Recommendation To Achieve A High 401k Amount By Age 50

Sign up for Personal Capital, the webs #1 free wealth management tool to get a better handle on your finances.

In addition to better money oversight, run your investments through their award-winning Investment Checkup tool to see exactly how much you are paying in fees. I was paying $1,700 a year in fees I had no idea I was paying.

After you link all your accounts, use their Retirement Planning calculator. It pulls your real data to give you as pure an estimation of your financial future as possible using Monte Carlo simulation algorithms. Definitely run your numbers to see how youre doing.

Ive been using Personal Capital since 2012. During this time, I have seen my net worth skyrocket thanks to better money management.

What Percent Should I Contribute To A 401

Brewer suggests that your contributions should be based on a percentage of your income, depending on your age. She recommends that you stash away between 10 percent and 15 percent of your gross income if youre in your 20s and 30s, or if you started saving during those years. If youre behind in retirement savings in your 40s and 50s, Brewer encourages you to set aside between 15 percent and 25 percent of your income.

If youre not saving anything for retirement right now and want to get started, start with at least 3 percent to get going, Brewer says. Increase your contribution by at least 2 percent each year and do a larger increase in years where you get a big raise until you hit your target savings percentage.

How Much Should Be In Your 401 At 30

Modified date: Oct. 15, 2020

How much should be in your 401 at 30, 40, 50, etc? What about other retirement accounts? These are good questions.

Ill try to answer them in this article, but I should warn you: Personal finance is personal.

The more you can contribute to your 401, and the sooner you can start, the better. But everybodys situation is different. Dont beat yourself up if you feel behind in the retirement game remember, you cant change yesterday but you can take action today and change tomorrow.

Whats Ahead:

Also Check: How Do I Invest In My 401k

Weigh Your Investment Options

401s tend to have a small investment selection thats curated by your plan provider and your employer. Youre not selecting individual stocks and bonds , but mutual funds ideally ETFs or index funds that pool your money along with that of other investors to buy small pieces of many related securities.

Stock funds are divided into categories. Your 401 will probably offer at least one fund in each of the following categories: U.S. large cap which refers to the value of the companies within U.S. small cap, international, emerging markets and, in some plans, alternatives such as natural resources or real estate. Diversify your portfolio by spreading the portion youve allocated to equities among these funds.

You want to allocate more to the biggest asset classes, like U.S. large caps and international. U.S. small cap, natural resources and real estate are not as prevalent asset classes, so youll take smaller bits of those, Walters says.

That might mean putting 50% of your equity allocation into a U.S. large cap fund, 30% into an international fund, 10% into a U.S. small cap fund and spreading the remainder among categories such as emerging markets and natural resources.

The bond selection in 401s tends to be even more narrow, but generally youll be offered a total bond market fund. If you have access to an international bond fund, you might put a bit of your savings in there to diversify globally.

How Much Should I Have In My 401k

Laurie BlankSome of the links included in this article are from our advertisers. Read our Advertiser Disclosure.

If youre wondering how much money you should have in your 401k, your wait is over. Retirement savings is much of the talk in todays personal finance world.

You want to make sure youre saving enough to meet your retirement goals. Otherwise, you may have to find ways to save more or possibly delay retiring.

While each person has a different financial situation, these insights can improve your retirement plan.

In This Article

Read Also: Can I Transfer Money From 401k To Ira

Increase Your Income If Need Be

Sometimes a lack of retirement savings is caused by mismanaged income. Its common to get caught up in everyday frivolous spending that seems harmless but causes major savings deficits over the years.

Other times there is a real lack of income that has caused a persons inability to save for retirement.

If youre managing your money well and minimizing waste but dont make enough to save what you need to save for retirement you may need to increase your income.

Luckily, there are several options for boosting your income:

- Get a part-time job

- Sell unwanted items

Then take that cash and use it to fund your 401k or other retirement accounts.

However, its important to remember that as you increase your income, you need to be sure to take that extra money and target it all toward retirement savings.

It might be tempting to use it for fun stuff like vacations and new and shiny things especially if youve been living on a tight budget for a long period of time.

Dont make that mistake. Instead, commit to funneling all extra income into your 401k or other retirement accounts, even if its only for a specified period like five years or ten years.

After that time is up, youll likely see a significant increase in your retirement savings. That increase will help ensure you wont be struggling to live in your later years.

How Much Should I Have In My 401k Based On My Age

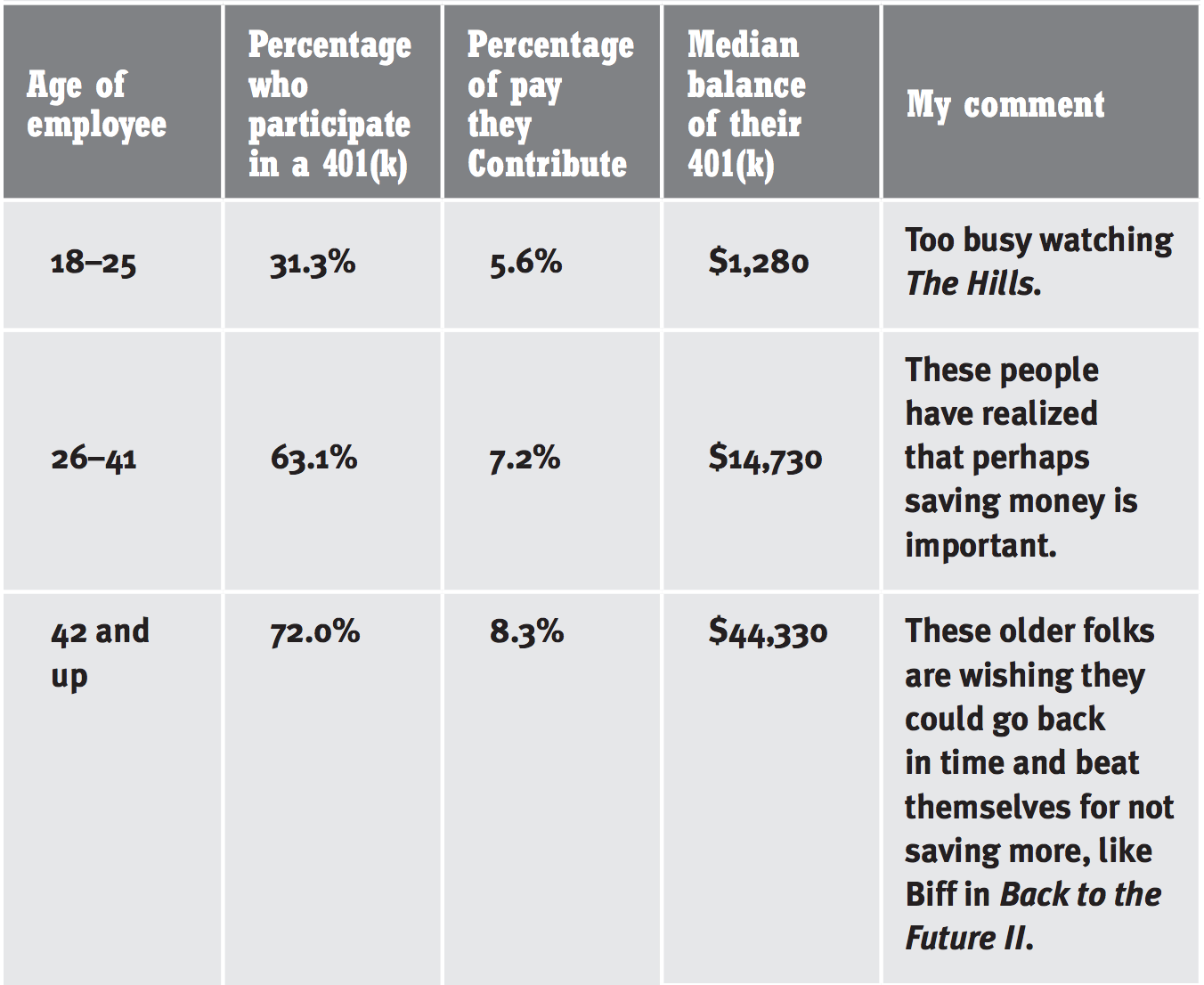

There are a few different schools of thought on how much a person should have saved in their 401k based on their age.

Every financial expert has a different opinion. When deciding what the right number is for you, I think one thing to keep in mind is that its better to have more saved than less.

Creating a potential post-retirement budget as a guideline will help you determine how much money youll spend after youre retired.

In an ideal world, you will be completely debt free by the time you retire and have minimal housing and other expenses.

Youll want to be prepare for these costs:

- Utility bills

- Travel

- Taxes

A persons income and expenses can make a difference when it comes to how much they should have saved at each interval age, but here are some general guidelines.

Use these guidelines in conjunction with your projected post-retirement budget to find out if you should have more or less saved by the time you retire than what is suggest ed here.

Do you have a 401k from an old employer that you need to rollover? Check out Capitalize which is free and will help take out the hassle of rolling over your 401k!

Don’t Miss: What Is A Pension Vs 401k

How We Use Your Personal Data

How we use your information depends on the product and service that you use and your relationship with us. We may use it to:

- Verify your identity, personalize the content you receive, or create and administer your account.

- Provide specific products and services to you, such as portfolio management or data aggregation.

- Develop and improve features of our offerings.

To learn more about how we handle and protect your data, visit our privacy center.

Save As Much As You Can

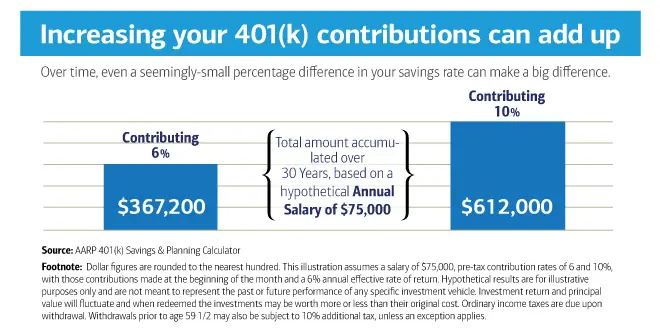

For most people, the biggest factor in the size of your 401 balance at retirement isn’t your rate of return, but the amount you save. Consider two employees who each earn $100,000 a year, get 3 percent raises each year, and earn 5 percent on their 401 plan. One contributes 5 percent of his salary each year the other contributes 8 percent. After 20 years, the worker who invests 5 percent of her salary a year will have $222,386. A worker who invests 8 percent will have $355,818.

“Anytime you can increase your savings is always a good idea, says Michael Foguth, president and founder of Foguth Financial Group in Brighton, Mich. So, yes, maxing out a retirement account is a good strategy to boost savings quickly.”

And if you can afford to save more, turbocharge your savings by taking advantage of the catch-up contribution if you’re over 50, adds Foguth. It allows you to save more money in your older working years, which is critical because you’re likely closer to retirement, he says.

And if can’t afford to max out your 401 right now, but that’s your goal, don’t give up. Do it gradually over time, says Michael Ingram, CFP, partner and wealth advisor at Octavia Wealth Advisors in San Diego.

Also Check: Can You Convert A Roth 401k To A Roth Ira

Working With Your Financial And Tax Professionals

A 401 plan can become the cornerstone of a personal retirement savings program, providing the foundation for future financial security. Consult your financial and tax professionals to help you determine how your employer’s 401 and other savings and investment plans could help make your financial future more secure.

Important NoteEquitable believes that education is a key step toward addressing your financial goals, and we’ve designed this material to serve simply as an informational and educational resource. Accordingly, this article does not offer or constitute investment advice and makes no direct or indirect recommendation of any particular product or of the appropriateness of any particular investment-related option. Your needs, goals and circumstances are unique, and they require the individualized attention of your financial professional. But for now, take some time just to learn more.

Please be advised that this material is not intended as legal or tax advice. Accordingly, any tax information provided in this material is not intended or written to be used, and cannot be used, by any taxpayer for the purpose of avoiding penalties that may be imposed on the taxpayer. The tax information was written to support the promotion or marketing of the transactions or matter addressed and you should seek advice based on your particular circumstances from an independent advisor.

What’s the next step for you?

A financial professional can help you decide. Let’s talk.

Contribution Limits In 2020 And 2021

For 2021, the 401 limit for employee salary deferrals is $19,500, which is the same amount as the 401 2020 limit. Employer matches dont count toward this limit and can be quite generous.

However, the total contribution limit, which includes employer contributions , has increased to $58,000 in 2021, up from $57,000 in 2020.

On top of these amounts, workers aged 50 and older can add up to $6,500 more annually as a catch-up contribution.

The 401 contribution limits also apply to other so-called defined contribution plans, including:

- 403 plans, available to education and non-profit workers.

- Most 457 plans used by state and local government employees.

- The federal governments Thrift Savings Plan.

| 401 plan limits | ||

|---|---|---|

| Maximum salary deferral for workers | $19,500 | |

| Catch-up contributions for workers 50 and older | $6,500 | |

| Total contribution limit, plus catch-up contribution | $64,500 | |

| Compensation limit for figuring contributions | $290,000 | |

| Compensation threshold for key employee nondiscrimination testing | $180,000 | |

| Threshold for highly compensated employee nondiscrimination testing | $130,000 | none |

Don’t Miss: What Is The Difference Between A Pension And A 401k

What If You Can’t Meet Your Employer Match

If you aren’t yet in a position to contribute enough to meet your employer’s match, and thus not enough to reach the desired 15% savings rate, aim to boost your retirement contributions by 1% to 2% each year. If you opt in to do so, some companies will automatically raise your contribution rate annually, so it’s worth making sure you are signed up for what is called an “auto-escalation” feature.

Ivory Johnson, a CFP and founder of Delancey Wealth Management, recommends increasing your contribution rate as you get pay raises until you max out the limit. There is a limit to how much you can contribute annually to your 401. In 2021, the standard annual contribution limit is $19,500 for 401 plans. And those over age 50 can use catch-up contributions to add an extra $6,500 in their 401 account. Employer contributions don’t count towards those specific limits.

Lynch reminds retirement savers to be strategic with the magic number they would like to contribute to their 401 before automatically trying to max it out, however.

“Situations can arise where you may need to prioritize your cash savings in your emergency fund or save for a different reason, such as for a down payment on property or a vehicle,” she adds. “$19,500 isn’t a small chunk of change.”

Keep in mind that although you don’t pay income taxes on the money you set aside in a 401, you’ll have to pay taxes later on when you eventually withdraw the funds in your nonworking years.

Anything Else I Should Know

Yep. A few things, actually.

Once you contribute to a 401, you should consider that money locked up for retirement. In general, distributions prior to age 59½ will be hit with a 10% penalty and income taxes.

If you leave a job, you can roll your 401 into a new 401 or an IRA at an online brokerage or robo-advisor. The IRA can give you more control over your account and allow you to access a larger investment selection.

401s typically force you to begin taking distributions called required minimum distributions, or RMDs at age 72 or when you retire, whichever is later. You may be able to roll a Roth 401 into a Roth IRA to avoid RMDs.

Recommended Reading: How To Set Up A 401k Account

A High 401k Amount By Age 50 Means Aggressive Savings

Contribute the maximum pre-tax income you can to your 401k for as long as you work. This is the absolute MINIMUM you can do to help ensure a comfortable retirement.

After you have contributed a maximum to your 401k every year, try and contribute at least 20% of your after-tax income after 401k contribution to your savings or retirement portfolio accounts.

This way, you will have potentially DOUBLE the amount in total retirement saving if your household income is $100,000 or more. If your household income is closer to $50,000, you should still see a nice 30% boost to your retirement savings if you consistently save 20% of your after tax income.

Challenge yourself to raise your after-tax and 401k contribution savings percent to possibly 50%. It wont be easy. But if you practice raising your savings rate by 1% a month until it hurts, youll find it easier than you think.

As a 50 year old, youve only got 9.5 years left until you can withdraw from your 401k penalty free. Make your contributions count! Also, make sure you have a proper asset allocation of stocks and bonds that is more conservative.

Too many people were too aggressive investing in stocks right before the financial crisis hit in 2009. As a result, not only did many lose 50% in their investments, they also had to work for years to come.

Figure Out The Ratio Youre The Most Comfortable Withbut Keep Upping Your Savings

There are lots of ratios out there recommending how to divide up your income. Some are as simple as spend 50%, save 50%. Although an admirable goal, most people will have a hard time with this. Especially in your twenties. I like 75/20/5.

- Spend 75%

- Save 20%

- Give 5%

But figure out the ratio youre comfortable with. You may want to defer charitable giving until youre debt-free. If you need most of your income to eat, it might be spend 90, save 10 or even 95/5. Thats okay. But you should reevaluate this as your financial situation changes and aim to get to at least 80/20.

In this example , if you earn $40,000, you would spend $30,000 or $2,500 a month, save $8,000 a year, or $667 a month, andif you wantset aside $2,000 a year for your chosen causes. Note that were working off of before-tax income, so that $2,500 a month for spending might be more like $2,000 after taxes).

Working backwards from this, lets say your employer will match up to half of a 6% contribution to your 401. So 6% of your pre-tax income is $3,000. Your employer throws in $1,500. You put that in, and you have $3,500 left in your savings budget.

If you dont have a fully funded emergency fund, this comes next. Open a simple online savings accounttheyre boring, but safeand load it with cash.

Recommended Reading: How To Lower 401k Contribution Fidelity

How Much Should I Save For Retirement

We get that question a lot. So we asked Stanley Poorman, advice and planning manager for Principal®, who said theres no one-size-fits-all answer.

A good rule of thumb is to save 1015% of your income toward retirement, but that also depends on when you get started. That may be fine if youre 25, but if youre starting at 50, you may need to save more to retire comfortably, Poorman says.

One way to get a quick snapshot of how much you may need to save is to use the Retirement Wellness Planner. By entering a few numbers, youll get a sense of whether youre on track or not.

Another factor is whether you have a matching contribution from your employer, and if so, what percentage the company contributes. Poorman suggests deferring enough of your pay to get that match.

Why We Recommend The Roth 401

If youre investing consistently every monthwhether its in a Roth 401, a traditional 401 or even a Roth IRAyoure already on the right track! The most important part of wealth building is consistent saving every month, no matter what the market is doing.

But if choosing between a traditional 401 and a Roth 401, we’d go with the Roth every time! Weve already talked through the differences between these two types of accounts, so youre probably already seeing the benefits. But just to be clear, here are the biggest reasons the Roth comes out on top.

Also Check: What Should I Do With My Old Company 401k