Tips On Maximizing Your Retirement Savings

- It can be difficult to put a light on what affects 401 returns. And you dont want to be left in the dark, especially when you reach retirement and need your savings the most. A financial advisor can help you understand retirement and all of its moving parts. SmartAssets free tool connects you with financial advisors in your area in five minutes. If youre ready to be matched with local advisors, get started now.

- 401s are not only reliable retirement savings vehicles, but they also offer plenty of tax breaks, including some you may not know about. To help, we published a report on the 401 tax rules you need to know to make the most out of your plan.

- You may find your companys 401 plan may not be the best option for you. And you may get better investment choices and tax breaks if you open an IRA or a Roth IRA. To help you decide, we published studies on the best IRAs and the best Roth IRAs.

What Are Some Alternatives To A 401 Loan

When cash is tight, borrowing from your 401 plan and paying yourself interest may seem like a good idea. But before you borrow, weigh all your options. Here are a few.

Loan Rules And Repayment Requirements

Contributions to 401 and other employer retirement plans are intended to be used for retirement, and as a result, 401 plans often have restrictions against withdrawals until an employee retires . As a result, any withdrawals are taxable , and even just taking a loan against a retirement account is similarly treated as a taxable event under IRC Section 72.

Yet unfortunately, the reality is that from time to time, employees may need to access the funds in their 401 plan before retirement, at least temporarily. To help address the need, Congress created IRC Section 72, which does permit employees to take loans directly against their 401 or other qualified plan balance from the 401 plan administrator, subject to certain restrictions.

The first restriction on a 401 loan is that the total outstanding loan balance cannot be greater than 50% of the account balance, up to a maximum cap on the balance of $50,000 . Notably, under IRC Section 72, smaller 401 or other qualified plans with an account balance less than $20,000 can borrow up to $10,000 , although Department of Labor Regulation 2550.408b-1 does not permit more than 50% of the account balance to be used as security for a loan, which means in practice plan participants will still be limited to borrowing no more than 50% of the account balance . If the plan allows it, the employee can take multiple 401 loans, though the above limits still apply to the total loan balance plan in the aggregate).

Read Also: Should I Keep My 401k Or Rollover To Ira

Interest Rates And Fees Charged On A 401k Loan

Understanding 401k loan interest as well as the fees you will be paying should be a crucial part of your decision as to whether or not you are going to take a loan from your 401k. You want to know this information much the same way as you would want to know the rates and fees from a bank.

Yes, on a 401k loan you do pay interest. But the upside here is that you do not pay the interest to your bank or even your 401k provider. Rather, you pay the interest back into your own account -all of it. This is certainly an advantage over taking a loan from a bank .

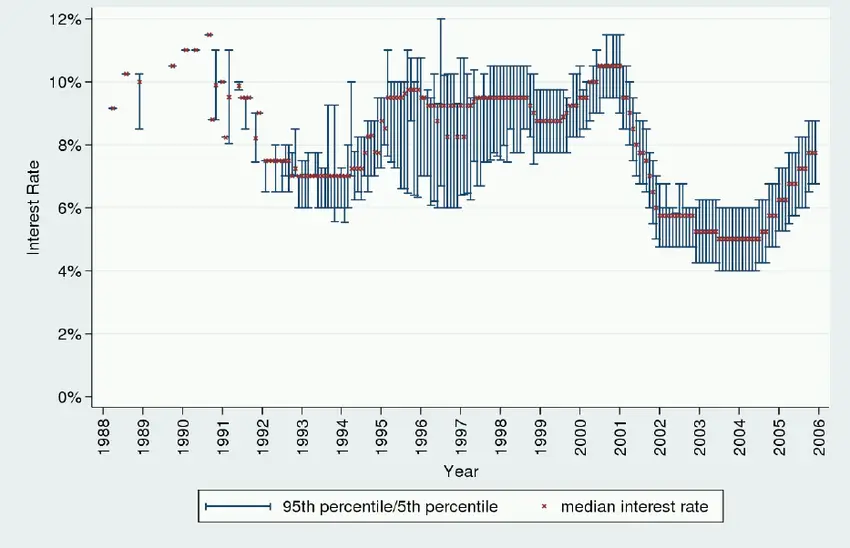

The 401k loan interest rate you pay varies from plan to plan, but it is quite common for plans to charge 1% over the federal prime rate. So, if prime is sitting at 6%, your loan interest rate will be 7%.

Weve also seen plans that charge a flat percentage regardless of what the prime rate is. And these plans usually set the rates fairly high sometimes 9 or 10%. These plans reason that they set the rates so high so the loan has less of a negative impact on the participant since they are paying themselves back so much more than at the usually lower rates. There is no right or wrong when it comes to interest rates. The plan is simply required to justify its decision if the need ever arises.

Fees are a slightly different story. Any fees that you are required to pay for taking a loan usually go to the 401k provider for the cost to administer the loan, not back into your account. Sorry!

When To Borrow From Your 401

Only borrow from your 401 when no other reasonable loan rates are available and only if the situation is dire.

Vacations are ruled out. So are 50-inch 4K TVs, shopping sprees and any form of consumerism that might be considered excessive. There are, however, emergencies or dead-end scenarios when a 401 loan may be your best or only option.

If youre suffering a medical setback and need cash fast, your 401 may be a good place to look. You may even qualify for a hardship withdrawal. In this case you wont have to pay the loan back, but youll still have to pay income taxes, plus the 10% early withdrawal fee.

The qualifications for hardship withdrawal differ from plan to plan. Check with your employer to see what yours may cover.

If youre looking at your 401 as a way out of debt, youre looking in the wrong direction. Debt is often the result of undisciplined spending or an unforeseen emergency like job loss or medical setback. Its rarely a one-time purchase that sends the consumer into financial despair.

Read Also: How Do I Find My Old 401k Account

What Bank Has The Highest Interest Rate

Here are Bankrates selections for the best savings account rates from top online banks:

- High Rate: Barclays Bank 0.40% APY.

- High Rate: Capital One 0.40% APY.

- High Rate: Discover Bank 0.40% APY.

- High Rate: Citizens Access 0.40% APY.

- High Rate: PurePoint Financial 0.40% APY.

- High Rate: CIT Bank up to 0.40% APY.

Alternative To 401 Loan: Hardship Withdrawals

If you need urgent cash for financial hardship, you may consider taking a hardship withdrawal from your 401 account. Unlike a 401 loan, you wonât be required to repay the money you take from your retirement account. However, you will be required to pay income tax and penalty on the hardship withdrawal, but you could be exempted from paying the 10% early withdrawal penalty.

IRS rules require that you cannot withdraw more money than you actually need for a specific financial need. You can take a hardship withdrawal to pay college fees, funeral or medical expenses, prevent foreclosure of your primary residence, or remodel your primary residence.

Tags

Don’t Miss: When Can I Move My 401k To An Ira

If You Default On Your 401 Loan You’ll Owe A Penalty

If you do not pay your 401 loan back as required, the defaulted loan is considered a withdrawal or distribution and thus subject to a 10% penalty applicable to early withdrawals made before age 59 1/2. That’s potentially a huge cost, especially when you also consider the loss of the potential gains your money would have made had you left it invested.

The penalty for defaulted loans still applies to COVID-19 related loans taken under the CARES Act’s special rules applicable in 2020. This can be confusing, as the CARES Act also altered the rules for withdrawals, enabling you to take a coronavirus-related distribution from your 401 in 2020 without incurring the customary 10% tax penalty. Unfortunately, if you default on your 401 loan, it doesn’t convert to a penalty-free withdrawal, even if you would have been entitled to one in 2020.

How Interest Rate On A 401k Is Calculated

Believe it or not, you can actually lend money to yourself. It’s true, and it can be much, much cheaper than a credit card — though that doesn’t necessarily make it a good idea. You can take a loan out from your own 401 retirement account, and pay it back to yourself with interest. While it would be nice to give yourself a no-interest loan , the world just isn’t that fair.

Whether taking a loan out of your 401 is a good idea or not is a matter for much debate, but it largely depends on your financial situation and your employment stability. The biggest downside to taking such a loan is that, should you lose your job, you are required to pay the loan back in full within 60 days or else risk paying penalties and taxes . Furthermore, financial planners will point out that taking principal out of your retirement account will make it grow more slowly, and that’s hard to argue with.

But if your employment situation is stable, you still earn some interest on the money you’ve taken out of your account, although you are the one paying the interest into it.

Recommended Reading: How To Transfer 401k To Bank Account

When Should I Take Out A 401 Loan

Most employer-sponsored 401 retirement plans allow employees to borrow against their accounts, but employers can restrict what you’re allowed to use the funds for. You’re also putting your retirement savings at risk, so be careful about what you’re borrowing for regardless of if there’s a restriction.

Situations that may necessitate a 401 loan include:

- Funeral expenses

- Making a down payment on a house

- Covering costs to prevent foreclosure or eviction

- Paying education costs for yourself or your family members

Do You Pay Interest When You Borrow From 401k

A loan lets you borrow money from your retirement savings and pay it back to yourself over time, with interestthe loan payments and interest go back into your account. A withdrawal permanently removes money from your retirement savings for your immediate use, but youll have to pay extra taxes and possible penalties.

You May Like: Can You Buy A House With 401k

Are There Any Restrictions On How A Solo 401k Loan Is Used By A Participant

No. In fact, as long as the employer does not place any restrictions on use of the loan that would benefit itself, a fiduciary, or other party in interest, there is no reason why a participant cannot independently make the decision to use loan proceeds in a way that would benefit the employer or other restricted party. See

Why Do I Have To Pay Interest On My 401k Loan

Borrowing money has a cost, in the form of loan interest, which is paid to the lender for the right and opportunity to use the borrowed funds.

As a result, the whole point of saving and investing is to avoid the need to borrow, and instead actually have the money thats needed to fund future goals..

Recommended Reading: What Happens When You Roll Over 401k To Ira

Compounding Interest And Your 401

While regular interest allows you to gain value on your original investment, compound interest builds on top of itself as well. The most significant benefit of compound interest is that the earlier you begin saving, the more your eventual earnings will snowball.

The easiest way to understand this is by imagining how it might work in action. If you were to begin this year by investing 1,000 dollars into an account with a ten percent interest rate, you would have earned an additional hundred dollars by the end of that year.

The following year, you would experience growth through compounding interest not only one the original thousand dollars, but also the additional one hundred you just earned!

As an extension of this exercise, imagine that every month, you invest an additional 100 dollars to this same account, as you likely do with your 401. Monthly compound interest would add an additional ten dollars to your account each month, while yearly compounding would only calculate interest annually.

In every case, having interest compounded as often as possible is the most beneficial for your savings goals!

By playing around with online calculators like this one on the Investor.gov website, you can see that the more frequently your investments compound interest, the more quickly your investments grow. Though interest can compound daily, monthly, quarterly, or annually, the most common periods are monthly and annually.

Zirp Danger: Zero Interest Rate Policy Impact On Whats Ahead

Last week, 401 Specialist published Institutional Investors Both Optimistic, Pessimistic Post-Pandemic. I believe that paranoia is more appropriate than schizophrenia at this time, and that optimistic statements are gaslighting, tricking investors into ignoring current realities.

As stock markets continue their meteoric rise, optimism currently prevails, driven in large part by investor biases. But investors should consider what might spoil the party. The most likely spoiler is the termination of Zero Interest Rate Policy since rising interest rates decimate stock and bond values. The reduction in bond values is straightforward because bond prices fall when yields rise.

The impact on stock prices is more nuanced. Investment analysts estimate a fair stock value by projecting earnings and then discounting those back to today.

So, if interest rates rise, the discounted present value of future earnings declines, making a stock worth less. In fact, current low-interest rates are the common justification for high stock prices, implying that stock prices would be lower if interest rates were higher.

Also Check: Can Anyone Open A 401k

Loan Amount Calculation Question:

How do I take out a personal loan from my solo 401k account? What interest do I need to pay back? I believe I read that the maximum that can be taken out is 50% of the account up to $50k. Is that amount based on the total value of the Solo 401k or whatever amount is in the physical account. Example: total value is $100k but only $30k remains in the account because of investments. Is the loan based on the $100k or the $30k?

Alternatives To Borrowing From Retirement

Dipping into your 401 likely will lead to more troubles than its worth. There are other ways to get by while keeping your retirement funds intact. Learn more about prioritizing retirement vs paying off debt.

Here are some methods of dealing with a financial emergency:

- Home equity loan This is a good option for homeowners. It comes with a fixed interest rate that never changes. Right now, the average home equity loan rate is 7.74%.

- A personal loan Even if the interest is higher than youd like, its often better than interfering with the appreciation of your 401. If you have a credit score above 720, you may be able to find interest rates around 10%.

- Nonprofit credit counseling Maybe you dont feel comfortable putting your home up for collateral,or your credit is too low for a decent interest rate on a loan. Consider working with a nonprofit credit counseling agency. A credit counselor will take a look at your budget, walk you through your spending habits and help you establish a more manageable financial lifestyle.

A 401 is first and foremost a retirement account, not just a second savings or vacation fund. The tulips have been blooming in Holland for 400 years. Theyll be around down the line when youre financially ready and able.

In the meantime, keep making contributions to your 401. Let it sit. Watch it grow. Youll thank yourself later.

5 Minute Read

You May Like: How Do I Stop My 401k

Taxes On 401 Loan Interest

401 plan contributions are made on a pre-tax basis, and this means that you donât pay taxes when you contribute to the plan. Instead, you pay taxes in the future when you withdraw money in retirement. However, unlike 401 contributions, you must use after-tax dollars when making loan payments, including the interest portion of the loan. This means that the interest will be taxed twice since you will also pay income taxes when you take a 401 distribution in retirement. However, the interest portion is a modest amount, and the impact of double taxation will be negligible.

How Much Can You Expect To Earn With Your 401k If You Dont Borrow The Money

We still need another estimate to complete our analysis. We need to know how much we expect our money to earn in the 401k plan if we dont borrow the money. This isnt likely to be an easy or precise estimate to get, either. The earnings will depend on how the money is invested. And each plan has different investment options available. Some are very conservative and only offer guaranteed type investments with a lower rate of interest. Other plans are heavily invested in the stock of your employer. Depending on the performance of that stock, your return can be terrific or terrible. And dont expect your employer to give you an estimate of what the return will be. Way too much legal risk for that to happen.

Ultimately, youll probably have to take a look at whats happened in past years, take a guess about the future and go with your instincts. Lets suppose that you think that the earnings will be about 3% higher than the loan interest rate. So hows that important?

Well, that $900 will grow before you retire. Theres an easy way to estimate what it will be worth at retirement. If the money earns 9% it will double every eight years. So if youre eight years from retirement, you will have $1800 less . If youre 16 years from retirement, it will double again. We dont know how old Lucy is. But she can figure out how many years she has until retirement and then double the lost earnings for every eight year period until she reaches retirement.

About the Author

Read Also: How To Transfer 401k Without Penalty