How Our Pension Forecast Calculator Works

Our pension forecast calculator isnt just simple to use its realistic. Its been created using UK data from across over 100 years, taking into account the highs and lows of different market conditions.

All you have to do is tell us how much youre saving, and for how long. Well then show you how much your pension could be worth by the time you retire.

Sound good? Then lets begin.

How Much Should I Have In My 401k Based On My Age

There are a few different schools of thought on how much a person should have saved in their 401k based on their age.

Every financial expert has a different opinion. When deciding what the right number is for you, I think one thing to keep in mind is that its better to have more saved than less.

Creating a potential post-retirement budget as a guideline will help you determine how much money youll spend after youre retired.

In an ideal world, you will be completely debt free by the time you retire and have minimal housing and other expenses.

Youll want to be prepare for these costs:

- Utility bills

- Travel

- Taxes

A persons income and expenses can make a difference when it comes to how much they should have saved at each interval age, but here are some general guidelines.

Use these guidelines in conjunction with your projected post-retirement budget to find out if you should have more or less saved by the time you retire than what is suggest ed here.

Do you have a 401k from an old employer that you need to rollover? Check out Capitalize which is free and will help take out the hassle of rolling over your 401k!

Pensions Have Become Much More Valuable

Given interest rates collapsed in 2020 and 2021, it takes more capital to generate the same amount of risk-adjusted returns/income. Therefore, the value of a pension has gone WAY UP because the value of cash flow has gone way up.

Just take a look at this chart regarding how much more capital is needed to generate $50,000 a year in income. Therefore, the proper safe withdrawal rate should be lower the it was in the past.

Lets calculate the value of various pensions below.

Recommended Reading: Can You Use Your 401k To Buy Real Estate

K Savings Potential By Age

The following chart depicts 401k savings potential by age, based on several assumptions. So this is how much you could have saved. These numbers can seem high to many people, especially if you are older and started your retirement savings when the contribution limit was much lower. It can still be used as a guide for your target total retirement savings amounts, including your IRA, Roth IRA, and after-tax savings. While its designed for one person, it can also be used as a guide for a married couple if one spouse decides to no longer work.

The assumptions we used for this chart include:

| AGE | |

|---|---|

| $827,000.00 | $6,610,084.46 |

*Generally, financial planners say the expected rate of return for a 401k is between 8% and 10%.

So, how do you stack up? Are you on the high end? The low end? Do you think these numbers are realistic?

How Much Should I Have In My 401k At Age 50

Are you close to age 50 and wondering how much should I have in my 401k at age 50? The 401k amount by age 50 depends on whether you are average or above average. The average 401k amount by age 50 is about $150,000.

But for the above-average 50 year old, he or she should have between $500,000 $1,200,000 in his or her 401k.

After all, the above-average 50 year old has been able to save and invest for at least 25 years in the greatest bull market of all time.

The above average 50 year old is also personal finance enthusiastic who subscribes to the free Financial Samurai newsletter with 100,000 other people. He or she has been diligently tracking their finances for a while.

To put things in perspective, the average 401k balance as of August 2021 is around $130,000 according to Fidelitys 12 million accounts. Thanks to an incredible rise in the S& P 500 since 2009, the average 401k balance for a 50 year old is at its highest level ever.

Even so, $130,000 is an incredibly low amount given the median age of an American is 36.5. Further, the median 401k amount is closer to only $30,000.

As an educated reader who is logical and believes saving for retirement is a must, Ive proposed a table that shows how much each person should have saved in their 401ks at age 25, 30, 35, 40, 45, 50, 55, 60, and 65.

Also Check: What Should I Do With My Old Company 401k

How Much Is Too Much In Your 401

For all of its shortcomings, the traditional retire-at-65 system does have a few cushy benefits in the US. You get low-cost health insurance coverage through Medicare, a reasonable pension through Social Security, and you also get to start taking penalty-free withdrawals from your 401 plan.

This system was originally designed to accommodate people who would work through their entire adult life, and retire only when they had lost all ability to be productive, presumably to die just a few years later. In fact, the life expectancy of US males only reached age 65 around 1950.

Books targeted at todays Late Retirees speak quite excitedly about the new idea that people get to live for twenty or more years in retirement, and thus the financial planning is much more complicated than it was just a generation ago. So as you can imagine, those of us planning a 50+ year period of retirement need to game the system even more.

This is one of the things about which I get the most email questions. People are asking,

Should I put money into my 401 if Ill be retiring much younger than the standard age? Wont I be hit with penalties if I try to use the money before then?

Lets review the basics:

Assuming we want to avoid the 10% penalty, we early retirees have a few options.

Strategy 1: Treat the 401 as your Old Man/Old Woman Money

Strategy 2: Use the Roth IRA Escape Hatch Loophole

Strategy 3: Use the Section 72 Early Retirement Grocery Money Loophole

How Do I Calculate The Value Of A Pension

Updated: by Financial Samurai

If youve got a pension, count yourself as one of the lucky ones. A pension is more valuable than you realize with interest rates plummeting to near all-time lows. With a pension, you wont be forced to lower your safe withdrawal rate in retirement like those of use who dont have pensions. This post will help you calculate the value of a pension.

Pensions, also known as Defined Benefit plans, have become rarer as companies force their employees to save for themselves mainly through a 401k, 457, 403b, Roth 401k or IRA. These savings vehicles are also known as Defined Contribution plans.

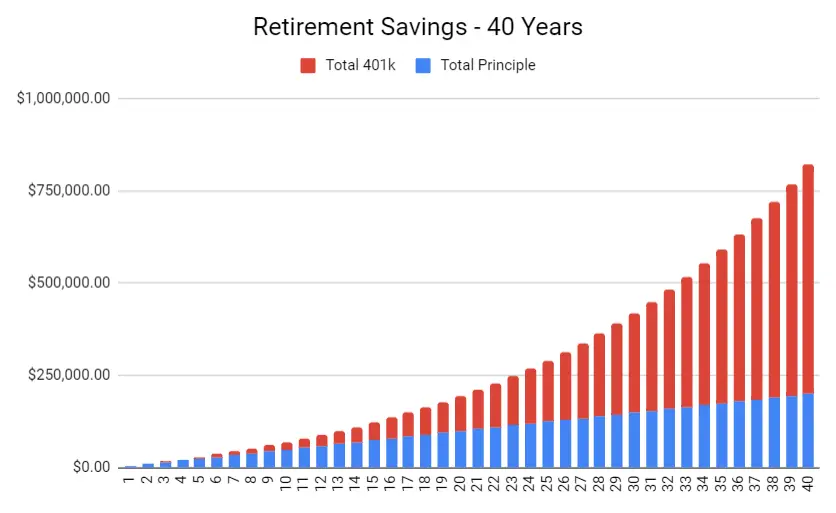

But as we all know, the maximum amount you can contribute to a 401K or IRA is only $19,500 or $6,000, respectively for 2021. Even if you max out your 401k for 33 consecutive years starting today, its unlikely your 401k or IRAs value will match the value of a pension.

Take a look at my latest 401k savings potential chart. After 33 years of maximum contributions, I estimate youll have between $568,000 $1,800,000 in your 401k, depending on performance. $1,800,000 sounds like a lot, but in 33 years, $1,800,000 will buy just $678,000 worth of goods and services today using a 3% annual inflation rate.

Given the power of inflation, to neither max out your 401k nor invest an additional 20%+ of your after-tax income if you dont have a pension is risky. When it comes to your money, its always better to end up with too much than too little.

You May Like: Can You Invest In 401k And Roth Ira

Retirement Withdrawal Calculator Insights

There are two sides to the retirement planning equation saving and spending.

The asset accumulation phase leads up to your retirement date followed by the decumulation phase where you spend down those assets to support living expenses in retirement.

The truth is retirement income planning is one of the most complex and controversial aspects in financial planning. There are so many different models with each being dependent on assumptions chosen, portfolio assets, and risk tolerance.

- For example, dividend growth stocks have the potential to provide inflation adjusting income and capital growth, but they will also deliver increased volatility and risk of permanent loss in the wrong market conditions.

- A bond portfolio will provide stable, reliable income, but the income and assets will erode in purchasing power over time due to inflation.

- Traditional fixed annuities can provide a floor of reliable income that you can never outlive and a potentially higher safe withdrawal rate than bonds or stocks alone can provide, but the downside is loss of liquidity and a potentially smaller estate for your heirs.

In short, there is no sure-fire solution to retirement income planning that solves all problems. Each strategy results in tradeoffs between risk and required income goals. No single retirement withdrawal calculator can model all spending alternatives effectively.

Related:5 Financial Planning Mistakes That Cost You Big-Time Explained in 5 Free Video Lessons

Periods Of Low Or No Salary

You might have years of low or no earnings. We will automatically exclude up to 8 years of your lowest earnings when calculating the base component of your CPP retirement pension. This will increase the amount of your pension.

The enhanced component of the retirement pension is based on your contributions to the CPP enhancement. Its calculated using your best 40 years of earnings. This will only affect you if you work and make CPP contributions after January 1, 2019.

Periods of raising children

The child-rearing provisions can help to increase your CPP benefits depending on your earnings during the period you were caring for your children under the age of 7. The provisions may also help you to qualify for other benefits.

Periods of disability

The months when you received a CPP disability payment will not be included in the calculation of the base component of a CPP benefit. This will increase your CPP retirement pension and may help you qualify for other benefits.

When calculating the enhanced component of the CPP , well give you a credit for the months youre disabled before you started collecting your retirement pension. The value of the credit is based on your earnings in the 6 years before you became disabled.

Pension sharing

You can with your spouse/common-law partner. Pension sharing can lower your taxes in retirement by decreasing your taxable income.

Recommended Reading: How To Transfer 401k Without Penalty

How Can I Increase Returns In My 401

There are two ways to increase the returns of your 401 account. First is increase investment performance and second is minimizing fees. These problems can be simple to solve in some cases and nearly impossible in others.

First, consider the right investments when getting your account setup or rebalanced. Actively managed funds generally dont perform as well as the market overall. If you can find low-fee S& P 500 index funds, you are likely in the best position for long-term returns. Even fancy hedge fund managers typically dont beat the S& P 500 in the long run.

For fees, review all of your investment options. According to the SEC, a 0.75% difference in 401 fees will cost $30,000 for every $100,000 invested over a 20 year period. Learn more about maximizing your 401 returns in our detailed guide here.

All information on InvestmentZen.com is presented without warranty. InvestmentZen has financial relationships with some of the products and services mentioned and may be compensated if consumers choose to sign up for products through links in our content. However, the analysis and opinions offered are 100% independent and our top priority is editorial objectivity.

Get In Touch

Using This Simple 401 Calculator

Our 401 Growth Calculator is a simple and easy way to estimate the long-term growth of your 401 retirement account by the time you want to retire. Knowing how much your current 401 account may accumulate in the future can help you determine if you should adjust your annual 401 contributions to help reach your retirement goals. After answering a brief series of questions, you will get your results, including your estimated accumulated plan balance at retirement, total out-of-pocket costs, and a summary table and bar graph illustrating your retirement plan accumulation over time.

Read Also: How To Rollover Fidelity 401k To Vanguard

How To Use Our Pension Forecast Calculator

You can use a pension forecast calculator to estimate the value of your pension pot at retirement. It will take into account not only your pension contributions but also estimated investment growth.

You can adjust the following variables:

- monthly/annual pension contributions

Read more in our handy guide: how much you need to retire.

You can adjust your contribution term to see how this might affect your pension pot value at retirement i.e. how saving for a longer or shorter period of time might impact how much money you have in retirement.

Woefully Inadequate Retirement Savings

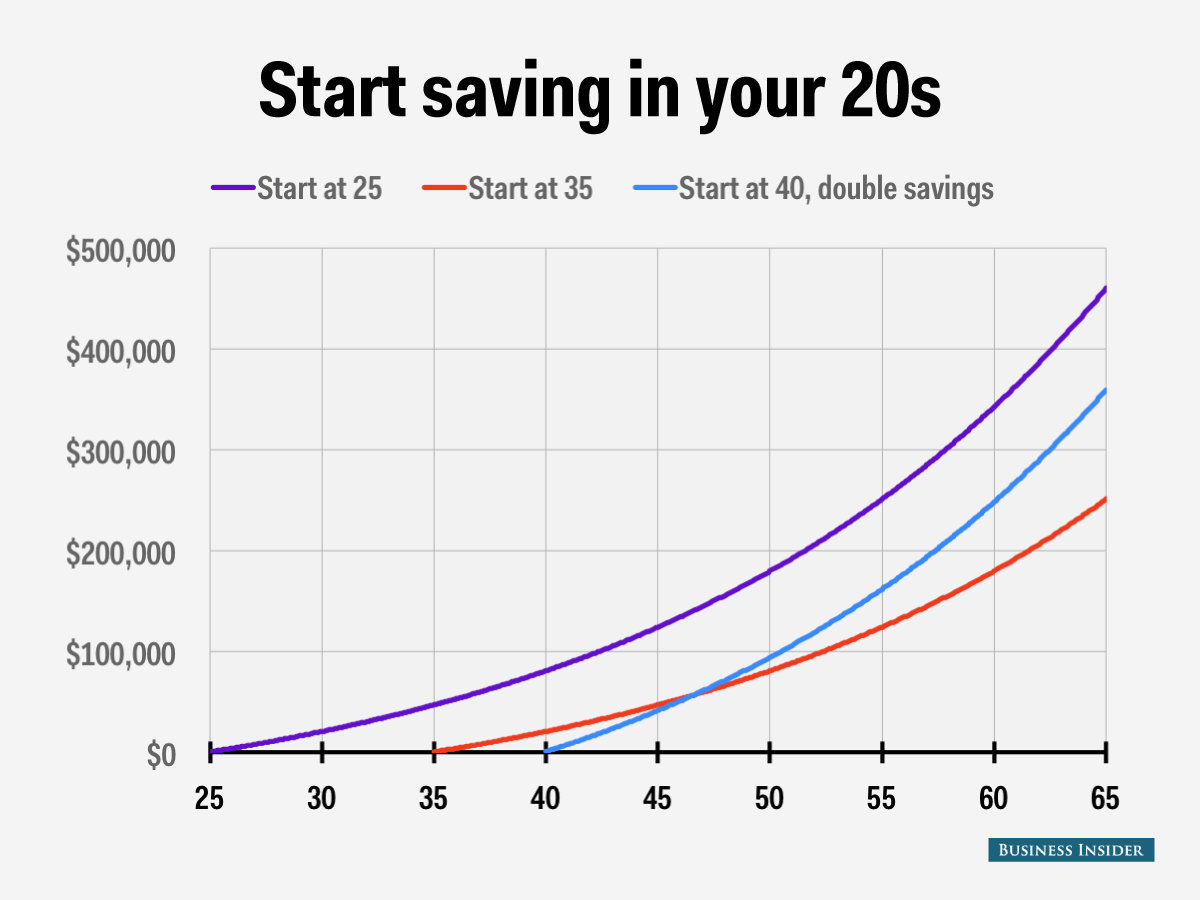

Putting off retirement savings is a big mistake. If you dont start saving right away, it can be very difficult to put money away. Can you believe that half of all US households have no retirement savings at all? Its true. Even households that saved for retirement havent saved enough. According to the latest Survey of Consumer Finance, the median value of retirement accounts for families near retirement age is $134,000. Thats only the people with retirement accounts. People with no retirement accounts have much less savings.

Anyway, even $134,000 wont be enough to support a frugal retirement. If you keep track of your annual expenses, youd know. For us, $134,000 would cover about 2.5 years of normal living. Thats not long enough. Many people spend 30+ years in retirement. What will they do once their savings are gone? They will have to depend on other sources of income such as Social Security Benefits and part-time work. Unfortunately, this usually means drastically downgrading their lifestyle.

Luckily, Im not average and you arent either. If youre reading this, youre way ahead of the average household.

I have been maxing out my 401k for many years now and my retirement savings are in great shape. Let me show you how wealthy youd be if you maxed out your 401k contribution every year since you started working. Hold on tight because you will be amazed by the power of compounding.

Read Also: What Is The Interest Rate On A 401k

The Benefits Of Compounded Savings

One of the greatest advantages of a long-term savings plan is compounded growth of earnings. This benefit of compounding growth is that returns generated by savings can be reinvested back into the account and begin generating returns of their own. Over a period of many years, the compounded earnings on a savings account can actually be larger than the contributions you have added to the account.

This potentially exponential growth of earnings is what allows your retirement savings to grow faster as more time passes.

What Kind Of Investments Are Available In My 401

Every 401 offers different investment options. Some 401 plans offer low fee Vanguard funds that charge an average 0.18% in annual fees. Other employers choose higher cost 401 providers that charge well over three times that.

Popular investments in 401 plans include target retirement date funds, mutual funds with risk and investments managed towards a specific retirement age, and broad market index funds like S& P 500 index funds. Just beware of investing in anything too risky. This is your retirement and matching the market return typically offers plenty of retirement savings as long as you contribute regularly and save enough each pay period.

Also Check: How Do I Change My 401k Contribution Fidelity

Recommendation To Achieve A High 401k Amount By Age 50

Sign up for Personal Capital, the webs #1 free wealth management tool to get a better handle on your finances.

In addition to better money oversight, run your investments through their award-winning Investment Checkup tool to see exactly how much you are paying in fees. I was paying $1,700 a year in fees I had no idea I was paying.

After you link all your accounts, use their Retirement Planning calculator. It pulls your real data to give you as pure an estimation of your financial future as possible using Monte Carlo simulation algorithms. Definitely run your numbers to see how youre doing.

Ive been using Personal Capital since 2012. During this time, I have seen my net worth skyrocket thanks to better money management.

How Much Can You Put In A 401 Per Year

The IRS sets the maximum 401 savings rate each year. It is common for the total to stay the same or just increase slightly depending on economic conditions. For 2020, the maximum you can save in a 401 is $19,500.

Individuals 50 years of age and older are allowed to make an additional catch up contribution on top of the regular 401 limit. For 2020, this total is $6,500. The total savings limit for these individuals is $26,000 including both the regular maximum and catch up contribution allowance.

Recommended Reading: How Much In 401k To Retire

How Much Will My Pension Be Worth

The value of your pension at retirement will largely depend on

- how much you pay in

- investment term

- how you choose to invest your money

This calculator allows you to adjust all of these factors so that you can see how much your pension will be worth using different scenarios i.e.

- paying more or less into your pension every month,

- paying in for longer or shorter periods

- choosing different investment strategies

How you choose to invest your money should be in line with your tolerance for risk. You shouldnt be encouraged to take more risk than you are comfortable with to try and reach your retirement goal faster or to try and make up for lower pension contributions.