If Im Eligible Should I Take A Distribution From My 401 Or Ira

Even with the new rules in place, its still advisable to exhaust most other resources, such as emergency funds or other easily accessible forms of savings, before tapping into your retirement accounts.

But if you are considering taking a distribution from your IRA or 401, think through the following first.

You Are Penalized By The Irs

If you withdraw money from your 401k before youre 59 ½ , the IRS penalizes you with an extra 10 percent on those funds when you file your tax return. If we use the example above, an additional $1,000 would be taken by the government from your $10,000 leaving you with just $6,000. If youre 55 or older, you could try to get this penalty lifted by the IRS through the Rule of 55, which is designed for people retiring early.

Also, there are exceptions under the CARES Act, which is designed to help people affected by the pandemic. There are provisions under the act that state individuals under the age of 59 ½ can take up to $100,000 in Coronavirus-related early distributions from their retirement plans without facing the 10 percent early withdrawal penalty under certain conditions.

What If You Only Need The Money Short Term

Although there are other qualifying exceptions to withdraw IRA or 401k assets penalty-free, those listed above are the major ones. But suppose youre not interested in paying any taxes at all. You can still use your 401k to borrow money via a loan. The interest goes to you, the loan isnt taxable, and it wouldnt show up on your credit report. Heres how it works.

Read Also: What Percentage Should I Be Putting In My 401k

How To Cash Out Your 401k And What To Consider

4-minute readMay 18, 2021

One of the surest ways to create a comfortable retirement for yourself is to begin saving early on in your career. A 401 plan a type of financial contribution plan which allows you to put a percentage of your salary into an account whose investment gains remain tax-free until funds are withdrawn presents one of the most popular vehicles for doing so. Even better, employers will often match the amount of money set aside up to a certain amount, effectively guaranteeing you free income.

However, in the event that access to money is needed, especially in the wake of a large or unexpected expense, its not uncommon to wonder how to cash out your 401 as well. Here, well take a closer look at the process of cashing out a 401 early, how long it takes to get access to money, and the pros and cons of doing so, including how much early withdrawal before retirement may cost you.

Leave The Account Alone

If your 401 investment balance is more than $5,000, most plans allow you to just leave it where it is. This is often the simplest choice. If you dont urgently need the money, leaving your 401 account alone allows it to continue growing from investment gains.

It may make sense to roll over the 401, though, if youre paying high fees for the management of the account where it is, or if you want more control over how your money is invested.

If the account balance is less than $5,000, your old company may also opt to distribute the money to you. Then its largely on you to roll it over into a new retirement account if you want to avoid having to pay taxes on it nowand possibly a penalty.

Read Also: How Much To Invest In 401k To Be A Millionaire

Roll Your Old 401 Over Into A New 401

If youve since gotten another full-time job and have access to an employer-sponsored retirement plan, you can streamline your plans by rolling over your old 401 into your new one. You can request the administrator of your old plan deposit the money from your account directly into the new plan by filling out some paperwork. This is called a direct transfer, as its made from custodian to custodian, and it saves you the risk of owing taxes.

You do have the option to elect instead to have the balance of your old account distributed to you by check. But then the onus is on you to deposit those funds into your new 401 within 60 days to avoid paying income tax on the whole balance. So, if you go this route, be sure your new 401 account is active and set up to receive contributions before you cash out your old account.

K Early Withdrawal Hardship Or Loan: Whats The Difference

Knowing the differences between a 401k early withdrawal, a hardship withdrawal, and a 401k loan is crucial. Due to the many obstacles to make a 401k early withdrawal, you may find you want to keep it untouched. If youre convinced you still need to use your 401k for financial assistance, consult with a trusted financial advisor to figure out the best option.

|

When Does This Apply? |

||

| Your funds are withdrawn to pay off large debts or finance large projects. | Your 401k fund is typically subject to taxes and penalties. | |

|

Hardship Withdrawal |

Youre only eligible for this type of withdrawal under circumstances such as a pandemic or natural disasters. | Withdrawals cant exceed the amount of the need and the funds are still subject to taxes and penalties. |

|

401k Loan |

The loan must be paid back to the borrowers retirement account under the plan. | The money isnt taxed if the loan meets the rules and the repayment schedule is followed. |

Don’t Miss: Can I Use My 401k To Buy Investment Property

How To Withdraw From A 401k When Leaving The Country

When you leave the United States, its easier to move your belongings and cash accounts than it is to tap into your 401k plan if youre under age 59 1/2. Even though youre leaving the country, IRS tax rules will follow your plan wherever you go. Because penalties for early access are high, you should explore less expensive options if you dont qualify for one of the exceptions available for persons under 59 1/2.

Review your situation. If youre over age 59 1/2, youll only pay income taxes as if you earned the money this year. Those under age 59 1/2 will pay a 10 percent penalty unless the withdrawal qualifies as a hardship, is used for unreimbursed medical expenses, health insurance premiums while unemployed for at least 12 weeks, a total disability or qualifying higher education expenses.

Complete paperwork if the 401k administrator wont allow telephone redemptions. To speed up the process, ask the company to email or fax the forms. Also, ask the 401k administrator if the company accepts faxed or emailed scans of the documents. If so, you may receive your funds more quickly.

File the receipt attached to your check after verifying your withdrawal was completed correctly. Review the withholding and any penalty withholding. If anything is incorrect, dont cash the check. Call the 401k provider and ask questions until youre satisfied that your withdrawal was successfully administered.

References

Build An Emergency Fund

This should be the foundation of your financial plan and experts recommend having about six months worth of expenses saved. You can park this money in a high-yield savings account to earn more interest than you would in a traditional checking account. An emergency fund should help you manage most of lifes curveballs.

Also Check: Can You Pull From 401k To Buy A House

What You Need To Know To Avoid Costly Mistakes

In an ideal world, everybody would leave their 401 funds alone until they need the money for retirement. That might mean rolling your account over to an Individual Retirement Account , but it also means not cashing out the funds prior to reaching retirement age, to allow the money to grow to its maximum potential amount. In investing, time truly is your best asset. At some point though, you will begin taking distributions, and here’s what you need to know.

The best way to take money out of your 401 plan depends on three things:

No More Creditor Protection

As long as your money’s in a 401 plan, it’s creditor-protected, meaning that it’s shielded in the event of bankruptcy. It is unwise to cash in a 401 plan to pay down your debt if it is likely that you will end up filing bankruptcy. The bankruptcy court cannot touch the money in your 401 plan, and creditors cannot attach liens against its assets, nor can they force you to withdraw this money to pay a debt. It is well-protected money meant for use in your retirement years.

Also Check: How To Find My 401k Money

Next Steps To Consider

This information is intended to be educational and is not tailored to the investment needs of any specific investor.

Fidelity does not provide legal or tax advice. The information herein is general in nature and should not be considered legal or tax advice. Consult an attorney or tax professional regarding your specific situation.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917

This Is What Happens To Your 401 When You Quit

When you quit your job, you have five options for your 401:

If youre considering quitting or transitioning jobs, you may be wondering what to do with your 401. Each of the options above has benefits and drawbacks, and you should carefully consider whats best for you.

Before you decide what to do with your 401, make sure you dont have a loan on your 401. 401 loans are appealing because they dont affect your debt-to-income ratio however, if you cant repay it by the tax due date after leaving your job, youll be taxed on the balance and charged an early withdrawal fee. Some companies offer special options here, so you should always check with your 401 administrator and plan documents.

Youll also want to keep in mind the fact that some account types only allow one rollover per year so if youre changing jobs frequently, this is something to be aware of. Refer to this chart from the IRS to learn more about account rollovers.

With this in mind, you have the following options for your 401 when quitting your job:

Also Check: How Much Money Do I Have In My 401k

How Can I Pull Out My Money From My 401

Cashing out a 401 can be a tempting idea, especially if you are facing financial difficulties or need to raise money for a major purchase. But even though the money in the account belongs to you, it is subject to certain rules and restrictions due to the tax advantages it provides account owners. One of the rules related to cashing out a 401 relates to the employment status of the account owner. You are allowed to cash out a 401 while you are employed, but you cannot cash it out if you’re still employed at the company that sponsors the 401 that you wish to cash out.

TL DR

You can cash out a 401 while you are employed, but you cannot cash it out if you’re still employed at the company that sponsors the 401 that you wish to cash out.

What Happens If I Stop Contributing To My 401k

If you are considering stopping contributions to a 401k, you would be better served to merely suspend those contributions. A short-term suspension will slow the performance of your retirement fund, but it wont keep it from growing. It also will lessen the temptation to simply withdraw all the funds and wipe out retirement savings in the process.

Read Also: How To Withdraw Money From My Fidelity 401k

Yes But It May Not Be Such A Great Idea

You can make a 401 withdrawal in a lump sum, but is it a good idea to do so? Usually, the answer to that is no. Tax-deferred retirement plans, such as 401s, are designed to provide income during retirement. In most cases, if you make any withdrawal and are younger than 59½, you’ll pay a 10% early withdrawal penalty in addition to income taxes on the amount you withdraw. Note that this early withdrawal penalty was not in effect for withdrawals of $100,000 or less in 2020 if you had been affected by the COVID-19 pandemic.

Here are some of the options available to withdraw a lump sum from your 401 and what you need to consider.

For Many This Relief Simply Isn’t An Option

Only about half the workforce has a retirement account, says Olivia S. Mitchell, professor of insurance/risk management and business economics and public policy, and executive director of Wharton’s Pension Research Council at the University of Pennsylvania.

And many have far less than $100,000 saved. A recent report found pre-retirees, Americans 56 to 61, had a median balance of $21,000 in their 401 accounts in 2016, which is the most up-to-date data on file. That total reflects almost 30 years of savings. Younger generations do not fare much better. Older millennials have about $1,000 saved in their 401s.

Not only that, but employees with retirement accounts tend to be the higher paid, better educated and longer-term workers. “Therefore allowing people to tap into their retirement accounts won’t help the millions who have no accounts,” Mitchell says. “Those with no accounts are also likely to be the people that will be needing the most help.”

Additionally, Mitchell predicts that the U.S. will see an increase in applications for early Social Security benefits, particularly if the recession is long and hard. “People taking early benefits will end up with a lifetime of lower payouts, and if they already ate into their 401s, they’ll be more likely to face shortfalls in their later years,” she says.

Don’t Miss: Can You Withdraw Your 401k If You Quit Your Job

Special Considerations For Withdrawals

The greatest benefit of taking a lump-sum distribution from your 401 planeither at retirement or upon leaving an employeris the ability to access all of your retirement savings at once. The money is not restricted, which means you can use it as you see fit. You can even reinvest it in a broader range of investments than those offered within the 401.

Since contributions to a 401 are tax-deferred, investment growth is not subject to capital gains tax each year. Once a lump-sum distribution is made, however, you lose the ability to earn on a tax-deferred basis, which could lead to lower investment returns over time.

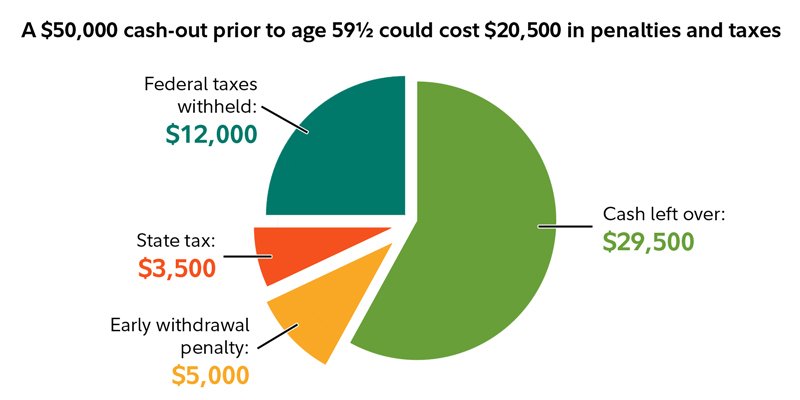

Tax withholding on pre-tax 401 balances may not be enough to cover your total tax liability in the year when you receive your distribution, depending on your income tax bracket. Unless you can minimize taxes on 401 withdrawals, a large tax bill further eats away at the lump sum you receive.

Finally, having access to your full account balance all at once presents a much greater temptation to spend. Failure in the self-control department could mean less money in retirement. You are better off avoiding temptation in the first place by having the funds directly deposited in an IRA or your new employer’s 401 if that is permitted.

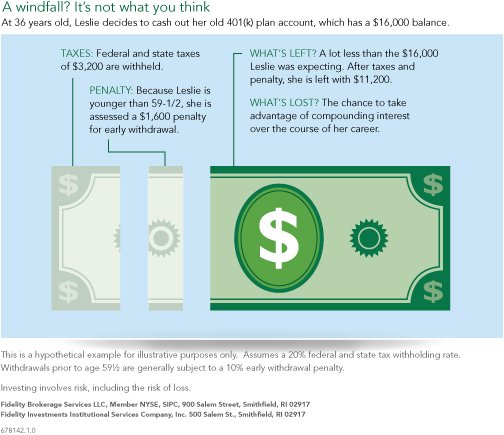

Why Early 401 Withdrawals Don’t Pay

When you fund a traditional 401 plan, the money you contribute goes in tax-free — and that’s a nice incentive to participate in such a plan. In exchange for that tax break, however, the IRS wants you to leave that money alone until you reach 59 1/2. Attempt to access that money sooner, and you’ll typically face a 10% early-withdrawal penalty on the sum you remove. This means that if you take a $10,000 distribution at age 32 to buy a new car, you’ll lose $1,000 as a penalty fee right off the bat.

Furthermore, any time you remove funds from a traditional 401, that distribution is taxed at your ordinary income tax rate. This holds true whether you withdraw money early or so during retirement when you’re supposed to. In the preceding example, in addition to losing $1,000 to that pesky early-withdrawal penalty, you’d also lose a chunk of that $10,000 to taxes. In fact, if we apply a 24% tax rate, that means that of that $10,000 distribution, you walk away with just $6,600. Ouch.

Read Also: What Is An Ira Account Vs 401k

Youre Our First Priorityevery Time

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.