What Is An Interactive Statement And Where Can I See My Interactive Statement Online

An interactive statement gives you:

- Quick links to important information about your holdingsincluding quotes, research, and performance.

- Easy-to-read portfolio and transaction information.

- Links to valuable portfolio planning and analysis tools.

- The ability to customize your statement by adding or hiding accounts.

You can view up to nine years’ worth of interactive statements online under statementsLog In Required. Your tax documents will still arrive by mail.

- Sign up for eDelivery

Contributing To Your Mit 401 Account

You contribute to your 401 account through deductions from your MIT paycheck. You can contribute pre-tax dollars, Roth post-tax dollars, or a combination of both. You may change your contribution preferences any time through Fidelity NetBenefits.

Your contributions are sent to Fidelity Investments at the end of each pay period. You may contribute as little as 1% and as much as 95% of your salary after amounts for Social Security and Medicare taxes and health and dental insurance have been subtracted. You may start, stop, or change your deferral or investment elections at any time.

Federal law limits the amount of your pay each year that may be recognized for determining your allowable contribution. In 2021, MIT can consider only the first $290,000 of pay for calculating your allowable contributions. This means that if your annual compensation exceeds $290,000, MIT Payroll will take 401 deductions from your pay until your pay for the year reaches $290,000, or one of the other 401 program limits has been reached .

Contribution limits

What MIT contributes to your 401 Plan

- MIT matches your 401 contributions dollar-for-dollar up to the first 5% of your MIT pay .

- MIT only contributes a match during months in which you have made a contribution

- The MIT match is provided pre-tax, and therefore is fully taxable when you withdraw your matching contributions from the plan, along with associated investment earnings.

When contributions are invested in your 401 account

What Do I Need To Know

Taking the time to choose your beneficiaries now can help your family avoid probate later. Please tell your family or friends if you’ve selected them as a beneficiary, because your beneficiaries must contact Fidelity themselves to receive their assets. We’ll distribute your assets to your beneficiaries without requiring a will or other legal documents.

You’ll need to assign at least one beneficiary for each account most of the time you can add, change, or delete your beneficiaries online. To get started, please provide:

- Beneficiary type

- Social Security number

You can also name contingent beneficiaries. Contingent beneficiaries receive your assets if there is no living primary beneficiary.

Note: Some retirement accounts or plans may require spousal consent , Keogh) before you can add or change the beneficiary.

If you do not see the account you want to update on the Beneficiary Summary page, and its not an annuity or a NetBenefits® account, you may have a workplace plan that’s not serviced by Fidelity. To request changes, contact your plan’s administrator or trustee.

Don’t Miss: Should You Convert Your 401k To A Roth Ira

Nav Update Cutoff Times

For investors, its important to understand the difference between the NAV update time and the trade cutoff time. Most mutual funds have self-imposed NAV updating deadlines, which are closely tied to the cut-off times for NAV publications in newspapers and other publications. This is typically around 6 p.m. EST.

The trade cutoff time, however, is the time by which all buy and sell orders for a mutual fund must be processed. These orders are executed using the NAV of the trade date. For example, if a mutual funds trade cutoff time is 2:00 p.m. EST, then trade orders must be processed before then to be filled at that business days NAV. If an order comes in after the trade cutoff time, it will be filled using the next business days NAV.

Letter Form Fidelity Investments Regarding Ubit Question:

I recently went through the process of applying for the ability to trade options in my Fidelity account. Last week I received a letter from Fidelity saying that I will be responsible for filing IRS Form 990T.

Questions:

- Is trading options in my solo 401k allowed?

- Is it a problem if Fidelity requires margin on the account in order to trade options?

- Assuming its allowed, is the Form 990T filing something that you will do for me each year?

Don’t Miss: What Reasons Can You Withdraw From 401k Without Penalty

How To Close A Fidelity Account For A Person Who Had Died

If you were assigned to close someones account in case they pass away, you need to take the right steps. Here is how the account closure process is initiated.

1) Tell Fidelity About the Persons Passing

Initially, you should let Fidelity know that the account holder passed away. There is a page on the Fidelity website made for this purpose, asking about information that will let them know what happened.

Since you may be going through hardship after the death of the loved one, you may not start the closure process immediately.

Luckily, Fidelity can still limit the accounts activity so you can resume the process later. You just need to give them some information first, which includes the name, date of birth, date of decease, and the Social Security number.

2) Get All the Right Documents

Before any assets are distributed, Fidelity will need specific documents.

One document is the death certificate of the account holder. If there were any end-of-life services offered to the deceased individual by a funeral home, then you can talk to the funeral director. They can provide you with death certificate certified copies.

You can also obtain these copies from the states vital records in the event you cant get them from the funeral director.

Meanwhile, if the will of the person who passed mentions you as the executor, you will have to go to probate court and file the will. The judge can then issue the letter of testamentary.

3) Get in Contact with Fidelity Again

Fidelity Account Number Prefix

The Fidelity prefix 39900001 will appear as your account number, followed by your account number.

By using the Fidelity mobile app, you can locate your account number. If your Fidelity account does not allow checkwriting, you must first determine which routing number and account number you wish to use. When opening a brokerage account with an X, Y, or Z symbol, use the 17-digit account number format. You can contact Fidelity by phone or online if you have any questions about your account. You can use Fidelity to gain a better understanding of your investments. Your portfolio should be reviewed. Keep an eye on your portfolio by dividing it into various accounts or by account or account to see whats there.

It is possible to encrypt 128-bit web pages using Fidelity. Fidelity offers free online account opening however, you must be logged in with a JavaScript-enabled browser in order to access the site. You can enter your X In Fidelity account number right here, and well do the rest. You must sign into your Fidelity account to begin. Account positions can be found under Accounts. On the left side of the page, youll see your Fidelity accounts. The Fidelity routing number is 101205681.

For a brokerage account number of X01999999, the 17-digit account number format would be 39900001. In order to use Fidelitys prefix 392, you must first use Fidelitys prefix 392. The numbers for your Fidelity brokerage account or 529 plan should appear in the 9-character format.

You May Like: Does Allied Universal Have 401k

What Are The Investment Options For My Core Position

Non-retirement accounts

Fidelity Government Money Market Fund , a taxable money market mutual fund investing in U.S. Government Agency and Treasury debt, and related repurchase agreements. Intended for investors seeking as high a level of current income as is consistent with the preservation of capital and liquidity.1,2

Fidelity Treasury Fund , a taxable money market mutual fund investing in U.S. Treasury securities and related repurchase agreements. Intended for investors seeking as high a level of current income as is consistent with the preservation of capital and liquidity.1,3

Taxable Interest Bearing Cash Option , a free credit balance and is payable to you on demand by Fidelity. Fidelity may use this free credit balance in connection with its business, subject to applicable law. Fidelity may pay you interest on this free credit balance, and this interest will be based on a schedule set by Fidelity, which may change from time to time. As of December 16, 2022, the interest rate for this option is 2.19%.

Generally speaking, these are the options available to you at the time you open your account. However, certain types of accounts may offer different options from those listed here. Please keep in mind that once your account has been established, you can change your core position to any other option that Fidelity might make available for that purpose.4

Retirement accounts

What Additional Detail Will I See If My Account Is Coded For Multi

Accounts coded for multi-currencyâthose holding foreign securities and/or foreign currenciesâwill see a Stock Exchange Daily Official List code which serves as an additional identifier for the security. Multi-currency accounts also display foreign securities ) in both the foreign currency and US dollars. The dollar sign is removed from all positions, but the Currency field provides a Currency Code for all positions.

Don’t Miss: How Much Can You Contribute To 401k Per Year

Stocks Have Been Clobbered This Year But People Are Still Contributing To Their Retirement Accounts

Stocks and bonds have been turning in volatile, bearish performances this year in an economy marked by high inflation and rising interest rates. But that hasnt deterred most retirement savers, especially the youngest ones.

401 participants have held relatively steady in their savings contribution rates and in their portfolio allocations, according to new third quarter data from Fidelity Investments. And GenZers have actually increased their contributions.

So its not surprising that the average 401 account balance fell to $97,200 in the third quarter, according to Fidelity, one of the countrys leading providers of workplace retirement plans. Thats down 6% from the second quarter and 23% from a year earlier.

Butthe average savings rate among 401 participants, meanwhile, held relatively steady at 13.8%, which includes both employee and employer contributions. Thats only down a fraction from the 13.9% recorded in the second quarter and the 14% recorded in the first quarter.

Meanwhile GenZers in the workplace those roughly ages 22 to 25 increased their savings levels from 10% to 10.3%. That may account for why the youngest generation of todays employees actually saw their account balances increase 1.2% relative to the second quarter, despite terrible market performance.

In terms of gender differences, men saved a bit more than women . And age wise, Boomers on the cusp of retirement saved the most .

Building A 401 Crypto Account

Fidelity is primarily known for its huge portfolio of retirement accounts. The company is the largest 401 provider in the U.S. and holds more than one-third of all of the funds invested in 401 accounts in the country. These funds are invested in a vast variety of assets, and now the company wants to add one moreBitcoin.

More specifically, the company announced in April 2022 that they are introducing a digital assets account option alongside their more traditional accounts. This will allow employees with 401 accounts to add Bitcoin to them, for which they will be charged an account fee of between 0.75% and 0.9% of funds invested in the digital asset account. There will also be a trading fee, but the amount of this has not yet been announced.

Its expected that Fidelitys digital asset account will be ready for use in the summer of 2022. At that point, employees with a Fidelity 401 account may be able to allocate a percentage of their account to Bitcoin, but only if their employer allows them to make such a designation. Ultimately, it is employers who have the final say in whether their employees will be able to add Bitcoin to their retirement accounts, and this may impose a significant bar on the widespread adoption of crypto in these accounts.

Don’t Miss: Is It Good To Invest In 401k

Can I Transfer An Existing Debit Balance And/or Options Contracts To Td Ameritrade

If you are transferring a margin and/or options account with an existing debit balance and/or options contract, please make sure you have been approved for margin/options trading in your TD Ameritrade account. Please refer to your Margin Account Handbook or contact a TD Ameritrade representative to ensure that your account meets TD Ameritrades margin requirements.

IRA debit balances:Many firms will charge fees to transfer your account, which may result in a debit balance after your transfer is completed. Debit balances must be resolved by either:

Funding your account with an IRA contribution

Liquidating assets within your account. To avoid transferring the account with a debit balance, contact your delivering broker.

Transferring options contracts:If your account transfer includes options contracts, the transfer of your entire account could be delayed if we receive your properly completed transfer paperwork less than two weeks before the monthly options expiration date. In this case, your contracts may be exercised or assigned by the firm from which you are transferring your account. Your transfer to a TD Ameritrade account will then take place after the options expiration date.

Read Also: Can I Take Out From My 401k

How Many Lost 401ks And Other Retirement Accounts Are Forgotten

Think lost and forgotten retirement accounts amount to chump change? Although no one keeps data on how much retirement money gets lost or forgotten, in an interview with Bloomberg, Terry Dunne of Millennium Trust Co., made an educated guess based on government and industry data that more than 900,000 workers lose track of 401k-style, defined-contribution plans each year.

That figure doesnt include pensions. According to the Pension Benefit Guaranty Corporation, an independent agency of the U.S. government tasked with protecting pension benefits in private-sector defined benefit plans, there are more than 38,000 people in the U.S. who havent claimed pension benefits they are owed. Those unclaimed pensions total over $300 million dollars, with one individual being owed almost $1 million dollars!

Could that money belong to you?

You May Like: Can I Roll A 401k Into An Existing Ira

Why Are Some Of The Fields On This Page Highlighted In Yellow

Fields highlighted in yellow indicate securities priced real-time throughout the day. The total of these changes, Today’s Change, displays beneath the Change $ column.

Those fields not highlighted in yellow indicate securities priced less frequently. These include:

- Fixed income securities

The total of these changes, Change in Securities Not Priced Today, displays beneath Today’s Change.

Two Great Online Resources For Investors

Investors can find a wealth of online resources on Fidelity Investments and NetBenefits.com. NetBenefits.com, which provides a comprehensive view of your account balance and information about your account plan, and Fidelity Investments, which offers a variety of investment options and support, are two excellent services. You can easily switch between these two resources because they are both accessible from the same location.

Also Check: Can I Have 2 401k Plans

Recommended Reading: Can You Transfer An Ira Into A 401k

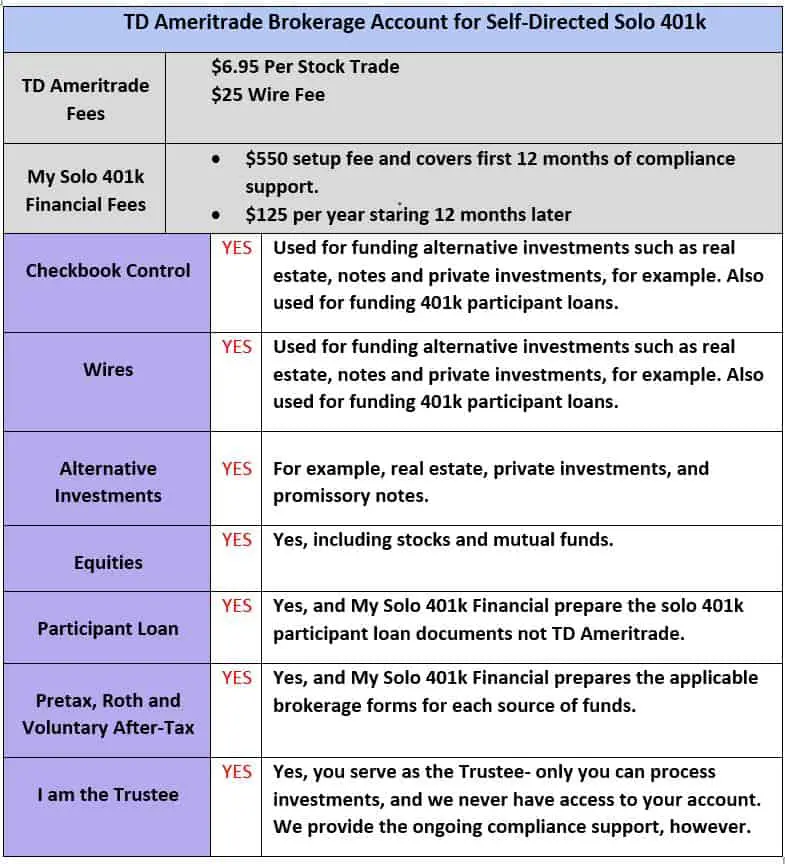

Fidelity Solo 401k Brokerage Account From My Solo 401k Financial

A Fidelity Investments Solo 401k brokerage account with checkbook control from My Solo 401k Financial is ideal for those looking to still have the option to invest in equities while also gaining checkbook control over their retirement funds for investing in alternative investments such as real estate, notes, tax liens, and private shares in addition to processing a solo 401k participant loan.

Timing Of The Brokerage Account Setup

After submitting the Fidelity brokerage forms to Fidelity Investments, between 5-7 business days , you should receive an email from Fidelity Investments that their system has updated your email address. This indicates the application is in processing.

When you start receiving emails from Fidelity, you can check if the account has been fully setup without having to wait on the Fidelity Welcome Letter in the mail which includes your new account number. Please try to log in using one of the following methods:

- If you have an existing Fidelity login , you should see the new Non-Prototype account appear under your portfolio with an account number that starts with the letter Z.

- If you do not have an existing Fidelity login, you can try to register to Fidelity.com at the following link: You will need to create a username and password.

Don’t Miss: Who Can Contribute To A Solo 401k

Fidelity Investments Review 202: Pros Cons And How It Compares

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments.

How To Open A Fidelity Brokeragelink Account

After talking to a Fidelity representative to make sure you fully understand all the details, you can open a Fidelity BrokerageLink account by completing the online application or by calling and asking to have a BrokerageLink Acknowledgement Form mailed to you.

- Online: Log in to your account on NetBenefits, then click the Quick Links drop-down next to your preferred plan. Select BrokerageLink to go to the BrokerageLink section under Investments. Review the information carefully, then click Open an Account and follow the steps. To open an account for multiple plans, select all the plans for which you would like to open a BrokerageLink account.

- Your representative can either walk you through the process of opening your account online, or send a Fidelity BrokerageLink Acknowledgement Form to your home address. Complete the BrokerageLink Acknowledgement Form and promptly return it to Fidelity, following the directions listed on the form. Please allow plenty of time for the mailing and processing of your BrokerageLink Acknowledgement Form.

Recommended Reading: What Is The Max Percentage For 401k