Option : Roll It Into Your New 401

If your new employer offers a 401, you can possibly roll your old account into the new one. You may be required to be with the company for a certain amount of time before youre eligible to participate in their plan.

You can choose to do a Direct Rollover, whereby the administrator of your old plan transfers your account balance directly into the new plan. This only requires some paperwork.

Or, you can choose an Indirect Rollover. With this option, 20% of your account balance is withheld by the IRS as federal income tax in addition to any applicable state taxes. The balance of your old account is given to you as a check to deposit into your new 401 within 60 days. There is one catch, though. Youll need to deposit the entire amount of your old account into your new account, even the amount withheld for taxes. That means using personal cash to cover the difference and waiting until tax season to be reimbursed by the government.

Option : Keep Your Savings With Your Previous Employers Plan

If your previous employers 401 allows you to maintain your account and you are happy with the plans investment options, you can leave it. This might be the most convenient choice, but you should still evaluate your options. Each year, American workers manage to lose track of billions of dollars in old retirement savings accounts, so you should make sure to track your account regularly, review your investments as part of your overall portfolio and keep the beneficiaries up to date.

Some things to think about if youre considering keeping your money in your previous employers plan:

Balance Between $1000 And $5000

For 401 balances less than $5,000, your employer doesnât need your permission to transfer your funds out of the 401 plan.

However, if you have over $1,000 in your 401âand you havenât opted to have your funds rolled over to a specific accountâthe planâs administrator is required to transfer your 401 funds to an IRA.

Recommended Reading: How To Cash Out Nationwide 401k

How Long Can A Company Hold Your 401 Funds When You Withdraw

When you leave a job, you can decide to cash out your 401 money. Generally, when you request a payout, it can take a few days to two weeks to get your funds from your 401 plan. However, depending on the employer and the amount of funds in your account, the waiting period can be longer than two weeks.

Each company has different time frames for making distributions when you request a payout. Check the waiting period of your employerâs 401 plan by checking the summary plan description given by the company. The waiting period starts when you request a payout up to when you receive the cash distribution, or funds are rolled over to an IRA or 401.

Youre Retiring Between The Ages Of 55 And 595

You can take money out of a 401 without incurring an early withdrawal penalty once youve reached 55 years of age. The age limit for penalty-free withdrawals from an IRA account is 59.5.

Thus, if you retire between 55 and 59.5 you might want to roll over part of your 401 to your IRA to take advantage of the investment opportunities there while keeping part of the money in your 401 so you can withdraw it without penalty to pay for living expenses in the meantime.

Don’t Miss: Can You Convert Your 401k To A Roth Ira

Move Money Into The Tsp

Whether youre a civilian employee, a member of the uniformed services, or a separated participant, you can move money from other eligible plans to your existing TSP account. However, you cannot open a TSP account by transferring money into it.

Things to know:

We will accept both transfers and rollovers of tax-deferred money from traditional IRAs, SIMPLE IRAs, and eligible employer plans such as a 401 or 403 into the traditional balance of your account.

We will accept only transfers of qualified and non-qualified Roth distributions from Roth 401s, Roth 403s, and Roth 457s into the Roth balance of your account. If you dont already have a Roth balance in your existing TSP account, the transfer will create one.

We will not accept Roth rollovers that have already been paid to you and will not accept transfers or rollovers from Roth IRAs.

How Do I Complete A Rollover

Read Also: How To Pull From 401k

Not Sure How To Get Started

If youre just starting out, and arent sure how to proceed, a target date fund is always a good idea. Sharma says if youre in doubt and need to make a quick decision, these kinds of funds can be a good starting point.

Its basically a low-fee fund offered by companies like Vanguard and Fidelity that has a year next to its name representing the year when youll approximately retire . The fund automatically buys a mix of stocks and bonds and adjusts it over time, he says.

How Long Do I Have To Rollover Really Old 401s

Itâs easy to lose track of 401s youâve held at former employers. At the rate Americans change jobs, itâs possible to have 401s outstanding at multiple employers.

Human resource departments and plan administrators can lose track of 401 accounts of former employers, causing them to sit in the plan untouched for years.

There are no specific time constraints with these plans. However, if the plan were to cash out your old 401, youâll have 60 days from the time they terminated the plan to roll it over to another retirement account.

Also Check: Can You Use 401k To Buy Investment Property

What Is A 401 Rollover

A 401 rollover is when you transfer the account balance in your old 401 to a new or existing 401 or Individual Retirement Account .

You’ll usually face the decision of what to do with your 401 when you leave a job, but you might even have an old 401 that you’ve forgotten about hanging around from a previous employer. It’s never too late to examine your holdings and decide whether to roll your assets into your current employer’s 401 or an IRA, or choose another option instead.

There are four main possibilities when considering a potential 401 rollover:

- Leave your old 401 account as is.

- Roll over the account into an IRA.

- Roll over the account into your new employer’s 401.

- Cash out the account .

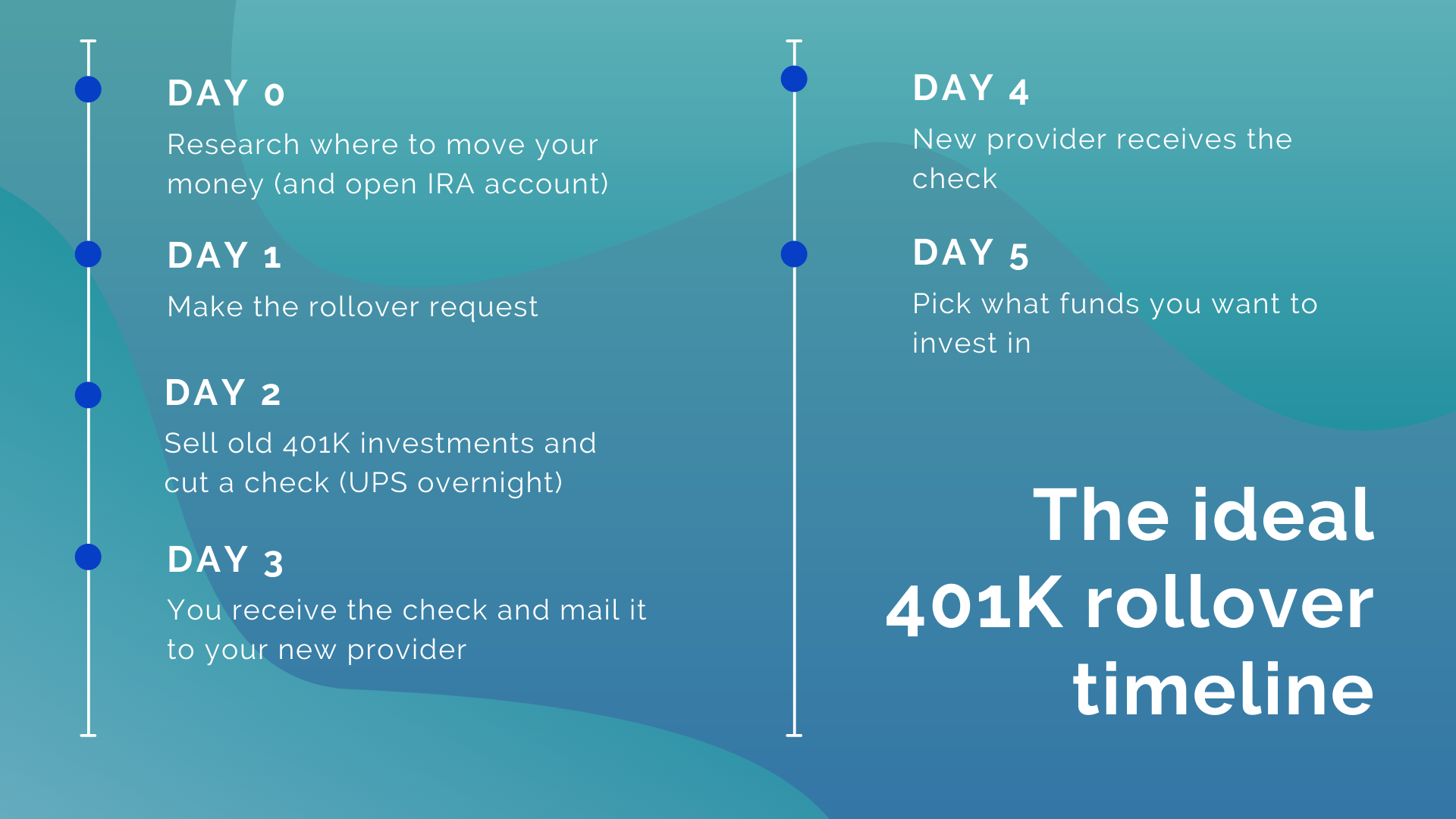

How To Roll Over A 401 To An Ira In 4 Steps

If you decide to do a 401 rollover to an IRA, typically the money from an old 401 must go into the new IRA account within 60 days. There are four steps to do a 401 rollover into an IRA.

Choose which type of IRA account to open

Open your new IRA account

Ask your 401 plan for a direct rollover or remember the 60-day rule

Choose your investments

Also Check: What Is A Robs 401k

How Much Of Your 401 Do You Get When You Leave An Employer

This one is definitely a 401 FAQ that many people wonder about. You are entitled to 100 percent of any contributions youve made into the plan, and how much of any employer match you are entitled to is based on how the plan is set up. A vesting schedule is based on the length of time required to have ownership in the employers contributions. If you are 100 percent vested in employer contributions you will receive all of the money the company has contributed on your behalf.

If you have not been with the company for the required amount of time you may receive a percentage of employer contributions, again based on the plans vesting schedule. The rest of the money set aside for you is forfeited back to the company for uses prescribed in the plan documents. Most 401 providers delineate how much of your balance is fully vested. If youre not sure, you can always call to inquire.

You May Be Able To Leave Your Account With Your Former Employer At Least Temporarily

Changing jobs is stressful, even in the best of circumstances. If youve lost a job and are scrambling for re-employment, youre likely focused on that. But eventually you will need to figure out what to do with your 401.

If your balance is $5,000 or more, you can leave the money right where it is which will give you time to decide the best course of action for you.

What you should do right away, regardless of the 401 balance in your old plan, and as early as your first day at the new job, is to sign up for your new companys 401 plan. Even if your new employer has an automatic opt-in feature that does not kick in for one to three months and if you rely on that, rather than taking the initiative you can miss 30 to 90 days of contributions and matching funds, Bogosian advises.

After six months, youve got a handle on the job, know youre going to stay and have some experience with your new plan. Youre now in a better position to compare your last 401 plan with this new one, including the diversity of the investments and the costs.

But what happens if the balance in your old 401 is less than $5,000? Your former employer may force you out of the plan by placing your funds in an IRA in your name or cashing you out and sending you a check.

Some companies have recently adopted auto portability meaning your small balance may automatically transfer to your new employers plan. Check with your HR Department or plan sponsor to see if this applies.

Don’t Miss: How To Rollover Fidelity 401k To Vanguard

Leave It With Your Old Employer

As long as your 401 balance is $5,000 or more, you can leave the money in your former employer’s plan. Doing this for a relatively short time may make sense. For example, if you were laid off and don’t have a new job yet, you may want to leave your existing 401 as is until you get a new job that offers a 401, and then do a rollover .

Technically, your 401 money can remain in your former employer’s plan as long as you want it to, but there are some good reasons not to leave it there indefinitely. For one thing, if you start contributing to a 401 plan through your new employer and leave your existing plan intact, you’ll be paying fees on two accounts. These costs can quickly add up, which will eat into your investment earnings. Additionally, if your focus is split between two accounts, you may not be as diligent about monitoring your account and rebalancing your investments as you would if you were concentrating on one plan with your current employer. Another hazard: Your former employer could go out of business. If this happens, your 401 balance is still safe, but accessing the account or rolling over funds may become more complicated.

Next Steps To Consider

This information is intended to be educational and is not tailored to the investment needs of any specific investor.

Recently enacted legislation made a number of changes to the rules regarding defined contribution, defined benefit, and/or individual retirement plans and 529 plans. Information herein may refer to or be based on certain rules in effect prior to this legislation and current rules may differ. As always, before making any decisions about your retirement planning or withdrawals, you should consult with your personal tax advisor.

The change in the RMD age requirement from 70½ to 72 only applies to individuals who turn 70½ on or after January 1, 2020. Please speak with your tax advisor regarding the impact of this change on future RMDs.

A qualified distribution from a Roth IRA is tax-free and penalty-free, provided the 5-year aging requirement has been satisfied and one of the following conditions is met: age 59½ or older, disability, qualified first-time home purchase, or death.

Be sure to consider all your available options and the applicable fees and features of each before moving your retirement assets.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917

Also Check: How To Find Your 401k Account Number

Leave The 401 In The Care Of Your Former Employer

If your 401 balance is low say $5,000 or less most plans will allow you to keep the money where it is after you leave. By default, you may be able to manage the money without making changes, but your investment choices will be limited. If the money is under $1,000, the company may cut you a check to force the money out. If the money is between $1,000 and $5,000, they will likely help you set up an IRA if they are forcing you out.

What Happens If I Dont Make Any Election Regarding My Retirement Plan Distribution

The plan administrator must give you a written explanation of your rollover options for the distribution, including your right to have the distribution transferred directly to another retirement plan or to an IRA.

If youre no longer employed by the employer maintaining your retirement plan and your plan account is between $1,000 and $5,000, the plan administrator may deposit the money into an IRA in your name if you dont elect to receive the money or roll it over. If your plan account is $1,000 or less, the plan administrator may pay it to you, less, in most cases, 20% income tax withholding, without your consent. You can still roll over the distribution within 60 days.

You May Like: Can I Rollover My 401k To A Roth Ira

Will Taxes Be Withheld From My Distribution

- IRAs: An IRA distribution paid to you is subject to 10% withholding unless you elect out of withholding or choose to have a different amount withheld. You can avoid withholding taxes if you choose to do a trustee-to-trustee transfer to another IRA.

- Retirement plans: A retirement plan distribution paid to you is subject to mandatory withholding of 20%, even if you intend to roll it over later. Withholding does not apply if you roll over the amount directly to another retirement plan or to an IRA. A distribution sent to you in the form of a check payable to the receiving plan or IRA is not subject to withholding.

How Long Do You Have To Roll Over A 401

If a distribution is made directly to you from your retirement plan, you have 60 days from the date you receive a retirement plan distribution to roll it over into another plan or an IRA, according to the IRS.

But if you have more than $5,000 in a 401 at your previous employer and youre not rolling it over to your new employers plan or to an IRA there generally isnt a time limit on making this decision.

Don’t Miss: Do Employers Match Roth 401k

Do I Have To Pay Taxes When Rolling Over A 401

Whether you owe taxes on a rollover depends on whether youre changing account types . Generally, if you move a traditional 401 account to a Roth IRA, you could create a tax liability. Here are a few scenarios:

- If youre rolling over money from a traditional 401 to another traditional 401 or traditional IRA, you wont create a tax liability.

- If youre rolling over a Roth 401 to another Roth 401 or Roth IRA, you wont create a tax liability.

- However, if youre rolling a traditional 401 into a Roth IRA, you could create a tax liability.

Its also important to know that if you have a Roth 401 that has any employer matching funds in it, those matching funds are categorized as a traditional 401 contribution. So if you transfer a Roth 401 with matching funds into an IRA, youll need to create two IRA accounts a traditional IRA and a Roth IRA to avoid any tax issues during the rollover.

Of course, youll still need to abide by the 60-day rule on rollovers. That is, you have 60 days from the date you receive a retirement plan distribution to roll it over into another plan, according to the IRS. Taxes generally arent withheld from the transfer amount, and this may be processed with a check made payable to your new qualified plan or IRA account.

Sign up for Bankrates myMoney today to track your finances in one place.

Open A New Account Or Use An Existing One

You may need to open a new 401 or establish an IRA before initiating a rollover. After all, you need an account to roll your funds into. If you already have a 401 or IRA account that you want to use, then you don’t need to open a new account. However, if you prefer to keep your rollover funds separate from an existing account, then opening a new account is still an option.

Opening an IRA is a simple and straightforward process with most online brokers. It can be done entirely online with just a few forms and clicks.

You May Like: How To Open A 401k Plan