But The Roth 401 Offers Some Additional Benefits:

- A Roth 401 can be rolled over without cost to a Roth IRA, which has no required minimum distributions and traditional IRA).

- No income limits on eligibility, unlike a Roth IRA.

- Of course, the benefit of taking out money tax-free in retirement.

Bankrates 401 calculator can help you estimate your savings over time.

Why We Recommend The Roth 401

If youre investing consistently every monthwhether its in a Roth 401, a traditional 401 or even a Roth IRAyoure already on the right track! The most important part of wealth building is consistent saving every month, no matter what the market is doing.

But if choosing between a traditional 401 and a Roth 401, we’d go with the Roth every time! Weve already talked through the differences between these two types of accounts, so youre probably already seeing the benefits. But just to be clear, here are the biggest reasons the Roth comes out on top.

Why Do Employers Match 401s Anyways

401s and other defined contribution plans are more cost-effective for the employer than managing a traditional pension plan funded entirely by the company, and are also preferred by most private-sector employees.

While an employer match is not required by the IRS, this company match can be a selling point for recruiting employees particularly if competing firms are offering a generous 401 matching plan.

Employers also get tax benefits for contributing to 401 accounts employer matches can be deducted on their federal corporate income tax returns, and theyre often exempt from payroll taxes and state taxes as well.

Read Also: How To Rollover 401k From Empower To Fidelity

What Is A Partial 401 Match

With a partial 401 match, an employers contribution is a fraction of an employees contribution, and the employers total contribution is capped as a percentage of the employees salary. According to Jean Young, a senior research associate with Vanguard Investment Strategy Group, partial matching is the most commonly used matching formula in Vanguard 401 plans.

Matching structures vary by plan, said Young. In fact, we keep records on over 150 unique match formulas. But the most commonly offered match is $0.50 on the dollar, on the first 6% of pay. About one in five Vanguard plans provided this exact matching formula in 2018.

Lets say you earn $40,000 per year and contribute $2,400 to your 4016% of your salary. If your employer offers to match $0.50 of each dollar you contribute up to 6% of your pay, they would add $1,200 each year to your 401 account, boosting your total annual contributions to $3,600.

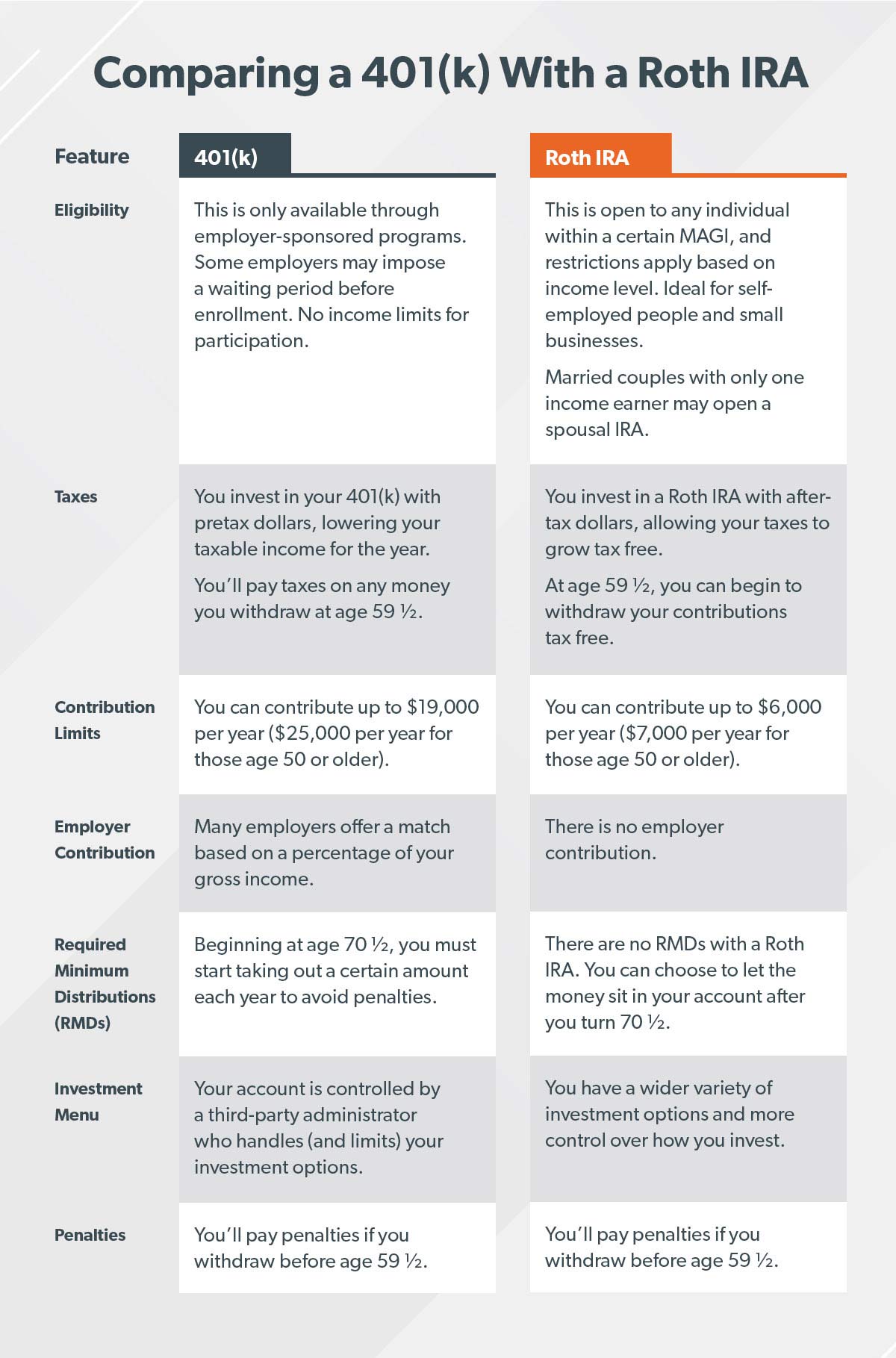

The Difference In Roth 401 And Pre

The Roth contributions, its very important that you understand theyre made with after-tax dollars. So whether its a Roth IRA that you fund on your own out of your own savings or checking account, or its a Roth 401, its made with after-tax dollars. This means that you dont get the tax break up front, but it has a whole lot of other amazing tax advantages that youre going to get later on, which Im going to discuss.

Now the pre-tax contributions, theyre going to be made before your tax is actually paid. So whether its a regular IRA, where youre going to make a contribution and take a deduction on your tax return, so the effect is, its before your taxes are paid. Or, its your pre-tax contributions into your 401 plan, those contributions are going to go in before your tax is paid.

So thats the biggest difference between Roth, which is an after-tax contribution, youve already paid your taxes. And pre-tax, and we also call pre-tax traditional contributions, thats the traditional way that 401 contributions were made. And those are made before your taxes are paid. So thats the real big difference. Theres a lot of other differences, but thats the big one that you need to be focused on today.

You May Like: How Much Does A 401k Cost A Small Business

Who Is Eligible For A Roth 401

If your employer offers it, youre eligible. Unlike a Roth IRA, a Roth 401 has no income limits. Thats a fantastic feature of the Roth option. No matter how much money you earn, you can contribute to a Roth 401.

If you dont have access to a Roth option at work, you can still take advantage of the Roth benefits by working with your investing pro to open a Roth IRA. Just keep in mind that income limits do apply when you contribute to a Roth IRA.

Can I Contribute To Both A Roth 401 And A Traditional 401

You can. Depending on your personal situation, it may be smart to contribute to both a Roth 401 and a traditional plan, allowing you to diversify your tax strategy. If you participate in both types of plan, you can split your contribution any way you wish up to the maximum contribution limit. For example, you could defer $9,000 into your Roth 401 and $10,500 into a pre-tax 401 plan.

Don’t Miss: Can You Invest In 401k And Roth Ira

What Is A Roth 401

A Roth 401 is simply a traditional 401 plan that accepts Roth 401 contributions. Roth 401 contributions are made on an after-tax basis, just like Roth IRA contributions. This means there’s no up-front tax benefit, but if certain conditions are met, your Roth 401 contributions and all accumulated investment earnings on those contributions are free from federal income tax when distributed from the plan. 403 and 457 plans can also allow Roth contributions.

What Is A Designated Roth Contribution

A designated Roth contribution is a type of elective deferral that employees can make to their 401, 403 or governmental 457 retirement plan.

With a designated Roth contribution, the employee irrevocably designates the deferral as an after-tax contribution that the employer must deposit into a designated Roth account. The employer includes the amount of the designated Roth contribution in the employees gross income at the time the employee would have otherwise received the amount in cash if the employee had not made the election. It is subject to all applicable wage-withholding requirements.

The law does not allow designated Roth contributions in SARSEP or SIMPLE IRA plans.

Also Check: Can I Take Money Out Of My Fidelity 401k

More Money Now Vs Later

It can be hard to turn your back on those attributes, but is a Roth 401 suitable for you? Here are the factors to consider.

-

It may cost you more on the front end to use a Roth 401. Contributions to a Roth 401 can hit your budget harder today because an after-tax contribution takes a bigger bite out of your paycheck than a pretax contribution to a traditional 401.

-

The Roth account can be more valuable in retirement. Thats because when you pull a dollar out of that account, you get to put that entire dollar in your pocket. When you pull a dollar out of a traditional 401, you can keep only the balance after paying taxes on the distribution.

When you pull a dollar out of a Roth 401, you get to put that entire dollar in your pocket.

-

Contributing the maximum to either account each year yields the same pot of money in retirement. The traditional 401 balance would then be reduced by your tax rate in retirement, whereas the Roth 401 balance would remain whole.

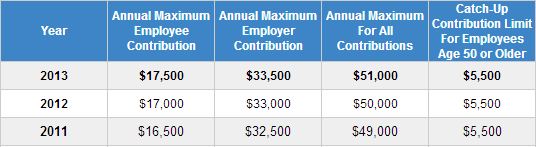

Do 401 Contribution Limits Include Employer Match

401 contribution limits only apply toward the employees contributions. For example, an employees 2020 contribution limit is $19,500. An employers match doesnt count toward that contribution limit, but the employer match does have its own separate limit and theres a cap on the total contribution amount from the employee and employer combined.

For instance, an employee can contribute up to $19,500 each year toward their 401 plus the employers matching contribution. The employer can match the employee contribution as long as it doesnt exceed the separate $57,000 employer-employee matching limit.

Read Also: Should I Borrow From My 401k

And Now The Main Event: The Mega Backdoor Roth 401 Strategy

The Mega Backdoor Roth 401 strategy looks and acts similar to a Backdoor Roth IRA, except it takes place inside a 401. One thing that sets 401s apart from IRAs is that they have much higher contribution limits than the aforementioned $6,000 or $7,000. Most people think the maximum amount that can be saved into their 401 is $19,500, plus an extra $6,500 catch-up contribution if you are 50 years or older.

However, that is only the amount an employee can elect to defer each year and receive certain tax benefits, either pre-tax or Roth. The total amount of money that can be stockpiled into a 401 in 2021 is $58,000, plus a $6,500 catch-up if you are 50+ years of age. This amount consists of three different pieces: employee elective deferrals, employer match, and employee after-tax non-Roth contributions.

12340 El Camino Real, #110, San Diego, CA 92130

Investment advice offered through Stratos Wealth Partners, LTD, a Registered Investment Advisor DBA Brown Wealth Management.

Roth 401 Vs Traditional : Which Is Better

The question about which 401 plan is better depends so much on your individual situation. A Roth 401 works well in many cases, but the traditional 401 is really good in others. But not knowing the future means youll have to do some guesswork about where your life will lead.

With perfect information about our career trajectory, future earnings, and future tax rates, wed simply be able to model whether contributing to our 401 on a pre-tax or Roth basis was best, says Roger Ma, founder and financial planner at lifelaidout in New York. Unfortunately, we dont know any of that information.

However, there are a number of situations where youre better off picking one or the other based on where you are now and what you might expect in the future. Bankrates 401 calculator can also help you figure out which plan makes the most financial sense for you.

You May Like: How To Grow 401k Fast

What Is A 5

The 5-taxable-year period of participation begins on the first day of your taxable year for which you first made designated Roth contributions to the plan. It ends when five consecutive taxable years have passed. If you make a direct rollover from a designated Roth account under another plan, the 5-taxable-year period for the recipient plan begins on the first day of the taxable year that you made designated Roth contributions to the other plan, if earlier.

If you are a re-employed veteran making designated Roth contributions, they are treated as made in the taxable year of qualified military service that you designate as the year to which the contributions relate.

Certain contributions do not start the 5-taxable-year period of participation. For example, a year in which the only contributions consist of excess deferrals will not start the 5-taxable-year period of participation. Further, excess contributions that are distributed to prevent an ADP failure also do not begin the 5-taxable-year period of participation.

Can My Outstanding Plan Loan Be Part Of An In

Yes. If the plan allows, you may roll over your outstanding loan balance from the plans non-Roth account into the plans designated Roth account through a direct rollover as long as there is no change in the loans repayment schedule. The loans taxable amount when rolled over as an in-plan Roth direct rollover would be the balance of the loan at the time of the rollover.

Read Also: Can You Roll A 401k Into A Roth

Can I Also Contribute To An Ira

Yes. Your participation in a 401 plan has no impact on your ability to contribute to an IRA . You can contribute up to $5,500 to an IRA in 2016 . exceeds certain levels. Similarly, your ability to make deductible contributions to a traditional IRA may be limited if your MAGI exceeds certain levels and you participate in a 401 plan.)

Do Employers Match Roth 401s

Some employers will match your Roth 401 contributions. It is important that you talk to your current or future employer to find out if they offer the Roth 401 employer match. However, keep in mind that the employer contributions will be made without any taxes having been paid on them, they are tax-deferred. This means that you will have to pay income taxes on the match and any growth associated with the match when you withdraw the money during retirement.

Don’t Miss: How To Transfer Your 401k To Another Company

What Is A Dollar

With a dollar-for-dollar 401 match, an employers contribution equals 100% of an employees contribution, and the employers total contribution is capped as a percentage of the employees salary.

We commonly see employers offer a 3%, dollar-for-dollar match, said Taylor. They match 100% of your contributions up to 3% of your salary.

Imagine you earn $60,000 a year and contribute $1,800 annually to your 401or 3% of your income. If your employer offers a dollar-for-dollar match up to 3% of your salary, they would add an amount equal to 100% of your 401 contributions, raising your total annual contributions to $3,600.

Which Is Right For You

First, check whether your employer offers a Roth 401 this account only took effect in 2006 and isnt offered by all firms. Approximately half of all plan sponsors now offer a Roth option. If you have a Roth 401 available, assess whether the Roth account provides similar features as the traditional 401, such as automatic enrollment.

Also, understand how your company’s matching contributions work . Many employers give you an incentive to participate in a 401 plan by matching your contributions consider contributing at least as much as needed to maximize your 401 match. If you have a company-provided match, your employer is allowed to make matching contributions even if you elect to participate in a Roth 401.

However, the company match must be made to the designated Roth 401 plan.

Some employers offer an after-tax 401 contribution option, but this can differ significantly from a Roth 401 and shouldnt be confused with a Roth 401.

Read Also: How Much Money Do I Have In My 401k

How Much Can I Contribute

There’s an overall cap on your combined pretax and Roth 401 contributions. In 2016, you can contribute up to $18,000 to a 401 plan. You can split your contribution between Roth and pretax contributions any way you wish. For example, you can make $10,000 of Roth contributions and $8,000 of pretax 401 contributions. It’s up to you. But keep in mind that if you also contribute to another employer’s 401, 403, SIMPLE, or SAR-SEP plan, your total contributions to all of these plans–both pretax and Roth–can’t exceed $18,000 in 2016 . It’s up to you to make sure you don’t exceed these limits if you contribute to plans of more than one employer.

Traditional Versus Roth 401 Contributions: The Effect Of Employer Matches

Journal of Financial Planning

Greg Geisler, Ph.D., is an associate professor of accounting at the University of MissouriSt. Louis, where he teaches a course on taxes and investments. His research interests include how taxes affect investment decisions of individuals. His work has been published in several journals, including Journal of Accountancy, Journal of Financial Service Professionals, and State Tax Notes.

David Hulse, Ph.D., is a faculty member in the Von Allmen School of Accountancy and the Martin School of Public Policy and Administration, both at the University of Kentucky. He has published tax-related articles in several journals and is a contributing author for a federal taxation textbook.

Don’t Miss: Can A Qualified Charitable Distribution Be Made From A 401k

How Do Roth 401 And Pre

How do these tax implications affect you? Lets look at a working life here.

What I did is I took just a sample scenario where, lets just say, youre 40 years old, and now you decide youre going to start saving for retirement. Thats great. And then you retire over here, right about age 62. Its just not on the chart there.

So you retire at age 62. And then you end up dying over here at age 84. This is a very common scenario that a lot of people have experienced throughout their life.

So, as you can see here, weve got a chart here with the pink, which is effectively your Roth contribution. And what youll notice there is, again, you have less money because you paid your taxes upfront. Less money in your account. So it may feel worse when in actuality its really not.

And then you can see right here, the red chart is your traditional or your pre-tax 401 contribution because you basically did not pay those taxes upfront. Youve got more money than youre using that you would have paid in taxes to grow for you. You can see here, you have more money when you retire at age 62 versus here with the Roth. Thats not necessarily a bad thing though.

Lets go ahead and follow through with the mathematical concepts here. If your salary is $4,000 a month, all things being equal, youre saving 10%. Your pre-tax savings is going to be $400, just like we just talked about. Your taxable income is now $3,600 because you saved that $400 into your pre-tax 401 at a tax rate of 20%.