Keep The Money In Your Old 401 Plan

Deciding what to do with an old 401 can be stressful, so its alright to keep your old account while you weigh your options. Many plans allow former employees to keep their 401s after they have left the company. Most investors dont typically choose to keep assets in an old 401 on purpose it often happens when investors dont understand their rollover options. Before deciding to keep your 401, make sure you are happy with the investment options and plan fees.

Taxes On Earnings From After

After-tax contributions to a 401 or other workplace retirement plan get a different tax treatment than their earnings. Since you’ve already paid taxes on the contributions, those withdrawals are tax-free in retirement. But the IRS considers the earnings to be pre-taxso they would be treated as pre-tax and you would owe income tax when you withdraw the earnings from the plan.

Earnings in Roth IRAs, however, aren’t subject to income tax as long as all withdrawals from the account are qualified withdrawals. So rolling after-tax money from a workplace plan to a Roth IRA means you can avoid taxes on any future earnings.

How To Convert Traditional 401 To Roth Ira

You can convert your 401 account into a Roth IRA through the following steps:

The first step would be to set up a Roth IRA if you dont have one already. You can open a Roth IRA with a brokerage firm.

The next step is to transfer all your 401 funds into a traditional IRA.

Finally, you can convert your traditional IRA to Roth IRA.

Direct rollover: You can request your employer or plan administrator initiate a direct rollover, commonly referred to as a trustee-to-trustee transfer. Once you complete the necessary documentation, your retirement plan administrator directly transfers the proceeds of your account to the designated IRA.

Indirect rollover: Instead of going for a trustee-to-trustee rollover, you can ask your plan administrator to issue you a check for the balance amount of your retirement account. You can then deposit this check into your IRA within 60 days of receiving it.

Any delay beyond 60 days will make you liable for withdrawal taxes and a 10% penalty if you are under 59 ½ years of age.

Rollover 401 to Roth IRA Tax Consequences__:__ The amount of money lying in your traditional IRA account at the time of conversion is considered your contribution, and you must pay taxes on it. You should include this amount in your taxable income for the year in which the conversion takes place.

Read Also: Why Rollover Old 401k To Ira

Tips For Retirement Investing

- Consider finding a financial advisor to steer you in the right direction in terms of savings and investments. Finding a qualified financial advisor doesnt have to be hard. SmartAssets free tool matches you with up to three financial advisors in your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- When youre starting to plan for retirement, you should consider the tax laws of the state you live in. Some have retirement tax laws that are very friendly for retirees, but others dont. Knowing what the laws apply to your state, or to a state you hope to move to, is key to getting ahead on retirement planning.

You Want To Increase Your Tax Diversification

Contributions to traditional IRAs are tax-advantaged, meaning you wont pay taxes on your invested funds until you begin taking withdrawals at retirement. Roth IRAs, on the other hand, are taxed up front but offer tax-free withdrawals after age 59 ½. If youre unsure how your tax and income situation might pan out in the future, having both types of accounts a traditional IRA and a Roth IRA is a smart move in terms of diversifying your future tax exposure.

Recommended Reading: How Does Taking Money Out Of 401k Work

Calculating Income To Report On A Roth Conversion

The first step is to figure out your Roth conversion income. If you’re converting deductible IRA funds, you’d report the current value of the funds on the day you make the conversion as your income. Your basis in a deductible IRA is zero because you received a tax deduction for your savings contributions.

If you’re converting nondeductible IRA funds, report as income the current value of the funds on the day you convert, less your basis. If you contributed $5,000 to a traditional IRA in 2016 and received no deduction for that contribution, your basis in those funds would be $5,000: $5,000 of income minus zero for the deduction.

Now let’s say you decide to convert that IRA to a Roth two years later in 2018. The value is now $5,500. You would report $500 of income on your tax return: $5,500 current value minus the $5,000.

Ask Your 401 Plan For A Direct Rollover Or Remember The 60

These two words “direct rollover” are important: They mean the 401 plan cuts a check directly to your new IRA account, not to you personally.

Here are the basic instructions:

Contact your former employers plan administrator, complete a few forms, and ask it to send a check or wire for your account balance to your new account provider.

The new account provider gives you instructions for how the check or wire should be made out, what information to include and where it should be sent. You can opt for an indirect 401 rollover instead, which essentially means you withdraw the money and give it to the IRA provider yourself, but that can create tax complexities. We generally recommend a direct rollover.

If you do an indirect rollover, the plan administrator may withhold 20% from your check to pay taxes on your distribution. To get that money back, you must deposit into your IRA the complete account balance including whatever was withheld for taxes within 60 days of the date you received the distribution. .)

For example, say your total 401 account balance was $20,000 and your former employer sends you a check for $16,000 . Assuming youre not planning to go the Roth route, you’d need to come up with $4,000 so that you can deposit the full $20,000 into your IRA.

At tax time, the IRS will see you rolled over the entire retirement account and will refund you the amount that was withheld in taxes.

You May Like: When Can I Roll A 401k Into An Ira

Determine If A Roth Ira Rollover Is Right For You

Ultimately you have to determine whether rollover to a Roth IRA is the best decision for your retirement planning. You can speak with a company representative or independent financial advisor to decide to proceed with the conversion process. If converting to a Roth IRA is the best decision for your retirement, take care to follow the conversion rules and avoid possible penalties.

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our reporters and editors focus on the points consumers care about most how to save for retirement, understanding the types of accounts, how to choose investments and more so you can feel confident when planning for your future.

Recommended Reading: Can You Convert Your 401k To A Roth Ira

Should You Convert To A Roth Ira Now

Once youve decided a Roth IRA is your best retirement choice, the decision to convert comes down to your current years tax bill. Thats because when you move money from a pre-tax retirement account, such as a traditional IRA or 401, to a Roth, you have to pay taxes on that income.

-

Roth IRAs boast huge tax advantages, including tax-free growth and tax-free withdrawals in retirement.

-

You can withdraw contributions at any time, for any reason, tax-free.

-

Unlike traditional IRAs and 401, a Roth doesn’t have required minimum distributions.

-

You pay tax on the conversionand it could be substantial.

-

You may not benefit if your tax rate is lower in the future.

-

You must wait five years to take tax-free withdrawals from the Roth, even if youre already age 59½.

It makes sense: If you had put that money into a Roth originally, you would have paid taxes on it for the year when you contributed.

A Roth IRA rollover is most beneficial when:

Converting A 401 To A Roth Ira

You can also convert traditional 401 balances to a Roth IRA. Generally, you’ll only be able to transfer a 401 to a Roth IRA once you’ve left the company that provided the 401 or once you reach the age of 59½, which is the age most plans allow for in-service withdrawals. That’s not always the case, however, so check the rules of your employer’s 401 plan.

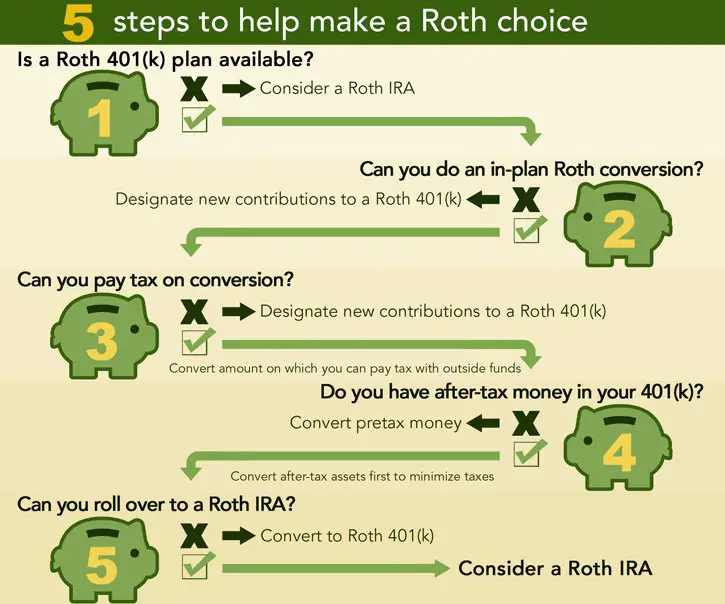

Another option that may be available to you: an in-plan Roth conversion. If your employer offers a Roth 401 option, you may be able to convert your existing pre-tax and after-tax balances to a Roth account within the plan. Some employers even offer an auto-convert feature inside their plan. You can set it up so that any after-tax contributions are automatically converted to a Roth 401 at regular intervals.

Taxes on a 401 to Roth IRA conversion depend on the type of contributions involved:

Pre-tax contributions onlyIf your 401 account is composed entirely of pre-tax money , then you’ll be subject to current-year income tax on the entire amount converted to a Roth IRA.

After-tax contributions onlyIf the contributions made to your 401 account were made entirely in after-tax dollars, you can roll them directly into a Roth IRA, as long as any tax-deferred earnings associated with them are also distributed from your employer-sponsored plan at the same time to another eligible retirement plan.

Read Viewpoints on Fidelity.com: Rolling after-tax money in a 401 to a Roth IRA

Read Also: How To Take Out 401k Money For House

How Do You Convert To A Roth Ira

The actual process for converting a 401 or traditional IRA to a Roth IRA is simple. In fact, its so straightforward that you can create problems before youre aware that youve done so.

Here are the three basic steps to convert your retirement account to a Roth IRA:

If you manage your own funds, you should be able to find steps to do a Roth conversion on your investment platforms site, says Kerry Keihn, financial advisor at Earth Equity Advisors in the Asheville area, noting that each institution has a slightly different process or forms.

Within a couple weeks and often sooner the conversion to the Roth IRA will be made.

When it comes time to file taxes for the year you made the conversion, youll need to submit Form 8606 to notify the IRS that youve converted an account to a Roth IRA.

> > > Get Your Free Gold Investor Kit Here

An individual retirement account is one of several types of IRAs. This type of IRA allows you to invest in bonds, stocks, and other assets, instead of having to invest in mutual funds and other products. A good gold IRA has a lower cost of investment than a standard or Roth IRA which invests solely in bonds, stocks, and mutual funds. However, there are differences between a standard and a hedge against inflationary climate.

There are several types of IRAs that an individual can open for investing. The most common IRA types include a standard IRA, a hedge against inflation, and a gold IRA. If you want to have the most flexibility with your investments, then you should invest in a standard IRA. To learn more about these different IRAs, as well as the pros and cons, we have looked at some of the more popular options.

Recommended Reading: When Can You Take Out 401k

Dont Roll Over Employer Stock

There is one big exception to all of this. If you hold your company stock in your 401, it may make sense not to roll over this portion of the account. The reason is net unrealized appreciation , which is the difference between the value of the stock when it went into your account and its value when you take the distribution.

Youre only taxed on the NUA when you take a distribution of the stock and opt not to defer the NUA. By paying tax on the NUA now, it becomes your tax basis in the stock, so when you sell itimmediately or in the futureyour taxable gain is the increase over this amount.

Any increase in value over the NUA becomes a capital gain. You can even sell the stock immediately and get capital gains treatment.

In contrast, if you roll over the stock to a traditional IRA, you wont pay tax on the NUA now, but all of the stocks value to date, plus appreciation, will be treated as ordinary income when distributions are taken.

How To Pick An Ira To Roll Over To

The most important question you need to ask is whether you want to start a traditional IRA or a Roth IRA. Traditional IRAs work much like traditional 401 plans. You contribute money before you pay taxes. The 2021 maximum contribution limit for traditional and Roth IRAs is $6,000.

With a traditional IRA, the money you contribute is deducted from your taxable income for the year. When you reach retirement, the money is taxable as you withdraw it. A Roth IRA, however, works differently. You contribute money post-taxes. The money is then not taxable when you withdraw it in retirement. If you think you might want to keep contributing to your new IRA after the rollover is complete, its important to decide which type of IRA you want.

Its also important to consider the tax implications. If you have a traditional 401 plan, that means you didnt pay taxes on the money when you contributed it to your account. If you want to move that money into a Roth IRA, youll have to pay taxes on it. You can roll over from a traditional 401 into a traditional IRA tax-free. Same goes for a Roth 401-to-Roth IRA rollover. You cant roll a Roth 401 into a traditional IRA.

Read Also: How To Start My Own 401k

Need To Open A Roth Ira

My favorite online broker is Ally Invest but you can check out our recap on the best places to open a Roth IRA and the best online stock broker sign up bonuses. There are many good options out there, but I have had the best overall experience with Ally Invest. No matter which option you choose the most important thing with any investing is to get started.

How To Roll Over Your 401

If your company or former employer allows 401 to Roth IRA conversions, take the following steps.

Open a Roth IRA with a brokerage firm or bank. Be ready with your Social Security number, proof of income and external banking information to fund the account.

Contact the financial institution holding your 401 plan. Request a direct rollover or trustee-to-trustee transfer of your 401 assets to the financial institution holding your Roth IRA.

In some cases, you may get a check of your 401 assets to deposit with the financial institution holding your Roth IRA. If so, you need to deposit it into your Roth IRA within 60 days or you may face an early withdrawal penalty. The process may involve some paperwork from your 401 plan administrator and the financial institution that manages your Roth IRA account.

Don’t Miss: Can You Contribute To 401k And Roth Ira

Two: Convert Your Traditional Ira To A Roth Ira

No doubt, there are significant advantages to moving your 401 money to a Roth IRA. But, as noted earlier, it will be a taxable event. You will owe taxes not only on your contributions and your companys contributions if it has a matching program, but also on your earnings, which include capital gains and dividends. This bump in income could boost you to a much higher income bracket so that you are paying more tax than if you left the money in a traditional IRA and paid taxes as you made withdrawals in retirement.

Because the taxation of your money is changing, the switch from a traditional IRA to a Roth is called a conversion rather than a rollover. More importantly, it is a permanent process. So you should make sure this is what you really want to do before you do it.