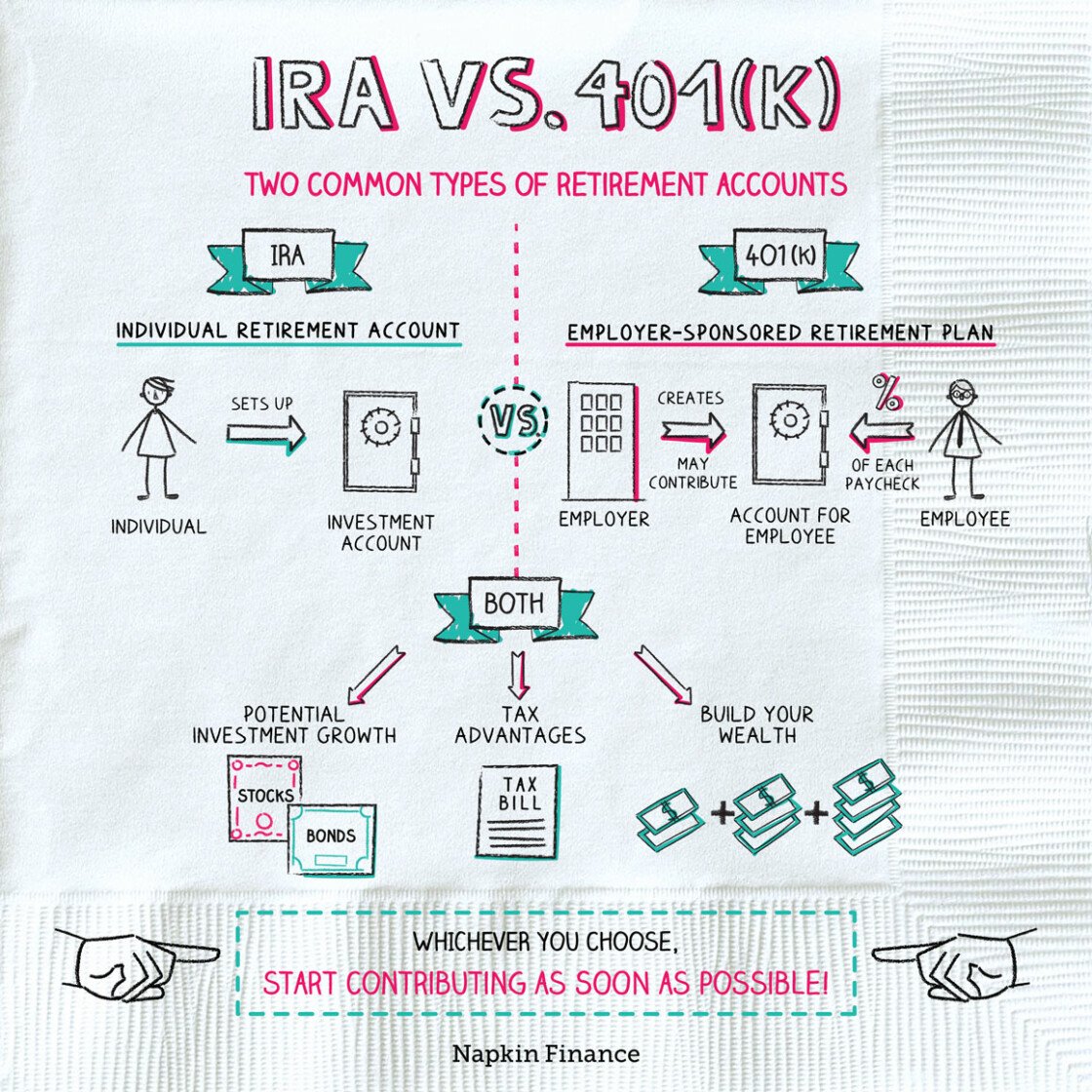

- Do your research to make sure youre making the best retirement choice for your needs. Heres a breakdown of IRAs vs. 401s.

How Much Of My Salary Can I Contribute To A 401 Plan

The amount that employees can contribute to their 401 Plan is adjusted each year to keep pace with inflation. In 2020 and 2021, the limit is $19,500 per year for workers under age 50 and $26,000 for those aged 50 and above.

If the employee also benefits from matching contributions from their employer, then the combined contribution from both the employee and the employer is capped at the lesser of $58,000 or 100% of the employees compensation for the year.

Sponsorship: An Employers Role

Each 401 plan has a sponsor, usually your employer. The sponsor decides which factors determine your eligibility, what percentage of your salary you can contribute to your plan, whether to match your contributions and which investments will be available within your plan. The plan administrator keeps track of the companys 401, handling management details and making sure that the plan runs smoothly. Your sponsor also chooses your plan provider, typically a financial services company that offers investment products, plan administration and record-keeping services.

Some provisions of your 401 plan are dictated by ERISA, the federal law that governs qualified retirement plans. For example, plans must cover all eligible employees and treat them equitably. Other details are specific to each individual plan. Thats why, if you move from one job to another, each with a 401, some things will seem familiar and others different.

401 plans are largely self-directed. You decide how much you would like to contribute to your plan, how you would like to investor reinvestthose contributions within the limits of your plans investment menu, and eventually how you would like to handle withdrawals from your account.

With many employers, you have to sign up before you can contribute part of your earnings to your plan account. You have to choose how much to put away. And you decide where to invest your contributions, selecting among the investment choices offered in the plan.

Also Check: How To Find Your 401k Account Number

Before You Pick Investments

When money goes into the plan, how will it be invested? Your plan probably offers investments that range from aggressive to conservative .

Aggressive investors hope to grow their money as much as possible over the long term. They use aggressive investments that are likely to go up and down sometimes dramatically over the short term. These investors hope they will be rewarded for taking risks. Over long periods of time, such as 10 years or more, these investments will hopefully provide positive returns and growth. But theres also a high likelihood of losing money at least temporarily at some point in time. You lock in those losses if you sell when youre down. Sometimes you need to sell because you need the money, and sometimes you sell because youre unhappy about what your investments are doing.

Conservative investors are less interested in growth. They are more concerned with reducing losses when the markets get crazy. They tend to prefer safer investments such as cash and bonds, but those investments are not completely risk-free. Conservative investors take the risk that they wont earn enough to keep up with inflation, and bonds can lose money in several situations .

You can be completely on one end of the spectrum or the other. Or you can find a place in between the extremes. Its possible to go for some growth without putting all of your money at risk.

Its often wise to use a risk tolerance questionnaire to help think about and get suggestions.

Think Planning Is Hard It Doesnt Have To Be

We all want to have a financially sound future while avoiding common pitfalls and missteps along the way. Your plan can provide assistance and insight into the challenges we all face when trying to save for retirement, and some of the best ways to help overcome them.

Here are some ways to get goingand keep goingtoward your goal of retirement readiness.

Recommended Reading: How Do I Find Previous 401k Accounts

How To Set Up A 401 Account

Since their inception in 1987, 401s have become the private sectors most common employer-sponsored retirement plan the Investment Company Institute says that there are roughly 60 million active participants in 2020. Participating in your companys 401 is a key component of saving for retirement, allowing you to divert a portion of your pre-tax income into an investment account. A financial advisor in your area can answer questions about retirement planning and help you create a plan for your financial needs. If you recently switched jobs or simply have never before contributed to a retirement plan, here are several easy steps to follow for setting up a 401 account.

What Are The Different Types Of 401 Automatic Enrollment

There are 3 major types:

1. Basic automatic enrollment, or Automatic Contribution Arrangement :

- You automatically enroll your employees in your 401 plan, unless they choose otherwise.

- Your 401 plan document must state the percentage that will be automatically deducted from employees wages.

- Employees can choose to contribute a different percentage, or they can elect not to contribute to your 401 plan.

2. Eligible automatic contribution arrangement :

- An EACA is similar to basic automatic enrollment, except that it has certain notice requirements.

- Participants who are automatically enrolled via EACA can withdraw their automatic contributions within 90 days of their first automatic contribution.

3. Qualified automatic contribution arrangement :

- A QACA has various requirements including annual testing, employee notification, employer contributions, special vesting schedule, and fixed schedule for employee contributions.

For more information on the 3 types of automatic enrollment, visit the IRS website.

Recommended Reading: Can I Roll A 401k Into A Roth Ira

Give Yourself A Raise

One reason to consider joining your employers 401 plan is because many employers will match your contributions up to a certain limit. Thats right theyll kick in extra money for your retirement, as a reward to you for joining the plan. Its like giving yourself a raise or a yearly bonus! If you dont join or contribute to your retirement plan, neither does your employer and that potential benefit is left on the table.

Can Employers Force Employees To Have Automatic Enrollment

Currently, automatic enrollment is voluntary for employees, meaning you cannot force employees to participate. But this could change, due to pending legislation.

Members of Congress have introduced the SECURE Act 2.0, which builds on the original SECURE Act. The new version would require employers to automatically enroll eligible employees in the companys 401 plan at a deferral rate of between 3% and 10%. The default rate would automatically escalate annually at 1%, up to a minimum of 10% and a maximum of 15%. Employees can choose to contribute a different amount.

Secure 2.0 has broad bipartisan support, and there is a significant likelihood that it will pass this year, either as a standalone or as part of broader legislation,one expert says in a May 2021 article published by the Society for Human Resource Management.

Recommended Reading: Should I Roll My 401k Into An Annuity

How To Make Catch

To begin making these extra contributions, youll need to contact your plan administrator or access your account online. You can make this election at any time and change the amount you wish to contribute each pay period if necessary.

Catch-up contributions must be made to 401 plans before the end of the year. IRA catch-up contributions, on the other hand, can be made up until the applicable deadline to file your income tax return. This date typically falls in the middle of April.

What Is The Difference Between Roth And Traditional 401

“The basic difference between a traditional and a Roth 401 is when you will pay the taxes on your money. With a traditional 401, you make contributions with pre-tax dollars, meaning the money going towards your 401 has never been taxed. That gives you a tax break up front, helping to lower your current income tax bill now. You will then be required to pay taxes when you withdraw your funds.

With a Roth 401, it’s basically the reverse. You make your contributions with after-tax dollars, meaning the money you are putting into the 401 has already been taxed. There is no upfront tax deduction benefit, however, withdrawals of both contributions and earnings are tax-free once you reach age 59½, as long as you’ve held the account for five years.”

Don’t Miss: How Much Will My 401k Be Worth In 20 Years

Talk To Hr About Enrolling In Your 401

If you’re interested in opening a 401, talk with your employer to learn about how your company’s plan works. Some employers automatically enroll employees and withhold a default amount of their paychecks, which you can change yourself at any time. You can also opt to stop contributing to the plan if you’re not interested in doing so right now.

Other companies require participants to declare their desire to participate in the 401. You’ll have to fill out paperwork saying that you’d like to contribute to the plan and how much money you’d like to set aside initially. You can always change this later.

You’ll also need to choose your beneficiary — the person you’d like to inherit your 401 if you die — when you sign up. Usually you choose a primary beneficiary and a secondary, or contingent, beneficiary who will inherit the 401 if the primary beneficiary is deceased or doesn’t want the money.

How To Apply For Canada Pension Plan Retirement Benefits

If you work in Canada, chances are you have noticed deductions for the Canada Pension Plan being deducted off of your pay cheque. Every individual who is employed or self-employed must contribute to this plan, which is the Canadian governments retirement income system.

- If you are employed by a company, your employer matches your contributions, which are withheld from your regular pay.

- If you are self-employed , you must make both the employee and employer contributions, and this is done each year when you file your personal T1 General tax return.

- CPP benefits do not start automatically. You must file an application with Service Canada to start your monthly pension.

Read Also: When Can You Take Out 401k Without Penalty

How Can I Learn About The Investment Options In My 401k

There are so many great resources from material online to a trusted advisor. We encourage you to take advantage of them all, however, a great place to start is by using the “Prospectus” of each investment within your 401 plan. This can be found by online, clicking on “Learn & Advice”, and then “Investment Performance”. There you will find the prospectus under the Links column.

You Are Leaving The Wells Fargo Website

You are leaving wellsfargo.com and entering a website that Wells Fargo does not control. Wells Fargo has provided this link for your convenience, but does not endorse and is not responsible for the content, links, privacy policy, or security policy of this website.

When considering a 401 plan for employees, keep in mind this flexible plan offering provides the highest level of employee pre-tax or Roth contributions, a wide range of employer contribution options, and an optional loan provision.

Recommended Reading: What Is My Fidelity 401k Account Number

How 401 Plans Work

The 401 plan was designed by Congress to encourage Americans to save for retirement. Among the benefits they offer is tax savings.

There are two main options, each with distinct tax advantages:

- A traditional 401 is deducted from the employee’s gross income. The employee’s taxable income is reduced by that amount and can be reported as a tax deduction for that year. No taxes are due on the money paid in or the profits it earns until the employee withdraws it, usually after retiring.

- A Roth 401 is deducted from the employee’s after-tax income. The employee is paying income taxes on that money immediately. When the money is withdrawn during retirement, no additional taxes are due on the employee’s contribution or the profits it earned over the years,

Not all employers offer the option of a Roth account.

If the Roth is offered, the employee can pick one or the other or a mix of both, up to annual limits on their tax-deductible contributions.

What Is A 401 Anyway

401 plans are retirement plans that help you save for the future. They allow you to save for your future out of your earnings, and your employer might also contribute to your account. If you receive profit-sharing and matching contributions from your employer, you build up savings even faster.

401 plans may be able to help you manage your taxes . You can potentially reduce the amount of income you pay taxes on by contributing to the plan, which can make it easier to save. Some plans also allow you to save after-tax Roth money, which can possibly provide tax-free income in retirement.

Theres a lot more to know, and well cover additional topics as we go.

Recommended Reading: How To Get Your 401k Without Penalty

Where Should I Invest My Money

You will need to decide where your 401 contributions will be invested.

|

|

Your employers plan will offer a menu of investment choices, typically mutual funds. Some types of funds are riskier than others. The mix of investments you choose will depend largely on how many years you have until retirement. Keep in mind that you can always change your investments later. |

|

|

Be aware of fees. Fees that you are paying will be deducted from your 401 on a regular basis, reducing the growth of your money. Look in your summary plan description for the administration fees charged by your plan provider. You should also find out the fees associated with the mutual funds you are interested in investing in there should be a link to each fund prospectus from your 401 website. If youre not sure about fees you will be paying, ask your employer. |

Elective Deferrals Must Be Limited

In general, plans must limit 401 elective deferrals to the amount in effect under IRC section 402 for that particular year. The elective deferral limit is $19,500 in 2021 and in 2020 and $19,000 in 2019. The limit is subject to cost-of-living adjustments. However, a 401 plan might also allow participants age 50 and older to make catch-up contributions in addition to the amounts contributed up to the regular 402 dollar limitation, provided those contributions satisfy the requirements of IRC section 414. These limits apply to the aggregate of all retirement plans in which the employee participates.

Read Also: How To Do A Direct 401k Rollover

How Should I Set Up My 401

Only employers can set up 401s. If youre an employee, this means you dont have to do anything. Many employers will add you automatically to their 401 plan when youre hired.

If your employer doesnt operate a 401, you can try asking them to set one up. A good way to do this is to tell them about the tax benefits they can enjoy if they make employer contributions.

Customizing Your 401 Plan

You can choose to customize several aspects of your companys 401 plan. These include:

-

Whether you want to allow loans to be taken from your plan.

-

Whether youll allow Roth 401s.

-

Whether you want to match employee contributions or contribute a fixed percentage of their salary.

You can select your customization choices in your 401s adoption agreement. Typically, the adoption agreement includes a list of checkboxes, making it easy for you to tick the features you want to offer.

Also Check: Can I Manage My Own 401k

Consider These 401 Benefits And Features

Here are some additional resources on your retirement planning options:

: Some factors to think about as you consider enrolling in your 401 retirement plan.

Questions to ask your employer: Consider asking these questions when starting a new job or enrolling in a retirement plan.

Earn more with an employer match: If your employer matches a portion of your contributions, consider putting in at least enough to get the full match.

You may be enrolled automatically: Your employer may enroll you in a plan automatically. Learn how that could help you prepare for retirement.

Over 50? Consider catch-up contributions: Learn about catch-up provisions for your 401 and other retirement accounts.

Are you on track for retirement?: Use our My Interactive Retirement PlannerSM to estimate how much youll need to save for retirement.

Enroll in Your Retirement Plan: Its never too early to start investing for your retirement.

Neither Nationwide nor our representatives give legal or tax advice. Please consult your attorney, legal or tax advisor about such questions.

The Benefits Of Catch

As you can see, the catch-up contribution limit is quite generous across different plan types. You can use our 401 calculator to see how much you can expect to gain by taking advantage of catch-up contributions.

So lets say you turned 50 years old this year and you reached your 2020 individual 401 limit. But, you dont use your catch-up contribution. Assuming an annual return of 7% on your 401 investments, a reasonable estimate according to some advisors, your account would grow to $20,865 by next year.

But by taking the full catch-up contribution, it would grow to $27,820. If you do nothing more and let your money grow until you turn 66, youre looking at a balance of more than $82,000.

In addition, you stand to gain even more if your company offers some type of employer match on your contributions. As noted above, the most you can contribute to your 401 if youre at least 50 years old is $26,000 in 2020. The IRS calls this money that you put into the account elective deferrals. They are separate from any employer match your company may offer. So in 2020, the total amount of tax-deferred contributions that can be made to your 401 plus all other defined contribution plans from all sources including your employer is $57,000 or $63,500 if youre age 50 or older.

DC plans typically cover workplace retirement plans. So if youre 50 or older, the most you can contribute in 2020 to all your IRAs, including any Roth options, is $7,000.

Don’t Miss: How To Start My Own 401k