Locate Where Your 401s Are

Before you can check how much is in your 401 account, you need to know where your 401s are.

The first place to look is the company with whom you’re currently working. Many companies have implemented auto-enrollment into their 401 plans, ensuring that most of their employees contribute to their retirement. Otherwise, participation may drop because they simply forgot or didn’t know it was available.

Contact your human resources department to get information on if you’re contributing to their 401 and your account information.

Additionally, if you’ve changed jobs a few times in your career, you may have old 401 outstanding in different places. Locating old 401s can be a tricky process as it requires much coordination and hunting down various entities and contacts.

If you’re unsure if you have outstanding 401s with old companies, we can help. Beagle will find any old 401s you have, identify any hidden fees, and provide options to consolidate into one, easy-to-manage account. Sign-up is free and only takes a couple of minutes.

Even misplacing one 401 from a previous employer could cost you thousands in potential retirement funds.

How Does Epf Work

As mentioned earlier, both the employer and the employee contribute 12% of the basic monthly wages towards EPF. While the employees 12% contribution goes fully towards the EPF, the employers 12% contribution is divided as follows:

- 33% towards Employee Pension Scheme

- 67% towards Employee Provident Fund

- 1% towards EPF Administration Charges

- 5% towards Employee Deposit Linked Insurance

- 01% towards EDLI Administration Charges

Over the years, EPF rules have changed with regards to coverage, contribution rules, withdrawal procedures, etc. Some significant rule changes occurred in September 2014, with a few more in February 2016. To keep our readers updated about the latest EPF rules, we have listed the main revisions at the end of this page. We will continue to update these as and when rule changes occur. Check back frequently to ensure that youre up-to-date with the latest rules related to EPF.

Check Your Super Statement

Most people would have a rough idea of the value of their home, but do you really know what your superannuation is worth and whether your fund is delivering the best value for you?

It all starts with that annual superannuation statement you receive. It is one of the most important bits of paper youll receive all year. While finance nerds like us run through their statements every year with a fine-toothed comb, we reckon thats not the case for most people. Many of you probably never read your superannuation statement, preferring to file it away the moment you receive it. Dont make that mistake.

Read Also: How To Borrow Against 401k Fidelity

Federal Insurance For Private Pensions

If your company runs into financial problems, you’re likely to still get your pension.

-

Insures most private-sector defined-benefit pensions. These are plans that typically pay a certain amount each month after you retire.

-

Covers most cash-balance plans. Those are defined-benefit pensions that allow you to take a lump-sum distribution.

-

Does not cover government and military pensions, 401k plans, IRAs, and certain others.

Youre Our First Priorityevery Time

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Also Check: How Much Does A 401k Cost A Small Business

Check The National Registry Of Unclaimed Retirement Benefits

The National Registry is a nationwide, secure database listing of retirement plan account balances that have been left unclaimed by former participants of retirement plans.

It is essentially a search engine of lost 401 plans.

The only thing you need to search the database is your social security number. No additional information is needed, and there is no cost to search the database.

How Long Do I Have To Deposit The Check

You should deposit the check you get right away. Even if the check is made out to your IRA provider , you should try to do it within 60 days of receiving it.

Get a prepaid envelope sent directly to your door with a tracking number! Start a rollover with Capitalize and well send you a prepaid priority mail envelope with detailed instructions to make sure your rollover is transferred successfully. Get started

Also Check: How To Collect Your 401k From Previous Employer

Turn Your Hobby Into Income During Retirement

While you may not want to get a real job after you retire, there are likely plenty of options that can help generate revenue for you. If you have any hobbies that require specialized knowledge or skills, you may be able to turn those into profit centers even after you retire. For example, if your hobby is woodworking, you can likely sell some of your pieces either locally or on the internet to earn a few bucks. The same is true for countless other hobbies, from needlework to baking to writing.

Follow These 2 Tips To Prevent This Issue

Read Also: Is Fidelity Good For 401k

S You Can Take Is Something Fishy With Your 401 Maybe You Fear That Your Regular Contributions Are Not Being Made Or They Always Seem To Be Made Late Problems Can Range From Simple Clerical Mistakes To Gross Mismanagement If You Notice An Error Or Have A Question About Your 401 Statement Contact Your Hr Rep Or Plan Provider If You Suspect That Your Company 401 Plan Is Being Mismanaged Or Misused In Any Way Contact The Department Of Labors Employee Benefits Security Administration By Calling Toll

Missing or late contributions.

Check your statements to be sure that your contributions are being made in a timely and regular manner. By law, employers generally must deposit your 401 contribution in your account within 15 business days after the end of the month in which they withhold your contribution. For companies with fewer than 100 participants, the deadline is within seven business days. The contribution amounts should match the amounts deducted from your paychecks.

Incorrect investments.

Make sure that your contributions are going into the mutual funds that you selected, and in the correct percentages. If you change your investments, the change should be reflected on your statement.

Changing investment menus.

Have the investment options for the plan changed without your notification?

Fund management changes.

Beware if your 401 plan managers such as the plan administrator, trustee or recordkeeper change more than once every two years.

Missing statements.

You should receive 401 statements at least quarterly, according to federal law.

What Is A Social Security Statement

A Social Security Statement is a statement that is available through the Social Security Administration . It shows you the benefits that youll be entitled to when you retire, or if you need to file a claim for disability.

The purpose of the form is to let you know what your benefits will be. Its important to remember that the information provided is just an estimate.

For example, your Social Security retirement benefit is based on your earnings history. Since youre still working, the information that will be needed to determine that benefit is not complete.

The SSA has a record of your earnings and taxes paid up to this point. But what they dont know is what your future earnings will be. The estimate makes the assumption that your earnings will continue at the same level as it was for the most recent earnings year.

So lets say that in 2016 you earned $50,000. Now this is earned income only, so investment earnings, retirement plan liquidations, unemployment insurance, and other unearned sources will not count toward your benefits calculation. Only your earned income wages, self-employment income, contract revenues, and the like are used to calculate your benefits.

The SSA will make the assumption that youll continue to earn $50,000 per year between now and the time you collect benefits.

Dont Miss: Can I Get My Husbands Social Security Card

Read Also: Should I Roll 401k To Ira

Contact Your 401s Administrators

Your human resources department or administrator will be able to help you check your 401 balance.

You have most likely been mailed statements of your 401 accounts yearly or quarterly unless there is a different address on file.

Speak with your representative to verify that your contact information and address are up to date to prevent future lapses in correspondences.

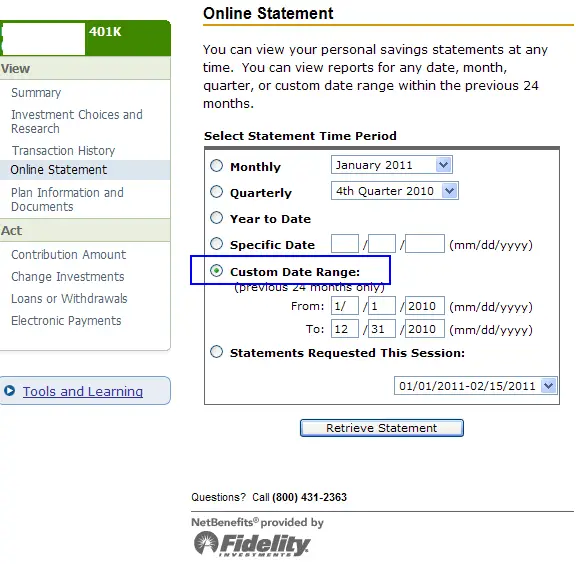

If your 401 plan’s administrator uses an online portal, similar to your online banking platform, they can help you get set up.

Online access to your 401 is excellent in checking your 401 balance and how your funds are performing. Some 401 platforms allow you to research the various funds, as well as reallocate your investments right on the platform.

National Registry Of Unclaimed Retirement Benefits

If your online sleuthing doesnt turn up anything, you can search the National Registry of Unclaimed Retirement Benefits, which helps employers connect with former employees who havent claimed their retirement benefits.

Just head to the website and enter your Social Security number, and it will search for any retirement plans associated with that SSN. If one is found, the site will contact the plan administrator on your behalf, or you can do so yourself. Youll then receive a benefit election form that allows you to specify how you would like to handle the funds.

Note that if a plan doesnt show up on this registry, that doesnt mean you dont have one. It may just mean that your former employer hasnt added your records to the database yet. The site notes that you should check back in the future, as more participants are added to the database daily.

Also Check: What Is The Difference Between Roth 401k And Roth Ira

Insights Delivered To Your Inbox

The Financial Planning 5

Terms and Conditions for the CFP Board Find a CFP® Professional Search

These terms and conditions govern your use of the Find a CFP® Professional Search feature on Certified Financial Planner Board of Standards, Inc.s Lets Make a Plan website . Before using Find a CFP® Professional, you must read and agree to be bound by these terms and conditions and CFP Boards Terms of Use, which also apply to your use of Find a CFP® Professional.

Permitted Uses

Find a CFP® Professional is compiled and published by CFP Board as a reference source about CFP® professionals in the United States. It does not include all CFP® professionals — only those who chose to be included. It may be used only by members of the public to locate CFP® professionals and obtain information about them, and individual CFP® professionals or their staff to view their own listings or those of colleagues. CFP Board reserves the right to block your use of this search tool indefinitely should CFP Board determine, in its sole discretion, that you are using it for a different purpose. Except as expressly provided herein, neither Find a CFP® Professional nor any of its data, listings, or other constituent elements may be modified, downloaded, republished, sold, licensed, duplicated, “scraped,” or otherwise exploited, in whole or in part. CFP Board expressly prohibits use of this information by individuals or business organizations to offer products or services to CFP® professionals.

Option : Move The Money To Your New 401

If you have a new job with a new 401, your current employer may permit you to roll over your old 401 funds into your new account. However, not all plans allow this, so check with your company’s HR department or plan administrator to see if it’s an option for you.

If it is and you decide it’s your best move, you must choose between a direct and an indirect rollover. Direct rollovers are the better choice because you don’t handle the money at all. You just fill out a form telling your old plan administrator where to send the funds and they take care of it for you.

With an indirect rollover, the plan administrator cuts you a check for the funds in your account and you place that money into your new account. But if you fail to do this within 60 days of cashing out your old account, the government considers it a distribution and taxes you on that money for the year.

Before you decide to move your money to your new 401, make sure you like your investment options and are comfortable with the fees your new 401 charges. Many employers don’t allow you to transfer money out of your 401 if you’re a current employee, so once you transfer your old 401 funds to your new account, they could be stuck there, at least until you leave your current job.

Don’t Miss: Who Does Amazon Use For 401k

How Much Retirement Savings Should You Have

There’s no magic savings number that’ll guarantee you financial security in retirement. A good rule of thumb is to stash away enough cash so that by the time you leave the workforce for good, you have 10 to 12 times your ending salary on hand in savings.

But remember, that’s the total you should be aiming for at the time of your retirement. And so if you’re 30 years old and are sitting on a retirement plan balance of $33,472, or something in that vicinity, you may not be in such poor shape.

How To Check My Account Balance

To check your bank account balance, you must keep in mind the following things.

- Firstly, your mobile number should be registered with the bank.

- The mobile number should be active to receive and send SMS and call.

- Having a smartphone is preferable. The reason is, with an active internet connection, you can use different apps like banking apps or UPI apps.

- You should also have your ATM or debit card activated with your bank account

- Also, internet banking should be activated by your bank.

Keeping these things in place, you can check your bank account balance anywhere and anytime. The various ways to check bank account balance are as follows

You May Like: What Is The Best Fund To Invest In 401k

Checking Your 401 Plan Balance

Your 401 plan is required to provide you an individual benefit statement at least once a year if your 401 plan doesnt allow you to direct the investments in your account or at least every quarter if you can direct your investments.

In addition to these statements, some 401 plans offer online access to your retirement accounts to check your balance or rebalance your portfolio. Your human resources department for your company can provide you with all the information you need to set up an online login to check your 401 balance.

Account Balance Vs Vested Balance

Why Is the Vested Balance Lower?

If your vested balance is lower than your account balance, you are not yet 100% vested in all balances. You may have matching funds or profit-sharing dollars in your account, but you have not met the service requirements to be fully vested. To get those numbers to match, you need to be 100% vested, which may require that you keep working at the same employer.

How Much Do I Get?

When you are not fully vested, you receive less than your full account balance. For example, if you quit your job and youre 40% vested, you would only get your vested balance as a rollover or cash-out payment. However, its crucial to verify your exact vesting percentage with your plans administratoras you read through statements and find information online, you might get inaccurate information .

Read Also: How To Borrow From 401k To Buy A House

Locate Office Of Employees’ Provident Fund Organisation

- Informational

Locate Employees’ Provident Fund Organisation office in various states in the country. Users can find details upon choosing the name of the state, office location and district name from the drop down menu. Information on region code and office code is also available in the search results.

What Is My Vested Balance

posted on

When you participate in a retirement plan at your job, you might have a vested balance in your retirement account. Those different buckets of money are typically a result of contributions that your employer makes for you. For example, you might receive matching funds on your contributions to a 403 plan, profit-sharing money in a 401, or other funds from your employer.

Also Check: How Do I Stop My 401k