To Add Eft Using An Offline Form

If you prefer to add EFT offline, then heres what you can do.

- Download the PDF form here: Electronic Funds Transfer Authorization

- Be sure to fill out sections 1, 2, and 5, plus those sections that apply to you.

- Attach a copy of a void check, bank statement, or deposit slip

- Submit the form by following the instructions that you will find at the bottom of the form

If you want to set up EFT for a third party account , then here are the steps:

- Download the PDF form here: Electronic Funds Transfer Authorization

- Be sure you fill out sections 1, 3, and 5, plus those that apply to you.

- Attach a Medallion Signature Guarantee in part 5, or you may proceed to a Fidelity Investor Center with all involved parties present to sign documents.

- Submit the form by following the instructions at the bottom of the form

Rollover Existing Fidelity Solo 401k/keogh/psp: Question:

Yes your existing solo 401k with Fidelity Investments would get restated to our solo 401k plan which allows for 401k participant loans and investing in alternative investments such as real estate. We would then fill out new Fidelity brokerage account forms so that Fidelity can open a new brokerage account for the self-directed solo 401k that we offer. Note that Fidelity will not simply re-title the existing account. They require new brokerage forms. Subsequently, we would prepare an internal Fidelity transfer form to have Fidelity internally transfer the existing solo 401k equity holdings and cash to the new brokerage account for the self-directed solo 401k. You will then receive a checkbook in the mail from Fidelity for the new solo 401k for placing your alternative investments, and/or you can process the investments via wire.

Making A Fidelity 401k Withdrawal

Your 401k is your money, and making a withdrawal is as simple as contacting Fidelity to let them know you want it. The easiest way is to simply visit Fidelitys website and request a check there. However, you can also reach out via phone if you prefer: Call 800-343-3543 with any questions about the process.

From there, you can download the appropriate withdrawal request form and then mail it to the address listed on the form. Fidelity will have your check for you in five to seven business days after receiving your request. There are no fees for requesting a check, but if you liquidate any holdings, there could be commissions or mutual fund fees associated with that.

Borrowing From Your 401k: What You Need to Know

Don’t Miss: Do You Get Your 401k When You Quit

Be Prepared To Print Scan And Mail Things

Oh, and possibly get them notarized as well.

TIAA-CREF allowed me to sign and scan the necessary documents, and send them back via their messaging service.

Vanguard, and the retirement plan for Ohio public employees, did not. Vanguard required a signature and that I mail the form back to them. The public employees fund, on the other hand, required that I sign and get the document notarized before either mailing or faxing it back to them.

Why is this all required? Because of the Retirement Equity Act of 1984!

That law, signed by Americas Handsome and Senile Grandpa, Ronald Reagan, was passed to keep people from screwing over their spouses. Thus, to roll over your 401, start taking withdrawals, or change beneficiaries, you have to get your spouses signature. And if youre not married, youve got to swear to your singleness in writing.

The particulars of proving that you are acting with the approval of your spouse vary from plan to plan. Some might simply require a signature others require notarization. If youre not married, some nice plan administrators might allow you to just swear to that by checking a box.

If you dont have a scanner at home , then there are several iPhone or smartphone apps that will do. .

All of this is crazy annoying, and counter to our expectation that transactions be smooth and seamless. But theres often a lot of money on the line in these transactions, and those plans dont want to be responsible for money being moved when it shouldnt be.

How Do I Complete The Account Transfer Form

– Open your new account online and follow the step-by-step tutorial.- To transfer to an existing TD Ameritrade account, print the Account Transfer Form and follow the instructions below:

Guidelines and What to Expect When TransferringBe sure to read through all this information before you begin completing the form. Contact us if you have any questions.

Information about your TD Ameritrade Account– Write the name/title of the account as it appears on your TD Ameritrade account. If you do not already know the number of the TD Ameritrade account into which you are transferring, leave the account number section blank.- You must complete the Social Security Number or Tax ID Number section because your transfer cannot be processed without this information.

Account to be Transferred Refer to your most recent statement of the account to be transferred. Be sure to provide us with all the requested information.

Transfer Instructions

– Please contact a New Client consultant if you want help completing the Account Transfer Form .

You May Like: How Does Taking Money Out Of 401k Work

Start Your Transfer Online

You’ll get useful tips along the way, but you can call us if you have a question.

You’ll need to:

- Enter the account information requested. Your instructions from that point will depend on the company holding your account and your account information. Not all transfers follow the same process, so we’ll ask only for the information needed to complete your particular type of transfer.

- Enter your personal information, such as your birth date and Social Security number, or if you’re already a Vanguard client, confirm the information that we’ve been able to prefill for you.

- Review your information and click Submit.

Want an idea of how long a transfer could take?

Fidelity Investments Review : Pros Cons And How It Compares

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhereâs how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks or securities.

Don’t Miss: How Do I Take Money Out Of My Voya 401k

Organize And Rebalance Your Accounts

After years of neglect, your forgotten retirement accounts may not be properly balanced. This means there may be too much emphasis on one type of investment, or not enough on another.

If you plan to keep the IRA or company plan open, you may want to consider diversification, so theres the right amount in stocks, bonds, U.S. investments or international exposure thats appropriate for your investment goals and risk tolerance.

Youll need to check each account individually at first. However, if you can list them all in one place, youll see how your combined investment diversification stands up. An online tracking service can continue to monitor your accounts, possibly flagging you if you need to consider rebalancing again.

Online tracking services cant do the rebalancing for you, however youll have to go to each individual account to manage the rebalancing. And if the diversification seems off but its not time for you to rebalance, youll have to look at each individual account to determine which one may be out of balance the most.

How To Roll Over

Since the steps to roll over an account balance can vary depending on the recordkeeper for your previous employers plan, the simplest way to make the process painless is to call Fidelity. UC-dedicated Fidelity Workplace Financial Consultants can help you through the entire process. Heres how it works:

Ready:

- Make sure you have an account statement for the retirement accounts that you want to roll to your UC 403, 457, or DC Plan account. A statement should include your account number, your account balance, and the prior recordkeepers telephone number.

- Your Fidelity Workplace Financial Consultant will help you contact the prior recordkeeper for your previous employers retirement plan and request that all required paperwork be mailed or emailed to you. Then, your Fidelity Workplace Financial Consultant can email or mail you a pre-filled Transfer/Rollover/Exchange Form.

Set:

- Once you receive the paperwork from your previous employers recordkeeper, follow the instructions to complete and sign all paperwork.

- Sign the pre-filled Transfer/Rollover/Exchange Form you received from Fidelity, and send it and the completed paperwork from your previous employers recordkeeper to Fidelity Investments, P.O. Box 770002, Cincinnati, OH, 45277-0090.

Roll:

Once Fidelity receives your check, you will receive confirmation by email or mail, depending on your communication preference. If you have any questions during the process, call Fidelity at 1-800-558-9182.

Read Also: What Happens To 401k When You Leave Your Job

What To Know About Fidelity Online Trading Services

Usage of Fidelitys online trading services constitutes agreement of the Electronic Services Customer Agreement and License Agreement. Before investing, consider the funds investment objectives, risks, charges, and expenses. Contact Fidelity for a prospectus or, if available, a summary prospectus containing this information. Read it carefully.

You Are Viewing This Page As An Investor

Advisors, switch views to see more relevant content.

TFSA basics

Regardless of what youre saving for, a TFSA is a great way to reach any financial goal.

RRSPs 101

You can reduce tax on your current income when you save for the future. Here are six RRSP tips.

For you and your goals

Over 1.5 million

To business leaders around the world

Over 25,000

* Source: More on the Value of Financial Advisors, by Claude Montmarquette and Alexandre PrudHomme, CIRANO, 2020. The average household with a financial advisor for 15 years or more had asset values 2.3x higher than an average comparable household without a financial advisor.

Commissions, fees and expenses may be associated with investment funds. Read a funds prospectus or offering memorandum and speak to an advisor before investing. Funds are not guaranteed, their values change frequently and investors may experience a gain or loss. Past performance may not be repeated.

Read our privacy policy. By using or logging in to this website, you consent to the use of cookies as described in our privacy policy.

This site is for persons in Canada only. Mutual funds and ETFs sponsored by Fidelity Investments Canada ULC are only qualified for sale in the provinces and territories of Canada.

88747-v202076

Recommended Reading: How To Recover 401k From Old Job

What Is A Routing Number

Youll find your bank routing number on the lower left-hand corner of your checks, right next to your account number. The first two digits in the routing numbers represent one of 12 Federal Reserve Bank districts the bank is located in. The next two digits are the Federal Reserve Bank district branch that covers your bank.

Bank Regionally, Get Perks: Fidelity Savings Account Review

How Do I Get My Fidelity Statements

Monthly and quarterly account statements, and prospectuses/reports are also available to view as web pages.

Recommended Reading: How To Cash Out Nationwide 401k

More From Portfolio Perspective

To give your retirement savings an extra boost, Jessica Macdonald, a vice president at Fidelity, recommends opting into an auto-escalation feature, if your employer offers it, which will automatically boost your savings rate by 1% or 2% each year.

And always contribute enough to get the full employer match, she said, “that way you won’t leave money on the table.”

Overall, aim to save 15% of your income in a retirement account, including the employer contribution, Macdonald also advised.

If you are over age 50, you set aside even more withcatch-up contributions. plans and $6,000 for IRAs in 2021 those who qualify can put an extra $6,500 in their 401 or $1,000 in their IRA.)

Finally, avoiding borrowing from these accounts at all costs. “Try to stash a little bit of money away in a rainy-day fund so you can dip into that instead,” Macdonald said.

Standard Deposits To Individual And Ira Accounts

- For most check deposits to individual brokerage accounts as well as to most IRA accounts , checks must be made payable to one of these:

- Fidelity Investments.

- National Financial Services, LLC.

- Account holder exactly as it appears on the Brokerage Account Registration. Checks payable to the account holder must be endorsed by the account holder to prevent paying bank from returning the check to Fidelity.

Don’t Miss: How Do I Transfer 401k To New Employer

Can I Transfer An Existing Debit Balance And/or Options Contracts To Td Ameritrade

If you are transferring a margin and/or options account with an existing debit balance and/or options contract, please make sure you have been approved for margin/options trading in your TD Ameritrade account. Please refer to your Margin Account Handbook or contact a TD Ameritrade representative to ensure that your account meets TD Ameritrade’s margin requirements.

IRA debit balances:Many firms will charge fees to transfer your account, which may result in a debit balance after your transfer is completed. Debit balances must be resolved by either:

– Funding your account with an IRA contribution

– Liquidating assets within your account. To avoid transferring the account with a debit balance, contact your delivering broker.

Transferring options contracts:If your account transfer includes options contracts, the transfer of your entire account could be delayed if we receive your properly completed transfer paperwork less than two weeks before the monthly options expiration date. In this case, your contracts may be exercised or assigned by the firm from which you are transferring your account. Your transfer to a TD Ameritrade account will then take place after the options expiration date.

How Long Will My Transfer Take

This depends on the type of transfer you are requesting:

Total brokerage account transfer:– Most total account transfers are sent via Automated Customer Account Transfer Service and take approximately five to eight business days upon initiation. ACATS is a regulated system through which the majority of total brokerage account transfers are submitted. Transfers coming from some smaller firms, which are not members of the National Securities Clearing Corporation , which is responsible for regulating and governing the ACATS system, are processed as non-ACATS transfers. Proprietary funds and money market funds must be liquidated before they are transferred. Please complete the online External Account Transfer Form – The transfer will take approximately 5-8 business days upon initiation.

Partial brokerage account transfer:– List the specific number of shares for each asset to be transferred when you complete the Transfer Form. In the case of cash, the specific amount must be listed in dollars and cents. This type of transfer is processed as a non-ACATS transfer. Please complete the online External Account Transfer Form.- The transfer will take approximately 3 to 4 weeks from the date your completed paperwork has been received.

Internal TD Ameritrade transfer:– Transferring assets between two TD Ameritrade accounts requires an Internal Account Transfer Form. .

Don’t Miss: How To Rollover 401k From Empower To Fidelity

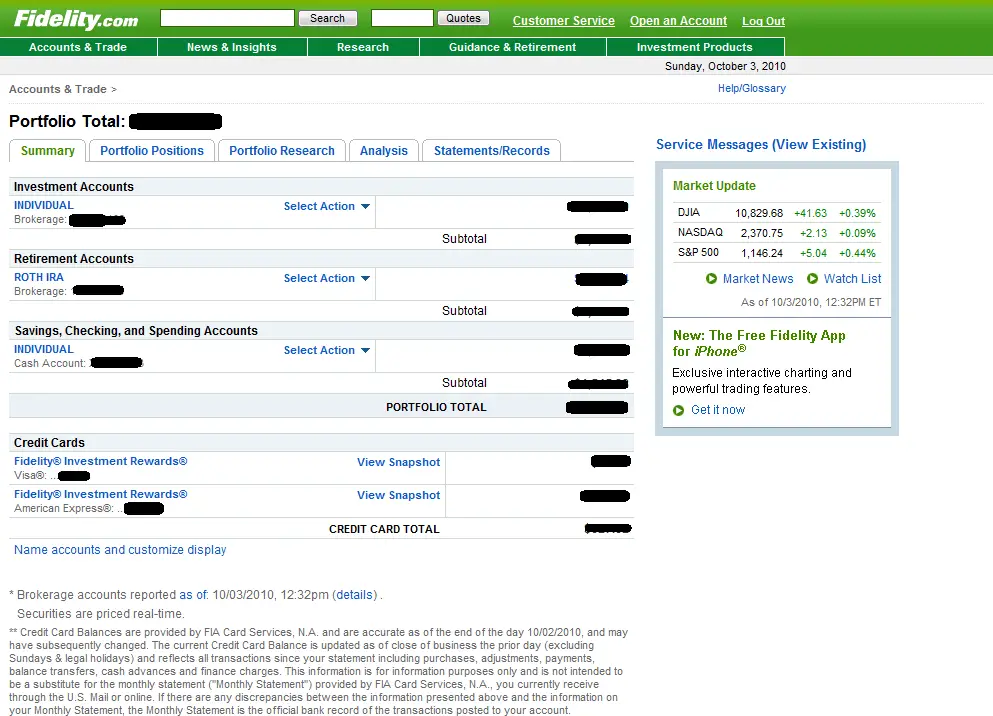

How Do I Log In To My Fidelity Account

You can get to the homepage by clicking on the Fidelity logo in the top left. Here you will be asked to enter the username and password you created. If this is the first time you are logging into your account online, you will need to click on the Register for online access button which is also in the top right hand corner of the homepage.

Where Can I Find My Fidelity 401k Fees

Whether due to my own ineptitude, or through deliberate camouflaging on Fidelitys part, I could not for the life of me figure out what these additional fees were. The info that I sought is information that your 401 provider must supply youyet I could not locate and account for these mysterious fees. A few days after giving up on Fidelitys website, I happened to receive an email with Fidelitys annual prospectus disclosure and viola, a CTRL F later and I finally uncovered the fees that were eating up nearly one percent of my account on an annual basis. You can find this required disclosure information under the Plan Information and Documents tab on your account.

Assuming Im not the only one who sucks at navigating an unfamiliar financial services website, I wanted to spell out those fees in somewhat plain English. For those who dont have a 401k plan through Fidelity, this information should still prove somewhat valuable, as it allows you to compare the fees in your own plan to another provider. I had a next-to-impossible time finding my own 401k providers fees, never mind search for those of competing plans.

Now, lets take a look at the Fidelity 401k fees that Im paying.

Also Check: How To Transfer 401k Accounts

Banks Can Have Multiple Routing Numbers

Banks and brokers have different routing numbers depending on a variety of factors. One factor is the size. For example, a major bank such as Wells Fargo has different routing numbers in each state. Smaller banks and online-only financial institutions usually only use one routing number nationwide.

An institution might also have different routing numbers to fulfill different functions. For example, Fidelity has different routing numbers used for its brokerage and mutual fund accounts.

| Fidelity Routing Numbers |