What Are Required Minimum Distributions

Required Minimum Distributions generally are minimum amounts that a retirement plan account owner must withdraw annually starting with the year that he or she reaches 72 , if later, the year in which he or she retires. However, if the retirement plan account is an IRA or the account owner is a 5% owner of the business sponsoring the retirement plan, the RMDs must begin once the account holder is age 72 , regardless of whether he or she is retired.

Retirement plan participants and IRA owners, including owners of SEP IRAs and SIMPLE IRAs, are responsible for taking the correct amount of RMDs on time every year from their accounts, and they face stiff penalties for failure to take RMDs.

Locate Where Your 401s Are

Before you can check how much is in your 401 account, you need to know where your 401s are.

The first place to look is the company with whom you’re currently working. Many companies have implemented auto-enrollment into their 401 plans, ensuring that most of their employees contribute to their retirement. Otherwise, participation may drop because they simply forgot or didn’t know it was available.

Contact your human resources department to get information on if you’re contributing to their 401 and your account information.

Additionally, if you’ve changed jobs a few times in your career, you may have old 401 outstanding in different places. Locating old 401s can be a tricky process as it requires much coordination and hunting down various entities and contacts.

If you’re unsure if you have outstanding 401s with old companies, we can help. Beagle will find any old 401s you have, identify any hidden fees, and provide options to consolidate into one, easy-to-manage account. Sign-up is free and only takes a couple of minutes.

Even misplacing one 401 from a previous employer could cost you thousands in potential retirement funds.

What Kind Of Investments Are In A 401

401s often offer a small, curated selection of mutual funds. Thats a good thing and a bad thing: On the plus side, you may have access to lower-cost versions of those specific funds, especially at very large companies that qualify for reduced pricing.

The negative is that even with discounted costs, that small selection narrows your investment options, and some of the funds offered may still have higher expense ratios than what youd pay if you could shop among a longer list of options. That can make it harder to build a low-cost, diversified portfolio.

Some plans also charge administrative fees on top of fund expenses, which can add up. If your 401 is expensive, contribute enough to earn your matching dollars, and then direct any additional retirement savings contributions for the year into an IRA.

Don’t Miss: Can I Transfer My Ira To My 401k

Am I Eligible For Old Age Security

Eligibility for Old Age Security depends on how much income you earn. The default value in the calculator is the 2019 maximum monthly payment regardless of your marital status. You can check the latest Old Age Security payment amounts to find out exactly how much money you’ll receive – and add it to the calculator for more accuracy.

A Beginner’s Guide To Understanding 401k Plans

The word 401k is synonymous with retirement, but how many of us actually know all the rules around 401k accounts? We’ll walk you through all the finer details, but we also know you’re busy, so we’ve also whipped up this handy table of contents for you, too. Feel free to self-serve some of the most frequently asked questions about 401k plans, or binge it all, top to bottom.

Now, onto the good stuff:

You May Like: How Much In 401k To Retire

The Benchmarks For Those Closer To Retirement

The range gets wider as you get older, so we also provide more detailed estimates for people approaching retirement. This helps someone find a realistic target based on income and marital status, which affect Social Security benefits.

A Closer Look at Savings Benchmarks Later in Your Career

Savings Benchmarks Later in Your Career| 11x | 14x |

Assumptions: See Savings Benchmarks by AgeAs a Multiple of Income above. Dual income means that one spouse generates 75% of the income that the other spouse earns.

Why Should I Use One

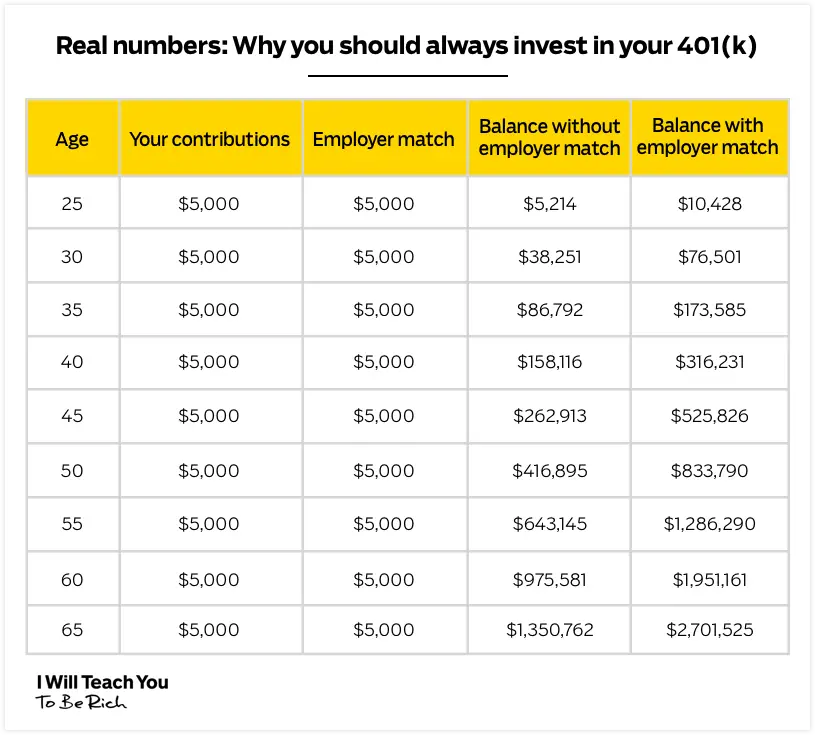

Matching dollars, for one thing. Over 90% of employers that offer a 401 plan also kick in a matching contribution, which means as you contribute, your employer will, too. Commonly, that match will be worth 50% to 100% of your contributions, up to a limit that typically falls between 3% and 6% of your annual income. If your employer offers up this free money, a good rule of thumb is to do everything you can to contribute enough to take advantage of it.

The other huge benefit of the 401 is that it allows you to put a lot of money away for retirement in a tax-advantaged way. The annual contribution limit is $19,500 for tax year 2021, with an extra $6,500 allowed as a catch-up contribution every year for participants age 50 or older.

You May Like: How To Do A Direct 401k Rollover

Pros And Cons: 401 Vs Ira

401 Pros |

|

|---|---|

|

|

|

|

When Is An Ira A Better Option

An IRA and a 401 are both retirement saving vehicles and the two share commonalities. But there are a few important differences that make IRAs the better choice in some situations.

A 401 is only available through your employer. If you work at a company that doesnt offer a 401, you cant get one. People in work situations where the employer does not offer 401 accounts can still get retirement savings accounts with tax benefits thats where the IRAs come in.

IRAs are another type of retirement savings account. Unlike a 401, an IRA is not tied to your employer. You can sign up for an IRA at online brokerage like E*Trade, Vanguard, or Fidelity and open an account.

Another reason why someone might choose an IRA is for the investment options. IRAs are generally known to have a wider selection of investment opportunities than what youll find with a 401. But keep in mind that the contribution limits with an IRA account is much lower than the limits with a 401.

You May Like: How To Set Up A 401k Account

Taxes For Making An Early Withdrawal From A 401

The minimum age when you can withdraw money from a 401 is 59.5. Withdrawing money before that age results in a penalty worth 10% of the amount you withdraw. This is in addition to the federal and state income taxes you pay on this withdrawal.

There are exceptions to this early withdrawal penalty, though.

If you want to remove money from a 401 account without paying taxes, you will need to meet certain criteria. According to the IRS, you generally dont have to pay income tax or an early withdrawal penalty if you experience an immediate and heavy financial need. One situation where this may apply is when you have medical expenses that arent reimbursed by your insurance and which exceed 7.5% of your adjusted gross income . If this happens, you dont have to pay taxes on the money you withdraw to cover that financial need. There are also other exceptions, such as for disabled taxpayers. The IRS provides a more complete list of situations where you wont pay tax on early withdrawals.

The big caveat here is that the amount you can withdraw tax-free is exactly enough to cover the cost of this financial need. And youll still pay the full income tax on your withdrawal only the 10% penalty is waived.

What Happens To My 401k If I Change Jobs

You have a couple of options, but the one most would recommend is a 401k rollover. A 401k rollover is when you transfer your funds from your employer to an individual retirement account or to a 401k plan with your new employer. A much less popular option is to cash out your 401k, but this comes with massive penalties income tax, and an additional 10% withholding fee.

You May Like: How To Withdraw Money From My Fidelity 401k

How To Make A Retirement Budget

wikiHow is a wiki, similar to Wikipedia, which means that many of our articles are co-written by multiple authors. To create this article, volunteer authors worked to edit and improve it over time.Learn more…

One of the biggest questions people have about retirement is, “How much money do I need to retire comfortably?” We can help you figure that out with our tips on creating a personalized retirement budget. Just compare how much money you’ll have coming in to what you can expect to spend. Let’s get to planning so you can enjoy your golden years worry-free!

Tips For Getting Retirement Ready

- If youre unsure of what your retirement plans should look like, a financial advisor can help you get things in order. Luckily finding a financial advisor doesnt have to be hard. SmartAssets free matching tool can pair you with up to three advisors in your area. Get started now.

- Dont forget about Social Security. Youll get a check from the government each month, which can help you get to your desired retirement income level. Find out how much youll get with our free Social Security calculator.

Don’t Miss: Can I Roll My Roth 401k Into A Roth Ira

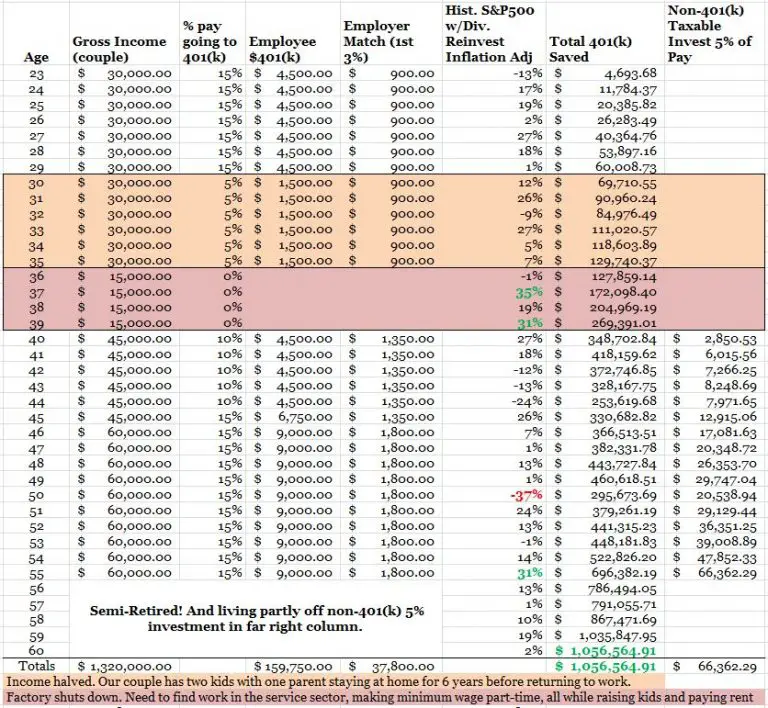

K Savings Potential By Age

The following chart depicts 401k savings potential by age, based on several assumptions. So this is how much you could have saved. These numbers can seem high to many people, especially if you are older and started your retirement savings when the contribution limit was much lower. It can still be used as a guide for your target total retirement savings amounts, including your IRA, Roth IRA, and after-tax savings. While its designed for one person, it can also be used as a guide for a married couple if one spouse decides to no longer work.

The assumptions we used for this chart include:

| AGE | |

|---|---|

| $827,000.00 | $6,610,084.46 |

*Generally, financial planners say the expected rate of return for a 401k is between 8% and 10%.

So, how do you stack up? Are you on the high end? The low end? Do you think these numbers are realistic?

Youre Our First Priorityevery Time

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Also Check: How To Collect My 401k Money

Two Favorite Real Estate Platforms

Fundrise: A way for accredited and non-accredited investors to diversify into real estate through private eFunds and eREITs. Fundrise has been around since 2012 and has consistently generated steady returns, no matter what the stock market is doing. For most investors, investing in a diversified portfolio is the best way to go.

CrowdStreet: A way for accredited investors to invest in individual real estate opportunities mostly in 18-hour cities. 18-hour cities are secondary cities with lower valuations. They also have higher rental yields, and potentially higher growth due to job growth and demographic trends.

Both platforms are free to sign up and explore.

Ive personally invested $810,000 in real estate crowdfunding across 18 projects. My goal is to take advantage of lower valuations in the heartland of America. My real estate investments account for roughly 50% of my current passive income of ~$300,000.

Follow my 401k savings by age guide. But in the meantime, also build a passive income portfolio so you can live a better life today. Given you cannot withdraw from your 401k without penalty until 59.5, it is your passive investment portfolio that matters even more.

How Much Should I Have Saved In My 401k By Age is a Financial Samurai original post.

Filed Under: Most Popular, Retirement

I spent 13 years working at Goldman Sachs and Credit Suisse. In 1999, I earned my BA from William & Mary and in 2006, I received my MBA from UC Berkeley.

Current recommendations:

Your Desired Retirement Lifestyle

Do you have a picture in your mind of what retirement will look like for you?

For example, do you plan to travel extensively, dine at the best restaurants, spend time with children and grandchildren , tour the country in a motorhome, buy a yacht or sailboat, or join a country club?

If so, you may need considerably more than $1 million to support this kind of lifestyle.

On the other hand, if you envision a simpler and more frugal retirement lifestyle, or you are one of the lucky few who has a robust retirement pension, $1 million might be plenty of money for you to retire on and still leave a generous inheritance for your heirs.

You May Like: How To Take Out 401k Money For House

Tips To Help You Plan For Retirement

- Want to create a financial plan that grows your money and provides for a secure retirement? You might benefit from talking to a financial advisor. Finding a qualified financial advisor doesnt have to be hard. SmartAssets free tool matches you with up to three financial advisors in your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- Your retirement plan should account for medical expenses. One option to help you plan for medical costs is a health savings account . HSAs are tax-deferred just like 401 plans. However, you dont have to pay any income taxes on withdrawals from an HSA as long as you use the withdrawals for medical expenses. Check out our guide to HSAs and whether you should consider one.

How Much Do You Need To Retire Comfortably

Planning for retirement takes work, and unfortunately, many Americans are woefully under-prepared when it comes to the state of their savings. What you need to retire isnt about hitting a specific dollar amount, instead, youll want to be able to replace enough of your income to live comfortably. This suggestion isnt black and white because the standard of living looks different for each individual consider what it takes to live comfortably and maintain your lifestyle. Many experts suggest that youll need roughly 80% of your salary after retirement to avoid making sacrifices.

Create a post-retirement budget based on the lifestyle youd like to maintain. This will serve as a guideline that determines how much you might spend when you retire. In some cases, it may be beneficial to seek financial advice to make sure you are planning accordingly. Most people hope to enter their retirement years debt free, but for some, this wont be the case. You may need to consider these expenses:

- Monthly debt payments

- Replacement vehicles or repair

- Miscellaneous expenses like travel

What role will Social Security play in your income? Generally speaking, Social Security is designed to replace about 40% of the average seniors income. If youll need roughly 80% of your salary to live comfortably, its up to you to make up the remaining 40%. This may be where your 401k comes into play.

Don’t Miss: How Much Does A 401k Cost A Small Business

Your 401 Savings And Where You Want To Retire

Where you plan on spending your retirement will have a major impact on how much money youll need to save in your 401. A number of different factors fall under this bucket, each with its own impact on your savings needs.

Cost of living is the most basic factor here. For example, retiring in Hawaii may seem like a tropical dream, but the cost of living in Hawaii is exceptionally high. If hitting the beach to surf in Oahu everyday is something you really want, youll have to make sure you have enough money in your 401 to cover the cost of living.

Big cities like New York and Los Angeles also have predictably high costs of living. However, more remote places like Montana and New Hampshire have much lower costs of living though, so youd need less in your coffers if you opt to settle in places like that.

Another location-based retirement savings factor to keep in mind is taxes. Each state has its own tax codes, and some dont have any income tax at all. Make sure you understand the tax policies of the state where you plan to retire so you have a sense of how much taxes will eat into your 401 savings over time.

For example, Texas does not charge any income taxes. That means when you withdraw funds from your 401 as a resident of Texas, you wont have any state taxes taken out. On the flip side, though, Texas has exceptionally high property taxes. So if you plan on buying a sprawling ranch in the Lone Star State, you property tax bill could be quite high.